(This article was last updated on March 14, 2023.)

We will focus on getting money out of Argentina in this article.

The information written here is correct at the time of this writing, but some things may change later.

If you want to get money from Argentina by investing (“killing two birds with one stone”) contact me using this form, use the Whatsapp function below, or email (advice@adamfayed.com).

Let’s Get to Know Argentina

The country is only about a third smaller than the United States. Despite the difference in size, Argentina is similar to the US in many ways: it is a country of amazing variety of landscapes, natural wonders and types of places – from high Rocky Mountains and glaciers to deserts and large busy cities to wide open country of cowboys.

Argentina is located at the southernmost tip of South America. Located in the Southern Hemisphere, its seasons are opposite to those in the United States. When it’s winter in the US, kids spend their summer in Argentina!

Some people refer to Argentina as “El Sur del Sur,” which means “South of the South.” In fact, the first settlers moved far south from North and Central America about 18,000 years ago into what is now Argentina.

Most North Americans are unaware of the breathtaking scale of this South American country. It also boasts an incredibly diverse climate and geography, from subtropical jungle in the north to arctic conditions in the south.

You have miles of coastline, towering Andes, desert regions and some of the most fertile farmland in the world. With a population of 46.3 million as of the time of update, it has modern cities, quaint villages, and everything in between.

Of course, there is a strong Spanish influence here, but with immigrants from all over Europe, the Baltics and even China, Buenos Aires is almost a microcosm of world cultures. No wonder it is often called the “Paris of Latin America.”

There is a sizable expat community in Argentina, and a lot of them live in this dynamic city on the banks of the Rio de la Plata. The city has a lot to offer to expats. As already mentioned, this is a city of immigrants so newcomers are always welcome here. Easily find familiar foods, customs, and people who speak your language.

History of Argentina Timeline

Argentina’s history dates back to the indigenous peoples who first inhabited the region thousands of years ago. In the centuries that followed, the country was colonized by Spain, and Buenos Aires was established as a settlement in the 16th century. Argentina gained independence from Spain in 1816, after a long struggle led by figures such as General Jose de San Martin.

In the late 19th century, Argentina experienced a period of economic growth and development known as the “Golden Age,” which saw the country become one of the world’s wealthiest nations. However, this period was marked by political instability and social inequality, which eventually led to the rise of populist movements and the Peronist political party.

The mid-20th century saw Argentina become embroiled in political turmoil and violence, including military coups and human rights abuses. The most infamous of these was the “Dirty War” of the 1970s, during which thousands of people were kidnapped, tortured, and killed by the military dictatorship.

Since the return to democracy in 1983, Argentina has struggled with economic instability, inflation, and corruption. The country has also undergone significant cultural and social changes, including the legalization of same-sex marriage and the legalization of abortion in 2020.

Today, Argentina remains a diverse and complex country, with a rich cultural heritage and a history marked by both triumphs and challenges.

A look at Argentina’s financial system

Since we’re in the topic of getting money out of Argentina, it’s important to also grasp Argentina’s financial system.

The country’s financial sector is made up of a range of institutions, including banks, insurance companies, pension funds, and capital markets.

Banks are the main players in the financial system, providing a range of services such as deposits, loans, and foreign exchange transactions.

The largest banks in Argentina are Banco de la Nación Argentina, Banco Macro, Banco Santander Río, and Banco Galicia, which together account for a significant share of the market.

In addition, there are local banks with foreign capital, mortgage banks, development banks, savings banks, financial companies, savings and loan associations for the construction of houses or other real estate, credit partnerships and representative offices.

Aside from domestic banks, several international banks also operate in Argentina.

Financial transactions are usually carried out in Argentine pesos (official legal tender), US dollars and government securities. Argentina’s financial system consists of three segments: Argentine pesos, foreign exchange, and liquid assets, which are managed by all banks in the financial system.

