Discover why I hate the Wolf of Wall Street Movie and how investing in offshore wealth solutions can provide additional financial leverage.

The Wolf of Wall Street was a fantastically entertaining movie, but in some ways, I can’t stand it.

The reasons are:

- It perpetuates many myths. For example, that it is still possible to money launder and use offshore “shelters” to hide money from the tax authorities as shown by this scene:

Now sure, the movie was set during the 1980s and early 1990s, and much has changed since then. The public hasn’t always changed their minds and stereotypes though.

2. That finance is all about greed – sure some customers and financial service providers might be that way, but it is a minority . The movie implies that Jordan Belfort, his workers and indeed clients, were all just guided by greed.

3. That investing is akin to gambling – there is, in reality, a huge difference between investing and speculation. “Investing” in high-risk IPOs, based on no research, isn’t the same thing as patient, buy and hold, investing

4. That getting rich is about showing off

As I have mentioned on many occasions, most wealthy people are quite humble and are less likely to buy luxury goods than many average earners.

The movie, however, tries to glamourise Belfort’s easy come, easy go, attitude to money in his younger days.

5. It doesn’t mention some of the long-term consequences of Belfort’s actions

Belfort’s net worth is now estimated to be -100m. In other words, he still owes victims more than the assets he owns.

He himself has admitted that he could have been wealthier today, if he had played the long game.

Why does this matter?

It doesn’t if you take movies with a pinch of salt. Many studies though, have suggested that we subconsciously yet “taken in” by these kinds of stories.

The fashion industry wouldn’t exist, after all, if we weren’t influenced by the views of others.

The interesting thing is, when I am out and about, many people ask me questions about investing and finance more generally.

What usually surprised them is some basic facts such as:

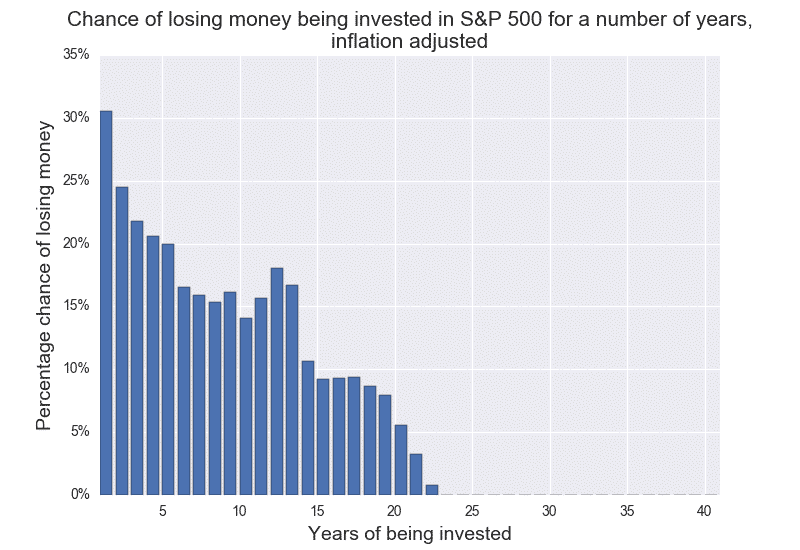

- Stock markets aren’t risky if you buy and hold them as per the stats below:

- That stock markets have outpaced real estate investing as per the article at the bottom of this article.

- That $10,000 invested in the S&P500 in 1942, would be worth about $55m-$60m today. A tidy sum, even adjusted to inflation.

I honestly believe that the media, including newspapers, TV and movies like this, contribute to some misguided beliefs.

So great entertainment, but take it with a pinch of salt.

Further reading

Stocks vs real estate: