In questa recensione delle obbligazioni ZP Secured Direct Lending, esamineremo le caratteristiche e i termini di questa opzione di investimento, oltre ai pro e contro associati.

ZP Secured Direct Lending PLC, emittente delle obbligazioni, è una società del settore creditizio con sede a Londra.

L’azienda punta a rendimenti regolari e interessanti investendo in un portafoglio diversificato di strumenti di debito garantito emessi da PMI britanniche.

Tra i collaterali possibili ci sono proprietà, attrezzature e crediti verso terzi.

Se desideri investire come espatriato o persona con alto patrimonio netto, che è il mio campo di specializzazione, puoi contattarmi via email (hello@adamfayed.com) o su WhatsApp (+44‑7393‑450‑837).

Se hai queste obbligazioni nel tuo portafoglio, ha senso richiedere una revisione del portafoglio, poiché questo tipo di investimento non è adatto a tutti.

Termini e Caratteristiche delle Obbligazioni

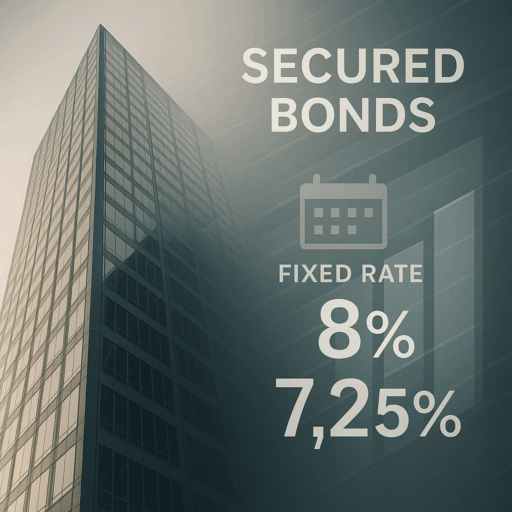

ZP 8% Senior Secured Bonds in scadenza 2024

Gli investitori professionali ricevono cedole con interesse fisso del 8%, pagabili trimestralmente, su obbligazioni senior secured con scadenza a settembre 2024.

Questa opportunità di investimento è destinata fino a 150 milioni, in sterline e dollari USA.

Le obbligazioni sono quotate su Euronext Dublin, negoziabili con facilità, e sono compatibili con strumenti come UCITS, ISA, SIPP, SSAS, QROPS e portfolio bonds.

Emissione originaria: settembre 2019.

Appartengono al programma di secured medium term note da 500 milioni di sterline di ZP.

ZP 7,25% Fixed Rate Bonds in scadenza 2026

ZP offre anche obbligazioni garantite da fino a 50 milioni di sterline con cedola fissa del 7,25%. Emesse il 23 dicembre 2021, scadranno lo stesso giorno nel 2026.

Queste obbligazioni sono quotate sul Vienna MTF per il trading.

Valore nominale unitario: 500.000 sterline; comprabile o vendibile in multipli di 1.000 sterline.

Anche queste fanno parte del programma secured medium term note di ZP Secured Direct Lending PLC.

Pro e Contro delle Obbligazioni a Tasso Fisso Garantite

Vantaggi

- In caso di default dell’emittente, le obbligazioni garantite offrono protezione grazie alla copertura tramite asset.

- Minore rischio rispetto alle obbligazioni non garantite: gli investitori hanno priorità sul collateral in caso di insolvenza.

- Le cedole periodiche garantiscono reddito costante e prevedibile.

- L’allocazione in portafogli diversificati riduce il rischio e migliora la stabilità, anche in mercati volatili.

Svantaggi

- In aumento di inflazione o tassi, il rendimento fisso può essere poco competitivo, e il valore dell’obbligazione può diminuire.

- Rischio di credito: il debitore potrebbe non rimborsare capitale o interessi.

- Se l’inflazione cresce più velocemente del rendimento obbligazionario, il valore reale delle cedole può diminuire nel tempo.

Considerazioni Finali

Queste obbligazioni, essendo quotate su mercati, offrono liquidità, cedole prevedibili e garanzie esplicite.

Inoltre, ZP Secured Direct Lending PLC resta operativa (going concern) e non ha programmi di liquidazione in corso, permettendo l’adempimento degli obblighi finanziari.

Tuttavia, è fondamentale esercitare cautela ed effettuare una due diligence accurata, poiché i risultati passati non garantiscono performance future.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.