This article was updated on Jan. 10, 2023

This article will tell you how to invest in the S&P 500 index from outside of the United States.

Many people across the world are looking to invest in US stocks and indeed stock markets like the S&P500, Dow Jones and Nasdaq.

It isn’t always easy, however, depending on your country of residency and some other factors.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some of the facts might change from the time of writing, and nothing written here is financial, legal, tax or any kind of individual advice, or a solicitation to invest.

The Standard & Poor’s 500 Index is a stock market index that follows the stock prices of 500 of the largest publicly traded companies in the United States.

It reports on the risks and profits of the companies with the most market capitalization and shows the outcomes of the stock market. Investors will use it as a standard to measure all other investments against, since it serves as a reference point for the entire market.

Standard and Poor are the names of the two financial firms that founded the organization that is now known as S&P.

Standard & Poor’s made the S&P 500 index available to the public for the first time on March 4, 1957. In 1966, McGraw-Hill became the owner of the company. It is now a part of S&P Dow Jones Indices, which is a company that is owned by S&P Global (formerly McGraw Hill Financial), CME Group, and News Corp., which also owns Dow Jones.

The prices of large-cap stocks in the United States, or stocks in businesses with a total worth of more than $10 billion, are what the S&P 500 index follows. If you keep an eye on the S&P 500, it will be simple for you to determine whether the most important stocks in the US are going up or down.

So, the S&P 500 tracks the prices of large-cap US stocks or stocks in companies with a total value of over $ 10 billion. By following the S&P 500, you can easily see whether the largest US stocks are rising or losing.

This is why the S&P 500 is often viewed as a metric to describe the overall health of the stock market or even the US economy.

As of August 31, 2020, the S&P 500 had an average 10-year annualized return of 12.66%. Meanwhile, the annualized performance of the S&P 500 reached 14.5% over the past 10 years through March 31, 2022.

How to invest in the S&P 500 index: How does it work?

The S&P 500 tracks the market capitalization of companies in its index. Market capitalization is the total value of all shares issued by a company. It is calculated by multiplying the number of issued shares by the share price.

A company with a $ 100 billion market cap gets 10 times more representation than a company with a $ 10 billion market cap. As of July 2020, the total market capitalization of the S&P 500 was $ 27.05 trillion. It has reached more than $ 35 trillion in 2022.

The committee selects each of the index’s 500 corporations based on their liquidity, size and industry. It rebalances the index on a quarterly basis in March, June, September and December.

How to invest in the S&P 500 index: Qualifications

What makes a company eligible for the S&P 500 index?

To qualify for the index, a company must be located in the United States, as well as have an unadjusted market cap of at least $ 12.7 billion, according to S&P Dow Jones Indices. This was downwardly revised – with effect from Jan. 4, 2023 –from an unadjusted market cap of at least $ 14.6 billion that was set previously, S&P DJI said.

At least 10% of the shares of the corporation must be publicly available, while most of its fixed assets and revenue must be in the United States (but it doesn’t have to be more than 50%). A company must also submit a form 10-K annual report. Finally, it is required that the company’s earnings for the most recent quarter and the aggregate of its earnings for the four most recent quarters in a row be favorable.

Stocks cannot be listed on pink sheets, where stocks that trade over-the-counter (OTC) are listed. It is required for it to be listed on the New York Stock Exchange, Nasdaq, or Investors Exchange.

Based on data from S&P Dow Jones Indices, the top 10 market capitalization weighted companies in the S&P 500 as of March 31, 2022 included:

- Apple Inc. (AAPL)

- Microsoft Corp. (MSFT)

- Amazon.com Inc. (AMZN)

- Alphabet Inc. A (GOOGL)

- Alphabet Inc. C (GOOG)

- UnitedHealth Group Inc. (UNH)

- Berkshire Hathaway Inc. (BRK.B)

- Nvidia Corp. (NVDA)

- Tesla Inc. (TSLA)

- Meta Platforms Inc. A (META), previously Facebook Inc. (FB)

Note that some companies appear more than once – Alphabet Inc., Google’s parent company, appears twice. This is because Alphabet and other companies have more than one class of sizable stocks. For this reason, the S&P 500 can hold more than 500 shares, although it only includes 500 companies.

Can you buy S&P 500 stock?

