(This article was last updated on March 17, 2023.)

In this article, we will focus on how to send money out of Vietnam. We have previously discussed how to transfer money from China and Taiwan.

There are a lot of expats who send money abroad for different reasons, such as investment on a house or payment of bills. We’ll explain some of the best ways to securely send your money out of Vietnam. Our job is to make it easier for you and suggest different cost-effective options for transferring money.

If you are looking for portable customized investment solutions for expats, which is what I specialize in, you can contact me by filling out this form, email me (advice@adamfayed.com) or use the Whatsapp feature.

This article will be updated regularly, but things could change soon after. Any information herein should not be construed as legal, tax, or financial advice.

Table of Contents

Living in Vietnam as an expat

The most difficult thing about moving to Vietnam is choosing where to live – in the country everyone will find something for themselves. Stretching over 2,000 miles from north to south and lapped all the way by the South China Sea, Vietnam offers plenty of opportunities for adventure seekers, history buffs, city dwellers and beach lovers.

How’s the weather in Vietnam?

Somewhere in Vietnam the weather is always good. There are four distinct seasons in Hanoi and the north: hot summers, cold winters, and delightful spring and autumn.

Ho Chi Minh City and the south enjoy warm and humid tropical weather all year round. Cities on the central coast are hot in summer and warm in winter, with a rainy season that typically lasts from late summer to mid-autumn.

Meanwhile spring reigns in Dalat, a promising expat haven in the Central Highlands. You will never need a snow shovel, but those who yearn for snow can sometimes find one on cold winter days in the far northern mountains.

Are Vietnamese people friendly?

The Vietnamese are hospitable, sincere, generous, and sincerely interested in foreigners; this is the perfect place to make local friends. It is not unusual to meet a stranger and soon be invited to visit his home or village. College students like to start conversations in English when they see a foreigner.

Don’t be surprised if you’re greeted with a smile or a short conversation in anticipation of a red light or a meaningful conversation with a waitress or vendor. Friendships in Vietnam often develop into family relationships; you will be called brother or sister, aunt or grandfather, and all the respect and kindness associated with such titles.

Is there an expat community in Vietnam?

Expatriates coming to Vietnam also have many opportunities to meet other foreigners. Expat communities across the country bring people together through frequent gatherings, many restaurants and bars cater to foreigners, and events such as food fairs, festivals and community projects provide many opportunities to meet friends both old and new.

Financial System and Vietnam Banking

The financial system in Vietnam has undergone significant changes over the past few decades, transitioning from a centrally planned economy to a market-oriented one. The Vietnamese government has implemented various reforms to promote economic growth and development, including modernizing its financial system.

The State Bank of Vietnam (SBV) is the country’s central bank and regulates the banking sector. The banking industry is dominated by state-owned commercial banks, but there are also joint-stock banks, foreign banks, and non-bank financial institutions.

In recent years, the government has been working to increase competition in the banking sector and encourage the growth of private banks.

Vietnam’s stock market, the Ho Chi Minh Stock Exchange (HOSE), was established in 2000 and has experienced significant growth in recent years. The market currently has over 400 listed companies with a total market capitalization of around $256.4 billion, as of the time of update.

In addition to the HOSE, there is also the Hanoi Stock Exchange (HNX), which mainly trades in government bonds and stocks of small and medium-sized enterprises.

The Vietnamese government has also implemented policies to promote the development of the insurance industry, which has seen rapid growth in recent years. There are both domestic and foreign firms present in the market.

However, the financial system in Vietnam still faces several challenges, including a lack of transparency, a high level of non-performing loans in the banking sector, and limited access to financial services in rural areas.

Do expats have access to Vietnam banking?

Expats living in Vietnam have a range of options when it comes to banking. Foreigners can open bank accounts in Vietnam, and there are several banks that offer services specifically for expats.

To open a bank account in Vietnam, expats will typically need to provide the following documents:

- A valid passport: This is required to verify the identity of the account holder.

- A visa or residency permit: Expats will need to provide proof of their legal status in Vietnam, such as a visa or residency permit.

- Proof of address: This can be a utility bill, rental agreement, or other document that shows the expat’s current address in Vietnam.

- Proof of income: Some banks may require proof of income, such as a work contract or salary statement.

It’s important to note that some banks may have additional requirements for opening an account, so it’s best to check with the specific bank before applying.

