Ever wonder what the best investments for beginners are?

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Introduction

If you want to start investing for your future this year but don’t know where to begin, you’ve come to the correct spot. Investing does not have to be difficult or confusing. In fact, investing in your future is one of the finest long-term investments you can make, particularly if you’re still a few decades away from retirement.

While investing is straightforward once you get started, knowing where to start can be difficult. The quantity of investment information accessible may be overwhelming, and you may find yourself filtering through ill-advised stock purchases, unsolicited advice from family members, and market news that is always full of drama.

The key to a good retirement account is to get started early and invest frequently. Furthermore, compound interest, which may provide a significant boost with a lengthy investment horizon, can make your money work for you and increase even while you sleep.

Don’t know where to begin? This article is here to help you. The finest financial methods are frequently the most straightforward. Let’s take a look at some of the best investments for beginners this 2022.

Investing Strategy for Beginners

Before you begin investing, there are a few things to consider.

First, think about your budget and emergency fund. Before you invest actively in the market, experts recommend having around six months’ worth of expenditures set away in a savings account. If you have a 401(k) via your company, it’s a good idea to start investing to it while growing your emergency fund. You’ll still be eligible for employer contribution matching. However, get your emergency fund in motion.

In most circumstances, it is best to pay off high-interest debt before beginning to invest. Those with school debts or mortgages with APRs less than 5% may choose to pay them off gradually while simultaneously investing in the stock market. Personal loans and credit card balances with APRs of 10% or more, on the other hand, should be addressed first, as any market gains would certainly be swamped by the interest on that debt.

Once you’ve saved enough for a rainy day fund, go beyond your budget and invest as much as you’re comfortable with (or can). Keep in mind that even $5 may be used to invest. Small, regular sums build up over time, and the most essential thing is to be consistent and begin as soon as possible.

Investment Vehicles

401(k)s, Roth IRAs, and Traditional IRAs

To acquire any of the funds, you must first get an investment vehicle. This is when specialized retirement funds, such as an employee-sponsored 401(k), Roth or Traditional IRA, come into play. Using a retirement account to purchase assets is a good approach to invest for the long term. These accounts offer tax benefits, allowing your profits to grow tax-free or tax-deferred for years.

Taxable Brokerage Accounts

Unlike a retirement plan, which has special tax advantages if you withdraw at the right age (59.5 is the earliest), a brokerage account is a standard investing account where you can be taxed on profits and withdrawals.

With a brokerage account, you may purchase assets such as stocks, bonds, and index funds. Unlike retirement funds, there are no restrictions on how much you may deposit or when you can take it.

3 Best Investments For Beginners In 2022

Now that you’ve read about investment vehicles, it’s time to learn about the investments themselves. Here are the 3 best investments for beginners that you can choose from as you start your journey with investing:

