Trading, clearing, reporting, and billing are just some of the many brokerage services that Interactive Brokers Hong Kong Limited offers, and they do it all without requiring clients to sign annual or even six-month commitments.

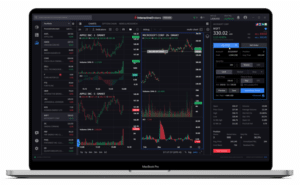

The platform provides premier broker services and facilitates effective business administration and customer care by means of a powerful client relationship management (CRM) system that is specifically designed for brokers.

By passing on the best bids and offers from available electronic venues without expanding spreads, adding hidden fees, or marking up quotes, Interactive Brokers Hong Kong Limited demonstrates a dedication to providing clients with the finest bond bargains possible.

Interactive Brokers Hong Kong Limited is regulated by the US Securities and Exchange Commission and Commodity Futures Trading Commission. Those in Asia, excluding India, Hong Kong, Japan, Australia, and Singapore, who open accounts will use Interactive Brokers LLC in the US.

Electronic account opening is made possible through the platform, and trading brokers who are willing to become public with their information provide service and marketing assistance to users. Customers have the option of either online trading themselves or having their broker do it.

Interactive Brokers Hong Kong Ltd expands investors’ horizons by providing access to market data around the clock and trading in stocks, options, futures, currencies, bonds, and funds.

Commissions on stock trades in Hong Kong range from HKD 0.015% to 0.05% of the trade value, and there are no spreads, account minimums, or platform fees for these trades. In addition to its convenient accessibility, cheap margin rates (as low as HKD 1.50%), integration with the IB SmartRoutingSM system, and the opportunity to earn extra money by lending fully paid shares of stock make this broker platform very appealing.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Interactive Brokers Hong Kong Account and Investing

What are the investment options available with Interactive Brokers Hong Kong?

- Stocks: Interactive Brokers Hong Kong lets clients trade stocks on the Hong Kong Stock Exchange, New York Stock Exchange, and NASDAQ, providing a variety of investing options.

- Options: Interactive Brokers Hong Kong allows clients to trade equities and indices in options, allowing them to explore different tactics.

- Futures: Clients can trade stocks, indices, and commodities. Clients have more investment options with this feature.

- Currency trading: Interactive Brokers Hong Kong offers US dollars, euros, British pounds, and Hong Kong dollars spot currency trading. This feature gives foreign exchange traders more flexibility.

- Bonds: Government and business bonds can be traded on the platform. This product diversifies portfolios with fixed-income securities.

- Mutual Funds: Interactive Brokers Hong Kong offers more than 7,000 mutual funds from various families, like BlackRock and Vanguard, without transaction fees.

- ETFs: Clients can easily trade a wide range of exchange-traded funds across asset classes and industries. This feature makes the platform more flexible for different investment styles.

- SSFs and EFPs: Interactive Brokers Hong Kong offers a variety of investment products through Single Stock Futures and Exchange for Physicals trading. This inclusivity permits portfolio customization.

- Warrants: The platform allows investors to trade warrants, which provide them the right but not the duty to buy or sell an underlying asset at a particular price before a given date. The investment tools available with this feature expand.

How to buy Hong Kong stock in Interactive Brokers

Create an account with Interactive Brokers Hong Kong Limited to get started. This entails revealing sensitive personal data and submitting to identity and address verification procedures.

After an account has been created, it must be funded so that the client has access to trade funds. Bank wire transfers and electronic money transfers (EFTs) are just two of the many funding alternatives that Interactive Brokers Hong Kong makes possible.

Customers can place an order for Hong Kong stocks once their account has been funded. The Interactive Brokers trading platform allows users to place market orders by simply typing in the ticker symbol for the security being traded and clicking on the corresponding button.

When placing a market order, customers designate “MKT” as the order type and provide the quantity of shares they desire to buy or sell. This uncomplicated method makes it easier for them to carry out their planned financial dealings.

Clients can get the best possible price by specifying “SMART” as the order destination and benefiting from intelligent routing. This triggers SMART routing, which sends the order to all accessible exchanges in search of the best possible price.

The final step in placing an order using the investing broker is reviewing the information for accuracy before sending it off to be carried out. This last check verifies the client’s purpose and prevents any mistakes from being made before the trade is actually made.

Interactive Brokers Hong Kong eligibility

Interactive Brokers Hong Kong Limited requires certain prerequisites and documentation to open an account. Account opening with Interactive Brokers Hong Kong Ltd requires:

- Residential criteria: Hong Kong residents must meet specified document requirements.

- Identification: Clients must show a passport, national identity card, or driver’s license to prove their identity and date of birth.

- Proof of address: The account opening process requires a bank statement or utility bill as evidence of residential address.

- Employment: Clients must supply their employer’s name, address, and phone number.

- Bank account: The account opening process requires clients to provide their bank account information for funding.

- To meet regulatory requirements, non-US citizens must furnish their SSN or ID number.

What are the account types available in Interactive Brokers Hong Kong?

A wide variety of account options are available through Interactive Brokers Hong Kong Limited. The online trading platform offers a number of different types of accounts, including:

Personal or family use only; designed for one person to use for trading or investing.

The two people who use the account are the “joint owners,” as the name implies. Joint accounts can be held as tenants with rights of survivorship, tenants in common, or community property, depending on the laws of the state in where the account holders reside.