One of the main challenges facing Argentina’s financial system is the country’s high inflation and economic instability, which has led to volatility in financial markets and made it difficult for financial institutions to plan for the future.

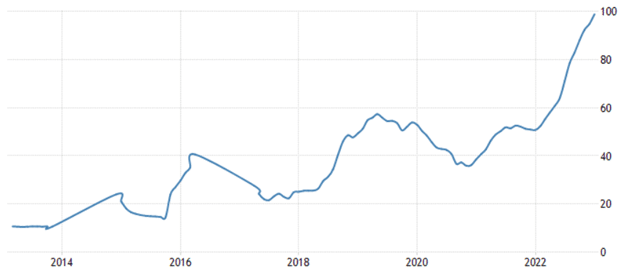

The inflation rate in the country surged to roughly 95% as of December 2022, the “highest since 1991,” according to a Reuters report citing data from national statistics agency INDEC. This figure even jumped further in January 2023 to about 99%.

The government has taken steps to address these issues, including implementing capital controls and restructuring the country’s debt. However, these measures have also led to restrictions on access to foreign currency and affected the availability of credit.

How is the banking system in Argentina?

In Argentina, Law No. 21,526 (1977) regulates banking. According to this law, the Central Bank of Argentina (BCRA) is the executive and regulatory body that issues standards and controls the activities of the financial institutions included in the law:

- powers and conditions of work in the banking sector

- definition of permitted, prohibited, and restricted transactions

- monetary control

- enforcement of operating standards

- information

- accounting and control systems

- dissolution and liquidation, etc.

In order to operate in Argentina, foreign banks must register with the BCRA and obtain appropriate authorization before starting banking operations in the country. In addition, there are minimum capital requirements for doing business with these organizations.

The banking sector in Argentina is relatively concentrated, with the four largest banks, Banco de la Nación Argentina, Banco Macro, Banco Santander Río, and Banco Galicia, accounting for a significant share of the market. There are also several other smaller banks and financial institutions operating in the country.

Is transferring money from Argentina thru a bank a viable option?

Of course, the banking system was impacted by high inflation, a volatile currency, as well as political and economic unsteadiness. These factors have contributed to a fairly high level of non-performing loans and have made it difficult for some banks to attract deposits and maintain profitability.

In this sense, no guarantee can be given to expats that their money will be in a safe place. In fact, authorities could “consider freezing peso-denominated bank deposit and savings accounts to limit further pressures on the exchange rate,” according to global credit ratings agency Moody’s, as quoted in a separate Reuters report.

Since there are so many expats and half of them definitely work and regularly send money to their families abroad, banking services is not quite a reliable option at the moment.

Besides, it is not a secret for almost everyone that transferring money through banks is inefficient in terms of taxation. This is because you pay a lot of money for arranging the transfer.

Thus, to send money abroad from Argentina, you will have to look for other options, such as dedicated money transfer companies, which are mainly focused on wiring your money with low fees and without any loss.

Initially, monetary losses are associated with different currencies since you send in pesos, and the recipient of money will receive it in the currency of the current country. Basically, money transfer companies always offer you a calculator where you have the option to select your currency and the amount and details of the recipient and see how much he or she will receive.

What is a money transfer company and how does it work?

A money transfer company is a financial institution that specializes in transferring money from one individual or entity to another, either within the same country or internationally.

A money transfer company is almost always the quickest and cheapest way to send money abroad. These companies can often offer lower transfer fees than traditional bank wire transfers but with the same level of security and reliability.

Specialized companies will have different fees for money transfers, often depending on the current market rate, as well as mitigating factors such as where you are sending money from and where the amount is being sent.

Money transfer companies typically offer a variety of transfer options, including online transfers, mobile transfers, and in-person transfers through agents or brick-and-mortar locations. Some money transfer companies also offer additional services, such as bill payments and prepaid debit cards.

Leading online translation providers are focusing on optimizing digital navigation to simplify the user experience so that every customer can enjoy the benefits of a simple service.

