What are 6 myths that expat investor shouldn’t believe? Whilst some of these myths aren’t only connected to expat investors, some are very specific to people living abroad.

1. Investing is risky.

The first myth isn’t an expat-specific issue. People all around the world assume that investing is risky.

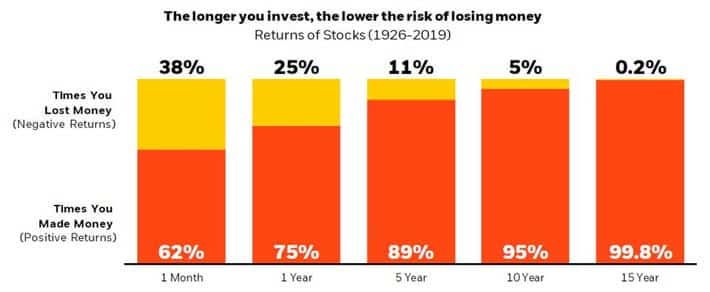

It doesn’t have to be. Certain types of investing are indeed risky. Investing in just one stock, or even ten, can be dangerous, as can being a short-term investor.

Investing in a diversified portfolio isn’t risky, at least if you hold onto the positions for the long term.

Below is an example of the S&P500 in the US – five hundred of the largest US stocks.

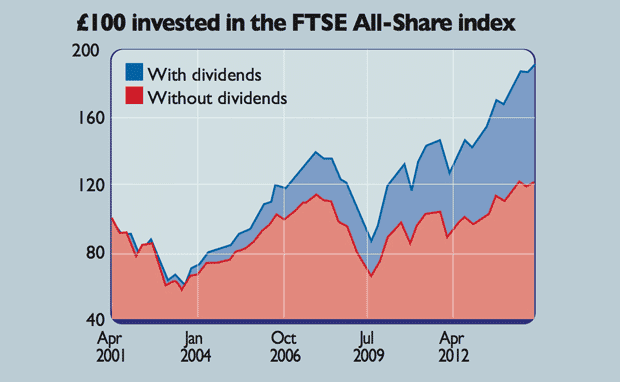

Even markets that haven’t performed as well as the US ones recently, such as the UK’s FTSE100 which tracks the top hundred firms in the United Kingdom, have adjusted well for dividends reinvestment.

2. Investing is for the rich, or at least having an advisor is

Long gone are the days when you need to be rich to invest. It is now possible to invest with minimal amounts of money.

Advisors are indeed used a lot by wealthier people, and many advisors (myself included) specialise in helping high-net-worth individuals.

Yet investment minimums tend to be reasonable for those who want advice or guidance. Even though I have continuously put my minimums up during the years, it is possible to get access to my team from $500 a month and myself from $2,000 a month or $100,000 as a lump sum.

Other advisors have lower or higher minimums, depending on their niche. Either way, you don’t need to be a millionaire to have an advisor.

3. It matters how the platform is regulated.

There are investing platforms, banking platforms, and offshore bond/life assurance platforms for the expat investor. The difference between the three is negligible if the investment choices and fees are similar.

For instance, if you invest in the Vanguard S&P500 with a bank charging 1% per year, your returns will be identical to if you invest in the same fund, with the same fees, with an insurance company.

In reality, the difference between these options is mainly a regulation issue. Indeed, there are sometimes tax advantages associated with picking a specific option.

For British, South African and Australian expats, offshore bonds have potential tax benefits if you return home. That won’t influence the gross returns, however.

The confusion is perhaps caused by the fact that the traditional insurance product gives the life assured’s beneficiary a massive payout if they die.

Some investors, therefore, have the misconception that if they invest with an insurance platform, that money has to go towards paying insurance – in other words, they aren’t fully invested on day one – which usually isn’t the case with modern offerings.

4. Some jurisdictions are “dodgy”.

This is where we get into the very expat-centric part of the discussion. Most locals invest back home because it is more familiar and “feels” safer unless they live in an unstable country.

Most expats are moving around and need portability. This is why most expats invest offshore. The offshore financial world was partly created to serve the needs of British expats living overseas when the British Empire was in its heyday.

Yet many misleading media reports, such as the Panama Papers, which was mainly a non-story, and popular culture, as illustrated by movies such as The Wolf of Wall Street, which showed the main character with cash strapped to him to get money into “tax heaven” Switzerland, perpetuates some long-held myths.

These days, most money in offshore jurisdictions aren’t used to illegally evade taxes, and you have transparency of financial information globally after OECD rules like the CRS.

Following on from this, we also find that some expat investors are comfortable with certain offshore jurisdictions, such as Switzerland or Luxembourg, but uncomfortable with others, such as Mauritius or Bermuda.

In reality, all major offshore jurisdictions now have proper investor protections. Often this misconception is about familiarity.

I have noticed that British people are less likely to think the Isle of Man is dodgy, Mainland Europeans have high trust in Luxembourg and Switzerland and some North and South Americans like Puerto Rico and Cayman.

Either way, no major offshore jurisdiction is dodgy these days.

5. Investing home is the safest way.

Most brokers in your home country won’t accept you. If you use an indirect way of gaining access to them, for example, by using a bank statement as proof of address and pretending you still live back home, you could be storing up problems in the future.

I have run out of the number of clients, especially in places like Canada, who have had accounts closed down due to the brokerage or bank being aware of the residency issue.

This can cause unexpected taxes if you need to liquidate the positions quickly and other hassles.

Moreover, some tax authorities, such as in Australia and Canada, suggest that expats must “show intent” to be deemed, non-tax residents.

That can mean closing down gym memberships and having as few connections back home as possible.

Even the UK, which is more liberal, has the automatic ties test and other tests.

Putting it simply, the more days you spend back home and the more ties you have to the UK, you can be considered a tax resident, even if you don’t spend 90 days a year in the country.

The days of “the 183 or 90-day rules” is long gone in many countries. With governments needing money with Covid-19 and ageing populations, this could get worse.

In reality, it is essential to set up portable investment accounts, which move with you from country to country, and keep fewer ties to your home country.

Ideally, you also need to use a brokerage or advisor who will keep your account even if you move outside the European Union or any specific area.

If you are looking to invest as an expat or have underperforming investments, you can apply for my services here.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Minimum to invest with Adam Fayed

Minimum amount for start up

It is all on my website. I will also email you.

I’ve Supported to be to your client was just praying to get someone who can support me for my feature success as Allah had already showed for me you, I’ve thrown the ball back to you. Show me link. But I’m requesting for you not email me per now, to people’s pressure, the won’t reach me Due to gravity falls.