The S&P 500 is not a company itself but a list of companies, also known as an index. Thus, while you cannot buy S&P 500 stocks, you can buy stocks in an index that tracks the S&P 500.

In fact, this is one of the best ways for budding investors to get their feet wet in the stock market. Some of the most popular index funds that track the S&P 500 include:

- Vanguard 500 Index Fund Investor Shares (VFINX)

- Fidelity 500 Index Fund (FXAIX)

- Schwab S&P 500 Index Fund (SWPPX)

- T. Rowe Price Equity Index 500 Fund (PREIX)

And now, for investors who are interested in S&P 500 companies and want to invest but don’t know where to start, let this article be a quick guideline for you.

How to invest in the S&P 500 index: Who can help you?

As mentioned earlier, you cannot invest in the S&P 500 index itself. On the other hand, you could put your money into an S&P 500 index fund, which attempts to replicate the results of the S&P 500. Instead of buying 500+ individual stocks (which are constantly changing anyway), this is an opportunity to invest in one fund.

Another way to invest in the S&P 500 is to invest in an exchange-traded fund (or ETF) that mirrors the index.

When investing in the stock market, an investor who wishes to maintain their diversification may do so through the use of an exchange-traded fund (ETF), which is a fund that is both cost-effective and tax-efficient. They are traded on stock exchanges and can be bought and sold like stocks.

You can invest in the S&P 500 in a variety of ways – with the help of a bank, broker, discount brokerage, financial advisor, or robo advisor.

How to invest in the S&P 500 index through a Bank

A bank may seem like the most convenient way to invest in the S&P 500 because it allows you to keep all of your accounts – checking, savings and index investment accounts – in one place.

The downside is that banks can have high fees and you may not always get the personalized, personal investment service you do when you need to talk to someone, such as your checking account or a loan. This is because investment is a side business for banks. (Their main purpose is to accept and lend money.)

Banks also tend to overcharge and are trading on brand name.

How to invest in the S&P 500 index through a discount brokerage

A discount broker or trading platform has consistently low commissions, but you are completely on your own – there are no tips to help you navigate your investment approach. It’s completely DIY.

This might work great for investors who understand their financial landscape and know how investing in the S&P 500 index fund fits into their investment puzzle, but most experts agree that it is wise to get some advice before investing.

This is a great option for the minority of people who have the self-control needed to invest by themselves.

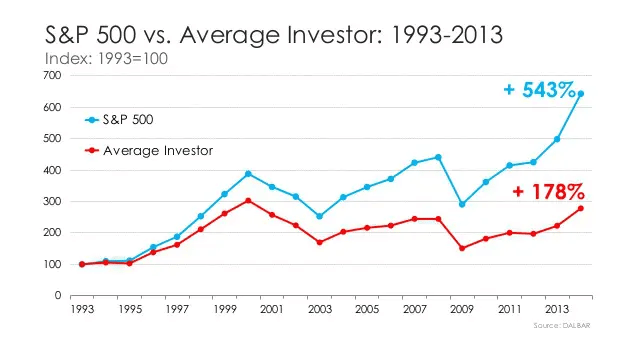

With that being said, it is a statistical reality that DIY investing doesn’t work compared to using advisors.

In the March 2020 crash, Fidelity claimed that 35% of people panic sold between March and May.

This helps explain results like these:

Everybody says they won’t be emotional when markets crash, yet few people seem to be able to follow up with actions when such a crash happens.

How to invest in the S&P 500 index through a financial consultant

A financial advisor can of course help you with this type of investment. A financial advisor knows your complete financial vision, has a complete financial plan for you, and is knowledgeable about how investing in an index like the S&P 500 can help you – especially you – achieve specific financial goals.

People think advisors can help with knowledge. This is true, but as per the last paragraph, assisting with emotional control is even more important.

How to invest in the S&P 500 index through robo advisors

Robo advisors are becoming more and more popular because many of them combine the benefits of low fees with the opportunity to discuss your investment approach with a real person.

They are less practical than financial advisors because they use algorithms to help them figure out which investments are right for you. Some robotics advisors offer the opportunity to speak with a financial planner, especially if you are investing large amounts of money.

How to invest in the S&P 500 index: A Step-by-Step Guide

To make an investment in S&P 500, you have to complete some easy steps. Let’s see the succession of the investing process with the following steps.

