Updated -January 1, 2022

This article will review which bank accounts pay the best interest rates, in both developed and developing countries alike, and for both expats and local savers.

It will also ask if putting money in the bank is a good idea in the first place, compared to other forms of investing.

For those interested in contacting me about fixed returns investments, savings accounts or investing in general, please email me on advice@adamfayed.com or use the chat function below.

If you prefer visual content, I have summarized the article below, in video format:

This post will be updated regularly. It could be expected that with the ongoing virus situation, interest rates will continue to fall around the world.

So a lot of the interest rates discussed below are “maximum levels” that might change in the coming weeks and months.

Before starting the list, what are the risks associated with bank deposits?

The first risk is “inflation risk”. Everybody knows that interest rates are close to 0% in most developed countries, at least in real terms.

Even in the US, which has been pushing up interest rates recently, the 2% base rate barely covers inflation.

Many expats , and indeed locals, are looking for alternatives. Most of the high-interest rate alternatives are in developing countries.

This isn’t a free lunch. In fact, you often are facing numerous risks, including;

- Currency risks. Interest rates have been very high in South Africa and Brazil in recent years, but the currencies have fallen hard, especially against the USD, but even against the Euro and British Pound

- Government/economy risk. Most developing countries can’t guarantee deposits in the event of a banking crisis.

- Political risk. Compared to developed offshore jurisdictions such as Isle of Man, Puerto Rico and some others, many developing countries regularly change rules about money movements, especially if there is a political backlash against hot money being moved in to buy property, using bank accounts.

- Institution risk. This is especially the case for small local banks, as opposed to Western banks operating subsidiaries in developing countries. The banks may collapse, with the government unable to bail them out.

- The relative risk of losing out. 5% may sound good, but the historical returns on the US S&P and Dow Jones have been 10% in USD terms. The volatility is just more prevalent, meaning 10% is merely a historical average. Therefore, using a deposit account for 3-6 months expenses makes sense, but not for long-term investment money (meaning those with 10, 15, 20 year + timeframes). The difference between getting 4%-5% and 10%, could be millions over a lifetime, even on relatively small amounts of money.

So what countries offer some of the best rates on bank deposits?

Despite the risks mentioned in the first section, which countries have some of the best rates on USD and local currency. In no particular order I have listed a few below:

1.Cambodia

Cambodia uses two currencies, the USD and Cambodian Riel, which has been surprisingly, relatively stable against the USD.

Many well-known institutions, such as New Zealand’s ANZ bank, serve Cambodia. Typically, interest rates are around 4.5%-4.75% for 1 year deposit accounts, and 6.5%+ on Cambodian Riel accounts.

Those rates increase if you lock away your money for a number of years.

Cambodia offers some of the highest USD interest rates in the world, as many of the options below are just on local currency.

2. Georgia

Georgian banks offer up to 9.4% on short-term interest rates on the local currency, and it is one of the easiest places in the world to open up bank accounts.

Like Cambodia, Georgia also gives good interest rates on the USD. However, some Georgian banks have recently lowered their deposit rates on USD accounts, which is ironic given that interest rates in the US have gone up!

Georgia is probably the easiest place to “fly and buy” when it comes to bank accounts.

You can open a bank account in as little as 20 minutes. All you need to do is have a passport and a local phone number to have a code to activate your account. This number can be a temporary SIM card.

Even though Georgia is still easy in terms of account openings, there have been reports that some Georgian banks have closed down accounts of deposit holders that don’t have “sufficient ties to the country”.

Who knows what the situation will be in ten years, but for now, Georgia probably still holds the crown for the easiest country to open an offshore bank account in.

3. Turkey

Anybody who has been watching the news in the last few years, would have seen how volatile the situation in Turkey has become.

Turkey is a great example of the aforementioned risks; local banks offer as much as 15%+ on the local currency.

Therefore, depositors in Turkish Banks would have lost money in USD terms, in the last 5 years.

Turkish banks have also made it more difficult to fly and buy, meaning that the procedures for opening up accounts has become more difficult.

These days you often need a local Turkish tax identification number (TIN) to open an account, meaning it is only really an option for expats living in Turkey.

4. Argentina

Another country with huge inflation and currency fluctuations, Argentina offers depositors up to 20% on the local currency – one of the highest on this list.

Given that inflation is currently 27%, and the currency has been in freewill against the USD, however, and this isn’t as good a deal as it first sounds.

Remember that most locals and expats living in Argentina are trying to get money out of the country, and not the other way around!

5. Armenia

Armenian banks do not offer high interest-rates in USD-terms. They do offer good returns on the local currency – the Armenian Dram.

Opening up accounts in Armenia, like Georgia, is much easier than some countries on this list, like Turkey.

6. Mongolia

Mongolia used to be praised as a country with an easy account opening system. That appears to have changed. These days it is known as a country known for difficult bank opening processes, Mongolia offers interest rates of up to 14% on Mongolian Tugriks, and 4%-5% on USD accounts.