The specific steps to initiate a transfer may vary depending on the provider you choose, but here are the general steps you’ll need to follow:

Choose a provider: Select a provider that offers the type of transfer you need, and compare the fees and exchange rates.

Provide identification: Depending on the provider you choose, you may need to provide identification documents to verify your identity, such as your passport or national ID card.

Provide recipient details: Provide the recipient’s name, address, and bank account information or other transfer details like a mobile phone number or email address.

Enter transfer details: Enter the amount you want to send, the currency, and any additional information required by the provider, such as the reason for the transfer.

Pay for the transfer: Depending on the provider, you may need to pay for the transfer using a bank account, credit or debit card, or cash.

Confirm the transfer: Review the transfer details and confirm the transfer. You may receive a confirmation number or reference code that you can use to track the transfer.

Once the transfer is initiated, the recipient will typically receive the funds within several minutes, a few hours or days, depending on the provider and the type of transfer.

While getting the best price for your money transfer is important, it’s also a good idea to consider a few other factors when looking for a reliable and secure money transfer service for your needs.

Let’s now probe into all the tax-efficient options for sending money abroad for Argentine expats. We will mainly focus on money transfer companies such as:

• Wise

• Currency Transfer

• World Remit

• Western Union

• Paypal

• Xoom

Sending money from Argentina via Wise

Who is Wise?

The first option on the list is one of the most famous – Wise. Focused on global transfers between banks, Wise is cheaper than a typical local bank for sending money abroad and is transparent about the exchange rate and applicable fees.

Formerly known as TransferWise, the company was founded in 2011 by Estonian entrepreneurs Kristo Käärmann and Taavet Hinrikus, who were frustrated with the high fees and poor exchange rates offered by traditional banks when sending money across borders.

Wise operates on a peer-to-peer model that matches users who need to exchange currencies with others who have the opposite currency needs. This allows the company to offer low fees and competitive exchange rates.

You can go to their website and get a preview of your transaction without the need to log in or sign up.

What about Wise currencies?

Wise allows users to transfer money online or through its mobile app. It allows you to set up a free account and hold more than 50 currencies to convert and wire money when you need to. Note that there’s a minimum deposit you must make to get your account details (there are only certain currencies with such details available). The deposit goes to your account anyways, so you can use it any time.

You will be able to transfer money to over 80 countries using Wise.

In some cases, Wise may not be the best choice for sending money abroad but for many, it will be the right choice, especially when it comes to saving money on bank fees and getting better exchange rates.

Ideally, choosing the best international money transfer provider starts with a helpful service that has offices in your country of residence that provides in-company services and security benefits. Wise’s key locations are in Austin in the US, Budapest in Hungary, Talinn in Estonia, London, and Singapore.

What are the fees?

Wise is extremely transparent, avoiding hidden fees associated with other competitors. It clearly defines what you are paying for, which means you can easily see what transaction fees will be associated with a fund transfer.

Each transaction is subject to a fee based on three factors: the amount you send, the payment method for the transaction, and the average market exchange rate.

If you send a nominal amount of money, you will always pay their minimum fee. It’s cheaper than the fees charged by other services. This nominal amount is 6 pounds to about 9 pounds for transfers up to a thousand pounds.

Wise is one of the most popular international money transfer companies that can offer you ultra-low fees and transparent operation.

Are there any drawbacks for getting money out of Argentina via Wise?

- Limited payment methods: Wise offers a limited number of payment methods in Argentina, including only bank transfers, debit cards, and credit cards. Cash payments are not currently available.

- Limited coverage: While Wise covers over 80 countries, there may be some countries or currencies that are not supported. Currently, sending money (e.g., USD) to your recipient in Argentine pesos is supported but wiring funds from Argentine pesos isn’t allowed.

- Verification process: To use Wise, you’ll need to provide personal and financial information to verify your identity, which can take some time and may require additional documentation.

