It’s never too late to build wealth. To do so, you need more than just a high income. It’s about making smart financial decisions that compound over time.

Whether you’re starting young or asking if age 50 is too late, understanding the basics of wealth creation is essential.

In this guide, we’ll break down exactly what you need to build wealth and answer key questions like:

- What does it mean to build wealth?

- What is the principle of building wealth?

- What are the 4 stages of wealth creation?

- What is the fastest way to create wealth?

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (hello@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a free expat portfolio review service to optimize your investments and identify growth prospects.

Some facts might change from the time of writing. Nothing written here is financial, legal, tax, or any kind of individual advice, nor is it a solicitation to invest or a recommendation of any specific product or service.

Meaning Of Building Wealth

To build wealth means to steadily grow your net worth by accumulating income-producing assets, minimizing liabilities, and making strategic financial decisions over time.

It’s not just about having money. It’s about creating long-term financial security and freedom.

For expats and high-net-worth individuals, building wealth goes beyond simple saving.

It’s essential for maintaining financial independence while navigating global tax rules, currency risks, and legacy planning.

With the right approach, building wealth ensures flexibility, stability, and control no matter where life takes you.

What Does Building Wealth Require?

Building wealth starts with the right mindset. Patience, discipline, and a long-term perspective are essential.

What Are the 4 Components of Wealth?

Wealth includes several key components that together create true financial strength:

- Financial Capital

This is the most obvious form of wealth: cash, investments, retirement accounts, and other tangible assets that generate income or appreciate over time. - Human Capital

Your education, skills, experience, and earning potential make up human capital. Investing in yourself increases your ability to generate income and seize opportunities. - Social Capital

The relationships, networks, and reputation you build open doors for business, investment, and personal growth. Social capital can often accelerate wealth creation through connections and trust. - Lifestyle Capital

This includes your health, time freedom, and geographic flexibility. Maintaining good health and having control over your lifestyle allow you to enjoy your wealth fully and pursue opportunities without constraints.

Together, these four components provide a balanced approach to building and sustaining wealth.

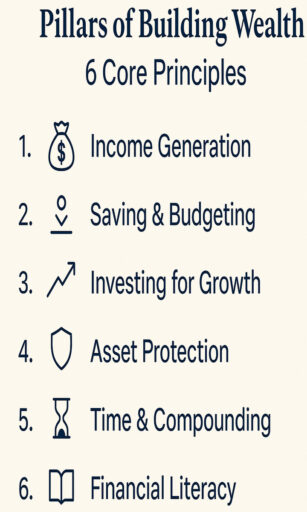

Pillars Of Building Wealth and Principles of Wealth Creation

Wealth is built through consistent, disciplined actions guided by time-tested principles.

These pillars provide the foundation:

1. Income Generation

This is the engine of wealth building.

Whether it comes from employment, entrepreneurial ventures, rental income, or portfolio returns, generating consistent and scalable income is the foundation of financial growth.

Increasing your earning power through higher education, acquiring in-demand skills, or cultivating a strong professional network, directly expands your financial capacity.

Diversifying income streams also reduces reliance on a single source, adding stability and resilience to your wealth-building strategy.

2. Saving and Budgeting

Living below your means is more than a frugal mindset. It’s a strategic decision that frees up capital for future opportunities.

Effective budgeting ensures that essential expenses are covered while setting aside money for emergencies and investments.

Over time, disciplined saving habits help you build liquidity, reduce financial stress, and create the financial flexibility needed to take calculated risks.

3. Investing for Growth

Savings alone won’t outpace inflation or create long-term wealth. Investing allows your money to work for you by generating returns over time.

A well-diversified portfolio—spread across asset classes like stocks, bonds, real estate, or private equity—helps manage risk while positioning you for growth.

Aligning your investment strategy with your time horizon, goals, and risk tolerance is key to achieving compounding success.

4. Asset Protection

Accumulating wealth is only half the equation; preserving it is just as crucial.

Insurance (health, life, property), tax-efficient planning, and legal structures like trusts protect your wealth from unforeseen events, litigation, or unnecessary tax burdens.

Without a protection strategy, a single unexpected event could derail your progress or deplete your assets.

5. Time and Compounding

Compounding is one of the most powerful forces in finance, where your earnings generate additional earnings over time.

The longer your money is invested, the more pronounced this effect becomes.

That’s why starting early and contributing consistently even in small amounts, can lead to significant wealth accumulation.

Delaying investment can cost you years of lost growth potential.

6. Financial Literacy

Financial knowledge is a critical and often underestimated asset.

Understanding how different investment vehicles work, staying informed about economic trends, and knowing how to evaluate financial products empower you to make smart, confident decisions.

Financial literacy not only helps you avoid costly mistakes, but also allows you to adapt and optimize your strategy as your circumstances change.

What Are the 4 Stages of Building Wealth?

Building wealth is a journey that typically follows four key stages:

- Accumulation

This stage focuses on increasing your income, managing expenses, and eliminating debt. It’s about laying the groundwork by saving consistently and building a financial cushion. - Growth

Once you have a stable base, the focus shifts to investing and expanding your assets. This stage is about maximizing returns through diversified investments and taking calculated risks. - Preservation

After growing your wealth, protecting it becomes critical. This involves setting up structures like trusts, using insurance, and implementing tax strategies to safeguard your assets from loss or unnecessary taxation. - Transfer

The final stage is planning how to pass your wealth to the next generation. Estate planning, wills, and trusts ensure your assets are distributed according to your wishes and help minimize inheritance taxes.

What Is the Fastest Way to Build Wealth?

If you want to build wealth quickly, focusing on these strategies can accelerate your progress:

- High-Earning Careers or Businesses

Increasing your income through advancing in a high-paying career or growing a successful business provides more capital to save and invest. - Aggressive but Calculated Investing

Taking higher, well-researched risks in investments such as growth stocks or real estate, can lead to faster returns, but it requires careful planning and risk management. - Minimizing Lifestyle Inflation

Avoiding the trap of spending more as you earn more lets you save and invest a larger portion of your income, speeding up wealth accumulation. - Leveraging Compounding Early

Starting to invest as early as possible let’s compound returns work in your favor over time, turning small initial amounts into significant wealth.

Is 50 Too Late to Build Wealth?

Absolutely not. With the right strategy, starting at 50 can still lead to meaningful wealth.

In fact, many people in their 50s have higher incomes and greater financial discipline, which can help accelerate their wealth-building efforts.

For late starters, key strategies include:

- Catch-Up Investing

Take advantage of catch-up contributions in retirement accounts and focus on maximizing your investment savings as much as possible. - Downsizing and Reducing Liabilities

Lowering living expenses by downsizing your home or paying off debt frees up more money to invest and save. - Setting Realistic Goals and Planning for Retirement

Adjust your financial goals based on your timeline and create a clear retirement plan that balances growth with risk management.

With focus and discipline, building wealth after 50 is achievable and can lead to a comfortable, secure financial future.

Conclusion

It’s never too late to build wealth.

Whether you start early or later in life, success depends on applying proven principles consistently over time.

Studies show that starting to invest just 10 years earlier can significantly increase your savings thanks to compounding.

However, even those who begin after age 50 can build wealth effectively through disciplined saving, smart investing, and focused planning.

Building wealth is not about luck. It’s about making intentional decisions and staying committed to your financial goals.

By following these fundamentals, you can build wealth and secure a more comfortable, flexible future no matter when you begin.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.