Canadians living overseas typically face three main choices: invest locally in their new country of residence, keep investments in Canada through brokers or real estate, or use an offshore, expat-focused solution.

Each route has tax implications, portability issues, and pros and cons depending on where you live, how long you plan to stay abroad, and your long-term financial goals.

This article explains all three approaches in detail, outlining the upsides and downsides, common misconceptions, and which strategies tend to be more tax-efficient for Canadian expats.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

This article is long. For the time poor and those who prefer video content, I have summarized the article below:

What are the best investments in Canada?

Local Solution: Investing Where You Live

Canadian expats living overseas might want to invest with a local brokerage and focus on real estate in the local area. In other words a Dubai broker if you live in the UAE, or a UK broker if you live in London.

This option has several advantages and disadvantages.

What are the upsides?

For Canadian expats living in the United States, this is probably the most tax-efficient option.

The US tax authorities, the IRS, make it much more tax efficient to invest inside the country for American residents, and most overseas brokers (whether in Canada or beyond) will not want to take American residents for legal reasons.

Another reason to take this option is if you are very “close” to your second home. In other words, if you have lived in another country for 30 years and know the place well, often with a family that is from that country, a local solution might make sense.

This is because you have become more of an immigrant, rather than an expat, and aren’t planning to move around every 3-4 years.

What about the downsides?

A local solution in your new country of residency has many negatives, including:

- It often isn’t the most tax-efficient option, with the exceptions mentioned above.

- Many developing countries have weak investor protections and less investment choices. If there is a financial crisis, for example, you are more exposed in a developing country in particular.

- If you are moving every 3-4 years, it is important to have an expat focused account which is portable.

- Many expats can get seduced by what I call “the growth story” in emerging markets. I have seen countless expats purchase local property, or buy into local stock markets, only to get their fingers burned. This is often because they are chasing previous returns, so have bought into a hot market.

- Some local brokers and solutions will make you sell the investment, if you move to another country. This is very tax inefficient as you need to pay capital gains taxes on selling.

- If you take advantage of a tax-efficient structure in your country of residency, that will only be available to you for the short-term, unless you permanently settle there. For example, if you are a Canadian in the UK, you can invest in stocks and shares through an ISA. This is a good route if you want to settle in the UK for decades. However, if you leave the UK, ISAs aren’t available to non-residents.

- In some countries, it is hard to find a reasonably-priced solution.

Canadian Expats-Solution: Canadian Brokers and Real Estate

Some Canadians want to invest with a broker back in Canada, even when they are non-residents.

This isn’t always possible, and indeed some brokers have even been known to close down accounts, if they know the customer is going overseas.

What are the dangers of investing in local real estate or with a local stock broker as an expat Canadian?

- Tax. Some types of investing are very tax disadvantageous. For example, if you buy a house in Canada, you usually need to pay tax on the rent as a non-resident, and many tax-schemes available to people living in Canada for investing, don’t apply to non -residents

- You will have a lot of tax complexity.

- Specifically you will have a lot of complexity with the property itself. You can find a real estate agency to look after the property, but that will reduce net returns, as you will need to pay for the service.

- That complexity can get even more difficult for “holiday rentals”, which can be treated differently from a tax point of view.

- Local brokers have been known to change their policy, meaning they have accepted expats and then changed their mind, due to new local legislation.

- Some brokers that accept Canadians living overseas (like Questrade as an example) can be quite picky about things like proof of address. I have known a couple of individuals that have had Japanese or Chinese language proof of address rejected. Some expat-focused brokers, in comparison, have bilingual staff, that accept proof of address from numerous languages.

Third Country Investment Solution: Offshore Investing

Offshore investing allows Canadian expats to invest through a third-country platform rather than locally or back in Canada. It offers tax efficiency, full online access from anywhere in the world, and specialist support for expats.

This is where our service, which you can apply for here, makes sense.

What are the benefits of investing offshore for expats?

- It is often tax-efficient to invest offshore as an expat

- You need a portable solution, where you can pay online, no matter where you live in the world

- It is better to have a platform that is familiar with expats. These platforms are more likely to have specialist advice.

