This article will review Wealthify. If you want to invest or ask me some questions, you can contact me using this form, or use the chat function below.

A quick note on inflation and DIY investing

Before discussing this solution, it is important to mention two things.

Firstly, academic research indicates that the average DIY investor gets lower returns than the market or those that invest through advisors.

So you are statistically unlikely to do well investing by yourself, regardless of how good (or bad) Wealthify is. That’s the biggest negative.

Many people also don’t consider inflation. According to a research from Finder.com.uk just two million people invest in the UK out of a population of 67 million!

Why should everyone invest? Because if you decide to hide your cash under the mattress or just let them in the bank you will be losing each year almost 3% of it.

It does not sound too much on a single pound but on £100.000 you will be surely going to miss those £3.000.

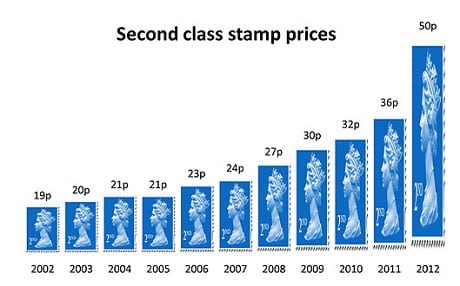

The chart below also shows how quickly the price of stamps has increased down the years.

What is Wealthify and how does it work?

Here is where Wealthify comes in handy, Wealthify is designed for all first-time investors! Wealthify is a robo-advisor broker that asks you how much you’re willing to ‘’sacrifice’’ in the present, diversifies it arguing to how much risk you are willing to take and that is it.

Forget all those bricks of academic or trading books! How do they do this? By gathering investment experts and then developing algorithms to select the worthiest funds and create investment plans that suit the client’s attitude towards risk.

These financial experts will continuously adjust the client’s portfolio to keep it on track on the same level of acceptance towards risk.

And you just need an internet connection to track your portfolio in real-time with PC, tablet, phone or via the Wealthify app available for both Android and iOS.

Aviva Partnership and its advantages

In 2018 Wealthify began a partnership with Aviva, a global financial services company and the UK’s largest insurance provider.

The Last half-yearly return of AVIVA in their second half of the year was of 2.3 billion pounds in cash and that is fundamental, as we are now facing the lockdown due to the coronavirus, companies have to push on cash reserves to make sure that the business is still in existence; this is often quite overlooked by a lot of new first time investors.

Wherever you put your money you need to check if the company, broker, or bank you are depositing your money is sufficiently strong to bear a crisis.

The biggest challenges facing robo-device brokers like Wealthify are funding from investors and client acquisitions.

As they usually charge their customers low fees their profit margins are really tight, so they need a vast amount of customers to be profitable.

Wealthify accounts and taxes

Wealthify allows you to have an investment ISA if you are a UK resident where you can invest up to £20,000 each year.

The ISA investment will benefit you as you will not pay taxes on your investment earnings.

If you already have an ISA investments account, then Wealthify staff can help you to transfer it to their platform and implement one of its investment plans.

This can be done online too. If you would like to open a Junior ISA for your son or daughter, then a Junior Stocks and Shares ISA could be a good investment on their savings for university fees or to start a business by the time they turn 18. Junior ISAs offer a tax breaks and you can save as much as £4,368 per child every year.

Investing profiles

Usually, with most robo-advisers, you are required to complete a risk profiling questionnaire before providing a sample portfolio.

In this regard, once you selected the preferred plan type (i.e an ISA) Wealthify goes straight to the point with five investment plans to choose from ranging from ‘cautious’ to ‘adventurous’ with both an original and ethical version of each.

The goal of Wealthify is to spread to the other 65M people in our country that could make their retirement years better without distress and effort to select the correct companies to buy and hold. With Wealthify you do not have to know anything of this, just let the broker make your pounds run selecting your investor profile!

Differently from other robo-advisors like Wealthsimple, Nutmeg and Moneyfarm that require far bigger amounts of starting capitals, you can open an account with as little as £1 and no upper limit on Wealthify, though above certain limits it starts being less convenient than other brokers because of their fees we will now be exploring.

