The Brazilian real estate market has always captured the attention of international investors. With its vast landscapes, bustling cities, and rich culture, Brazil offers a unique allure for those looking to diversify their portfolios.

However, while Brazilian real estate might seem like a golden opportunity, several factors make it a risky venture. In this article, we’ll delve into seven reasons why you might want to reconsider investing in Brazilian real estate at this time.

If you want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Economic Instability in Brazilian real estate

Brazil’s economic landscape has been tumultuous, casting shadows over the prospects of Brazilian real estate. The nation’s new leadership confronts a myriad of domestic and international challenges, with rising poverty, inequality, and the lingering aftermath of the Covid-19 pandemic at the forefront.

Additionally, the management of the Amazon rainforest and the need to mend Brazil’s international reputation are pivotal issues on the policy agenda.

Economic Challenges Under New Leadership

Luiz Inácio Lula da Silva, commonly known as ‘Lula’, assumed the presidency of Brazil in January 2023. His inauguration was followed by political unrest, with violent protests erupting in the country’s capital, Brasília.

These events, coupled with a deeply divided political arena, have set the stage for a challenging economic journey.

Brazil’s economic growth has been sluggish. In 2021, Brazil recorded a GDP growth of 4.6%, lagging behind other BRICS nations like India and China, which boasted growth rates of 8.9% and 8.1% respectively.

Projections by the OECD for Brazil’s economic growth stand at a mere 2.8% for 2022 and an even lower 1.2% for 2023.

Labor Market and Inflation

The repercussions of the economic crisis are evident in the Brazilian labor market. In 2021, 14.4% of working-age Brazilians found themselves unemployed, a stark contrast to the 7.3% unemployment rate during the end of Lula’s first presidency in 2010.

The burden of unemployment disproportionately affects women, especially those heading single-parent households. Inflation, once tamed during Lula’s earlier tenure, now poses a renewed challenge.

Brazilian real estate investors must grapple with stagnation in economic growth, high unemployment, and rising inflation, which diminishes Brazilians’ ability to manage their finances and afford basic necessities.

Currency Depreciation and Deindustrialization

Brazilian real estate is further impacted by the country’s currency woes. The Brazilian real has undergone significant depreciation in recent years.

Moreover, Brazil has witnessed a pronounced deindustrialization over the past two decades. From constituting 26% of Brazil’s GDP in 1980, the industry’s contribution dwindled to just 11% in 2018. This shift has made the Brazilian economy heavily reliant on commodities and services.

Social Implications of Economic Policies

Austerity measures and structural changes in social programs, particularly during the term of Lula’s predecessor, Jair Bolsonaro, have exacerbated inequality. Brazil, which had successfully exited the Hunger Map in 2014, found itself back on the list by 2021.

A staggering 33.1 million Brazilians currently face food scarcity, a significant increase from the 19.1 million in 2020. Furthermore, 58.7% of Brazilians live with some level of food insecurity, with the black Brazilian population experiencing a 70% surge in hunger.

International Economic Challenges

On the global front, Brazil’s economic challenges are accentuated by international dynamics. While a potential commodities boom could benefit Brazil, it is accompanied by rising energy and fuel costs, escalating living expenses worldwide, and the enduring economic scars of the Covid-19 pandemic.

Brazil’s diminished international reputation, primarily due to environmental concerns and human rights violations, poses another challenge.

Lula’s administration will need to rebuild trust, attract foreign investments, and foster new international trade agreements to stabilize the Brazilian real estate market and the broader economy.

Regulatory and Legal Challenges

Brazilian real estate, particularly for foreign investors, is riddled with a myriad of regulatory and legal challenges. While the allure of investing in Brazil might seem enticing, it’s crucial to understand the complexities that come with it.

Complex Property Ownership Laws

Brazilian real estate is governed by a set of intricate property ownership laws. As per the Brazilian Federal Constitution and the Brazilian Civil Code (Law No. 10,406 of 2002), the right to own property is assured.

However, the actual transfer of real estate ownership requires a transfer deed, which must be drawn up by a notary public and registered with the competent real estate registry.

If one fails to register this transfer deed, the property remains under the name of the former owner, making it susceptible to credit risks, seizures, attachments, or other liens.

Frequent Changes in Real Estate Regulations

The Brazilian real estate regulations are not static. They undergo frequent changes, which can be a potential pitfall for foreign investors. These shifts can lead to unexpected costs or legal challenges.

For instance, Brazilian law dictates that an asset will be regulated by the laws of the country where it is located. Most aspects concerning real estate are governed by the Civil Code and the Law of Public Registries (Law No. 6,015 of 1973).