7. India

Many banks in India offer 6%-7% on local rupee deposits, but much lower amounts in USD terms.

The Indian Rupee has depreciated in recent years against the USD though, and with local inflation running at 6% per year, the aforementioned interest rates aren’t spectacular.

8. Pakistan

Banks in Pakistan are known to give double digit interest rates for fixed deposits.

The risks of investing in Pakistan for a non-resident is huge though, and questions would certainly be asked by your local bank about why you are transferring money to Pakistan!

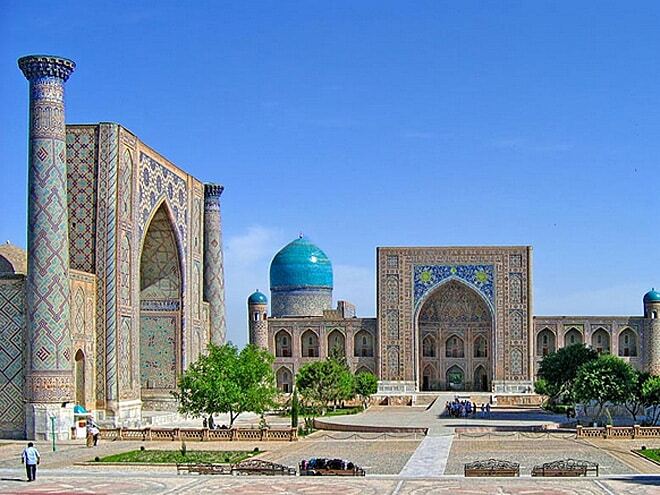

9. Uzbekistan

Interest rates in Uzbekistan are 16%, with many banks offering more in local currency.

Like many of the countries in this list, the Uzbeki Som has had its share of huge devaluations against the USD.

Many customers have also complained about the lack of online access when it comes to Uzbek banks.

10.Azerbaijan

You can get over 10% in Azeri Manat terms, if you bank in Azerbaijan. The currency has been more stable than you might think, although it has depreciated sharply against the USD of late, going from 0.79 to 1.7.

The currency especially declined after they went to a free floating currency in 2015.

For those that prefer USD rates, they only offer 3% yearly interest.

11. Mexico

Mexico is one of the favorite expat destinations for Canadian and American expats and offers reasonable rates of return against the Mexican Peso – often as high as 7% or more.

That doesn’t mean that putting money in a Mexican bank is without risks.

The Mexican Peso was 11 against the USD in 2003. It is now 18.8 at the time of writing.

The good news is opening up a bank account in Mexico is fairly easy, with names such as HSBC, Banamex and and Santander in the market.

Reports suggest that you do usually have to physically go to the bank – online account openings still aren’t normal in the country unless you already bank with one of the aforementioned foreign banks outside of Mexico.

Some banks also require FM2, FM3, or FMM Visas, meaning that opening up an account as a non-resident might not be easy.

USD denominated accounts are available at banks, but only to US and Canadian citizens, or corporations.

12. UK overseas territory

UK overseas territory doesn’t offer the best interest rates in the world, regardless of whether you are interested in Cayman Islands or Isle of Man.

But if you are an expat, and want a safe way to earn 2%-3% on your savings, in a regulated framework, this is the best option for most people.

Many Isle of Man banks, moreover, do allow accounts openings to be done remotely, meaning you can send off the paperwork. This is a significant advantage over some of the fly and buy destinations, which requires a physical visit.

Account minimums can be as low as $4,000-$6,000, depending on the provider. Due to FATCA, most American expats cannot open accounts in these jurisdictions.

The process of opening accounts for expats, and others, can be straightforward or long, depending on many factors.

Typically, numerous documents are needed, including proof of address and identity, and even more documents if you want to open up a company account offshore.

As the above lists shows, it isn’t easy to find a country to deposit money which is safe, straightforward and convenient, and with good interest rates.

Isle of Man offers convenience, safety and convenience, whilst some of the countries with high interest rates don’t have the security and convenience – often requiring in-person visits.

There are many benefits to offshore banking, especially for expats, but it is best if banking is used for transactions and short-term cash flow, compared to low-cost investing in index funds and other investments.

Frequently asked questions.

This section will look at some frequently asked questions (FAQs)

Are offshore bank accounts legal?

It is surprising that in the year 2020, some people still have a “Wolf of Wall Street” view of offshore – secret and dodgy.

The reality is, we now live in a world of more open banking information and banking outside your country of residency is not only legal, it is normal.

Offshore doesn’t just mean “traditional offshore”. If you are a British expat in Dubai, and you still bank in the UK, you are banking offshore.

So we are miles away from the kinds of scenes we saw in the 1980s, popularized in movies, where people would literally strap money to themselves, to evade taxes!

What are the alternatives to bank deposits?

Fixed return and long-term orientated investments are two options, which are typically safer than investing in frontier markets banks.

Is Georgia the easiest place in the world to open up a bank account still in 2020?

Probably. TBC Bank and others are very efficient assuming you just want individual banking and can actually visit the country. If you can’t travel to open up an account, there are better options out there.