- Exchange rate fluctuations: Exchange rates can fluctuate quickly and unpredictably, which means the final amount received by the recipient may differ from what was initially quoted. However, Wise offers a rate guarantee for a short period of time to minimize this risk.

- Transfer limits: Wise has transfer limits depending on the account type, verification level, and recipient’s bank which may not be suitable for larger transfers.

Aside from the ones listed above, Wise recently said it is “temporarily” shutting down Argentine peso balances and related transactions:

- You won’t be allowed to set up new ARS balance or add the currency to your account

- You are restricted from converting your existing ARS balance to another currency

- You can’t transfer funds from your ARS balance to another currency

The provider stated: “Argentina has multiple exchange rates at the moment, so we had to close all ARS balances. This is because we can’t guarantee our high level of service to all our customers using ARS right now.”

However, you still can:

- Spend your ARS with your Wise-issued card

- Wire money from other currencies to an ARS bank account in the country

- Transfer funds from your existing ARS balance to a bank account within the nation

Transferring money from Argentina thru CurrencyTransfer

Who is CurrencyTransfer?

CurrencyTransfer, founded in 2014 by Daniel Abrahams and Stevan Litobac, supports 28 currencies and offers transfers to more than 170 countries globally.

Both founders had previous experience in the foreign exchange industry, and they recognized a need for a more cost-effective and efficient way to transfer money across borders. Because they charge brokers directly, you don’t have to pay to use the trading platform.

CurrencyTransfer aggregates the exchange rates of its member brokers. It also allows you to compare real-time exchange rates with the average market rate. This means that you can choose a provider that offers a rate that is closest to the market average, which is often the best option.

Does CurrencyTransfer charge fees?

CurrencyTransfer does not charge any fees for money transfers. The company’s exchange rates are also higher than those of banks. So not only are transfers free, but your recipient gets more money when you use their services.

Are there minimum transfers?

Currently, CurrencyTransfer has a minimum transfer amount equivalent to 5,000 pounds (about 1.2 million pesos) to ensure the “quality of service,” per its website.

What are the pros of wiring funds using CurrencyTransfer?

Competitive exchange rates: provides access to a network of multiple currency providers, allowing users to compare rates and fees and choose the best option for their needs.

Zero transfer fees: no transfer charges compared to traditional banks, which can help users save money on their international payments.

User-friendly platform: The platform is designed to be easy to use, even for those who are not familiar with international finance. Additionally, users can access support from dedicated account managers who can help them navigate the platform.

Payment scheduling: Users can schedule payments in advance, which is particularly useful for businesses that need to make regular payments to suppliers or employees overseas.

What about the cons of using the platform?

Limited payment options: Only offers bank-to-bank transfers, which may not be suitable for users who prefer alternative payment methods such as credit or debit cards.

No cash pickups: Unlike some other money transfer providers, CurrencyTransfer does not offer cash pickups, which may be inconvenient for some users.

Limited availability: Not available in all countries, so users should check whether the platform is available in their location before signing up. Transfers denominated in Argentine pesos can only be received in Chinese yuan.

Longer processing times: While CurrencyTransfer’s payment processing times are generally competitive, they may be longer than some other providers, particularly for certain currencies or payment methods.

Getting money out of Argentina via Western Union

How did Western Union get into money transfer services?

Another option is Western Union. This company gives you an easy way to send cash abroad, even if the recipient doesn’t have a bank account.

Western Union is a big name in the money transfer industry, but they didn’t start as a money transfer service provider. The firm was founded in 1851 by founded by a group of businessmen, including Hiram Sibley, Ezra Cornell, and Samuel Selden.

Initially, the company was established as a telegraph business, and it played a major role in the development of the telegraph industry in the United States. The telegraph was a groundbreaking technology at the time, enabling people to send messages across long distances much faster than was previously possible.

