As somebody speaking to expat clients for over a decade now, I can confirm that most are confused about investing options whilst living overseas.

They hear contrasting information from different sources, about property, stocks, pensions and other investment choices. Worries about tax are also common.

This article will try to speak about some of the investing options for expats, in a clear and straight forward manner.

Needless to say, I can’t review the situation for around 200 countries and nationalities, but will focus on the key points and commonalities.

I will also answer some of the most frequently asked questions (FAQs) and make some concluding remarks.

For those interested in investing please email me (hello@adamfayed.com).

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What are the most frequently sold expat policies?

Savings plans and offshore bonds, are widely sold to expats. These policies are usually administered from British Overseas Territory such as Isle of Man, Bermuda, Cayman Islands and British Virgin Islands, although some are administered from places such as Ireland and Luxembourg.

These policies are especially widely sold in high density expat cities like Qater, Dubai, Hong Kong, Saudi Arabia and Singapore, but they are sold in over 150 countries globally.

Whilst there are often benefits to such plans, including significant tax advantages for British and Australian expats, many of these expat plans aren’t the best in the market.

I also spoke about these plans on video form:

What are some of the good alternatives to these traditional expat investments?

Many platforms and newer life insurance and banking firms, charge much more reasonable fees, whilst maintaining the tax benefits of the traditional expat plans.

This is especially the case for online firms, that have cut out many of the traditional costs, associated with financial services.

This brings with it significant advantages. Over a 10-year life cycle, a cheaper policy may save you tens, or even hundreds of thousands of pounds.

This will improve the net performance of your investments.

How about local investment solutions?

In a small number of places, local solutions make sense. For example, expats living in the United States should usually consider local solutions, for tax reasons.

In general, however, expats are moving from country to country every 3-5 years. Or even if they are not, they often want to return home eventually.

So local-solutions often don’t make sense for a number of reasons. Firstly, some local solutions aren’t very tax-efficient for expats.

Second, many expats I know are cashing in their policies, every time they move. This isn’t tax or cost-efficient, as capital gains tax applies every time you sell.

There is also the issue of investor protections. Many countries don’t have the sorts of investor protections that many offshore jurisdictions provide, such as Luxembourg, Isle of Man, British Virgin Islands and Bermuda.

Such locations usually have British Government protection (90% deposits protection in the case of Isle of Man), or the segregated accounts system, which negates the need for a guarantee.

Currency can be another issue. I have met countless expats who save and invest in the local currency, only to see a sharp devaluation relative to the USD.

This can happen even in unexpected situations. 10 years ago, most expats in China were interested in local solutions, as they were convinced the RMB would keep rising against the USD.

Subsequently, the RMB has moved from 6:1 to about 7:1 against the USD, and the local stock market has underperformed relative to the USD.

In addition to this, countless local providers have limited investment choice, especially in emerging and frontier markets.

What are the biggest financial mistakes you have seen expats make overseas?

Familiarity-bias is a huge issue. It is human nature to be reassured by investments that others close to you are making, even if you would never have considered that option a few years ago.

Very few expats, as an example, are interested in local property or land on day 1 of their expat adventure.

Over time, after listening to talk of huge returns at dinner parties, many expats get seduced by the chance to get rich quick.

Whilst this can sometimes work, we have to remember that property is a complex legal product, and it isn’t liquid.

Meaning that you can’t just sell it easily. This is an even bigger issue with land investments. In 2014, I met two expats, in Indonesia and Cambodia, that boasted to me about their returns.

Subsequently, they couldn’t sell their land (the expat in Cambodia) or apartment (the expat in Indonesia) for various reasons.

A gain isn’t a gain until you sell, and most developing countries don’t have the sorts of legal systems that we have back home.

Beyond that, the lack of compulsory savings and a “keeping up with the Jones” mentality, means many expats on huge packages are failing to invest much money at it.

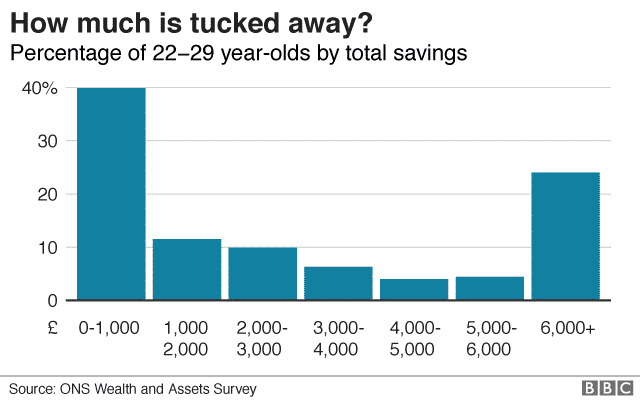

It is true that many people back here aren’t investing much as per the figures below, but they are part of a social security system:

Are the big expat banks some of the best options?

