Expat financial advisor in Democratic Republic of Congo – that will be the topic of today’s article.

I will compare some of the options available locally, alongside more portable, online, and international options like what we offer.

For any questions, or if you are looking to invest as an expat, you can contact me using this form, or via the WhatsApp function below.

It makes sense to have a portable option as an expat, as opposed to a localized one, and that is something we specialize in.

INTRODUCTION

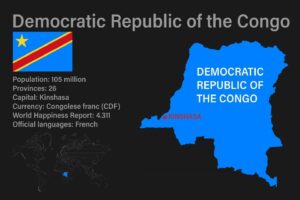

Democratic Republic of the Congo (About this sound pronunciation, also known as Congo-Kinshasa, DR Congo, DRC, DROC, or Congo – a state in Central Africa. By area, it is the largest country in sub-Saharan Africa, the second-largest in all of Africa (after Algeria) and the 11th largest in the world.

The Democratic Republic of the Congo, with a population of about 105 million, is the most populous French-speaking country in the world, as well as the fourth most populous country in Africa (after Nigeria, Ethiopia, and Egypt) and the 15th most populous country. country in the world.

He is a member of the United Nations, Non-Aligned Movement, African Union, and COMESA. Since 2015, the Eastern DR Congo has been the site of an ongoing military conflict in the Kivu. The capital and largest city is Kinshasa.

The territory of the Democratic Republic of the Congo, concentrated in the Congo Basin, was first inhabited by gatherers from Central Africa about 90,000 years ago and was achieved by the Bantu expansion about 3,000 years ago. In the west, the Kingdom of the Congo ruled around the mouth of the Congo River from the 14th to the 19th century. In the northeast, center, and east of the Azande kingdom, Luba and Lunda ruled from the 16th and 17th centuries to the 19th century.

In the 1870s, shortly before the battle for Africa began, Europeans conducted an exploration of the Congo Basin under the direction of Henry Morton Stanley, sponsored by Leopold II of Belgium. Leopold officially acquired the rights to the territory of the Congo at the Berlin Conference of 1885 and declared the land his private property, calling it the Congo Free State.

During the Free State, its colonial military unit Force Publique forced the local population to produce rubber. From 1885 to 1908, millions of Congolese died as a result of disease and exploitation. In 1908, Leopold, despite his initial resistance, ceded the so-called Free State to Belgium, which became known as the Belgian Congo.

Congo achieved independence from Belgium on June 30, 1960, under the name Republic of the Congo. Congolese nationalist Patrice Lumumba was elected as the first prime minister and Joseph Casa-Wubu became the first president. During the Congo crisis, Joseph-Desiree Mobutu, who later renamed himself Mobutu Sese Seko, officially came to power in a coup d’état and renamed the country Zaire in 1971.

People’s movement of the revolution as the only legal party. By the early 1990s, Mobutu’s government began to weaken. The destabilization in the east following the 1994 Rwandan genocide led to the 1996 Rwandan-led invasion that led to the expulsion of Mobutu in the First Congo War the following year.

The Democratic Republic of the Congo (DRC) is the largest country in Sub-Saharan Africa (SSA) in terms of an area equivalent to Western Europe. The DRC has really valuable and natural resources, including minerals such as cobalt and copper, hydropower potential, significant arable land, tremendous biodiversity, and the second-largest rainforest in the world.

DRC has the third-largest poor population in the world. Poverty in the DRC is high, remains widespread and pervasive, and is on the rise due to the impact of COVID-19.

Political context

Felix Antoine Tshisekedi Chilombo, son of Etienne Tshisekedi, the country’s longtime opposition leader, won the presidential election in December 2018. He succeeded Joseph Kabila, who ruled the country for 18 years, in the first peaceful transfer of power in the history of the DRC.

Following the creation of a new political alliance known as the Sacred Union by President Felix Chisekedi, the former prime minister and head of the Senate stepped down in January and February 2021. February 15, a week after he was sworn in as head of government. African Union President Tshisekedi has appointed a new Prime Minister, Jean-Michel Sam Luconde Kenge, who has served as CEO of the state-owned mining company Gecamines since 2019. The new government is expected to be formed in April.

Economic situation

Economic growth in the DRC has slowed from pre-COVID levels of 4.4% in 2019 to around 0.8% in 2020. The growth was driven by the extractive sector, which, thanks to strong demand from China, increased by 6.9% in 2020 (up from 1% in 2019). Meanwhile, non-mining sectors contracted 1.6% (versus 5.7% growth in 2019) due to pandemic-related mobility constraints, weaker trading activity, and limited government spending. Private consumption and public investment declined in 2020 by about 1.0% and 10.2%, respectively.

The current account deficit came to about 4.0% of GDP in 2020 and it was only partially financed by capital inflows, resulting to a decline in international reserves.

While trying to respond to the pandemic, the government faced significant pressure on spending, while revenues declined due to slower economic activity and increased tax relief measures. As a result, the budget deficit widened to 1.9% of GDP in 2020.

For financing, the government initially resorted to advances from the Central Bank (BCC) until April 2020, and then mobilized emergency support from the International Monetary Fund (IMF) and African Development. Bank (AfDB). It also increased domestic debt output and accumulated arrears. Consequently, the total volume of both external public debt and domestic debt rose in 2020, according to estimates, to 15.9% and 8.9% of GDP, respectively.

Although the DRC has initiated reforms to strengthen governance in natural resource management and improve the business climate, the country is ranked 183 out of 190 countries in the 2020 Doing Business report. Key corporate governance indicators remain weak.

Social context and developmental issues

On 7 February 2021, a relapse of Ebola virus disease (EVD) was reported in Butembo, North Kivu, where the previous epidemic (EVD10) was declared complete in June 2020. severity, 12 cases were confirmed in four provinces: Biena, Butembo, Katwa and Musienene. There were four deaths and four recoveries. The 11th EVD epidemic was officially announced on November 18, 2020, with 119 confirmed cases and 55 deaths.

From March 10, 2020, measures are being taken to contain the spread of COVID-19. As of April 1, 2021, more than 28,000 cases have been confirmed, most of them in Kinshasa, although the pandemic has affected 23 of the 26 provinces.

The DRC is ranked 175 out of 189 countries in the 2020 Human Development Index, although some estimates of the HDI have improved slightly from 2018 to 2020. The DRC’s Human Capital Index stands at 0.37%, lower than the Southeast Asian average of 4.0. This means that a child born in the DRC today will be 37% more productive as an adult than he would be if he had a full education and full health in the early years. On average, a Congolese child is in school for 9.1 years, which is 4.5 years of schooling (2020 estimate). 43% of children are malnourished.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 336.6 million answers views on Quora.com and a widely sold book on Amazon