Step 1: Open a brokerage account

If you want to invest in the S&P 500, you first need a brokerage account. This can be a retirement account such as a traditional IRA or Roth IRA sponsored by an employer 401 (k) or similar, or your own traditional taxable brokerage account.

There are many brokerage companies to choose from. Look at the buying and selling fees for mutual funds and ETFs if you are opening a new account intending to invest in the S&P 500. Many brokerages offer their own funds or a group of partner funds without commission for trading mutual funds. For ETFs, you must pay any trading fees.

Step 2: Choose between mutual funds and ETFs

You can buy the S&P 500 index funds as mutual funds or as ETFs. Both track the same index and work in the same way, but there are some key differences you should be aware of.

- Mutual funds are designed to be held for a relatively long period of time. They only trade once a day after the close of the market. Some have a minimum investment amount and a minimum investment period. And early withdrawals can lead to fines. On the other hand, you can buy and sell mutual funds in round dollars.

- ETFs are bought and sold like stocks. The price is constantly changing throughout the day as traders buy and sell. Most major discount brokerage firms allow you to trade all ETFs for free. There is no minimum hold time or minimum purchase amount other than the price of one share. In some cases, ETFs can have lower expense ratios and can be purchased through brokers such as Public.com, which is known for its low fees and zero fees.

For most people, ETFs will be a more attractive way to start investing in the S&P 500. However, mutual funds also have their advantages. It’s up to you to decide what works best for your portfolio.

Step 3: Choose your preferred S&P 500 fund

After settling on either exchange-traded funds (ETFs) or mutual funds, you can begin contrasting individual aspects of each type of fund in order to select your preferred option. Consider first whether there are any costs or fees. You should avoid paying too much if you can obtain essentially the same thing from a number of different sources.

Here are the fees for popular mutual funds:

- Schwab charges 0.02% on the Schwab S&P 500 Index Fund (SWPPX) with no minimum investment amount.

- Fidelity charges just 0.015% on its Spartan S&P 500 Index Investor Class (FXAIX) shares with no minimum investment.

- The Vanguard 500 Index Fund (VFINX) has a charge of 0.14% and a minimum of $ 3,000. Note that as of the time of update on Jan. 10, this fund is closed to new investors, as per its website.

And here are the fees in the ETF world:

- The Vanguard S&P 500 ETF (VOO) is worth 0.03%.

- iShares Core S&P 500 (IVV) costs 0.03% per year.

- The largest and oldest S&P 500 ETF is the State Street Global Advisors SPDR S&P 500 ETF (SPY) with a 0.0945% expense ratio.

What is the average return on the S&P 500?

For nearly the last century, the S&P 500’s average annualized total return (including dividends) has been about 10%, unadjusted for inflation.

However, keep in mind that this does not mean that you can expect to receive a 10% return on your investment in the S&P 500 Index Fund every year.

For example, in 2008 the S&P 500 ended the year with a staggering 37% drop. The next year it grew by 26%. Achieving an annualized return of 10% requires a long-term investment mindset and a willingness to overcome market volatility.

What are the benefits of Investing in the S&P 500 Index Fund?

One of the benefits of investing in a fund that reflects the S&P 500 is that large-cap companies – those included in the S&P 500 – are generally considered more stable (read: less risky) investments and tend to increase the value of the stock.

Another advantage of combining several companies into one index is that it makes it easier to invest in all of these companies at the same time. If you want to invest in the S&P 500, you can of course buy shares of every single company in the S&P 500. That means 500 separate transactions.

This could mean a lot of clicks or phone calls – and it could mean talking to your very confused stockbroker or financial advisor, who will then tell you about a much easier way to invest in the S&P 500: simply by investing in the S&P 500 Index Fund. You can invest in one transaction in all 500 companies at the same time.

And another benefit of investing in an S&P 500 fund is its inherent diversification based on a wide range of components across a variety of industries. The nature of the stock market is unpredictable, but experts often recommend investing in index funds that track general market benchmarks, such as the S&P 500.

How would you compare the S&P 500 to other indexes?

The S&P 500 is one of several leading stock indices used to measure and understand the performance of the US stock market. Here is a comparison with other common stock indexes.

