Most expats have assets in numerous countries. If something happens to you, the last thing you want is for your family to wait years to get the money back.

This article will speak about passing down assets to your family as an expat, and some tips.

If you want to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

We often worked with trusts, life insurance firms, lawyers and others to find the right solutions for our clients.

1.Deal with investment providers with a solid track record of paying family members quickly

Most expats think they should create an expat will. There are two problems with this:

- In a multi-jurisdiction environment, wills don’t always work. It is best to create numerous wills in each jurisdiction where you hold money. This can become expensive

- Even where wills work, they can take a long time to go through probate and other legal processes

I was at a convention recently where one speaker, who deals with expat clients like myself, is currently helping the bereaved family.

The family had offshore investments, land, property and many assets. Over a year on, and the money from the land, property and bank accounts still hasn’t been passed on. It is going through probate.

In comparison, the insurance-investment provider paid the family in three days. Yes three days after the death certificate was sent to them!

What was the reason for this speed? They have a system where you can elect a beneficiary, which is a letter of wishes.

Provided the beneficiary has the death certificate, there is no reason why probate is even needed, from the point of view of plenty of these investment providers.

Of course, it is unlikely that you will know which providers have these processes, and can be relied upon to pay out quickly.

A good advisor can help. I have seen the massive differences between providers when it comes to paying out family members.

The above doesn’t mean that wills are a bad thing. It merely shows that there can be more efficient ways to deal with the situation.

2. Deal with providers where ownership can be changed

Some investment providers allow you to change the ownership of an investment account. That means you can change it into a joint name, or even give it to your children whilst they are alive.

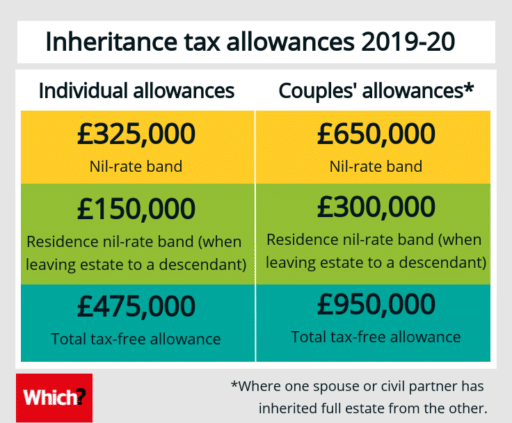

Others don’t allow it. Whilst it is true that changing the ownership of accounts when you are alive can have tax implications, so can inheritance tax when you die, as shown by the current rates in the UK from Which.

Therefore, it can make sense to carefully consider this factor.

Gifts can be a tax-efficient way to reduce inheritance tax, and even if they aren’t, it can reduce anxiety.

3. Consider trusts and life insurance

Trusts hold the asset for the family. You don’t need to be super rich to own a trust.

Having a trust means that if you are incapacitated or dead, the assets can be used as you have set out.

In comparison, life insurance is a good way to deal with a “liquidity event”, which in human terms means needing cash quickly.

Going back to the aforementioned advisor whose family still hasn’t got the money more than a year after the death of their father, they are due to pay inheritance tax.

It is normal for people to Google “what happens if I can’t pay inheritance tax”. This is especially an issue if most of the assets are held in things that are difficult to sell, such as land, property and private businesses.

It can be relatively cheap to get millions in life insurance. That can tide over a family, and pay the inheritance tax bill, without being out of pocket.

4. Don’t be complacent about domicile

Many people assume they don’t have to pay inheritance tax because they are a non-tax resident. That is usually not the case.

Take the UK as an example, where I am from. It is relatively easy, as a Brit, to not need to pay UK income and other taxes, provided I don’t spend too many days in the UK, or own too many UK assets such as property.

However, domicile is different to tax residency. Domicile is much more difficult to change. You often have to go through a long process to change that.

In conclusion then, with the right planning, you can have peace of mind for your family.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.

Let’s peace our world together

Kingdom of wonder