You can hold USD in an Indian account, but only through specific account structures and regulatory conditions set by the Reserve Bank of India (RBI).

The rules for holding USD differ significantly for Indian residents and NRIs, particularly around permitted accounts, cash limits, and reporting obligations.

This article covers:

- Is it illegal to hold foreign currency in India?

- Can an NRE account hold foreign currency?

- How much cash can I bring to India without declaration?

- What is the difference between NRE, NRO and FCNR accounts?

Key Takeaways:

- USD holding in India is allowed only through approved foreign currency accounts.

- Cash USD holding by residents is tightly restricted.

- NRIs can hold USD via FCNR accounts, not NRE or NRO.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Is it illegal to hold foreign currency in India?

Holding foreign currency in India is legal, but only within limits and through RBI-approved account structures under India’s Foreign Exchange Management Act (FEMA).

Residents may retain foreign currency up to a specified threshold, while larger amounts must be deposited into approved accounts or converted into Indian Rupees (INR).

USD deposits can only be made into eligible foreign currency accounts; standard resident savings accounts do not accept foreign currency deposits and require conversion into INR before credit.

Permitted account formats include Exchange Earners’ Foreign Currency (EEFC) accounts for residents and NRE or FCNR accounts for non-resident Indians (NRIs).

How much USD can an Indian hold?

Under RBI regulations, Indian residents may hold up to USD 2,000 (or equivalent in other foreign currencies) in physical cash or travellers’ cheques obtained from permitted sources.

This limit is designed to allow for short-term travel or minor foreign transactions while maintaining regulatory oversight.

Amounts exceeding this threshold must be deposited with an authorized dealer bank or credited to an RBI-approved foreign currency account, ensuring proper documentation and compliance with India’s foreign exchange rules.

How long can we keep dollars in India?

Foreign currency held in cash must generally be deposited into an approved account or converted into Indian Rupees (INR) within 180 days of receipt, as per RBI regulations.

Retaining cash beyond this period without proper deposit or conversion is not permitted and may lead to regulatory scrutiny.

If the funds are placed in an RBI-approved foreign currency account, such as an EEFC or FCNR account, they can be legally maintained for a longer duration while remaining fully compliant with Indian foreign exchange rules.

What happens if I bring more than 10,000 USD to India?

If you bring more than USD 10,000 (or equivalent) into India without declaring it, the excess can be confiscated, and you may face penalties or regulatory scrutiny under FEMA.

Bringing amounts above this threshold is allowed only if you declare them at customs using the Currency Declaration Form (CDF) when entering India.

This rule applies to residents and non-residents alike, and includes cash, travellers’ cheques, or bearer negotiable instruments.

Proper declaration ensures compliance with RBI and customs regulations and avoids legal consequences.

Can I hold USD in my NRE account?

No, NRE accounts cannot hold USD directly.

They are funded by foreign currency remittances, which are converted into Indian Rupees (INR).

To hold USD or other foreign currency without conversion, NRIs must use an FCNR (Foreign Currency Non-Resident) account, which allows deposits in major currencies.

Which currency is permitted for FCNR?

FCNR (Foreign Currency Non-Resident) accounts can hold a range of major currencies approved by the Reserve Bank of India (RBI), including USD, GBP, EUR, JPY, AUD, CAD, and CHF.

These accounts allow NRIs to earn interest directly in the foreign currency while avoiding conversion into Indian Rupees (INR), helping to preserve the value of their funds.

By maintaining deposits in their original currency, account holders are protected against exchange rate fluctuations and potential currency depreciation.

FCNR accounts also provide full repatriation of both principal and interest, making them a convenient tool for managing international funds while staying compliant with RBI regulations.

Do I have to pay tax on my NRE account in the USA?

Interest earned on NRE (Non-Resident External) accounts is completely tax-free in India, providing a key benefit for NRIs who want to grow foreign funds without Indian tax liability.

However, for US tax residents, this interest may still be subject to taxation in the United States, since the IRS requires reporting of worldwide income.

NRIs must also disclose foreign financial accounts under FATCA (Foreign Account Tax Compliance Act) regulations to ensure compliance.

Failure to report NRE account holdings or interest can result in penalties, so it’s essential to coordinate with US tax advisors while maintaining these accounts.

How much money can NRIs keep in India?

NRIs can maintain unlimited balances in NRE or FCNR accounts, making these accounts suitable for holding substantial foreign funds in India.

Deposits must originate from legally earned foreign income or eligible remittances and comply with Reserve Bank of India (RBI) regulations.

These accounts also allow NRIs to earn interest in the original foreign currency, protecting against exchange rate fluctuations and preserving purchasing power.

How much USD can NRI carry from India?

NRIs are allowed to carry up to USD 3,000 (or equivalent) in cash when leaving India, which applies to travelers departing on personal or business trips.