As stated before, Wealthify is a broker for small to medium size investors with capitals below £100.000, larger investors would surely find better fees on other brokers.

Wealthify charges two fees:

- A management fee -> you will pay a management fee of 0.7% up to £15,000. From £15,001 to £50,000 you will pay 0.6%, from £50,001 to £100,000 it’s 0.5% and above that level, you pay just 0.4%.

- And other investment costs such as fund charges which account for 0.22% of the total fees you will be paying.

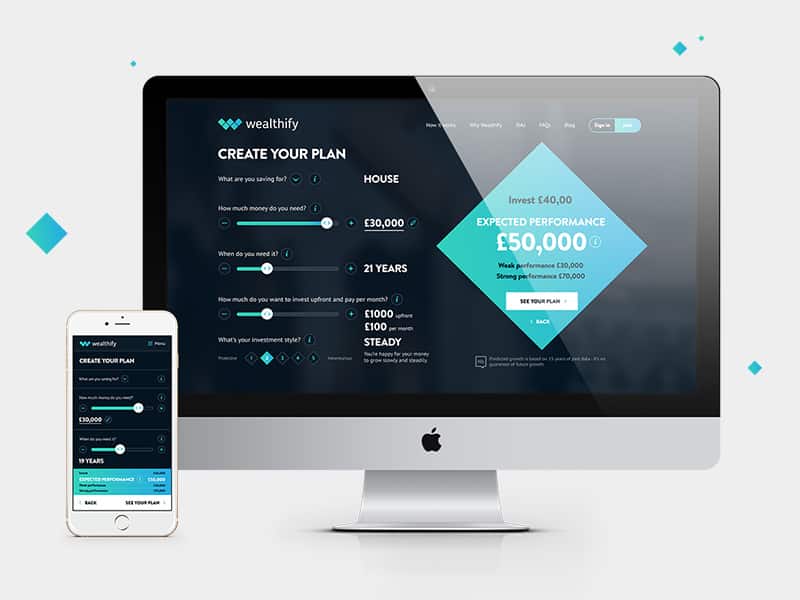

Do you want to start investing just £1.000 and then add £100 every month? Something you do not see too often in other brokers are interfaces as simple like this:

The user interface of this page is exceptionally good with the use of scroll bars to set your desired investment amount, the time span you want to invest for and the level of risk you are happy to take.

This interface gives you an idea of what you can expect investing the amount you selected over the years you set below, in this case after 40 years from now, investing £100 every month with a starting deposit of £1.000, you will be expecting a sum of money ranging between £72,625 and £206,577.

Obviously, all of this is not guaranteed and it depends solely on the way the market will behave in the future.

Yield and expectations for each plan

What is the yearly yield return for each profile? After some calculations you can come up with this conclusion with the original theme:

- Cautious, 1.5%

- Tentative, 2.0%

- Confident, 2.5%

- Ambitious, 3.0%

- Adventurous, 3.5%

Wealthify also specialises in offering an ethical version of each plan to help you invest in socially and environmentally responsible assets. This means your money will not be invested in guns and oil or companies suspected to abuse of child labour.

- Cautious, 1.0%

- Tentative, 1.5%

- Confident, 2.0%

- Ambitious, 2.5%

- Adventurous, 3.0%

As you see it drops by 0.5% on each profile.

This is how it performed in 2018, a year of losses:

- Cautious, -1.65%

- Tentative, -2.88%

- Confident, -4.43%

- Ambitious, -6.10%

- Adventurous, -7.62%

And here 2019, a year of overall great earnings:

- Cautious, +6.43%

- Tentative, +9.37%

- Confident, +11.96%

- Ambitious, +14.75%

- Adventurous, +17.14%

The best performing years yielded over 10% but during events like COVID-19, you can expect a sudden -30% until it recovers.

Where are your investments going?

By pressing continue you will then see the chart with the relative costs for our £1,000 starting investment with an additional £100 a month.

What are you expected to pay on the adventurous profile over 40 years? £14.04 the first year and similarly all the other years to come and 0.89% of general investment fees. That is important data to keep in our mind because if this value is too high it could drag too much on our overall performance.

Wealthify provides data on where your money is going to be invested, in my case with the adventurous plan my portfolio will focus on shares (high yield) and safer options like governmental bonds and proprieties.