Speaking about familiarity, some expats are reassured by familiar-sounding banking names. In general, the bigger banks take advantage of their brand name and charge high fees. Moreover, they aren’t independent.

In practice, this means they will have a limited number of funds available. For example, HSBC Expat is likely to sell HSBC funds, and offer limited solutions, as opposed to cheaper alternatives.

In general, banks are best for banking solutions, and platforms are best for investments. It might seem convenient to have everything under the same roof, but it is usually expensive.

How about expat taxes on investments?

Expat taxes are incredibly complex areas, as it depends on your nationality and where you live. I am not a tax advisor, but I will try to summarize here.

As a generalization, for American expats, it makes sense to invest with a broker back at home. This is unless an expat brokerage firm has a product specific to US expats.

For expats living in America, meaning non-Americans living in the US, it can also make sense to contact a US broker.

For most nationalities, however, investing offshore whilst living overseas, makes the most sense. Sending money home can cause tax issues, as can only focusing on local solutions.

This is especially the case if you need to move cities/countries every 2-5 years, meaning your liquidate your investments every time you move.

As capital gains taxes apply when you sell an investment, it is preferable to focus on long-term expat investing.

For British expats, in particular, portfolio bonds can have significant tax advantages, but it does depend on the charging structure chosen.

What about ISAs and other forms of tax-efficient investing?

Most onshore tax-free investment options like ISAs for British people aren’t available for expats unless it is just a short-term assignment.,

If you are spending less than 6 months a year overseas, however, the situation can be a bit different, as your tax residency may be in your home country.

Most onshore brokers also don’t accept expats. For example, Hargreaves Lansdown, the biggest UK brokerage firm, doesn’t accept expats as new clients.

They do keep open accounts for Brits living overseas, who applied before they left the country, provided it isn’t held within an ISA.

How about Bitcoin and alternative investments such as FX?

Many people ask me about these alternative investments, especially if they have seen another expat make great money from them.

Any investment can go up. That in and of itself doesn’t make it a good investment. Countless investments have gone up in the short-term.

Tech stocks that had little or no revenue and business earnings, went up for 5-10 years during the 1990s. Commodities, long-term losers, have also had great 10 year periods.

The point is Bitcoin doesn’t have any business earnings, unlike something like index funds. It doesn’t have a yield either, like Treasuries bonds.

So the only thing holding up the price of Bitcoin is the hope that the person sitting next to you, will want to pay more for it than you paid.

Even if Bitcoin and digital money is the future, that doesn’t mean it is a sensible investment. Using the aforementioned tech stock example, there is no doubt the internet was the future in the 1990s.

The cream of the crop has done great, as shown by the Nasdaq’s fantastic performance, beating even the S&P500 and Dow Jones since 1999.

However, that doesn’t mean the valuations of those tech companies in the 1990s was justified. No matter how good their products and services were, they didn’t have any business earnings, so most tech firms with high valuations in the 1990s went bust.

Only those technology firms with solid business earnings, like Apple and Amazon, who managed to monetize their products and services, managed to avoid bankruptcy and get bigger.

Another example would be pharmaceutical stocks. Imagine tomorrow, a drug was invented that would cure cancer AND reverse ageing…..we can now all live until 150 and live more active lives!

Sounds unrealistic, but it may happen sooner than we think. The point is, this would be a bigger game-changer that even the internet when it comes to global GDP.

In the short-term, the stock would probably soar in value. Maybe even go up by 10,000% or 20,000%.

People would speculate that the healthcare firm that invented the drug, will be able to monetize the drug with greater sales.

If that happens, and business earnings follow, the high valuations may be justified. If for whatever reason, the healthcare firm can’t monetize the invention as much as expected, the price would eventually fall back down.

It might tale 5 or 10 years, but business earnings are the key to long-term stock market rises. It is the tail that wags the dog.

