Are you familiar with Yieldstreet? In this article, we’ll dig into the platform’s offerings, the investment minimums, charges, as well as eligibility to invest. We’ll also explore how it can add value or be a risk to your investment basket.

If you want to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

What is Yieldstreet?

Yieldstreet sets itself apart from traditional investment platforms by offering a unique approach to investing. Unlike standard platforms that allow you to invest in common financial assets like stocks, bonds, and funds, Yieldstreet focuses exclusively on alternative investment classes through crowdfunded debt.

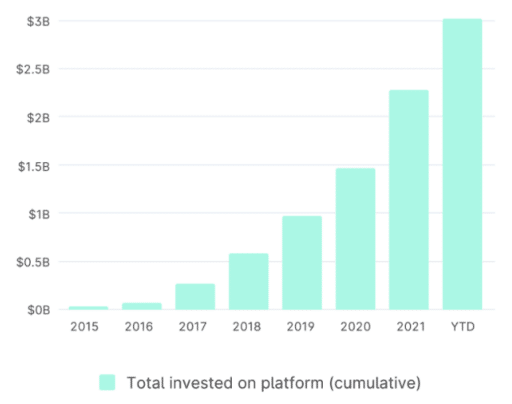

At the time of writing, Yieldstreet recorded total investments worth more than $3.2 billion on its platform.

How does it work?

On Yieldstreet, you and other investors contribute funds to support a specific loan that is tied to an underlying investment. Your profits will be based on the conditions of that loan.

This differs from many other websites that structure alternative investments, as you do not actually own a portion of the asset itself. Instead, you own a portion of its debt.

Alternative investment classes encompass many investment opportunities that fall outside the conventional realm of securities and financial products. These classes are not regulated by the Securities and Exchange Commission.

Yieldstreet’s platform enables investors to easily incorporate private assets into their investment portfolios. In order to produce investment funds, the firm purchases assets including art, real estate, and other valued alternative assets. Shares of these assets may be purchased by investors who want a piece of the asset’s future appreciation or income stream.

Yieldstreet’s debt structure emphasizes income investing. As an investor, you can earn active returns over the investment’s lifespan through interest payments generated by the asset. When the asset fully repays its principal, you will have received your original investment back.

In addition to these offerings, Yieldstreet also provides individual investors with opportunities to participate in private structured credit deals. These deals typically offer a minimum assured return and protect against the risk of declining earnings. Normally, such deals are only accessible to institutional investors or hedge funds.

What assets are accessible on the platform?

Yieldstreet provides a diverse range of investment opportunities across various asset classes. Investment options on the site include the likes of art, structured notes, and properties.

Investors in real estate may pick from residential, commercial, and industrial properties. When it comes to art, investors have the chance to own shares in valuable art pieces, although the minimum investment for art funds typically starts at $10,000.

For short-term notes, the platform offers fixed annualized yield targets that are exclusively visible to members, complying with the regulations set by the Security and Exchange Commission. Short-term notes are investment instruments that have a relatively short maturity period.

Structured notes are available in categories such as tech, consumer, and diversified portfolios, with a minimum investment requirement of $15,000. They are designed to provide customized investment opportunities tailored to the investor’s risk tolerance and investment objectives.

Investors interested in supply chain portfolios can participate, but the minimum investment threshold is set at $10,000. This investment option provide investors with exposure to various companies involved in the supply chain industry.

For those seeking a more diversified approach to their alternative investments, the Prism Fund is available as an option. It is a multi-asset class fund that gives exposure to all relevant asset classes. Unlike direct investments, the Prism Fund is open to both accredited and non-accredited investors. Additionally, investors may have the opportunity to roll their proceeds into future offerings of the Prism Fund.

Comprehensive information is provided on each investment option, including the offering size, maximum and minimum acceptable investments, expected annual return, investment duration, as well as an explanation of the associated risks and any noteworthy advantages.

Are the assets liquid?

Alternative investments are known for their illiquidity, meaning that converting them into cash can be challenging due to the absence of a robust secondary market.

On the Yieldstreet platform, there is no secondary market available, and investors receive their returns through monthly distributions. While the Prism Fund, offered by Yieldstreet, includes quarterly “liquidity events” where the company repurchases a limited number of shares from investors, it’s important to note that most active investments on the platform lack liquidity.

Certain short-term assets may hold your capital in a frozen state for several months, while others may impose restrictions on withdrawals for years.

That’s why it’s important for investors to proceed with care and not risk money they can’t afford to lock up for a long time. It’s crucial to carefully consider one’s liquidity needs and investment horizon before committing to alternative investments.

