BullionVault Review – that will be the topic of today’s article.

If you are looking for alternatives and want to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Who is BullionVault?

BullionVault is a company registered in the United Kingdom, which specialises in buying physical gold and other metals online.

The idea behind the company was that physical gold had traditionally been the preserve of the wealthy, due to the storage and insurance costs. Physical gold traditionally also had the negative of lack of liquidity – meaning it is difficult to find a buyer quickly.

By having an online system where costs are shared, and a large pool of investors, BullionVault decreased the costs associated with holding physical gold, and made finding a buyer and seller seamless.

Starting in 2003 with around $500,000 in seed funding, the company has grown to profitability and has become one of the largest firms of its kind in the world, with 100,000 clients spread over 170 countries.

BullionVault started by allowing people to trade gold. It has now expanded to include silver, platinum and palladium.

What are the costs?

There are three to four costs associated with BullionVault:

- Dealing commissions when you buy and sell. Starting at 0.50% for smaller amounts, it falls to as low as 0.05 for larger amounts.

- Storage fees. This is 0.12% a year.

- Burglar alarm. This charge isn’t compulsory, but the service alerts you to account withdrawals and changes to cell phone numbers and other sensitive information held on the online account. The cost is only $0.20 per text.

- Fund remittance charges. Most UK withdrawals are free, but charges are up to £20 by Chaps and $30 via SWIFT.

Most investors can expect to pay at least 0.50%-0.62% per year.

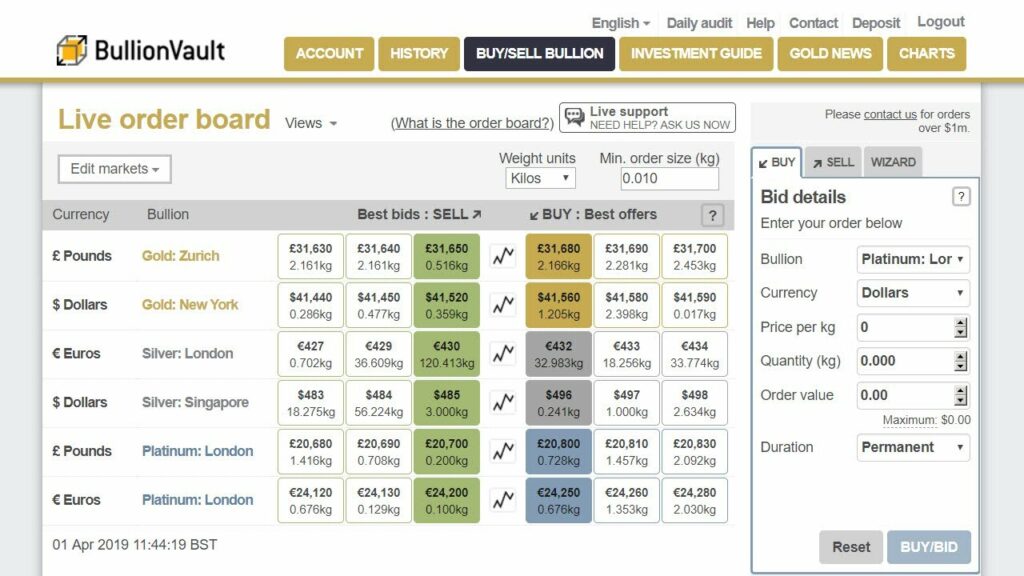

What does the online system look like?

At the time of writing, the system looks like this:

Over time, they are always improving the online system, to enhance the user experience.

Where is the gold stored?

The gold is currently stored in either Zurich, London, New York, Toronto or Singapore. The customer makes the choice about where to store the gold, silver, platinum or palladium.

What are the different currency options available?

You can be charged in the following currencies: Dollars, Euros, Pounds or Japanese Yen

Compared to alternatives such as Goldmoney, is BullionVault better?

Better is of course subject. At the time of writing, BullionVault does have lower spreads and costs. These things are always changing, however, so it is best to check the latest information.

What are the positives associated with this option?

- It is a safe way to trade gold, silver and some other metals. The parent company is strong, and they have a good model for people looking to buy physical metals.

- It is almost as liquid as ETFs, at least de-facto. The only way you won’t find a buyer is if nobody is looking to buy on the system, which is unlikely.

- They have added numerous currency options to the mix.

- It is possible to become a client from most countries in the world.

- The security of the physical gold is good, as the costs pay for insurance and other safeguards.

What are the negatives associated with this option?

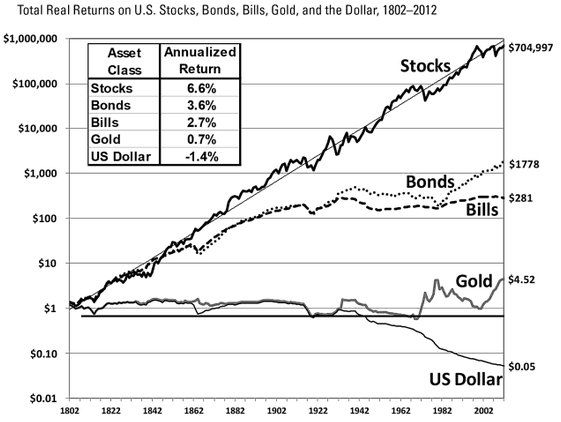

- The biggest negatives are the assets themselves. Gold and other metals perform very badly long-term, despite having some great periods, such as from 2000 until 2010 as per the graph at the end of this section.

- What is more, these assets aren’t always a hedge against inflation or economic downturns. As mentioned, gold and silver had a great period from 2000 until 2011, but it was interrupted by the Global Financial Crisis of 2008. Likewise, gold’s decent run after 2016 was interrupted by the Covid-19 crisis in 2020. On both occasions, gold only recovered once it was clear that the worst was over. Gold tends to only do well when people are quite risk-averse – not panicking. When people panic, they have tended to go toward government bonds and the Dollar.

- Gold also isn’t a strong hedge against inflation, as witnessed by the poor performance of gold in the last year. At the time of writing, gold is stagnant in the last 12 months, despite inflation hitting a 30-40 year high in many countries.

- The cost is higher than ETFs, and gold ETFs are liquid. What is more, as gold ETFs can be held on brokerage accounts, it is easy to hold them in tandem with other investments.

- BullionVault is appealing to a certain kind of paranoid mindset, with a subset of gold buyers. A certain kind of gold buyer is obsessed with government confiscation of gold. However, having the vaults stored offshore won’t solve that issue. If governments wanted to collect more revenue, they could simply start taxing people who own offshore gold vaults, rather than try to confiscate directly. This is unlikely to happen, just as confiscation is equally unlikely. The point is the logical fallacy that you need to pay extra for offshore gold storage compared to buying an ETF, to deal with this “risk”.

Conclusion

BullionVault is a good, safe and transparent system if you want to buy physical gold, silver and other metals. The bigger question should be why you want to buy physical gold and silver to begin with.

Most people are buying for the wrong reasons, for example the mistaken belief that these metals perform well during economic recessions, depressions and inflation.

The only sensible reason to own gold is to diversify your portfolio. This should be a 5%-10% weighting at most.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.