Restrictions for Foreign Investors

Foreign investors face specific challenges when it comes to Brazilian real estate. For instance, there are restrictions on the acquisition of rural properties or those located in the country’s border area.

Current rules demand that the acquisition or lease of rural properties by foreign entities, or even Brazilian companies majorly held by foreign investors, requires prior approval from either the Brazilian Institute of Agrarian Settlement and Reform or the Brazilian National Congress.

These rules also apply to corporate transactions that result in the indirect transfer of rural properties.

Border Zone and Rural Property Restrictions

Brazilian law has provisions that restrict the acquisition or possession of rural properties located in the country’s border zone. This acquisition depends on approval by the National Defence Counsel.

To navigate these restrictions, a foreign investor aiming to invest in rural Brazilian real estate should either seek approval from the competent bodies or consider other legal structures, such as granting in rem rights or entering into a joint venture with a Brazilian partner.

The Ever-Evolving Legal Landscape

While the current legal framework presents challenges, it’s also worth noting that discussions and reforms are ongoing. For instance, the Brazilian Congress is deliberating on a bill that could significantly reform the Brazilian framework on security interests.

The primary goal of this reform is to expedite foreclosure processes and minimize the underutilization of encumbered assets. However, the outcome and impact of such reforms remain uncertain.

Property Maintenance and Management Concerns

Brazilian real estate is not just about acquisition but also about maintenance and management. While Brazil offers a plethora of beautiful properties, potential investors should be wary of the intricacies involved in property management.

The Impact of Brazil’s Climate on Properties

Brazil’s diverse climate, ranging from the lush Amazon rainforest to the bustling cities like São Paulo and Rio de Janeiro, has a direct impact on property maintenance.

While the tropical climate is undoubtedly captivating, it brings with it a host of issues. Properties are often subjected to weather-related damages such as humidity, leading to mold and structural damage.

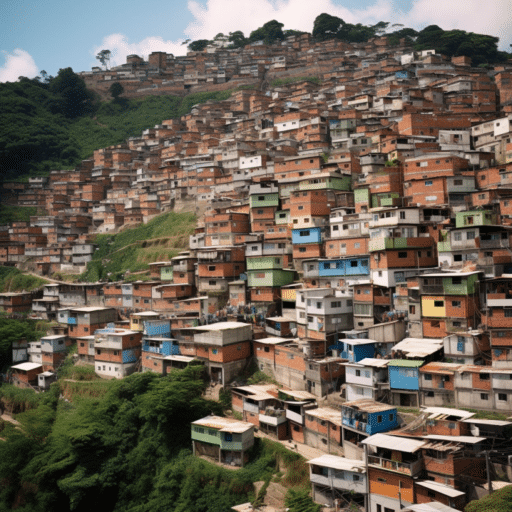

Moreover, certain regions, especially the favelas or informal settlements, are prone to flooding. These weather-related challenges not only escalate maintenance costs but also make regular upkeep essential for Brazilian real estate.

Infrastructure Challenges in Urban Areas

Brazil’s rapid urbanization has led to a surge in the number of residents in cities. For instance, São Paulo, the largest city in Brazil, houses 10 million people, making it one of the most densely populated cities. With such a dense population, infrastructure problems are bound to arise.

Many regions, especially the favelas, grapple with inadequate infrastructure. These areas often lack proper sewage and water systems.

A study by Brazil’s Institute of Applied Economic Research estimated that 28.5 percent of the urban population does not have access to public water, sewage, and garbage collection services. Such challenges further increase the costs and complexities of property maintenance in Brazilian real estate.

The Complexities of Managing Properties in Favelas

Favelas, the informal low-income housing settlements in Brazil, house an estimated 20 percent of Brazilians. These settlements, which began as makeshift structures for soldiers post-civil war, have grown over the years, often in areas prone to natural disasters like mudslides.

Managing properties in such areas requires a deep understanding of the local challenges. For instance, retrofitting these densely built areas with roads and utility systems is a daunting task.

Moreover, the prevalence of crime, especially drug trafficking, in these areas makes property management even more challenging. Brazilian real estate in such regions requires not just maintenance but also a proactive approach to ensure the safety and well-being of the residents.

The Challenge of Finding Reliable Property Management

While Brazilian real estate offers numerous opportunities, finding trustworthy property management is a significant hurdle. The cultural differences, coupled with language barriers, often lead to misunderstandings.