Expats can open bank accounts at most banks in Vietnam, including state-owned banks, joint-stock banks, and foreign banks. Some banks offer specific services for expats, such as international money transfers, foreign currency accounts, and English-language support.

Why do people send money abroad?

The need to transfer money to or from Vietnam may arise for various reasons:

- Purchase of residential property by a foreigner

- Remote work and salary

- Financial assistance (both ways)

- Millions of goals

Are there restrictions for sending money from Vietnam?

Yes, there are restrictions on sending money out of Vietnam. The Vietnamese government has certain regulations in place to control the outflow of money from the country. These restrictions are primarily aimed at preventing money laundering, terrorism financing, and tax evasion.

To send money out of Vietnam, individuals and businesses are required to comply with the country’s foreign exchange regulations, which are administered by the State Bank of Vietnam (SBV). Among other things, these regulations require that individuals and businesses provide certain information and documentation to the SBV, such as the purpose of the transaction, the source of the funds, and the identity of the recipient.

In addition, there are limits on the amount of money that can be sent out of Vietnam. Individuals are generally allowed to transfer up to US$5,000 per transaction, while businesses are subject to different limits depending on their size and sector.

It is important to note that failure to comply with Vietnam’s foreign exchange regulations can result in fines and other penalties. Therefore, if you are looking to send money out of Vietnam, it is recommended that you consult with a licensed financial institution or a professional advisor to ensure that you are complying with all applicable regulations.

How to Send Money out of Vietnam

Transferring money to friends, relatives in another city or business partners in another country is becoming easier. With the digital era, almost all banks are developing special apps, and new money transferring companies are opening their branches around the world.

Each tourist has his own horror story on the topic “How I transferred money to Vietnam.” But the reverse version is even worse. Let’s find out the most popular and guaranteed ways in the country.

What are the most convenient ways for money transfer in Vietnam?

Previously, to transfer money, you had to go to the post office and fill out a receipt. At the same time, the recipient had to wait a long time for his parcel, like from 3 days to a few weeks.

Nowadays, with the continually growing digital advantages and due to electronic payment systems, your money transfer operation can take only a few minutes to several hours.

The sender can use different ways to transfer money:

- send money by mail

- contact the bank

- use the help of Internet banking

- use one of the popular international money transfer companies

All these methods transfer your money to the addressee at different speeds and at different rates. Your choice will depend on various parameters such as the amount of the transfer, the destination, and the timeframe during which you want to send the money. You can choose the most convenient payment system.

Money transfers through banks in Vietnam

Express Transfers

Express transfers, also known as instant or same-day transfers, are a type of electronic funds transfer that allows money to be sent and received almost immediately. In Vietnam, most banks offer express transfer services to their customers. These services are typically available for both domestic and international transfers.

To use an express transfer service in Vietnam, customers must first have an account with a bank that offers the service. They must also provide the necessary information, such as the recipient’s name, account number, and bank information, as well as the amount they wish to transfer. Some banks may also require additional information, such as the purpose of the transaction.

The fees for express transfers in Vietnam vary depending on the bank and the amount being transferred. In general, the fees are higher than for standard transfer services. However, the convenience and speed of the service may be worth the additional cost.

On the other hand, there are also certain banks that offer money transfer to Vietnam without the need to open an account first.

SWIFT international transfers

The abbreviation SWIFT is probably very familiar to you, which means “Society for Worldwide Interbank Financial Telecommunications.” The main purpose of this is to transfer information and make payments in an international format.

This method can be utilized while sending any amount of money to any country in the world. The main thing is that the recipient bank is connected to the SWIFT system.

To transfer money from Vietnam via SWIFT, you will need to have a bank account in Vietnam that offers SWIFT services. You will also need to provide the necessary information for the transfer, including the recipient’s name and account information, as well as the SWIFT code for the recipient’s bank.

In Vietnam, the SWIFT code is also known as the Bank Identifier Code (BIC). It is a unique code assigned to each bank that participates in the SWIFT network. You can find the SWIFT code for a specific bank by searching online or contacting the bank directly.

Once you have provided the necessary information and initiated the transfer, the funds will be sent through the SWIFT network to the recipient’s bank. The transfer may take a few days to process, depending on the banks involved and the destination country.

Such transfers are convenient if you urgently need to send money to another country – for example, to pay for tuition.