As for FX trading, it is a bad idea entirely. Currencies don’t go up as an asset class. The Euro can’t go up against the USD, at the same time as the USD goes up against the Euro.

Therefore, on each trade, one person loses and one person wins. The same thing happens tomorrow.

Compound probability dictates that the more you trade, the statistical chances of losing money increase.

Being a sensible long-term investor always beats being a trader and speculator, long-term.

Why are index funds good investments?

100 years ago, Ford’s Model T was innovative. Now you would need to invent the flying car to be considered innovative.

The point is, humanity does innovate with time. It isn’t always a straight line. We have wars, political and social problems.

Just in the last 100 years, we have had 2 huge global conflicts and countless regional ones. That hasn’t stopped the biggest firms from getting more innovative.

Ultimately, the stock market is just the biggest firms in the country and indeed the world. What is the Dow Jones? It is 30 of the biggest firms in the US. The S&P500? 500 of the biggest firms in the US.

MSCI World is the biggest world firms. Over time, these indexes have always gotten more profitable.

In the short-term speculation can win the day. Over the long-term, business earnings linked to innovation is the key.

Are index funds, therefore, an 100% sure bet?

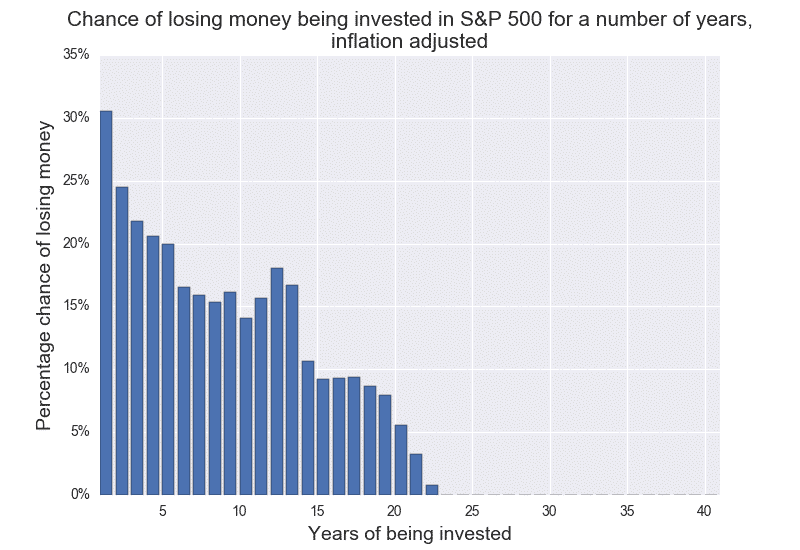

100% of buy and hold investors have made money in index funds IF they have bought and held the indexes for 20-25+ years.

Investors who hold 2-3 indexes (MSCI World, S&P, FTSE100 as just three examples) are even more likely to make money, especially the case if they have also had a bond index.

Too many people, however, try to time markets. Let’s look at recent times. When Trump was running for election in 2015-2016, many investors said `i want to wait until the election before investing`.

That was when markets were at 16,000-18,000 in the US. He won the election, and markets soared.

That isn’t necessarily a reflection on Trump – indeed markets have always risen long-term as mentioned before and even usually go up short-term under most presidents.

The point is, with markets at 27,300 as I am writing this, there is a reasonable chance US Markets will never again see 16,000-18,000.

They briefly fell to 21,000-22,000 in December but didn’t come close to 18,000, let alone 16,000. That recent example is just one of thousands of historical examples I could have given.

The point is, market timing doesn’t beat time in the market. There is a whole set of academic evidence against it.

Should you pay for advice?

This is entirely a personal decision. It is possible to DIY, and some people do it very well. However, investing is simple but not easy as Warren Buffett once said.

Emotionally speaking, some of the fundamentals of investing like not market timing, isn’t easy. In fact, it is easier said than done.

I am sure you know many people who panicked during the 2008-2009 financial crisis and obviously now regret it. It isn’t easy, after all, to stay calm with sensationalist media stories coming on a daily basis.