S&P 500 vs NASDAQ

The NASDAQ tracks one hundred of the largest and most actively traded non-financial domestic and international securities on the NASDAQ stock market.

Like the S&P 500, the NASDAQ uses a market cap weighting formula, although other factors also influence the inclusion of stocks. To be part of the NASDAQ, a stock must have a minimum daily trading volume of 100,000 shares and be traded on the NASDAQ or other major exchange for at least two years.

Unlike the S&P 500 and the Dow, the NASDAQ includes some foreign companies and is heavily focused on technology companies. Because of this, the NASDAQ does not reflect the overall US market so much as the attitude of investors towards the tech industry.

In 2022, the NASDAQ has averaged -33.47%. However, keep in mind that its high profitability in recent years is largely due to its heavy technological weight.

S&P 500 vs DJIA

The Dow Jones Industrial Average (DJIA), also known as the Dow, tracks far fewer companies than the S&P 500. The Dow tracks 30 US blue-chip companies that are considered the largest, most stable and most successful and well-known companies that are leaders in their industries.

Unlike the S&P 500, the DJIA is weighted by price, not market capitalization. This means that the percentage of a company in the index is proportional to its share price. The components with higher stock prices receive more weight in the index. This has several important consequences:

- Smaller Dow components can have a disproportionate impact. Firms whose stock prices are quite high have more of an effect on the level of the Dow Jones than they do on the level of the weighted market cap index. This is irrespective of the size of their market cap because the weighting is based on the stock price. A company that has shares that are priced more affordably but has a market capitalization that is significantly higher will have less of an impact on the overall direction of the Dow Jones.

- DJIA may face greater volatility. Because of its price weight, the Dow may also experience sharper and more frequent ups and downs than the S&P 500. Consider this: XYZ is worth $ 200. When it drops in value by $ 1, the DJIA falls by a larger percentage than if the company with the cheaper shares lost the same amount. This happens even though $ 1 is a lesser percentage of $ 200 than, say, $ 20.

However, over the long term, the S&P 500 and the Dow show similar rates of return.

According to the measurements provided by the SPDR Dow Jones Industrial ETF (DIA), the average return on the Dow Jones since the index’s founding in January 1998 and continuing through March 2022 stood at 8.70%. In the meantime, the total return on the S&P 500 index has been 10.67% on an annualized basis since the index’s modern structure was first introduced in 1957 up until March of 2022.

The Standard & Poor’s 500 Index is a stock market index that follows the stock prices of the 500 companies in the United States with the most market capitalization that are traded publicly. When following the movement of US stocks, one of the most important tools to use is the S&P 500 index.

Here every investor can find his goals and follow them, the most important thing to remember is to diversify your funds and not be focused on one index fund.

How to invest in the S&P 500 index: Is there a “best way” to do this?

There is no best way. Each person is different. If you are a DIY investor that has successfully invested for 25 years and never panic sold, then DIY investing might be best.

If your financial situation is complex (let’s say you are an expat), or you are likely to panic sell during a crash, then having advice is best.

Each investment approach has its merits, depending on a person’s specific situation.

Since the S&P 500 Index Fund includes 500 different companies, it is inherently a diversified investment.

And you can certainly invest in a fund that only tracks S&P 500 companies. But investment management companies offer many different fund types and portfolio recommendations.

For example, there are funds that include the S&P 500, but also include other types of investments — for example, foreign stocks or technology companies — that simply do not meet the S&P criteria for a “big giant American company.”

No matter how passionate about the S&P 500 you are, you should still view those 500 as one investment in your basket – you don’t want all of your investment eggs to be put into it.

It is better to also own a bonds index, and an international one, in tandem with the S&P500 index.

Investing money in an index like the S&P 500 means that the value of your investment can fluctuate a lot over time.

A wise investor doesn’t just put money into an account and doesn’t forget about it. Actually, let’s fix this: a wise investor can throw money into an account and forget about it if that investor has someone adjusting the investor’s portfolio to accommodate changes in the market.

When choosing an investment platform with portfolio rebalancing, you take into account market changes.

This means that you maintain the same asset allocation over time – for example, a portfolio that contains 50 percent of stocks and 50 percent of bonds – in line with what you designated when you started investing.

With the frequency you choose, your robot advisor will execute certain transactions that will return your interest to where you want it.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.