- You can still gain access to Canadian funds, US funds or any other countries funds, from a third country. For example, you don’t need to physically have money in the US, to gain access to the S&P500 or a Canadian index.

- Some third-party parties are more flexible about foreign language proof of address

- Capital gains taxes are usually at the end of the account – assuming you buy and hold and don’t buy and sell, which is recommended. That means if you live in a 0% capital gains environment (like in most Middle Eastern countries and some countries in Asia Pacific), you often pay no tax with this option. A significant advantage.

This option isn’t the best option for American residents, for the reasons explained above.

Best Investment in Canada: Bottom Line

For most expats, a third country can be a great option, in terms of investment choice, portability and so on. There are exceptions to this generalization though, including for American residents.

Of course, what you invest in is even more important than where you invest. Investing is best done if it is long-term and not based on speculation.

Frequently Asked Questions (FAQs)

Can you get double taxed on Canadian real estate income?

Typically Canada has double taxation treaties with most countries expats reside in. So whilst you would be taxed on the Canada-side for your rental income, you would probably not be taxed in your country of residency.

How about sales tax on property as opposed to just income tax on rental income?

Individuals have to collect, remit and report the sales tax (which includes GST/HST/QST) if they’re earning an income through their rental property which is a short-term residential rental property or is under lease by the government.

You also have to submit the details of the province where the property is located. The tax rates vary between 5% to 15% depending on the province where the property is located. Expats are required to pay the taxes in case of selling or buying such type of property too.

Can you contribute to TFSA as a non-resident?

Typically the answer is no, you can’t contribute to a tax-free savings account as non-resident. However, you usually contribute to a ‘Registered Retirement Savings Plan (RRSP)’ while being an expat, if it is carried forward from your time of residence in Canada.

Can you buy Canadian index funds or mutual funds?

Typically, you can purchase index funds in Canada or mutual funds. Most platforms, regardless of which country they are from, have access to the Canadian markets. This could be indirectly (a North American fund or ETF for example) or directly.

You don’t need to have an account with a Canadian brokerage to invest in Canadian ETFs.

Difference between ETFs and mutual funds

Whilst there is a technical difference, if investor 1 buys an S&P500 index-linked ETF, and investor 2 buys an S&P500 index fund, both investors will get almost identical returns.

The main difference is that ETFs can be sold more easily – often almost instantly – whilst index funds can take a few days to sell.

This might sound good, but can often lead to investors panicking. Research from Vanguard has shown that investors are more likely to sell in the middle of the day, during volatile periods like stock markets falling.

So if used correctly (buy and hold) and not used to buy and sell, index-linked ETFs and index funds will get you almost identical results.

If buying ETFs it is better to stick to broad-based ones such as the S&P500, MSCI World and maybe 10% in MSCI Emerging Markets. It is best to avoid sector-specific and niche ETFs, like “the cancer ETF”.

Should I leave money in Canadian Banks?

Keeping a small amount of money in the Canadian Banks for unexpected costs is fine. However, money in the bank isn’t a good investment. The reasons are:

- Interest rates are either low, or high. However, where they are high, there is currency and inflation risk. Look at places such as South Africa or Argentina in recent times. Great local interest rates, but negative USD returns in many cases.

- The Canadian Banks are making a profit on your money, so you aren’t getting a great deal.

- If it was such a good idea, why isn’t Warren Buffett and all the investor move their money to South Africa, Mexico, Argentina and other places? In fact, many investors are trying to move their money out of these countries.

I hear the US could be going into a recession and stocks could be about to crash?

Nobody can time markets. I have never met anybody who has profited from trying to move in and out of markets. Markets have increased, and fallen, during periods including:

- Nuclear standoffs

- Wars – hot and cold

- Various elections

- Government shutdowns

- Stagnating GDP and rising GDP

Investing works best when it is; a). Low cost. B). Diversified. c) reasonable in terms of costs. “Boring advice” but true.

Selling a Canadian property does that trigger capital gains tax?

If you sell Canadian real estate while being an expat, you might be subject to capital gains taxes. The gains are often subject to a withholding tax to make certain you do report the transaction.

What documents are needed to open up a brokerage account?