And you can also observe in which countries these investments are made, usually, for safer investments, you look for already developed market such as European and American well-known companies, State indexes and their relative governmental bonds. Meanwhile, the Emerging markets (Asia and Africa) represent a high-risk high-return option. The Global represents the most diversified ETF option (we will analyse farther what it is) that follows exactly the trending of our global economy, always in a bullish market, meaning up-trend, growing.

Creating your risk-based portfolio is relatively easy and really fast.

Manage your portfolio as you wish

Upon completion of your plan, you can also alter the risk level of it to see how it impacts your overall assets. You will then be presented a multiple-choice questionnaire to see if the investment is suitable for you, some questions you will be asked to answer include:

- Do you plan to withdraw at least half of the money within the next three years from your account?

- Do you accept the unfortunate probability that the money you deposited could go down?

- Do you understand what a high-risk investment is?

- How would you feel if your investment fell by 20% in a 12 months-span period?

- What are your current savings levels? Do you have at least 3 months of salaries to rely on?

- How much debt do you currently have to repay?

Based on your answers, Wealthify can decide whether you are or you are not eligible to investing. If for example, you are covered in debts and you have little to no savings, they will not let you invest for your own safety. They want to show everyone that they are committed to living up to moral and present-day legislative obligations to enlarge their audience for their honesty. It is also true that you could lie on these questions and you would still manage to invest as if nothing happened like on every but this can happen in any other robo-advice service.

How does Wealthify compare against its competitors?

In 2019 Wealthify underperformed its competitors in terms of earnings but at the same time demonstrating that it is indeed overall safer than Wealthsimple and Nutmeg at high-risk high-return investments and tries to keep your capital the safest possible.

Comparison with traditional investments on regulated brokers

We do have to consider that Wealthify is made for the newcomers to the world of finance. It is easy and straight to the point. Also, your expectations can not be too high if your knowledge in finance is minimal, therefore your earning expectations act accordingly, in fact, these earnings are not even close to what Warren Buffet is gaining, but it prevents you from losing money because of inflation and in exchange, it is better than keeping your money in the bank and not using them.

As we stated earlier the maximum expected yield return with the adventurous plan is 3.5%. Yet the global economy grows on average by 6-7% annually so we are underperforming the market by choosing these kinds of advisors. Generally, it takes just 1-2 hours of research to find better portfolios that best suit your age. Let us dive into how they are chosen!

What do investors buy?

Generally, the rule goes like this:

- Governmental bonds are the safest and give a return between 0.25% to 2% as the government always prints money in case, they do not manage to repay their debt towards investors;

- ETFs are derivatives (collection of contracts) of a vast number of companies that belong to the same sector, like an ETF that contains 100 of the best performing airlines in the world, so if one fails, the overall trend is still positive and therefore less risky as it is diversified.

- Shares are the riskiest because they could perform negatively or extremely good and generally you buy them individually so you must know what you are doing and do the research to be convinced that the company will still exist in the future.

How is a portfolio determined from your starting age?

Generally, the younger you are the riskier investments you can make, therefore much more shares you can buy; as you get old you want to preserve your investments or savings for your retirement so it is better to move your money towards ETFs and Governmental bonds.

Vanguard ETFs:

Vanguard ETFs have increasingly become more and more popular for their risk-reward ratio.

As we stated before, the global growth ratio is currently around 6-7%, much more than what Wealthify and its competitors offer, and there is a single Vanguard ETF that could be sufficient to single-handedly eliminate these robo-advisor competitors.

The Vanguard Total World Stock ETF is an extremely diversified ETF that makes us richer as our planet progresses, and our economy is always going up, never down, or otherwise, we would reverse in time and technology towards the Stone age. This is what this Vanguard ETF offers:

- Invests in both foreign and U.S. stocks.

- Seeks to track the performance of the FTSE Global All Cap Index, which covers both well-established and still-developing markets.

- Has a high potential for growth, but also a high risk; share value may swing up and down more than the U.S. or international stock funds.

- Only appropriate for long-term goals.

Hereunder you can observe that your capital doubles every ten years equivalent to a 7% growth.

What are the impressions of their customers?