For the benefit of a named beneficiary, a trustee manages these funds in a trust account.

You can set up a Family Advisor Account to act as a hub for all of your clients’ separate accounts. A single Interactive Brokers Hong Kong login makes it easy for professional traders to keep track of all their accounts.

Investment Accounts for Advisors, Family Advisors, Non-Professional Advisors, Family Offices, and Hedge Funds are designed with institutional clients like RIAs, FOs, and HFs in mind. Their unique organizational needs are taken into account, and they are designed accordingly.

What are the account minimums for Interactive Brokers Hong Kong?

Minimum deposits required by Interactive Brokers Hong Kong Limited are as follows:

A front-end deposit of USD 10,000 (or its non-USD equivalent) is mandatory for Broker Accounts, and this amount is credited against commissions over the initial 8 months.

There is no required minimum deposit for Client Accounts, giving individuals the freedom to begin trading immediately without incurring any costs.

Inactivity Fees: If, after the initial 8 months, the total commissions paid in any given month fall below the monthly minimum, a maintenance cost equal to the difference will be assessed. With a USD 2,000 minimum and a total of USD 1,400 in commissions, the maintenance fee would be USD 600.

While there is no hard and fast minimum to register a Family Advisor account, building a margin account does require a commission of USD 2,000.

What are Interactive Brokers Hong Kong fees for trading?

Trading fees are low across all markets at Interactive Brokers Hong Kong.

Commissions for trading Hong Kong equities range from HKD 0.015% to 0.05% of the trade value. It’s important to note that there are no extra costs for making these trades on the online platform, including spreads, account minimums, or platform fees.

Minimum commissions for Futures and Options trades are HKD 18 for Stock Exchange of Hong Kong equities and 15 Chinese yuan for Shanghai-Hong Kong Connect and Shenzhen-Hong Kong Connect stocks.

IB SmartRoutingSM and margin rates as low as HKD 1.50% are also available to customers. This technology helps you get the best possible execution by searching multiple exchanges and dark pools for the lowest possible stock, option, and combo pricing.

Minimum commissions for Singapore Exchange (SGX) equities are based on the total value of all trades executed in a given month. The minimum commission for trades with a monthly value of SGD 2.5 million is 0.08% per trade value (minimum SGD 2.50). In contrast, the lowest cost is 0.005% per trade value (minimum SGD 0.15) for a monthly trading value of up to 50 million, and vice versa.

Trading stocks or ETFs listed on a US exchange is advantageous because it does not charge commissions to its customers. This makes trading in the US market a more affordable option.

What is the process for opening an account with Interactive Brokers Hong Kong

Users can open Hong Kong Interactive Brokers accounts by following these steps:

- Clients can visit Interactive Brokers Hong Kong and click “Open an Account” on the website.

- Choose the Account Type: Clients must choose the account type that meets their demands. Individual, joint, trust, family advisor, and institutional accounts are available.

- Provide Personal Information: Clients must provide their name, address, birthdate, and contact information.

- Provide Employment Information: Clients must provide their employer’s name, address, and phone number.

- Funding the account requires clients to provide their bank account information.

- Provide Proof of Identity and Address: Clients must provide a passport, national identity card, or driver’s license with their name and birthdate. Bank statements and utility bills are needed to prove residential address.

- Clients must fill their accounts after opening them to guarantee they have enough funds to trade. Interactive Brokers accepts bank wires and electronic payments transfers.

What are the advantages of using Interactive Brokers Hong Kong over other brokers in the region?

With a wealth of useful features, Interactive Brokers Hong Kong is a clear frontrunner among investment platforms in Hong Kong. There are no spreads, account minimums, or platform fees in addition to the incredibly low commissions on Hong Kong stocks that are offered to clients.

You can invest in stocks, indices, metals, ETFs, options, futures, bonds, spot currencies, mutual funds, and much more on this site. Investors may stay abreast of market movements and make educated bets thanks to Interactive Brokers Hong Kong’s round-the-clock availability of market data.

The platform’s accessibility to the IBKR BestX tool, which was developed to maximize execution, and its transparent and affordable financing rates only add to its allure.

In addition to their standard offerings, Interactive Brokers Hong Kong also acts as a prime broker, providing services such as a robust CRM system designed specifically for brokers. This helps with both business management and customer support.

Investors using Interactive Brokers Hong Kong’s services can rest easy knowing that they are covered by the city’s robust investor protection infrastructure thanks to the city’s Investor Compensation Fund.

What are the disadvantages of using Interactive Brokers Hong Kong?

While Interactive Brokers’ complex features are appealing, the platform can create some obstacles, particularly for inexperienced traders. Newcomers to the trading world may be put off by the platform’s learning curve due to its seeming complexity.

Additionally, the account opening process with Interactive Brokers HK is considered by some as slow and cumbersome when compared to alternative brokerage platforms. This could make the onboarding process more difficult for brand new customers.

The possibility of Interactive Brokers’ customer service being overloaded is another factor to think about because it could have an impact on the company’s responsiveness and support availability for customers. In times of extreme demand, responses to customers’ questions and worries may take longer than usual to process.

In addition, there are technological issues that can arise on the platform, such as problems with showing a large number of places in a sorted order. Traders navigating the site may encounter some frustration as a result of these technical challenges. Users, especially newcomers, should keep these things in mind when interacting with Interactive Brokers Hong Kong.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.