Without a reliable team to oversee properties, especially in challenging areas like the favelas, investments can quickly turn sour. Moreover, the historical complexities associated with renting or buying homes in Brazil add another layer of challenge to property management.

Market Saturation and Low Liquidity

The Brazilian real estate market, like many others globally, operates on the principles of supply and demand. However, recent trends indicate a growing saturation in certain areas, leading to an oversupply of properties.

This oversupply results in lower rental yields and extended periods before properties are sold. Such saturation directly impacts the liquidity of Brazilian real estate investments, making it challenging for investors to cash out when they deem necessary.

The I-Buyer Model and Its Impact

Online firm Grupo Zap introduced the instant home buyer (i-buyer) model in Brazil, aiming to rejuvenate the stagnant real estate market. This model involves online firms assessing and purchasing properties directly from owners.

After acquisition, these properties undergo renovation and re-enter the market. The introduction of this model in Brazil by Grupo Zap seeks to address the prolonged transaction periods, with property owners waiting an average of 468 days to finalize a sale.

Grupo Zap’s data indicates that transactions in the Brazilian real estate market have decreased by 30-40% since its peak in 2014.

To counteract this, the company plans to invest 100 million reais (approximately $25 million) in property acquisitions in Brazil’s major urban centers over the next year. Their goal?

To bring more liquidity to the currently stagnant Brazilian real estate business and simplify the often complex and opaque transaction process.

Challenges and Opportunities

Lucas Vargas, the chief executive at Grupo Zap, highlighted the fragmented nature of real estate transactional data in Brazil. This fragmentation complicates the negotiation process for both buyers and sellers, often leading to extended negotiations.

Additionally, the Brazilian real estate market faces challenges with mortgage lending, as only a few major banks offer it, and often at exorbitant fees. This situation creates a pent-up demand, with many potential buyers eager but unable to make purchases.

However, Vargas remains optimistic. He believes that the i-buyer approach, combined with the emergence of more credit offerings, will significantly boost the Brazilian real estate market. He anticipates the current 500,000 yearly transactions to double in the next decade.

The Role of Technology in Addressing Market Saturation

Grupo Zap places a strong emphasis on technology to support its i-buyer business model. Innovations such as virtual reality property tours aim to enhance the property search experience.

More importantly, the company relies heavily on data analytics and machine learning for asset acquisition, valuation, and sale. These technologies play a pivotal role in mitigating risks associated with the i-buyer model, such as acquiring properties that later depreciate in value.

Potential Hidden Costs

Brazilian real estate, like many international markets, comes with its share of hidden costs. While the allure of owning property in Brazil might be strong, it’s crucial to understand the full financial picture before committing.

High transaction fees, various taxes, and other unexpected expenses can quickly erode potential profits, making Brazilian real estate a more intricate venture than one might initially perceive.

Imposto Sobre Transmissão de Bens Móveis – ITBI

This tax, specific to Brazilian real estate, is levied on property transfers. Often considered the most significant additional expense for real estate buyers, ITBI is a percentage charged based on the property’s value.

The rate can vary depending on the state in which the property is located. For instance, in São Paulo, the ITBI typically amounts to 3% of the property’s price.

Real Estate Register

A crucial step in the property acquisition process, the Real Estate Register formally acknowledges that the property now officially belongs to the buyer. Unlike the ITBI, this fee isn’t a percentage but is determined by the market value of the property.

For example, in 2014, São Paulo properties valued between BRL 60,000 to 100,000 had a register cost of BRL 967.54.

Public Deed

Another essential document in the Brazilian real estate process, the public deed’s cost, is also based on the property’s value and can vary from state to state.

This document might be necessary at some point to validate the buyer’s ownership of the property. In São Paulo, in 2014, properties valued between BRL 80,500 to 100,700 had a public deed cost of BRL 1,527.69.

Imposto Sobre a Propriedade e Território Urbano – IPTU

IPTU is an annual property tax, and while not hidden, it’s a vital cost for any potential buyer to consider.

The rate is set by each municipality and is based on the property’s value and its potential for urban development. For instance, São Paulo properties valued at BRL 70,000 in 2014 had an IPTU of BRL 70.60 annually.

Imposto Sobre Operações Financeiras – IOF

IOF is a tax that, while not directly related to real estate sales, impacts financial transactions involving currency exchange, insurance operations, loans, and securities. Foreigners bringing money into Brazil should be aware that they’ll need to pay the IOF tax.

This federal tax remains consistent across Brazil, with rates such as 0.38% for foreign direct investments and a maximum of 1.5% for credit operations.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.