1. Target Date Funds

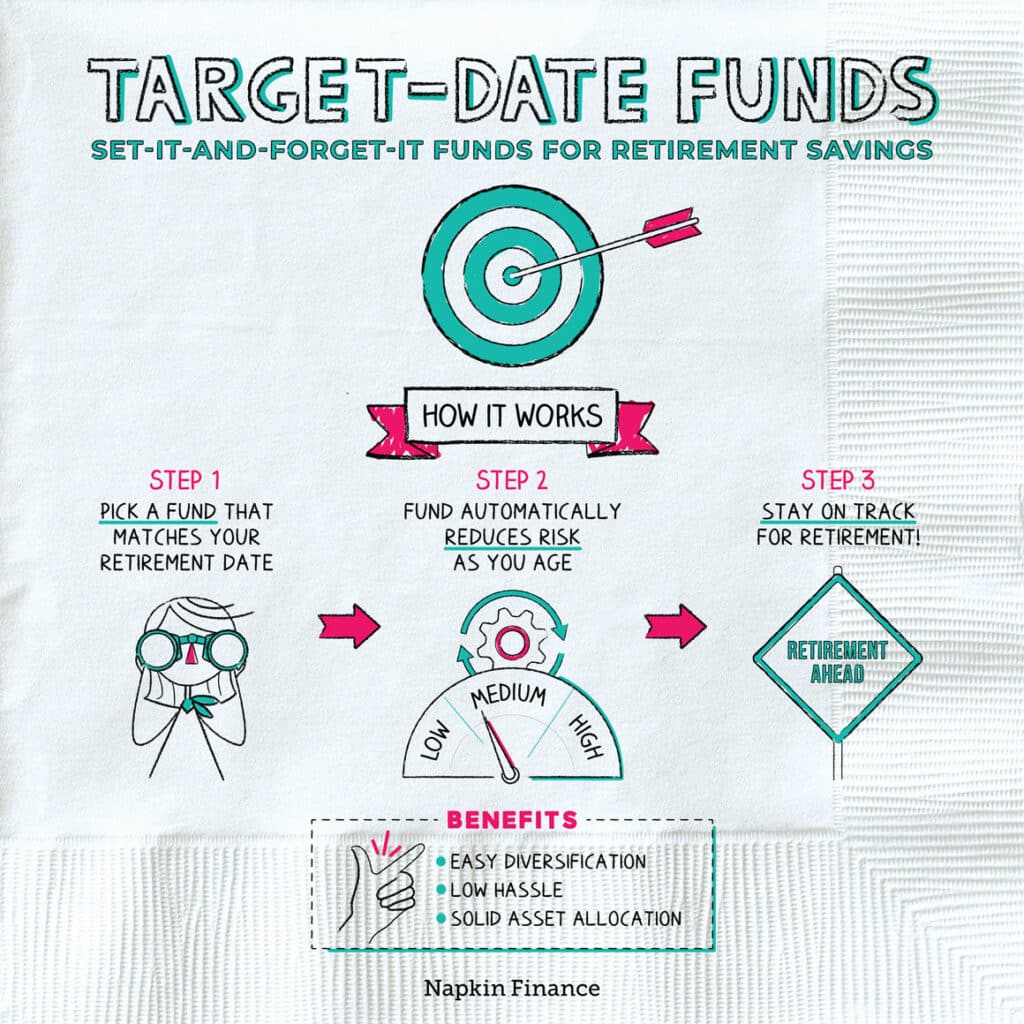

Experts love target date funds, and for good reason. Target date funds are a mix of stocks and bonds in a single fund that automatically become more conservative over time.

Designed to mitigate risk the closer you get to retirement, target date funds often include a year in their name, such as “Target Date 2060 fund.” Employer-sponsored retirement plans commonly offer target date funds as investment options, since they allow employees to easily set it and forget it, so to speak.

Target date funds are a straightforward method to save for a certain day and time, and they enable access to a wide range of markets. This is advantageous since you do not have to select specific stocks or conduct extensive research.

If you want something simple, target date funds are a wonderful place to start. You can fund one through your company’s 401(k), a brokerage account, or your own Roth or regular IRA.

In fact, wealthy investor and creator of Personal Finance Club once said that if he could remake his whole portfolio, he would invest in a single target date fund. Target date funds are the best investments for beginners.

2. Index Funds

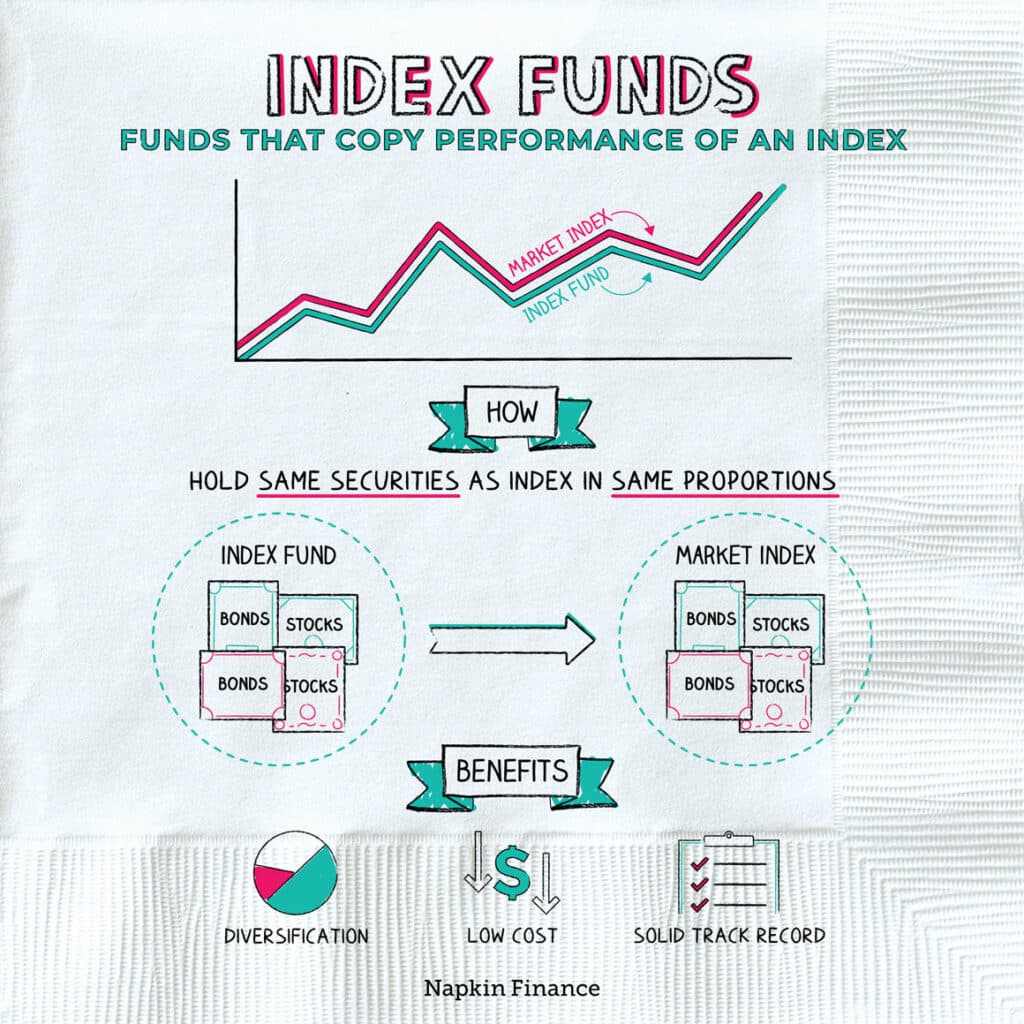

Index funds are investments that monitor and attempt to replicate an index, such as the whole market, the S&P 500, and many others.