However, transferring money via SWIFT can be expensive, as banks may charge high fees for international transfers. Additionally, the exchange rate used for the transfer may not be the most favorable, resulting in additional costs for the sender and recipient.

Transfers from card to card within one payment system (for example, VISA to VISA)

The advantage of this money transfer method is that it is available at any time of the day, even on weekends when banks are closed.

To make a card-to-card transfer within one payment system, both the sender and the recipient must have accounts with the same payment system.

For this transfer, you will need access to an ATM or Internet banking. The card can be either a Vietnamese or a foreign bank; what’s important is that this card belongs to a certain payment system (for example, VISA), and you know the card number, as well as first and last name of the recipient.

In this case, the funds will be received within 3 hours if these are VISA cards of one bank and within a day if these are cards of different banks. But more often than not, the money arrives within minutes. Prices for this type of money transfer may vary, depending on the conditions of the bank.

Transfers by code

Transfers by code are a type of money transfer service that allows you to send and receive money using a unique transaction code. This code can be generated and sent to the recipient via email, SMS, or other messaging services. The recipient can then use this code to withdraw the funds at an authorized payment center or bank branch.

In Vietnam, there are several payment systems that offer transfers by code services. To use such, both the sender and the recipient must have accounts with the same payment system.

To initiate a transfer by code, the sender must log into their payment system account, select the option to transfer funds, and enter the recipient’s information, including the amount to be transferred and a message (if applicable). The payment system will then generate a unique code and send it to the recipient via email, SMS, or other messaging services.

Note that this money transfer method may not be as secure as others, as the code could potentially be intercepted or stolen.

After all these bank-related ways, below you can find some of the best working international money transfer companies that are convenient for sending money from Vietnam. They can help you transfer money in a few minutes without additional information such as a SWIFT code, details, etc.

Money transfers via money transfer firms

What is a money transferring company and how does it work?

A money transfer company is almost always the cheapest way to send money abroad. These companies can often offer a lower transfer fee than banks, but with the same level of security and reliability.

Specialized companies will have different fees for money transfers, often depending on the current market rate, as well as mitigating factors such as where you are sending the money from, where and the amount being sent.

Leading online money transfer providers are focusing on optimizing digital navigation to simplify the user experience so that every customer can enjoy the benefits of a simple service.

The steps to initiate a money transfer are as follows:

- Step 1: Choose a money transfer provider

- Step 2: Create a free account

- Step 3. Set up translation

- Step 4. Recheck the commission and confirm

- Step 5. Track your transfer

While getting the best price for your money transfer is important, it’s also a good idea to consider a few other factors when looking for a reliable and secure money transfer service for your needs.

Ultimately, the cost of your international transfer will depend on how much you are sending, the exchange rate at the time, and the fee structure used by the provider you are using.

How should you choose the money transfer service provider?

Below are some important considerations to consider when choosing the best money transfer service for you:

Security

Make sure the money transfer service you are considering is registered with the relevant financial authorities in the country it operates in and use secure encryption methods to keep your money safe

In addition, it is worth learning about the reputation of the company by reading the reviews of its users. This is a good way to double-check if their services are up to the high standard they claim.

Expenses

Some money transfer providers, such as Wise, will offer money transfers at the average market rate, adding a set fee for their services. Conversely, other companies will add a small premium to the true exchange rate.

To give you an idea of what to expect, most banks add a mark-up of 4% to 5%, while most money transfer providers typically apply an average exchange rate spread of 1%. It is good to note that all providers will charge a fee or surcharge in exchange for their services, but it is important to be transparent about these fees before you make a transfer.

Speed

Since a huge percentage of money is stored digitally, you might think that all international money transfers would be as instant as sending an email, but unfortunately this is rarely the case.

We recommend that you check the estimated transfer time with each service provider, given that the day you transfer money will affect the transfer time. Delivery speed depends on weekends and business days.

Availability

Make sure the money transfer provider you are looking for supports the transfer route you need. Currently, not every company offers its services to all territories or countries, so this is a very important factor to iron out before deciding on a service provider.

Which international money transfer companies support transactions from/to Vietnam?

Let’s now see which international companies are good for sending and receiving money from Vietnam.

MoneyGram

MoneyGram is among the largest money transfer providers in the world. It has a network of about 350,000 in over 200 countries and territories.