Brokers all ask for proof of ID (passport, ID card or drivers license) and proof of address dated in the last three months (utility or bank statement) due to international anti-money laundering rules.

Some brokers also ask for proof of funds, like pay slips or contracts, but this is more common with bigger sums of money.

Are there some third countries to avoid for expats?

It should go without saying that some blacklisted countries should be avoided, and established offshore jurisdictions are better.

As a generalization I would also avoid US brokerages unless you are an American citizen or resident. The reason is simple; taxes again!

If you invest in say Interactive Brokers and you live in Dubai or London, there is a chance (albeit small) that your heirs could pay US inheritance taxes.

What are the biggest mistakes made by expats?

Procrastinating and taking years to make a decision, is often the biggest mistake. The first rule of investing is to show up – actually to invest and not leave money in the bank losing to inflation.

This is especially important for expats, because there is usually a lack of compulsory savings, unlike in Canada, Australia and most European countries. Back home, even procrastinators can build up small investment portfolios, as tax is paying for the basics.

Apart from that, either being too cautious or too aggressive, can be a mistake, as can only focusing on local solutions.

Finally, “doing your own research” can be more dangerous than you might think, unless you do it in the right way, as my video below illustrates:

Vanguard funds

Vanguard can accept for some expat locations, and not for others, and those rules are often changing. For example, Vanguard have opened up in new countries recently, and now can’t accept US specified persons.

How about getting money out of countries like China?

I have written an article about this in the past. There are numerous ways to get money out of countries which have put restrictions on capital outflows.

In general, paying for a monthly investment, is a bit easier, compared to sending large amounts of money out of such countries. You can often pay with Visa and MasterCards for your brokerage accounts.

How about if I am a joint US and Canadian citizen?

In this case, you are still considered a US specified person. So you should focus on having a US-compliant solution, which complies with FATCA.

Should I use a financial advisor?

A financial advisor costs money, but so do personal trainers, and most people that go to the gym, would say personal trainers can be motivators and show them how to use the equipment correctly.

So, a financial advisor that helps with your overall financially planning picture can motivate you and show you best practices.

I have seen some people DIY invest very well, but more often than not, like the person who injures themselves using gym equipment incorrectly, they underperform.

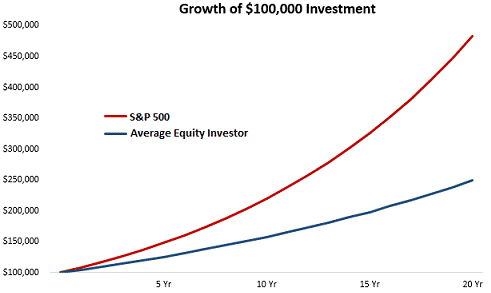

For instance, plenty of research that has been done, has shown that DIY investors trail the indexes, even if they invest in the same investment:

Often this is because they are “buying high and selling low”. For example, I have met countless DIY investors that panicked during 2008-2009, or after Trump’s election in 2016, and now regret not staying the course.

So a good financial advisor can justify their fees, by giving advice that will save you money, and make you more money in the long-term.

How about investing in emerging market ETFs?

Having 10% in MSCI Emerging Markets won’t hurt. Remember though, that GDP growth and markets aren’t always connected.

Look at China in recent times. Excellent stock markets performance but some of the worst stock market returns since 2006.

This might be an extreme case, but even a broad-based emerging markets index, hasn’t always beaten established markets like the US in recent decades.

One reason for this is that many emerging market firms IPO in the US (Alibaba is one example of many) and most big corporations now earn a lot of profits in China and other markets.

Take Apple’s revenue share as an example, which is currently 30% in the Asia-Pacific region, 25% in Europe and only 44% in the Americas.

Is investing in Canadian Dollars best?

It depends. In general, as an expat, investing in USD and some other currencies is fine. Fewer brokers accept Canadian Dollars in the expat market, compared to USD, Euros and some other currencies.

Could these things mentioned above change in the future?

Good financial advice doesn’t change as quickly as tax. Tax-efficient investing can always change, even on a yearly basis, after each government budget.

Who knows what will happen with future Canadian budgets but a rational investor can only deal with the information available at the time.

What is a sensible asset mix?

