Saudi Premium Residency can be obtained by applying online through the official Saudi Premium Residency portal, allowing eligible foreigners to live, work, and own assets without a local sponsor.

It is designed for professionals, investors, and long‑term residents who want greater freedom, security, and economic participation in the Kingdom.

This article covers:

- Who qualifies for Saudi Arabia Premium Residency?

- What is the requirement for premium residency in Saudi Arabia?

- How long does it take to get Premium Residency in Saudi Arabia?

- How much is Premium Residency in Saudi Arabia?

- What is the validity period of Premium Residency in Saudi Arabia?

Key Takeaways:

- Saudi Premium Residency removes the need for a local sponsor.

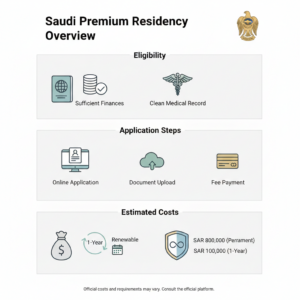

- Eligibility is based on income, assets, and background checks.

- Costs vary by residency type and duration.

- The program is best suited for long-term residents and investors.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Who is eligible for premium residency in Saudi Arabia?

Premium residency in Saudi Arabia is available to foreign nationals aged 21 and above who can demonstrate financial independence, a clean legal and security record, and compliance with Saudi health and immigration requirements.

Applicants must hold a valid passport, have no criminal record, and show no prior legal or immigration violations in Saudi Arabia.

Proof of financial capability is required, along with a medical examination and valid health insurance coverage.

Eligibility groups include:

- Professionals and skilled workers – Must show stable employment or professional income, and in some cases provide educational or professional certifications.

- Investors and business owners – Must demonstrate business ownership, investment capital, or portfolio holdings, supported by official documentation.

- High-net-worth individuals – Must provide proof of substantial personal or liquid assets to confirm financial independence.

How do I apply for Premium Residency in Saudi?

You apply for Saudi Premium Residency online through the official Premium Residency portal without needing a Saudi sponsor.

The application process generally involves:

1. Create an online account – Sign up on the Saudi Premium Residency platform to start your application and access the required forms.

2. Complete the application form – Fill in personal, professional, and financial details accurately to meet eligibility criteria.

3. Upload supporting documents – Provide a valid passport, proof of income or assets, medical records, and background information to verify your eligibility.

4. Pay the application fee – Submit the required fee online to process your application and confirm your commitment.

5. Respond to follow-up requests – Authorities may ask for additional documentation or clarifications during their review, so stay attentive to notifications.

Once all steps are completed, Saudi authorities review the application, and approval is granted if all eligibility and compliance requirements are satisfied.

What documents are required for Saudi Arabia Premium Residency?

At minimum, a valid passport is required to apply for Saudi Premium Residency, along with other supporting documents to prove eligibility.

Required documents typically include:

- Proof of income, assets, or business ownership to demonstrate financial solvency

- Recent medical records and valid health insurance

- Criminal background clearance or police certificate from your home country

- Any additional documents requested by the authorities during application review

Submitting complete and accurate documentation helps ensure a smooth approval process and reduces delays during verification.

What is the salary requirement for premium residency in Saudi Arabia?

Researchers applying for Saudi Premium Residency must earn at least SAR 14,000 per month, while healthcare professionals typically need SAR 35,000.

Meanwhile, executives may require SAR 80,000 or more depending on their category.

These amounts apply only to specific eligibility tracks, while other residency types such as investors, entrepreneurs, or property owners, are assessed based on capital, assets, or business ownership rather than a fixed salary.

How much does Saudi Premium Residency cost?

The permanent Saudi Premium Residency requires a one-time fee of SAR 800,000.

Other options, such as the one-year renewable residency at SAR 100,000 per year or category-specific permits for investors, entrepreneurs, gifted individuals, and property owners starting around SAR 4,000, are assessed based on type and duration.

Fees are subject to change and typically payable in full upon approval.

How long does it take to get premium residency in Saudi Arabia?

Saudi Premium Residency typically takes 3 to 6 months from submission to approval.

The timeline depends on the completeness of documents, background checks, and verification of financial and eligibility information.

Once approved, applicants can choose either a one-year renewable residency or the permanent unlimited residency, depending on the option selected.

Is Saudi premium residency worth it?

Saudi Arabia Premium Residency is worth it for individuals seeking long‑term stability, business ownership, and personal independence within the country.

It allows holders to live and work without sponsorship, change employers freely, own businesses, and sponsor family members.

However, the cost and eligibility requirements mean it is best suited for professionals, investors, and high‑income individuals rather than short‑term residents.

How does Saudi Premium Residency affect taxes?

Saudi Premium Residency does not automatically create new personal income tax obligations, as Saudi Arabia does not levy personal income tax on employment income.

However, tax exposure may arise from business activities, foreign income rules in your home country, or international tax residency considerations.

Premium residents should assess their global tax position carefully, especially if they maintain assets or income abroad.

What is the difference between Saudi Arabia Premium Residency and Iqama?

The main difference is that Premium Residency allows living and working in Saudi Arabia without a sponsor, while an Iqama is tied to an employer or sponsor.

A standard Iqama limits your ability to work for multiple employers, own property, or start a business independently.

Premium Residency grants greater autonomy, including the ability to invest, own property, and travel freely in and out of the country.

The two also differ in cost and duration: Iqama is a yearly permit with lower fees, while Premium Residency ranges from SAR 100,000 for one-year renewable residency to SAR 800,000 for permanent residency.

In short, Iqama provides standard, sponsor-tied residency, while Premium Residency offers independence, flexibility, and long-term security for expatriates and investors.

Conclusion

Saudi Premium Residency offers a powerful alternative to traditional sponsorship‑based residency for those who qualify.

For individuals focused on long‑term residence, investment opportunities, and lifestyle flexibility in Saudi Arabia, it can provide clarity, control, and legal certainty that standard visas do not offer.

FAQs

What are the two types of Saudi Premium Residency?

The two types of Saudi Premium Residency are the one‑year renewable residency and the permanent residency option.

Both offer similar privileges, but the permanent option requires a higher one‑time payment.

Can I own property with Saudi premium residency?

Yes, Saudi premium residency allows foreigners to own residential, commercial, and industrial property in most regions of Saudi Arabia, subject to local regulations.

How much is 1 year Iqama in Saudi Arabia?

A standard one‑year Iqama (residency permit) typically costs around SAR 600–650 per year for issuance or renewal, though this can vary slightly by category.

This base government fee does not include additional costs like work permit (Maktab Amal) charges, health insurance, or dependent fees, which employers usually pay but can significantly increase total costs.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.