It also has a full range of funding and pickup options, including cash delivery and phone reloads in multiple markets. And transfers are fast: cash is usually available within minutes, while bank transfers take hours to many popular destinations.

But all of these features come at a price. MoneyGram used to be one of the most expensive transfer providers.

What are transfer minimums, limits, and fees?

Clients in Vietnam can receive or send a minimum of 1 USD (or its currency equivalent). Meanwhile, the maximum transfer amount are:

- 10,000 USD per transaction

- 25,000.00 USD per continuous 3 months

- 75,000.00 USD per continuous 12 months

- 100,000.00 USD per continuous 12 months after the successful verification

How much you would pay for the money transfer will depend on how much you are sending. For instance, you’d pay 18 USD for sending 1,000 USD, according to a MoneyGram agent. Remember that all fees and any applicable exchange rates are subject to change and are not set until the transaction is sent.

How can you send money out of Vietnam via MoneyGram?

Online transfer is currently not supported in Vietnam. Customers can send money out of Vietnam in person, which the recipient can get from an agent location, or from his or her bank account or mobile wallet.

If you want to send money to a MoneyGram service point in another country, you must first of all find a point near you, prepare for your visit, and here you need to have the following information and documents with you:

- Your ID, if applicable

- The recipient’s full name that matches their ID and their location

- The amount you want to send plus the fee

The next two steps involve completing the transaction and notifying the recipient that you have sent the money.

If applicable, complete the submission form. Provide the agent with the completed form with the appropriate funds (including the transaction fee). Save the receipt and provide the recipient with an 8-digit reference number to receive.

If you prefer to transfer money to a bank account, you need to provide the following information:

- Your ID

- Full name of the recipient, corresponding to its identifier, bank name and account number

- Location of your recipient

- The amount you want to send plus the fee

Share the 8-digit reference number with your recipient and the funds will be credited directly to their account.

If you chose the third option, i.e. transferring money to an online wallet, you must provide your ID, the recipient’s full name corresponding to their ID, and their mobile phone number with an international dialing code, as well as the amount you want to send, plus fees . Otherwise the same, the funds will be credited directly to the recipient’s mobile wallet.

How can you receive money?

- Find the nearest MoneyGram branch

- Fill out the form in the form of receiving money, where you will need to indicate the number from the sender’s receipt

- Present the form and an identity document to the employee of the department.

You won’t have to do anything if your money is sent to your bank account or mobile wallet.

Western Union

Western Union is the world’s largest money transfer provider with over 500,000 locations in over 200 countries and territories. Unlike many providers, Western Union offers both domestic and international transfers; the ability to quickly send and receive cash abroad is its specialty.

Transfers via the international Western Union system are provided with a money transfer control number, which allows you to quickly find the transfer and check its status. Money can be received in a few minutes after sending in more than 200 countries around the world.

What are Western Union’s options for sending and receiving funds?

Transferring money from Vietnam through this service provider can be done in person at a branch or partner bank. It can be picked up from an agent location in the recipient’s country or sent directly to the receiver’s bank account or mobile phone.

Access to receiving via mobile phone is limited to certain countries, which are listed on Western Union’s website.

You do not need to have a bank account to transfer money using Western Union.

After you have transferred the funds, the bank issues a receipt with a 10-digit control number. It, as well as the amount, country and city of the transfer, must be named by the recipient.

What about the fees?

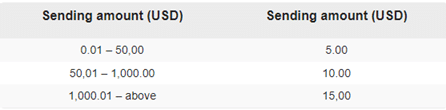

A of the time of update, Western Union has the following bracket for sending money out of Vietnam. These could change so it’s always better to double-check with the agent location itself. However, it should give you an idea of what to expect.

The only drawback of the system may be that the dollar will be greatly overvalued, which will affect the transfer of money abroad.

The transfer fee is paid only by the sender. In exceptional cases, a commission may be charged from the recipient, for example, when transferring to a legal entity.

TransferWise

This is an Estonian company that allows you to make transfers to other countries, paying only the difference in rates and a low commission. This is a great alternative to bank transfers, as the money goes to the recipient’s bank card, but you don’t lose money on interest.

You can fund the transfer in various ways, such as using a bank account or card, but the recipient must have a bank account. The highly rated mobile apps and website provide useful cost calculators and other information to make transfers convenient.

How do Wise fees look like?

TransferWise offers cheap ways to send money from the US to over 80 countries. The exchange rates are among the best you will find.