In general, it makes sense to have greater allocation to stocks when you are young, and gradually increase your allocation to government bonds as you age.

This is for two reasons; stocks markets have averaged 8%-10% long-term, but are more volatile than bonds, and bonds increase when stocks fall.

So as you approach retirement in your mid 55s or 60s, it is important to take some risk off the table. In your 20s and 30s, you don’t need to worry about volatility because markets always come back.

The one exception to the “markets always come back” rule is Japan, which shows the importance of having a diversified portfolio and not relying on one “hot” country like some investors did in the 1980s.

So broad-based indexes like MSCI World and indexes that are very internationalized (like the US S&P500) are safer than domestically-focused indexes.

More adventurous assets like private equity can be fine, for 5%-10% of your portfolio, if you have a good advisor.

What are investments to avoid?

For most investors, there should be a clear distinction between an investment and a speculation. Foreign exchange (FX), crypto and various other things commonly referred to as investing, are merely speculating.

That speculation might or might not pay off, but it remains a speculation. With these kinds of investments, you are hoping that the person coming after you will pay more for you, than you have paid.

So often it is a zero sum game. For example, the USD can’t go up against the Euro, at the same time as the Euro goes up against the USD.

In comparison, with many sensible investments, every buyer of that investment can profit from any increases in price. If I buy the MSCI Word, and you do, as an example, we can both profit from price rises.

Is this a good time to invest given the global pandemic?

Nobody can time markets. It is always good to be as long-term as possible.

The current valuations are very attractive for any long-term investor, regardless of what happens in the short-term.

Life insurance for Canadian expats

If you have kids, or plan to have them, basic life insurance can make sense. This is cheap and easy to get. In general though, it makes sense to separate life insurance from investments.

Life-insurance based investments are seldom good value, because they are primarily insurance, and not investing. There are some exceptions to this rule, for example, when life insurance firms are simply regulated as insurance firms, but are based on an investment principle.

What is the biggest threat going into?

Rising inflation. Losing 2%-3% a year to inflation is painful. 4%-7% a year could be destructive.

What’s your contact details and main service areas?

I specialize in regular and lump sum investing. The minimums are $100,000 on the lump sum side, and $750 a month on the regular investment accounts.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 353.2 million answers views on Quora.com and a widely sold book on Amazon.

Further reading

I am the most viewed writer on Quora.com on financial matters, with 222.2 million answer views and counting in the last few years.

In the article below I discuss

- How to invest a large inheritance, or for that matter, a smaller one?

- How to invest a large sum of money?

- If you get a large sum of money, from whatever source, can you retire from it straight away?

- Is investing in one go best, or should you invest monthly to reduce the risk?

- What sort of safe income can you get from investing a sum of money from inheritance or another source?

- What mistakes should people avoid when investing an inheritance.

- How about for expats moving from country to country, or locals who plan to live overseas in the future? I specialise in this area. Should people who receive inheritances as expats invest back home, in their current country of residence or another country? Of course, much might depend on your country of nationality and how taxes are treated locally, but this article looks at this question in general terms.

- There is an old Chinese proverb that wealth seldom last three generations. How can people avoid this and create generational wealth?

Here is a preview of the article

It will depend on several factors.

The main factors are:

- How much risk do you want to take

- Where do you live

- What’s your cost of living. That is related to the previous point, but can also be related to whether you have kids and dependents.

- Is there something specific about your situation. For example, if you are an expat who will move from country to country.

The first thing to remember is cash in the bank will inflate away.

Even with 2%-3% inflation, it will soon eat away at your capital, now that interest rates are 0% in most countries.

In many of the countries where interest rates are higher, the currency risks are bigger due to devaluations and so on.

In general, the safest way to invest a large pot of money is

- Invest in a liquid portfolio of ETFs and other investments. By liquid I mean something which you can sell easily. Investing all into something like a business or real estate is riskier because if you invest into the wrong thing, you can’t sell it.

