Why you can lose money on property with 3% capital gains + 6% net yields

I got a big reaction, mainly of shock, when I said online today that it is possible to lose money on property even if you get 3% net capital gains + 6% rental yields. This was after I gave the example of somebody who moved to a country like Georgia, for tax reasons, as they […]

Client review/Testimonial

Below is a client testimonial that came to me from one of my review articles. To whom it may be of interest: Are you worried that your retirement investments are not being managed as well as they should be? I am a British citizen and I have worked contract within the Oil and Gas industry […]

Investing in ETFs for beginners

In the video below I speak about the different ETFs on offer in the market and whether index-linked ETFs are different to index funds. I also discuss why Vanguard’s Founder Jack Bogle warned against ETFs.

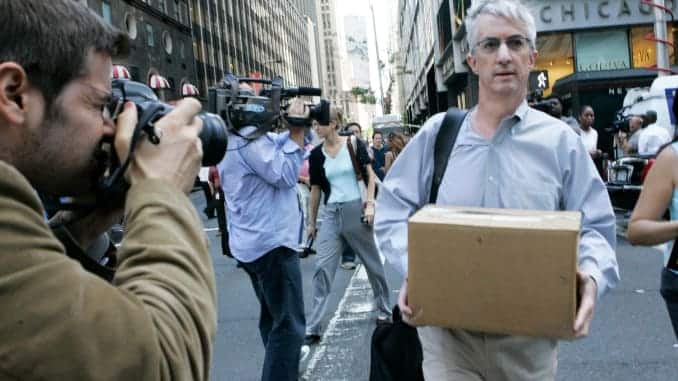

What if I retire 1 day after a Lehman collapse?

One of the biggest misconceptions and fears people have is that “markets might collapse 1 day after I retire”. These worries seem to imply: We invest from our 20s until 65 and then the money is just left in cash. Meaning that a crash a few weeks before retirement would cut our retirement savings in […]

The biggest financial headaches for people living in emerging markets

About 50% of my clients are either expats living in emerging markets, or locals based in Latin America, Africa or “Emerging Europe”. Whilst we all know that emerging markets are fast growing, there are several challenges facing people living in these locations in terms of their finances. The biggest ones are: A lack of investment […]

Client Interview

In the interview below I asked my client questions such as: Why he became my client? Why did he prefer dealing with somebody online compared to using the banks? And many more things. Enjoy!

What are the best international banks for expats? Lloyds International, Saxo Bank + others

Expat banking review