Carrying amounts above this limit as physical cash is not permitted, and exceeding it without proper declaration can lead to regulatory penalties under FEMA.

For larger sums, NRIs must use authorized banking channels, such as wire transfers or NRE/FCNR accounts, to move funds abroad safely and in compliance with RBI and customs regulations.

This framework ensures proper monitoring of cross-border currency flows while allowing NRIs flexibility to access their foreign funds.

Can we deposit USD in a NRO account?

No. An NRO (Non-Resident Ordinary) account only accepts deposits in Indian Rupees (INR).

So if an NRI wants to deposit USD (or any other foreign currency), it must first be converted to INR through the bank before being credited to the NRO account.

This aligns with RBI/FEMA rules; NRO accounts are meant for income earned in India (like rent, dividends, or pensions) and for repatriating funds after conversion, not for holding foreign currency.

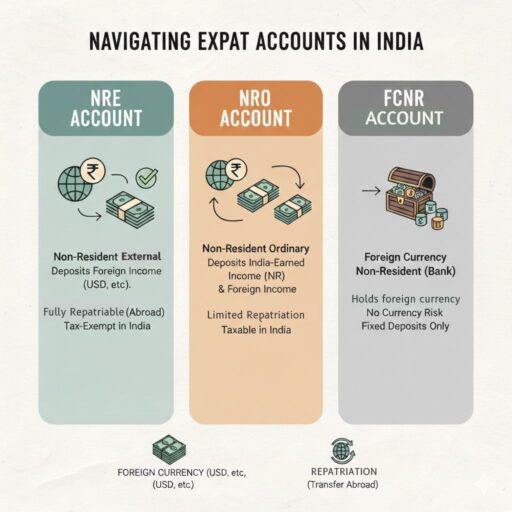

NRE vs NRO vs FCNR

These accounts differ mainly in who can open them, the currency they hold, repatriation rules, and tax treatment.

Here’s a summary at a glance to quickly compare their key features and purposes.

| Account Type | Currency Held | Purpose | Repatriability | Tax on Interest | Key Notes |

|---|---|---|---|---|---|

| NRE (Non-Resident External) | INR (foreign remittances converted to INR) | Sending money from abroad to India | Fully repatriable | Tax-free in India | Suitable for NRIs to remit funds; maintains INR balance |

| NRO (Non-Resident Ordinary) | INR (Indian income or converted foreign funds) | Managing Indian earnings like rent, dividends, pensions | Partially repatriable | Taxable in India | Designed for income earned in India; funds converted to INR |

| FCNR (Foreign Currency Non-Resident) | Foreign currency (USD, EUR, GBP, JPY, etc.) | Holding deposits directly in foreign currency | Fully repatriable | Tax-free in India | Protects against exchange rate fluctuations; interest paid in foreign currency |

Do I need to declare foreign bank accounts in India?

Yes, Indian residents are required to declare all foreign bank accounts, financial assets, and overseas investments in their annual income tax filings under Schedule FA of the Income Tax Return.

This includes accounts held individually or jointly, and even dormant or inactive accounts abroad.

Failure to report these assets can result in penalties, interest, or legal action under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act as well as other income tax regulations, making full disclosure essential for regulatory compliance.

Conclusion

Holding USD in India requires navigating RBI rules, account types, and repatriation limits, which vary for residents and NRIs.

While NRE and NRO accounts are INR-denominated, FCNR accounts offer a strategic way for NRIs to preserve foreign currency and hedge against exchange rate fluctuations.

Understanding these distinctions helps optimize global funds management, ensures regulatory compliance, and provides flexibility for international financial planning.

Staying informed about reporting obligations and permissible limits is key to avoiding penalties and making the most of your foreign currency holdings in India.

FAQs

How much cash can you legally keep in India?

There is no specific legal cap on holding INR cash, but large amounts may attract scrutiny under income tax and anti-money laundering laws.

Foreign currency cash limits are governed by FEMA rules.

Which bank gives 9.5% interest on FD in India?

Some small finance banks, like Unity Small Finance Bank, offer very competitive fixed deposit rates, including up to 9.50% p.a. for senior citizens on certain tenures.

Regular FD rates at Unity can reach around 9.00% p.a., significantly higher than most large public-sector banks.

Rates vary by tenure, deposit amount, and promotional periods, so checking the bank’s current FD schedule is recommended.

How much NRI is tax free in India?

Income earned outside India and credited to NRE or FCNR accounts is tax-free in India.

Income sourced within India, such as rent or capital gains, remains taxable.

How much money can NRI send to India without tax?

There is no limit on remittances sent to India, but tax applies based on the nature of income, not the transfer amount.

Gifts and family transfers may qualify for exemptions under Indian tax law.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.