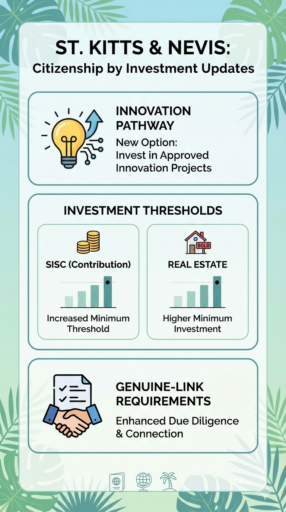

The St Kitts and Nevis Citizenship by Investment program is undergoing major updates, including the introduction of the Innovation Pathway, revised investment thresholds, updated application requirements, and stricter genuine-link criteria.

These St. Kitts and Nevis Citizenship by Investment updates aim to strengthen ties to the country while creating faster routes for entrepreneurs and tech investors.

This article covers:

- What are the updated requirements for St Kitts and Nevis CBI?

- How much to invest in St Kitts to get citizenship?

- How does St. Kitts compare to other CBI programs?

Key Takeaways:

- Innovation Pathway enables faster routes for entrepreneurs and tech investors.

- Genuine-link and due diligence requirements are updated; physical presence is not yet confirmed.

- Fast processing (3–6 months), multiple options, and strong passport access.

- Higher costs reflect quality, demand, and rigorous compliance support.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is the St Kitts and Nevis Citizenship by Investment Program?

The St Kitts and Nevis citizenship by investment program allows foreign nationals to obtain citizenship through a qualifying economic contribution.

Applicants can gain citizenship either by making a real estate investment or a contribution to the Sustainable Growth Fund (SGF).

The CBI program is globally recognized for its efficiency, offering visa-free or visa-on-arrival access to over 149 countries, including the EU and the UK.

Recent updates aim to introduce more innovation while maintaining rigorous due diligence.

Key Updates to the St Kitts and Nevis CBI Program

Since 2025, the St Kitts and Nevis Citizenship by Investment (CBI) program has undergone significant updates, combining revised financial thresholds, enhanced compliance, and new pathways for innovation.

- Revised investment thresholds: The minimum contribution is now USD 250,000 for the Sustainable Island State Contribution (SISC) and USD 325,000 for approved real estate, with higher thresholds for single-family homes (USD 600,000) and larger families. These adjustments reflect market trends and ensure that investment levels align with the Federation’s economic objectives while maintaining a competitive edge among global CBI programs.

- Enhanced due diligence: Background checks have been expanded to assess applicants’ financial integrity, source of funds, and criminal history. This ensures that the program continues to meet international compliance standards, protecting the reputation of the CBI program and the Federation while maintaining trust with global partners and visa-free countries.

- Genuine-link requirement: Applicants are now required to demonstrate physical presence or meaningful economic/civic engagement in St Kitts and Nevis. This change emphasizes that citizenship should reflect a substantive relationship with the country, including participation in local economic activities or community initiatives, rather than being solely a financial transaction.

- Priority One concierge and civic integration services: These new services provide personalized guidance to help applicants meet genuine-link obligations, navigate administrative requirements, and integrate effectively into the Federation. This ensures that new citizens are supported in contributing to local development and maintaining compliance with program expectations.

These updates reinforce St Kitts and Nevis’ CBI program as a forward-looking, compliance-focused pathway, prioritizing economic contribution, substantive engagement, and meaningful connection to the country.

It also maintains fast processing and strong global passport access.

St Kitts and Nevis CBI: When Will the Updates Be Implemented?

The 2025 updates, including revised investment thresholds and enhanced due diligence, are already in effect.

The 2026 reforms, most notably the Innovation Pathway and stricter genuine-link requirements, are currently being implemented, with full operational rollout expected throughout 2026.

Staying informed is essential, as eligibility requirements, processing times, and procedural details may continue to evolve under these reforms.

St Kitts and Nevis CBI Innovation Pathway

Starting in 2026, the St Kitts and Nevis CBI program will introduce its Innovation Pathway, aimed at attracting entrepreneurs, innovators, and investors involved in business, research, technology, and skills-transfer projects that contribute to economic diversification.