Who can invest?

Alternative investments have a greater degree of risk than more traditional investments, thus the Securities and Exchange Commission frequently limits their availability to “accredited investors.”

Accredited investors are those with assets above $1 million or individual and joint household income worth over $200,000 or $300,000, respectively.

Yieldstreet predominantly offers investment opportunities with minimum investments of $15,000 or more, primarily catering to accredited investors.

However, for non-accredited investors, Yieldstreet provides a narrower selection of assets along with its Prism Fund, an income investment portfolio aiming for a targeted 7% rate of return. The fund is scheduled to conclude on March 9, 2024, and at that point, it will return investors’ principal.

What are the investment minimums and target returns?

Minimum investment requirements typically range from $10,000, albeit there are specific funds on the platform that may have higher thresholds at $20,000 or more. The Prism Fund, however, offers a more accessible minimum investment amount of $2,500 for its assets.

While a few funds are open to all investors, the majority of funds are limited to accredited investors.

YieldStreet aims to achieve returns anywhere from 3% to 18% as of the time of writing.

What are the fees?

When evaluating any investment or trading service, it is crucial to pay attention to certain factors that can impact your overall costs and returns. Firstly, consider the trading fees, which are charges imposed on each trade you make. This might be a flat charge or a spread dependent on the asset’s purchasing and selling price. Trading commissions should also be taken into account, since brokers may charge a percentage depending on transaction volume or value.

Another important factor is the presence of inactivity fees, which are fees charged by brokers for not actively trading, such as keeping money in a brokerage account without making transactions. It’s also essential to be aware of non-trading or other fees that a platform may charge. These fees can include charges for making deposits or withdrawals from your brokerage account or fees associated with signing up for additional services.

In the case of Yieldstreet, the main cost drivers are management fees, which are a percentage of the overall investment taken by the firm annually to cover account management and other overhead expenses. Yieldstreet typically has an average annual management fee ranging from 0% to 2.5%.

Some investments may also have flat annual fees, which are disclosed on the individual offering pages. Depending on the offering’s legal structure, investors may also be required to pay yearly fund expenditures; these costs are specified in full on each offering’s page.

On average, Yieldstreet charges around 2% per year in management fees, with additional small fees. These costs are typical for private equity investments but greater than those of exchange-traded funds or mutual funds. The specific annual management fee may vary across different funds offered by Yieldstreet.

Can I lose money on Yieldstreet?

Yieldstreet investments are risky, as are all investments. Investing in a real estate fund that owns a commercial complex, for instance, runs the risk of bankruptcy if any of the property’s tenants fail to pay their rent. If such happens, you could lose everything.

So before making any investment, on Yieldstreet or elsewhere, it is strongly advised that investors do extensive research and due diligence to reduce the associated risk. Individuals may lower their risk of investment loss by making educated judgments based on a thorough assessment of the investment opportunity, its risks, and any other relevant considerations.

Investors may better preserve their cash and make more educated investment decisions by acquiring pertinent information, assessing the investment’s performance, and, if necessary, seeking expert guidance.

How to Sign Up on Yieldstreet

Go to Yieldstreet’s website and look for the Sign Up button which will send you to the registration page. Now there are two options here: you can opt to personalize your experience or just proceed to signing up already.

If you choose “personalize my experience,” you need to provide information about your investment background and current portfolio size. Then you will be directed to the signup page and can opt to join via your Google or Apple account, or your email.

If you pick “skip to sign up,” you will be asked if you’re an accredited investor. You have to pick from several options about how much assets you currently have.

Answering these questions will allow Yieldstreet to create a custom Dashboard just for you.

If you are an accredited investor, you will be brought to your Dashboard where you have to select the type of account to begin investing. The options are Individual Account, Self-Directed IRA, and Entity Account. Don’t forget to verify your email as you won’t be able to create an investor account otherwise.

Your investment goals, risk tolerance, and other personal details will also be requested.

When you’re ready to begin investing on Yieldstreet, you may browse your Dashboard for deals and do so after you’ve completed the required procedures.

How to Invest on Yieldstreet

Yieldstreet offers various investment options to accredited investors, including the opportunity to make direct investments in alternative assets through their Yieldstreet account. This feature allows investors to access a wide range of open offerings and participate directly in alternative investments.

Yieldstreet Wallet

Yieldstreet also provides the Yieldstreet Wallet, which is a savings account held at Evolve Bank & Trust. This savings account is FDIC-insured, but the interest rate offered may be currently low. The Yieldstreet Wallet serves as a funding source for investments through Yieldstreet, including Individual Retirement Accounts (IRAs).