Because it is diversified, has reduced costs, and exposes you to a large portion of the market in a single transaction, an index fund is an interesting and reasonably safe option to make your first investment.

Small sums of money can be the starting capital to start investing in index funds. The Fidelity® ZERO Large Cap Index Fund and Fidelity® ZERO Extended Market Index Fund, for example, have no minimum investment requirements. Most major asset managers have comparable products that the common investor may readily open with a little initial deposit.

Index funds, like target date funds, can be acquired through a taxable brokerage account or tax-advantaged retirement plans such as a 401(k), conventional or Roth IRA.

3. ETFs

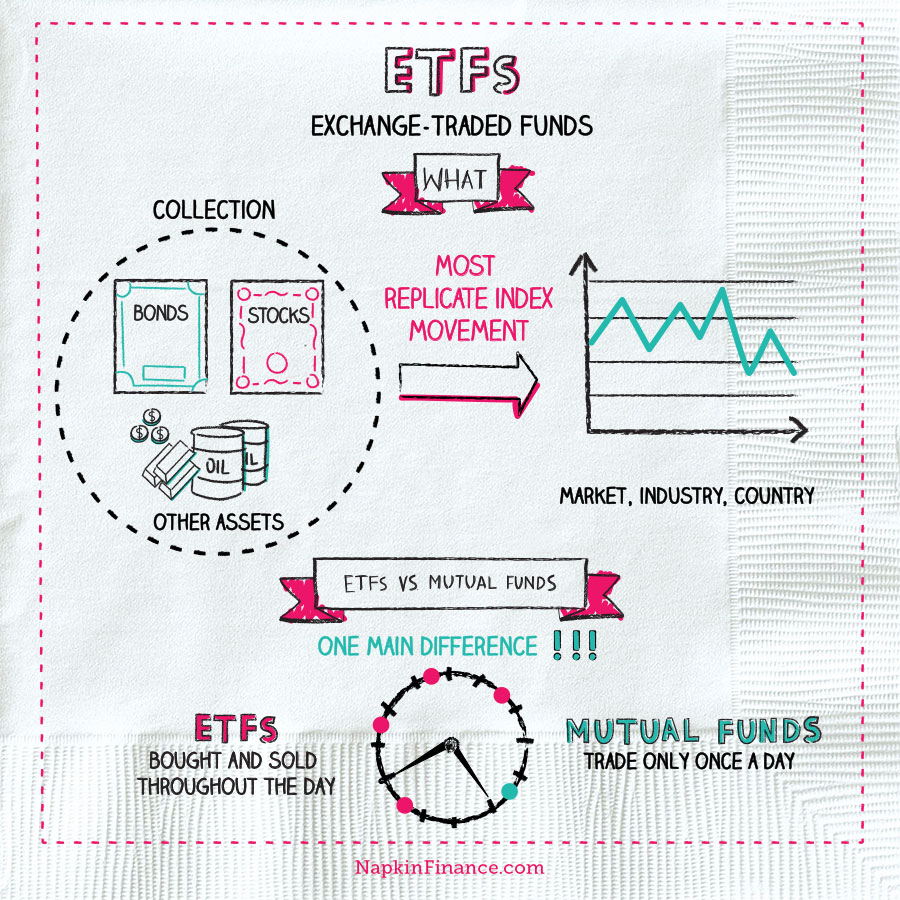

An exchange-traded fund (ETF) is a form of instrument that tracks a certain index, sector, or commodity and may be bought and sold like a stock throughout the day. ETFs are traded on an exchange, unlike mutual funds, which may only be traded once a day after the market closes.

ETFs are also a good option for taxable brokerage accounts because of their tax efficiency.

Start Investing Today

An investment adviser can help you decide which assets are appropriate for you by asking you a few questions about your risk tolerance and investment timeline to, if you need help with your investment portfolio.

Most investors employ advisors due to their reliability in investments. You can open an account once you’ve determined your risk tolerance.

Invest Consistently

Invest at regular periods, like as when you are paid. This approach is known as dollar-cost-averaging, and it works by contributing consistently over time to get you in the habit of investing.

Simply concentrate on consistency. Some businesses may even put a percentage of your paycheck into your investing account automatically. Make certain that the money in your account is not just sitting there.

Make an additional effort to make sure it’s being put to good use. It’s not always enough to just transfer money across accounts, depending on the kind. You must purchase the stock or fund you intend to invest in with many online brokers.

Finally, check in on a regular basis. Markets rise and fall, but if you have a long-term perspective, you can withstand the downturns. Check to ensure that your accounts are running as intended, that dividends are being paid, and that your investments are appropriate for your risk tolerance and long-term goals.

You’ll be setting up your future self with enough cash when you’re ready to retire if only you invest with consistency, time in the market, and investments you feel good about.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.