Western Union quickly became the largest telegraph company in the US, and it expanded its services to include money transfer services in 1871. This was a natural extension of its telegraph business, as it enabled people to send money quickly and easily across long distances.

By the end of the 19th century, Western Union had become one of the largest financial institutions in the world, and it continued to grow rapidly throughout the 20th century.

The company operates in over 200 countries and territories and has over 500,000 agent locations worldwide.

What services are now provided?

Western Union offers a variety of services including money transfers, bill payments, money orders, prepaid cards, and other financial services. It provides access for both individuals and businesses, and its services are available through its website, mobile app, and agent locations.

How do fees and exchange rates look like?

Western Union has been a leader in the money transfer industry for many years, and it has a reputation for reliability, convenience, and security. However, its fees can be higher than some other money transfer providers. Moreover, it may not offer the same range of payment and delivery options as some of its competitors.

For getting money out of Argentina, you’d pay a 50-peso fee for 1,000 pesos that you’re sending to the US, for instance. Such fee changes depending on how much you’re transferring. You can wire the payment to another bank account, with a discount on your first transfer. You can also send it for cash pick up.

If you’ve noticed so far from our list, Western Union allows for money transfer from Argentine pesos to a different currency. The other providers don’t support this.

Depending on the country you’re sending money to, a typical Western Union exchange rate can be up to 6% higher than the market average. If you’re sending a large amount overseas, that means hundreds of dollars go straight into Western Union’s treasury.

Delivery speed depends on the translation option. At the agent’s office or over the phone, your transfer can be completed within minutes (at a higher cost). The cheapest options may take five days or longer (bank deposit), depending on the country.

So yes, Western Union can also be a good option for sending money from Argentina to your family or friend.

What are the upsides and downsides of using Western Union?

Positives

- Wide network: Western Union has a large network of over 500,000 agent locations in more than 200 countries and territories, making it a convenient option for sending and receiving money internationally.

- Fast transfers: Most Western Union transfers are completed within minutes.

- Multiple payment options: Offers a range of payment alternatives, including cash, credit card, and bank transfer, which can provide flexibility to customers.

- Security: Western Union has implemented measures to help protect against fraud and unauthorized transactions, such as 2-factor authentication and encryption.

Negatives

- Fees: Western Union charges fees for its money transfer services, which can vary depending on the transfer amount, destination, and payment method used. These fees can add up and make the service more expensive than other options.

- Exchange rates: Western Union often applies a markup to the exchange rate when converting currency, which can result in the recipient receiving less money than expected.

Moving funds from Argentina using Paypal

Who is Paypal?

PayPal is a popular online payment system that allows users to make electronic payments and money transfers securely over the internet. PayPal was founded in December 1998 by a group of entrepreneurs consisting of Peter Thiel, Max Levchin, Luke Nosek, Ken Howery, and Yu Pan.

The firm headquartered in San Jose, California, provides a platform that enables businesses and individuals to make online transactions, send and receive money electronically, and manage their finances. PayPal’s payment system allows users to link their credit or debit cards, bank accounts, or PayPal balance to their account.

What are Paypal fees?

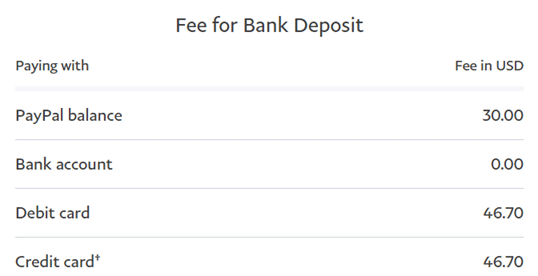

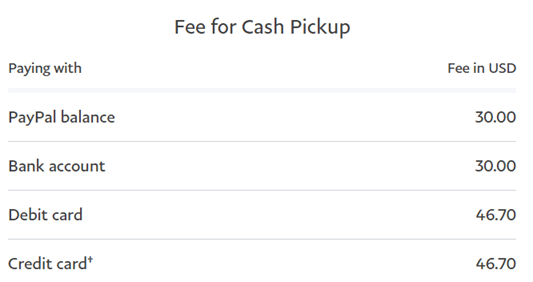

The provider charges a 5% fee for sending international personal transactions. The minimum international fee stands at 0.99 USD and can go as high as 4.99 USD.