Company accounts will also require more due diligence.

How about other countries?

Whilst most countries might not as liberal as Georgia, few make it difficult if you are actually a resident.

Take Cambodia as one example of many. To open up an account, you just need your passport, proof of long-term residency, a certificate of employment and so on.

All these which are easy to get if you are working in the country.

How about options in low-interest environments like Europe and Singapore?

Most of the highest interest rates are in emerging Europe, including Armenia, Georgia, Serbia and Ukraine.

In terms of “traditional Europe” , almost all countries have close to 0% interest rates, with banks offering little more. In the UK, some banks do offer 3%+ on smaller deposits.

In Singapore, Hong Kong and Dubai, things are not much different – in other words you will struggle to beat inflation.

At the time of writing Maybank in Singapore offer 2.1%, with Hong Kong banks offering little better.

Dubai is marginally better with the CBI eSaver account offering savers 3% per year.

Do some banks offer monthly interest?

Yes Kotak Mahindra Bank and Union Bank of India both offer this service, and pay over 6%. Yes Bank offer the highest interest rates in India at over 7% per year.

However, once again, we have to remember that this isn’t a free lunch.

Inflation in India is 6% for expats and locals alike, and the currency is unstable. Those invested in Indian banks would have lost money in recent years, due to the sharp depreciation:

Is it a mistake to invest in a bank?

Having a small amount of liquid cash is fine, but remember a few points:

- If putting money in the bank was such a good idea, why isn’t George Soros and Warren Buffett rushing to put their money into these institutions?

- If it was such a good deal, how are the banks making a profit from your money? After all, banks are different to investment platforms – they actually use depositors money to lend to others.

- Even if it is safe and secure, markets in the long-term, have always beaten cash.

The video below looks at a simple question, why invest if you can get 6% or even 12% in a bank?

Do you offer banking services?

I don’t offer banking as a stand alone product but I do help existing clients that wanting banking + investments or second residencies.

What are the main benefits of offshore banking?

It gives you diversification and can be part of a second residency or wider wealth management solution.

For example, some second residency programs which allow you to pay less tax, like in Malaysia, require you to open up a local bank account.

Is it hard to open up an offshore bank accounts if you live in certain countries?

Yes, as a generalization, if you live in Iran, Iraq, Somalia and even Myanmar, you are more likely to be rejected by banks.

I have had countless clients living in Myanmar, and many of the traditional Isle of Man banks, will not accept Myanmar-residents.

In fact, many banks make it clear that even if you aren’t resident in Myanmar, but you are gaining consulting income from inside the country, that they cannot accept such payment.

Even international online banks, which tend to be more progressive (such and Revolut) have been known to close down accounts, after receiving payments from locations such as Myanmar.

As you can imagine, for residents in US-sanctioned countries, such as Iran, the situation is more difficult.

In this situation, some of the “fly and buy” options such as Georgia, can be a good option.

That doesn’t mean that you should assume that banks in Georgia are always lenient. You should always ask them about rules and regulations before you fly and buy.

However, they tend to be better options than the more traditional banks in the “first world”.

In general, it is likely to become progressively more difficult to open up bank accounts as a non-resident.

Even in countries like Hong Kong, it used to be very easy to open up offshore bank accounts.

Those days are gone.

Is it harder for Americans to open up bank accounts?

In most countries, it is now much more difficult for Americans to open up bank accounts, due to the aforementioned tax changes by the IRS.

This is especially the case for American residents – “flying and buying” gets more difficult if you have an American tax number and live in the US.

If you are actually a resident of Cambodia, Georgia or the other countries on this list, the situation is much easier.

Some financial institutions will still shy away from taking American clients though – especially for investment accounts.

Conclusion

Banking offshore is fine, as is having some money in the bank for emergencies if you are a local.

The best interest rates in the world are found in emerging markets, which have higher risks and interest.

Getting 6% in the bank sounds good, until you realize 5 years later that the currency has fallen hard against the USD, Euro or Pound, and local inflation is out of control.

Or for that matter, you have been stuck with a bank account paying 3%-4% in USD terms, when the US Stock Markets have averaged 10% historically.

Better to use a bank for banking and investment platforms for investing. Ultimately if banking for money was such a good idea, Soros, Buffett and all the institutional money would be moving their cash to emerging market banks!

In general banking offshore, even for offshore current accounts paying 0%, is also getting more difficult. So opening up an account sooner rather than later, is always prudent.

We are in a new world now in terms of low-interest rates. They went down in 2008, and have decrease further, due to unexpected crisis in 2020.

It is unlikely interest rates will return to their previous 2008 levels, anytime soon.

Due to ongoing risks in the banking system in emerging markets, it is usually safer (if you are long-term) to invest in markets at lower valuation points, provided you don’t panic during any falls.

Further Reading

What kind of investment options are available for American expats now the IRS has gotten more restrictive? The following article focuses on American expats in particular – what good investment options exist these days for those living overseas?

I want a best job

Building maintenance