Greece Tax Exemption Guide

Greece tax exemption and advantageous tax structure aims to lure competent workers and investors from abroad. This program is part of efforts to strengthen the

Expats: Essential guides and tips for living abroad, from cultural adaptation to legal matters, tailored for the global expatriate community.

Greece tax exemption and advantageous tax structure aims to lure competent workers and investors from abroad. This program is part of efforts to strengthen the

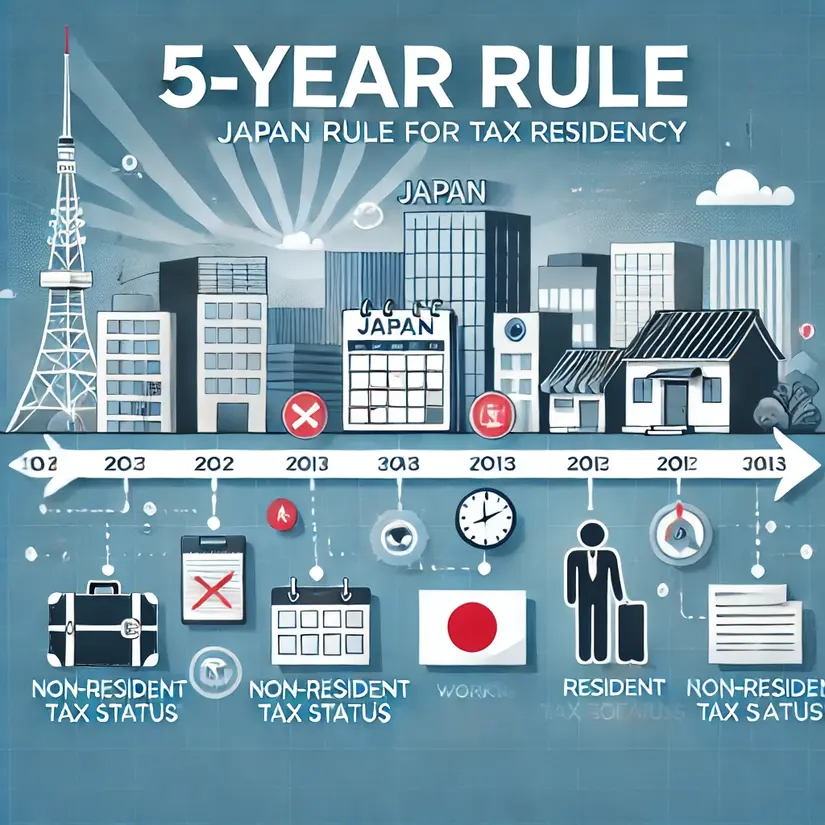

Inheritance taxes are due in Japan for both foreigners and Japanese citizens, but the precise exclusions and obligations vary depending on residency, type of visa, and

The 5 year rule in Japan is a material component of tax residency and system for foreign asset reporting. It backs the government’s attempts to improve

In this post, we’ll delve into what a Trump win means especially for American expats who live abroad. We’ll specifically tackle the following points: You need

The Greece non-dom regime is an alluring alternative for retirees as it makes paying taxes relatively easier, among other advantages. We’ll discuss what this tax

By providing helpful tax treatment on their overseas income, the Greece non-dom tax regime aims to draw in foreigners looking to relocate their tax residency

The flat tax in Greece for foreigners is advantageous and is intended to draw in high-net-worth individuals. It can drastically lower their total tax obligation.

This post outlines important information on Canada departure tax, or exit tax, for those who are leaving the country and turning into non-residents for tax

There may be certain factors to take into account when inheriting money from overseas, particularly with relation to taxes and money transfers. This post will

There are various considerations for setting up a business in Mauritius. This post, in particular, will explore: If you are looking to invest as an

If you don’t know what to do with an inheritance, this guide is for you. We’ll discuss how investing an inheritance as an expat works,

For those accustomed to offshore investing, the idea of being able to keep your Canadian stocks investment while living abroad might sound like a really

How much money can you move overseas? Is there a limit? What factors should you take into account? What countries have restrictions for international money

In this post, we’ll talk about: If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you

Investors leaving the UK might ask: Though there are significant tax and administration implications, in principle, you can maintain your stocks if you leave the

Investing in UK funds from abroad provides a number of ways to diversify your basket. Question is, should you take the plunge? The regulatory structure

Can I invest in ISA UK if I live abroad? Definitely. We’ll discuss that here and other relevant matters, including: This article is mainly for

The type of business being formed and the services offered can affect the cost of opening a company in Panama. Interested in starting a business in

A person’s legal status and tax responsibilities are largely determined by their place of residence. Individuals are permitted by UK domicile of choice to shift

There are several advantages to opening an offshore USD account, particularly for people and companies who want to handle their money abroad. Documentation must be

There are many deliberations that come into play for retiring abroad: affordability, quality of life, environment, healthcare options and accessibility, among other things. So, where

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

Gain free access to Adam’s two expat books.

Gain free access to Adam’s two expat books.

Get more strategies every week on how to be more productive with your finances.