Last 5 reviews on trust-pilot, https://www.trustpilot.com/review/wealthify.com:

- 5 stars: I made a small investment in an ethical… I was amazed with the number of updates I was getting and the proactive approach of the support team in managing my account thoroughly and efficiently.

- 5 stars: I opened an ISA nearly a year ago and… Before our current Corona situation the return had yielded up to +9% and even with the global financial problems that we are facing they still portray only -0.5% of losses. I will undoubtely consider using this year’s allowance for another ISA with this company.

- 5 stars: Just the beginning I have an interest for long term investments but I didn’t know where and how to start picking the right investments for myself. Although I only invested a small amount so far, I have already made a considerably high return than I expected – and all from ethical investments!

- 5 stars: I love this company It is so easy to invest in ISA shares for your pension and they proactively update me with their ideas and changes to their plans to suit my risk, which are communicated really well and quickly.

- 5 stars: Great Service Overall exceptional communication, easy to use app and super innovative features.

Last 3-1-star review on trust-pilot:

- 1 star: Tucked up I transferred some of cash from an ISA account to Wealthify but as It did not come from my linked account they rejected it. Though, they sent it back to my current account and not back to the ISA and this made me lose my tax-free status without repayment.

- 1 star: There advert tells people anyone can…Their advert tells people anyone can invest on their broker up until you put in you fill the questionnaire and they tell you that you do not have sufficient money! Yet again another broker full of bs!

- 1 star: Terrible My intention was to invest fifty pounds a month for the following ten years. I answered their questionnaire to be then told both times that I was not a good candidate for the investment program. Really? Without motivation. Not impressed.

Is the app for mobile supported on all devices?

You can download their app on iOS and Android devices and seems also quite intuitive and straightforward for newbies to finance, resulting at the top with 5 stars in this review.

It also has an online calculator with which you can create your own hypothetical investment plan based on the amount invested considering the time frame, starting capital and monthly investment etc. This can provide useful projection into the yields you could expect given present and past levels of market volatility.

Customer support

There are some traditional contact options such as a chat, e-mail and phone number to send enquiries of every kind and get support for your needs briefly. They also provide an adequate FAQ sufficient to answer most of your doubts on their service.

Their phone line is answered locally in the UK from UK-resident staff between 9:00 AM and 6:30 PM from Monday to Friday and on Saturdays with the following timetable 9:00-12:30 PM.

Although their customer support do know a lot about finance and have degrees in this field, bear in mind that they do not provide financial ANY KIND of advice, they are not allowed to direct with your investments, it is something you should NEVER expect help with since all you need to do is listen to their robo-advisor.

Payment methods allowed:

It is possible to deposit and withdraw via bank transfer or direct debit, but support e-wallets or debit/credit cards payments are rejected.

Bank transfers typically need from 3 to 5 business days to get in your account. Direct debits take up to 7 business days to leave your account and then 2-3 days to appear in your investment plan.

Conclusions:

Advantages +++

Wealthify is extremely easy to use on all your devices and the interface dumb-proof showing what you can expect after some years you invested your money and by allowing you to calculate it by yourself without a financial advisor.

It is designed to target the great masses to be part of the market, to save your income from inflation and possibly make some additional money on your savings.

It is not intended for trading or anything related but for small to medium investors that want to ”chill” and sleep relaxed that their money is safe. What they are doing is great as the investments will also support local companies in the UK and global companies to run faster towards their goals in a ”standard” or ”ethical” way.

Disadvantages —

As it is not intended for big investors, the fees are quite high if you invest over £100,000 and it is better if you choose another broker.

Also, with a little research, most people could discover that there are way more profitable opportunities on the market such as Vanguard ETFs that are as safe as Wealthify’s and its competitors but much more profitable on average.

The website almost contradicts itself when it shows that the amount you invest is, after years, always higher than what you invested so there is no point in choosing the safer over the riskier, for long-time investments.

It might be a good beginner platform, but it also isn’t well suited to the more affluent or niche markets.

Further Reading

1. RL360 Regular Savings Plan Review explores structured savings options, offering insights that complement considerations in the Wealthify Review.

2. How does AJ Bell’s investment solution measure up?