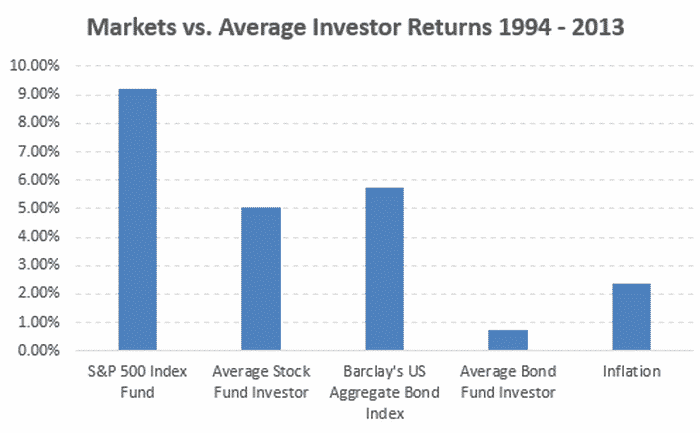

That is one reason for the results below, which compares the average investor to the indexes:

So in the same way that many people see the benefit of a personal trainer, rather than doing the gym individually, an advisor can add significant advantages.

What services do you provide?

I provide investment management services. Specializing in lump sums from $75,000, and monthly investments from $600.

Where are your clients based and can you accept me?

I have clients in the UK, Belgium, UAE, China, Australia, South Korea, Hong Kong, Mexico, Canada, Thailand, Singapore and tens of other places.

I can take clients from any country apart from those living in the US. US expats are usually OK.

Can I use expat-specific investment platforms?

Yes, you can. This option often makes sense, especially if you are living a transient lifestyle.

How about property investments which don’t involve direct real estate?

I have previously looked at how expats can invest in property without the hassles of being a landlord in this article

Should you also have offshore or expat banking?

This can be a good idea, for a simple reason of tax implications. If you send a huge lump sum home, after investing for 15 years as an expat, the authorities will want to look into that.

Even if no tax is due, it can cause headaches. Numerous people have been asked to prove that the amount they have received, won’t be a yearly event, and many other things.

You also have the issue of residency. Courts of law, in countless countries including Australia, have asked expats to prove they really are expats.

In other words, the more ties you have to your home country (bank accounts that are frequently being used, property and so on), the more questions are being asked.

This is especially an issue for “digital nomads” who often don’t have tax identification numbers for long periods of time.

Having no tax residency has certainly become more difficult, and it is a misconnection that being out of your country of citizenship for 183 days, means you are authentically tax exempt.

Having offshore banking and investments (merely the investments are outside your country of residency and citizenship) reduces these risks.

Like anything, these rules change, so it is best you use an advisor that is up-top of such things.

What’s the best broker or DIY platform for expats?

This depends on many things. If you are American, the answer might be different to if you are British.

If you plan to stay in just one country for 20 years, your needs may be different from somebody who is moving from country to country, as some brokers only accept clients in specific countries.

Moreover, the brokerage you actually pick, isn’t as important as the investments themselves.

Almost all DIY platforms these days are safe, and well-regulated.

How about for expats on short-term assignments?

It depends how short-term. If you are outside your country of residency for a few months, you are still going to be a tax resident back home.

In this situation, expat specific investments aren’t as useful as the “career expat”.

How about something like robo-advisors?

Robo-ddvisors can be good for basic needs, and indeed many advisors are using them to automate some basic tasks.

The issue with the technology however, is that it doesn’t account for your very specific situation.

It also doesn’t do financial planning, such as budgeting. It more focuses on pure investment advisory advice.

So for many expats, the technology works best, when an advisor uses it, in tandem with more traditional advice.

It is, however, allowing many expat advisors to have global client banks, and negating the need for face-to-face advice.

This isn’t the only technology allowing for the more efficient use of man power.

In recent years, I seldom meet clients face-to-face, due to new technology.

Conclusion/summary

In general, it is best to focus on expat-specific investing, rather than local investing.

This is unless you are American, or an expat living in America, although different local circumstances can exist in different countries, and laws can always change.

Long-term and low-cost investing beats market timing and speculation, or for that matter keeping money in the bank.

What are your contact details?

My main email is hello@adamfayed.com. I am also available on numerous apps, such as WhatsApp.

Further reading

For expats with existing policies overseas, you may find the following article useful.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Hello sir I am a Filipino Expat worker employed in a consulting firm where our employment is based on project assignments which is sometimes short term or in a long term period of minimum of two years to three years. Di we are receiving good oayçheck about 60K to 80K USD per annum but what I would like to hàve an investments that will help me during my retirement. A

Thanks for being in touch Napoleon. I will email you.

I will love to invest

I will love hear more