The company offers low commissions. The fixed cost for many countries is a combination of a fixed amount of around $1 and a percentage of just under 1% of the transfer amount.

Credit card fees are higher. Using an ACH transfer from your bank account or debit card is usually cheaper. If you pay by bank transfer with TransferWise, your bank will likely charge you a fee.

But this international money transfer is not always the best option for large transfers. Some providers charge no fees and offer competitive markups, which can make some transfers cheaper than TransferWise.

How can you transfer money via Wise?

To transfer you need the following:

- Register on the company’s website (only for the sender). You get a real IBAN account, which you can also use to receive money from other countries

- Select the amount you want to send

- Add recipient bank details

- Verify identity (ID photo)

- Pay for the transfer

- You can track your transfer

WorldRemit

WorldRemit is an online money transfer service founded in 2010 that allows people from all over the world to send money to their friends and family abroad.

Payment methods also vary greatly, but include (depending on the country) bank transfers, debit and credit cards, SOFORT, Apple and Android Pay, Poli, Interac, ACH and Trustly. In the United States, WorldRemit offers money transfer services from all 50 states.

WorldRemit is a low-cost alternative to traditional money transfer services, and the fact that you can transfer money anytime, anywhere using the WorldRemit website or mobile app makes it a very convenient service. There is no need to go to an agent, stand in line and wait. Everything happens online, which means that WorldRemit’s fees are more affordable than many of its competitors, and its customers save on costs.

How does WorldRemit work?

- Open an account. Go to the WorldRemit website and open an account for free

- Enter the recipient’s details. Tell WorldRemit where and to whom you need to send money

- Customize your transfer through WorldRemit. Enter the transfer amount and transfer payment method

- Pay for the transfer. Transfer funds from your local bank account or pay with a debit or credit card.

- Let WorldRemit do the rest. WorldRemit will convert your money into the recipient’s currency and send it to them via the selected payout option.

What about taxes?

While there is no specific tax that applies when sending money out of Vietnam to abroad, there may be additional fees charged.

For instance, if you are sending money abroad from Vietnam, you might have to pay a foreign exchange fee for your Vietnamese dong to the receiver’s local currency. This fee could fluctuate based on the exchange rate and the financial institution you are transferring money from. Exchange rates may be marked up by some service providers.

However, the situation is different for your recipients. Depending on the individual rules and legislation that apply, they might have to pay taxes or other charges in their native country.

In many nations, inbound money transfers are exempt from taxes and other charges, particularly if they are made as a personal gift or payment. However, on occasion, especially when the transfer includes a significant amount of money or is part of a business deal, the recipient may be required to pay taxes on the money they receive.

In most cases, it makes sense for expats to invest money while living abroad rather than send money home to buy houses and invest in their home country.

This is due to taxes and other reasons. In some cases, governments such as the UK government may even classify you as a local tax resident if you strengthen your “ties” to the country.

General Tips for International Money Transfers

1.Compare the cost of translation from several providers

There are two types of costs: upfront payment and exchange rate markup. Find a provider that offers the cheapest combination of low fees and the best exchange rate you can get. Usually, non-banking online providers offer cheaper transfers than banks.

2. Know how exchange rates work (and how to find the best one)

An exchange rate is the price of one currency in relation to another currency. For example, if you want to convert US dollars to Euros, you should check how much one US dollar is worth in Euros.

Most transfer providers won’t give you the exchange rate you’ll find on a currency exchange platform like Bloomberg.com (or when you exchange rates on Google), but a currency platform can be a useful starting point to see what the best rate looks like.

When checking the exchange rate for an international transfer using services such as Western Union, be guided by the amount in foreign currency. The higher it is, the more money your recipient will receive.

3. Avoid paying by credit card

This is an option for some providers, but there may be a higher down payment and your credit card issuer may be responsible for charges such as interest and cash advances. If you need fast money delivery, use a debit card. A transfer paid directly from a bank account is usually much slower.

How to Send Money out of Vietnam: Final Thoughts

Getting money out of Vietnam is probably easier than out of China, but challenges remain, including getting a competitive rate.

Very often expats face such problems of sending money abroad in a secure and cheaper way, but usually bank transfers can cost a little expensive than sending the amount by money transferring companies.

The above mentioned international money transferring companies are the best ones, and you can be sure these will help you to securely send your money or receive it.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.