Under this pathway:

- Applicants may qualify by establishing innovation-driven ventures or long-term partnerships in priority sectors.

- The pathway is designed to support meaningful economic engagement rather than purely transactional investment.

- It complements the existing investment options by enabling applicants to contribute through productive innovation and sustained involvement in the federation’s economy.

This initiative reflects a broader shift toward genuine-link requirements and a more substantive relationship between new citizens and the country’s socio-economic development.

Is it Easy to Get Citizenship in St Kitts and Nevis by Investment?

Yes, it is still relatively easy to get citizenship in St Kitts and Nevis by investment vs other programs, but the 2026 reforms introduce stricter genuine-link expectations that add new substantive criteria beyond just paying the investment.

- Processing time: Standard applications generally take about 3–6 months.

- Innovation Pathway: For qualifying innovation or business contributions, this route may offer faster review once fully implemented in 2026.

- Substantive requirements: Applicants must meet financial thresholds and enhanced background checks plus genuine-link standards, which include physical presence or meaningful economic activity in the federation. Meaning the process isn’t purely transactional anymore.

- New support services: To assist with compliance and genuine-link obligations, the government will provide “Priority One” concierge and civic integration services for new citizens.

- No language/residency tests (traditional routes): There is still no formal language exam, and while there is no fixed residency requirement under the traditional real estate or SISC routes, the exact number of days that may be expected under the 2026 genuine-link reforms has not yet been confirmed.

How Does St. Kitts Compare to Other CBI Programs?

St. Kitts and Nevis is widely regarded as the world’s leading citizenship by investment program, having retained its #1 position in the 2025 CBI Index for the fifth consecutive year.

The Federation excels across all major pillars, including ease of processing, due diligence, investment options, citizenship timeline, and certainty of product, demonstrating both global recognition and investor confidence.

When compared to other Caribbean CBI programs:

| Feature | St Kitts & Nevis | Dominica | Antigua & Barbuda |

| Investment Options | SGF, Real Estate, Innovation Pathway | EDF, Donation, Real Estate | Donation, Real Estate |

| Processing Time | 3–6 months | 3–4 months | 3–6 months |

| Visa-Free Travel | 140+ countries | 130+ countries | 140+ countries |

| Minimum Investment | $250,000 | $200,000 | $230,000 |

St Kitts offers fast processing, multiple investment options, and strong passport strength, but it comes at a higher cost than some other Caribbean programs.

Conclusion

The 2026 reforms mark a turning point for St Kitts and Nevis’ Citizenship by Investment program, shifting it from a transactional offering to a pathway that values genuine engagement, innovation, and economic contribution.

With the Innovation Pathway and enhanced genuine-link expectations, citizenship now reflects both an investor’s commitment and their alignment with the Federation’s long-term growth and social development objectives.

For prospective citizens, this evolution underscores that success will hinge on strategic, value-creating participation rather than mere financial investment.

Supported by initiatives like the Priority One concierge and civic integration services, the program balances efficiency with meaningful integration.

It sets a global benchmark for sustainable, forward-looking CBI programs, where a passport is not just access, but a partnership with a nation investing in its own future.

FAQs

Is Saint Kitts’ passport strong?

Yes. The St Kitts passport provides visa-free access to over 140 countries, including the EU Schengen zone and the UK.

Why is St Kitts so expensive?

St Kitts is relatively expensive to live in due to high costs for housing, imported goods, and everyday services, driven by its small population and limited local production.

Tourism and high-quality infrastructure also contribute to elevated living expenses compared with other Caribbean islands.

For those looking at the Citizenship by Investment program specifically, the higher program fees further reflect global demand, investment quality, and rigorous due diligence.

Is it safe to travel to St Kitts right now?

St Kitts is generally safe for tourists and investors, with low crime rates in residential and tourist areas. Standard precautions are advised.

How long does it take to get St. Kitts and Nevis citizenship?

Citizenship through naturalization generally requires long‑term lawful residence of at least 14 years under the nationality law before applying for citizenship, followed by several months of processing.

Citizenship through marriage can be pursued after being married for at least 3 years, with government review and verification taking additional months.

By contrast, the Citizenship by Investment program remains the fastest route, with standard processing typically 3–6 months and accelerated options potentially quicker.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.