Best Offshore Banking Countries List

The best jurisdictions for offshore banking in 2026, such as Singapore and Switzerland, combine political stability, regulatory transparency, and digital banking efficiency. Choosing the right

The best jurisdictions for offshore banking in 2026, such as Singapore and Switzerland, combine political stability, regulatory transparency, and digital banking efficiency. Choosing the right

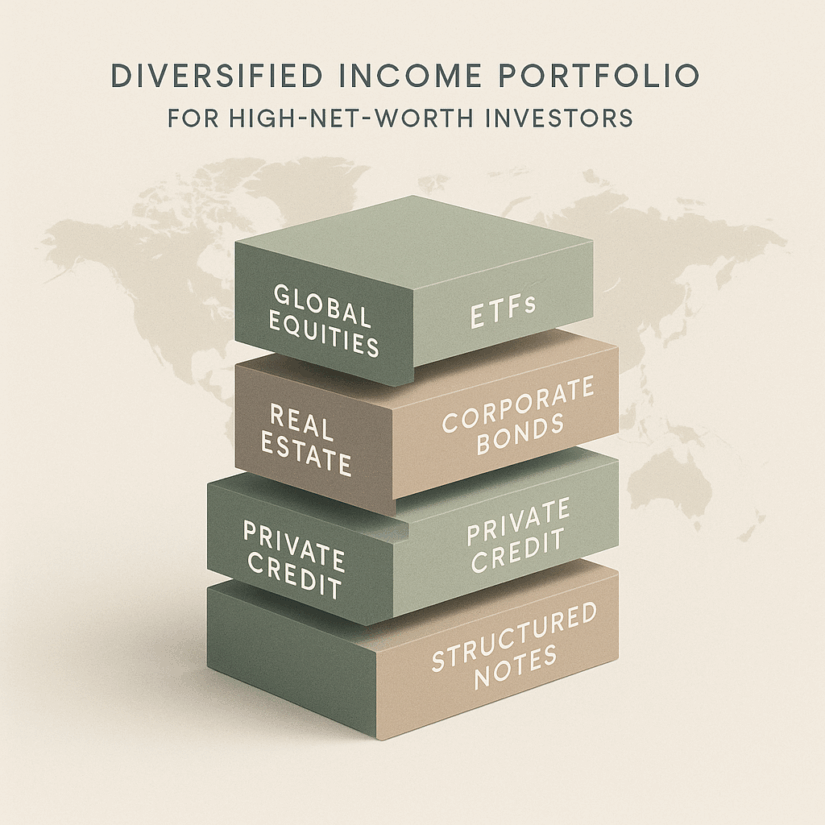

Expats and high-net-worth individuals have several income options than just cash and government bonds. Modern portfolios mix dividend-paying global stocks, income-focused funds and ETFs, and

Estate planning in Spain is more complex than in many other European countries because of forced heirship rules, regional tax differences, and separate inheritance laws

The best investment strategies in 2026 focus on globally diversified portfolios that combine high-quality fixed income with growth assets like technology, private credit, and selective

Non-CRS Countries are jurisdictions that have not adopted the Common Reporting Standard, meaning they don’t automatically share financial account data with other tax authorities. As

The difference between offshore banking and traditional banking lies in accessibility, regulation, and purpose. Traditional banks mainly serve domestic customers under local laws, while offshore

Uganda’s banking sector offers a wide range of savings and fixed deposit options, with standard accounts offering modest rates (often 1%–3.5%) and fixed deposits reaching

A Panama Foundation for estate planning creates a separate legal entity to hold and manage assets, providing strong protection from personal creditors, lawsuits, and inheritance

International financial planning involves creating strategies that manage wealth, investments, taxes, and assets across multiple countries to optimize growth and minimize risk. Effective international financial

Cook Islands trusts offer strong asset protection, but they come with challenges such as high costs, complex compliance, and limited recognition in some foreign jurisdictions.

Forming a foundation in Nevis involves creating a legal entity to hold and manage assets under the Nevis Multiform Foundation Act. A foundation in Nevis

A Panama foundation is a separate legal entity with corporate-like features, while a Cook Islands trust is a legal arrangement between a settlor, trustee, and

When it comes to asset protection, a Panama Foundation is typically used for estate planning and holding assets without commercial activity, while a Panama Company

While Panama Foundations offer strong asset protection and privacy, one of the main Panama foundations problems is the risk of misuse within opaque offshore structures,

A Guernsey trust is an offshore legal arrangement that allows assets to be held and managed for beneficiaries with strong asset protection and governance. A

A Guernsey foundation is a legal entity established under Guernsey law to hold and manage assets for family, business, or charitable purposes. Guernsey foundation structures

The main difference between a trust and a foundation in Panama is that a trust is a private legal arrangement, while a foundation is a

Wealthy individuals favor using Panama trusts for estate planning for its privacy and international flexibility. A Panama trust is a private legal arrangement where a

People put money in Panama for its tax advantages, banking privacy, and investment opportunities. These factors have made it a preferred hub for asset protection,

US citizens use a Cook Islands trust, but it requires careful planning to stay compliant with US tax laws. These trusts are a sought-after option

Cook Islands trusts can be worth it for individuals seeking the strongest asset protection in the world, but they also come with high costs, strict

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

Gain free access to Adam’s two expat books.

Gain free access to Adam’s two expat books.

Get more strategies every week on how to be more productive with your finances.