What are the benefits of transacting with Paypal?

- Accessibility: PayPal allows users to make online payments quickly and easily, without the need to enter credit card information or other personal details for every transaction.

- Safety: PayPal uses advanced encryption technology and fraud detection measures to protect users’ financial information and prevent unauthorized transactions.

- Wide acceptance: PayPal is accepted by millions of merchants and websites around the world, making it a convenient payment option for many online transactions.

- Buyer protection: PayPal offers a range of buyer protection policies and dispute resolution services to help users resolve issues with their transactions.

What of the drawbacks?

- Fees: PayPal charges fees for certain transactions, such as receiving payments for goods and services, currency conversions, and withdrawals to bank accounts or credit cards. Such costs can be quite high. There’s a currency spread markup of 3% to 4% as well when converting your money to another currency.

- Account limitations: PayPal may place limits or restrictions on accounts in certain circumstances, such as high-risk transactions or suspected fraud, which can be frustrating for users.

- Customer support: Some users have reported issues with PayPal’s customer support, such as long wait times or difficulty resolving disputes.

- Limited currency options: PayPal only supports a limited number of currencies, which can be an issue for users in certain countries or regions.

While we’re here, let’s also look into certain providers that support sending money to Argentina, though they currently don’t provide services for getting money out of the country.

Sending funds to Argentina thru WorldRemit

How did WorldRemit start?

WorldRemit’s network is not as big as brands like Western Union, but it’s also a popular online money transfer service that enables users to send and receive money from anywhere in the world.

The service was founded in 2010 and is headquartered in London, UK. It currently operates in over 130 countries and offers a wide range of payment and delivery options. More than 70 currencies are supported.

Founders Ismail Ahmed, Catherine Wines, and Richard Igoe came together with the goal of creating a more affordable and convenient way for people to send money across borders. They saw an opportunity to leverage the power of technology to disrupt the traditional money transfer industry, which was dominated by large, established players with high fees and slow delivery times.

Other delivery options, such as mobile phone top-ups, bill payments, and door-to-door cash delivery, complement this service for some delivery destinations.

How are the fees and exchange rates with WorldRemit?

You can often find better rates and lower fees with WorldRemit. In addition, the WorldRemit app and website tell you in advance what exchange rates and fees you will be paying for without first registering. This makes it easy to compare with other companies to see if you’re getting the best deal.

Transfers through WorldRemit will add a fee and markup to the average market margin. Transfer fees for WorldRemit vary, but the standard fee from sending US dollars to most countries is 3.99 USD via cash pickup from a partner. It can also be free from charges if you’re sending directly to a bank account.

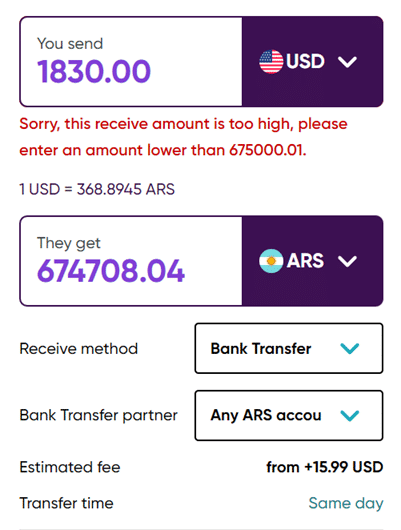

Specifically for getting money into Argentina, the fee for sending to a bank account is at 15.99 USD. Note that you can send up to the equivalent of 675,000 Argentine pesos. Other currencies have different limits.