IRA Accounts

For investors with a Yieldstreet Wallet, there is an option to open a self-directed IRA through Yieldstreet. This IRA allows for “checkbook control,” enabling investors to buy and sell a variety of alternative assets, including investments in the Prism Fund, within the framework of a Yieldstreet.

The annual fee for this type of account varies based on the annual deposit rate. Users with balances up to $100,000 pay an annual fee of $299, while those with balances exceeding that amount are subject to an annual fee of $399.

How to Raise Capital on Yieldstreet

Yieldstreet collaborates with seasoned asset managers and operators to initiate, assess the viability of, and manage investments in various asset categories.

If an individual or entity possesses expertise in lending, asset management, investment services, or requires credit-based, asset-backed capital, Yieldstreet offers a comprehensive solution for expanding their business.

By providing capital, rapid execution, and genuine flexibility, Yieldstreet serves as a one-stop platform for investment partners. Once the committee approves an investment opportunity and the necessary due diligence is completed (a process that typically takes 3-4 weeks), Yieldstreet can disburse funds within 24 hours.

You have to submit certain payments and quarterly reports. Yieldstreet will handle other matters like distributions to investors, and reports and tax forms, among other things.

What are the Pros and Cons of Yieldstreet?

Pros

- Offers a low-cost way to obtain exposure to high-value alternative assets, making it a competitive option for investors. Investors may take part in investing opportunities that were previously exclusively available to institutions or wealthy people.

- The annual costs usually range from 0 percent to 2.5 percent, making them competitive with similar services. These charges are reasonable relative to the rest of the investing industry and are meant to aid the client in achieving optimal results.

- Provides access to numerous investment options in different asset classes. This paves the way for investors to construct diversified portfolios.

- Yieldstreet’s emphasis on asset-backed investments is a major selling point for the platform. These investments provide more security since they are backed by real-world assets, such real estate or artwork, rather than just paper. The potential for loss while purchasing alternative assets is reduced by this function.

- The investing options are notable for their minimal stock market correlation. Investments on Yieldstreet may or may not move in unison with the stock market, unlike more conventional equities and indexes like the S&P 500. This minimal correlation presents a potential investment path that is unaffected by stock market movements, which may be helpful for portfolio diversification. By spreading their money out over a variety of asset types, investors may lessen their reliance on a single market’s performance and, in theory, enjoy more consistent returns.

Cons

- Some funds on Yieldstreet have high minimum investment requirements. This means that investors need to commit a substantial amount of capital to participate in certain investment opportunities. These high minimums can limit accessibility for some individuals.

- Alternative investments, including those offered on Yieldstreet, are generally less liquid compared to traditional investments like stocks or bonds. This means that it may be more challenging to convert these investments into cash quickly. Investors should be prepared to hold their investments for a longer period and understand the potential limitations on liquidity.

- Many investment options on Yieldstreet are restricted to accredited investors. Such restriction can exclude non-accredited investors from accessing certain investment opportunities on the platform.

- Yieldstreet does not offer live customer service, which can be a drawback for some investors who prefer direct assistance or have specific inquiries or concerns that require immediate attention.

- Investing in alternative asset classes, which Yieldstreet specializes in, carries inherent risks. These alternative assets are typically considered riskier investments, and their higher yields reflect this risk. While Yieldstreet aims to mitigate risks by emphasizing secured investments backed by tangible assets, such as real estate or shipping vessels, it’s important to recognize that risk cannot be completely eliminated.

- One notable issue with Yieldstreet is the perception created by its marketing materials, which may lead some investors to believe that investing on the platform guarantees income and security. Investors are really putting their money into high-interest loans backed by moderate- to high-risk assets. It’s essential to approach investments on Yieldstreet with a clear understanding of the underlying risks and avoid assuming guaranteed returns.

- Understanding the risks associated with any investment is crucial. However, many investors may find it challenging to gain a comprehensive understanding of the risks inherent in each specific asset on Yieldstreet. This lack of transparency can make investing on the platform more speculative and requires investors to carefully evaluate and allocate their assets accordingly.

Bottom Line

Yieldstreet presents a unique investment opportunity that combines elements of fixed-income investments and high-risk investments. The platform typically appeals more to high net worth individuals due to the potentially high minimum investment requirements, although there may be options with lower minimums available. When considering investing on Yieldstreet, you must bear a thorough understanding of the risks involved.

Investing on Yieldstreet can potentially yield favorable returns, but it is recommended to approach it as a limited part of one’s overall investment portfolio. Proceed with caution due to the high-risk nature of alternative assets and limited liquidity.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.