- Only withdraw 4% per year of your portfolio. On $3.2m that is about $128,000 a year. Increase that by 2%-3% to keep in line with inflation. The founder of the 4% rule of retirement said 5% or even 6% could be safe, but it is best to be conservative:

- Invest 60% in stocks and 40% in bonds. Your chances of being down are low for that asset allocation as per below:

- Rebalance your portfolio from the good performing parts to the bad ones. For example, if you are 60% in stocks and 40% in bonds, and then stocks beat bonds in 2021, you will need to sell some stocks to retain the 60%-40% balance.

Things to avoid are

- Failing to take advice. Many people who receive huge inheritances are new to investing and personal finance, and then trade on emotion.

- Dipping your toes in. Many people try to invest it gradually (dollar cost averaging) rather than in one go because it feels more emotionally easier. Yet numerous academic studies have shown that investing a lump sum straight away is more likely to beat dollar cost averaging or monthly investments.

- Trying to time the markets. I know somebody who received an inheritance in September. He was worried about markets because of, quote, “the virus and the election”. 4 months later and markets are up about 20%! Nobody can time markets. Being well balanced is good enough.

- Being too risk adverse or too cavalier with risk. You need a balance. Too little risk, keeping money in the bank, often leads to big indirect losses to inflation over time. Likewise, trying to dig your toes in with dollar cost averaging will hurt you (more than likely) long-term. But putting 100% in stocks or 100% in one real estate property also doesn’t make sense. A diversified strategy is needed.

- Not staying the course. Even somebody who invested one day after the 2000, 2008 or 2020 crashes have done fine if……..they didn’t panic sell during the crash. There is no need to fear market crashes unless you can’t trust yourself not to click the sell button!

- For expats specifically, it is a mistake to not consider some unique aspects of your case. For example, in some tax systems, you pay an arm and a leg to send money home. Take the UK as an example. If you are a British person living overseas, you don’t usually need to pay taxes to the UK government . There are complex rules, like the ties test, but in general you don’t need to pay. The exceptions are…….if you spend a lot of time in the UK and you own assets in the UK like rental property. Then you are taxed too death, especially in the case of property!

- Not thinking carefully enough about spending. It is easy to go on spending spree but then it affects your overall pot.

- Not paying off any debts which are charged at high interest rates, such as credit cards. 16%-24% is excessive and should be paid off asap.

Great article. I just sent you an email Adam.

Hi Adam I live in Dubai. Is this advice still applicable?

Hi Glenn yes it is. Will email you soon.

Great article thanks. Very useful

Thanks Stuart

Hi Adam, As a non-resident I understand stock dividends are taxed at source but what about capital gains on a stock sale?

My understanding is that there is no tax in this instance. Basically, it seems that Canada doesn’t tax non-residents on stock sales, but they do on certain property-related investments. These laws are always changing though and I am not a tax advisors. In general, it makes sense to ensure that new money is being invested outside of Canada. It also protects you from future changes in the Canadian tax laws.

Hi Adam, I appreciate the information you’ve laid out here. Could you possibly give examples of brokers (both in Canada and in third countries) that accept Canadian expats? You mentioned Questrade, but I’m curious what other options would you recommend.

Hi Adam,

Appreciate the helpful article. I’ve been living in the US for a few years now, and have finally made the decision to stay here mid-long term. I gather options for investing in the Canadian market are limited for a US resident, but let’s say I have 60k CDN cash sitting in a bank account back home collecting dust. The way I see it, my options are as follows:

1) Continue to let it burn a hole in my pocket.

2) Try and find an offshore broker that will let me invest in the Canadian market, and deal with the tax complexities.

3) Convert it to USD and invest it with the rest of my US portfolio.

Any other options I’ve missed? How would you handle 60k in a Canadian account as a US resident?

Thanks Jeff, I will email you.

Hi, you mentioned that Questrade is a place for an non resident Canadians expat to invest their money. Convenient because I have registered and no registered accounts with them, and had them during my first expat posting. However, now I have a non-registered margin account with them. A post from Profit Moose states that QT won’t permit margin accounts for non residents. What is true? Leaving the country soon for another expat term and I’ll need to get going on it if I need to close my margin account. Profit Moose implies that Interactive Brokers Canada does allow margin accounts for non residents. Moving to the UAE will be back in Canada in 4-5 years.

I guess there are restrictions on non-residents, and don’t forget that as a non-resident there are much more tax-efficient options available to you.