WorldRemit fees and exchange rates may vary depending on the following:

- Location. Fees and exchange rates may vary depending on the country you are shipping to. Even if two destination countries use the same currency, the exchange rate offered by WorldRemit may differ when shipped to each.

- Quantity. Although the fee for most transfers is $3.99, in some countries the fee will be higher depending on the amount you send.

- Delivery. Sending cash usually has a higher fee, while sending to a bank account is cheaper and can even be free of charge.

Unlike many competitors, WorldRemit offers the same exchange rate no matter how much you send.

What are the advantages of WorldRemit?

- Convenient: WorldRemit is an online service, which means that you can send or receive money from anywhere with an internet connection.

- Wide range of payment and delivery options: WorldRemit offers a variety of payment and delivery options, including bank transfers, mobile wallet transfers, and cash pickups.

- Low fees: WorldRemit charges a flat fee for each transaction, which is typically lower than what traditional money transfer services charge.

- Competitive exchange rates: WorldRemit offers competitive exchange rates, especially thru bank account transfer instead of cash pick up.

- Fast transfers: WorldRemit offers fast transfers in many cases, which can be especially helpful in emergency situations.

- Multiple currencies: WorldRemit supports many popular currencies, making it easy to send money to many countries around the world.

What about disadvantages?

- Limited currency support: WorldRemit doesn’t support all currencies, which could be a problem if you need to send money to a country with a less common currency. Also bear in mind that you’re allowed to wire money that will be converted into Argentine pesos, but you’re unable to transfer from the local currency.

- Transfer limits: Has limits on how much money you can send or receive in a single transaction or over a certain period of time. You cannot pay with cash too.

- Potential delays: While the service offers fast transfers in many cases, there have been reports of delays or problems with transactions.

- Verification process: WorldRemit may require additional verification steps or documentation before processing your transaction, which can be time-consuming.

- Customer support: Generally has good customer support, but some users have reported difficulty reaching customer support or resolving issues with their transfers.

Wiring funds to Argentina via Xoom

Who is Xoom?

Xoom is a digital money transfer service that was founded in 2001 and acquired by PayPal in 2015. It allows users to send money internationally, pay bills, and reload mobile phones using a mobile app or website.

Founders Kevin Hartz, Alan Braverman, and John Kunze wanted to provide a faster, more convenient, and more affordable way for people to send money internationally.

Xoom offers competitive exchange rates and lower fees than many traditional money transfer services, making it an attractive option for people looking for an affordable and convenient way to send money internationally.

Xoom operates in over 160 countries and allows customers to send money to bank accounts, mobile wallets, or for cash pickup at participating locations. The service also offers real-time tracking of transactions and notifications to keep customers informed throughout the transfer process.

Compared to its competitors, Xoom has an average exchange rate margin and markup rates above the market average are also on the same level.

To use Xoom, you must first register for an account and download the mobile app. You can then send money through the app or by logging into the Xoom website. Your money transfers can be funded from a bank account, debit card, credit card, or PayPal balance.

How are transfer times?

The service provider completes most translations within minutes. But you will need to provide a lot of personal information in order to send large amounts of money.

Some destinations may take longer to translate even if you use the funding options above. Using a bank account tends to slow down the transfer process and it can take several days for the money to transfer. It is important to note that large money transfers can also take longer than small money transfers.

What are Xoom fees like?

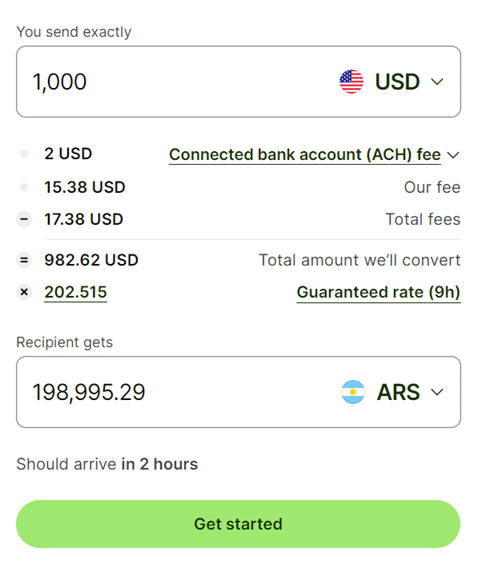

Xoom charges a fee for all transfers. These fees usually start at 2.99 USD and increase from there. Below shows the sample fees if you’re sending 1,000 USD to Argentine pesos:

What are the pros and cons of using Xoom?

Pros

One of the biggest advantages of using Xoom over other payment apps is that transfers are fast, usually within minutes. As for the exact transfer time, it depends on the payment method, as well as on the selected delivery method.

If you use a credit card, debit card, or PayPal balance as your payment method, a Xoom transfer can often arrive instantly or within minutes. But it can be expensive, especially if you use a credit card.

When you use any personal finance or payment app, security is an important consideration. Xoom uses 128-bit data encryption to keep your data private. This means that you can be sure that your personal and financial data is protected.

Cons

One potential disadvantage of Xoom is its fees. While the charges are generally competitive, they may be higher than other money transfer services for certain transactions. Additionally, the service provider’s exchange rates may not always be the most favorable, which can result in additional costs for users.

Another potential issue with Xoom is its customer service. While it offers customer support through phone and email, some users have reported difficulty getting issues resolved or receiving timely responses from customer service representatives. This can be frustrating, particularly if you are experiencing an issue with a transaction or need help with a transfer.

Additionally, Xoom’s speed of transfer may be slower than other services, particularly for larger transactions.

A quick guide to remember when making money transfers

It’s safe to assume that majority has a bank account. But what should you use when sending money to friends and family? Answer: It depends on your circumstances.

Compare the values with other services you are considering to make an informed decision about which service to use. We recommend that you think carefully before making a transfer, and consider one of the companies listed above.

How to compare transfer companies when transferring money from Argentina?

Of course, you want to consider costs. But other factors can influence your choice, let’s look at them.

Exchange Rates

Almost all providers distort exchange rates to make a profit. Compare the rate you offer with the average market rate – the rate that banks and money transfer companies use when trading among themselves – and find the lowest margin between them.

Transfer Fee

Find out if the provider charges a flat fee or a percentage of your transfer. If you are sending a large amount, ask if you qualify for a free transfer.

Payment and Delivery Options

Some transfer companies allow you to pay by credit card online, over the phone or through the app. Others offer cash and pickup locations. Also ask how your recipient can receive your funds: bank account, cash withdrawal, mobile wallet, etc.

Transmission Speed

If you need to get it done quickly, companies like Western Union and MoneyGram make it easy to get cash quickly, often in minutes. If you have more time, you’ll get better rates and fees from an independent provider.

Transfer Limits

Your best option may depend on how much you want to send. For large transfers, choose the best exchange rate, especially since providers encourage large transfers by offering low fees. For smaller amounts, take into account the commission you will pay on top of the exchange rate.

Flexible Transfer Options

Ask if you can schedule payments in advance or protect your transfer from market fluctuations with a limit order or forward contract.

Support

Most companies offer customer service via online chat, phone, in person, or email. Make sure help is available if you need it.

Benefits of using non-cash money transfers

You get the exchange rate, which means they outperform the banks. They trade at real-time exchange rates and use various monitoring tools to select the best exchange rates.

The online transfer method is faster and faster than conventional methods. The transferred money is received on the same day, and in some cases within a maximum of one or two business days.

The online method provides a wide range of currency pairs and currency options.

The online system is available 24/7. You have the opportunity to transfer money at any time of the day.

It is possible to withdraw money from Argentina, but it is getting more and more difficult. It is best to carefully consider each option and send smaller amounts gradually so as not to go beyond the rules. Additional restrictions may also be introduced in the future.