As I previously mentioned on this article, gold has not historically been a good long-term investment.

However, this article will answer some of the following questions:

- Is gold a good investment for 2020 and 2021 specifically?

- If you are interested in gold, which portfolios are best for you?

If you want to invest and are confused by all the options out there, you can contact me using this form, or use the chat function below.

The importance of Gold in history briefly explained

Before we begin, it would make sense to explain why gold is a popular investment in many cultures around the world, despite its long-term underperformance.

When we refer to the richest people on the planet, we tend to talk about Bill Gates, Warren Buffet, Jeff Bezos, and others who triumphed in our era.

However, historically, the richest people owned gold and some of them, such as Mansa Musa with a net capital of 400 billion, the Emperor of Mali, had more money than the rich today.

If we adjust it by today’s standards and contemporary gold price, it could be above a Trillion.

Gold, throughout all our history, has been an element of trade because of their rarity. The first coins in history were invented in Lydia, and they were made out of gold and silver.

In Medieval times, before the invention of banknotes, traders would get ambushed in the middle of the forests and all their gold sacks would be stolen.

Our ancestors found gold majorly in the water streams, today we have to dig to find it and, as most of it got dug in the surface, we now have to use technology to explore the soil in depth.

This partially explains why gold buying is culturally embedded in many countries – it has been familiar for many centuries.

What has the long-term performance been like?

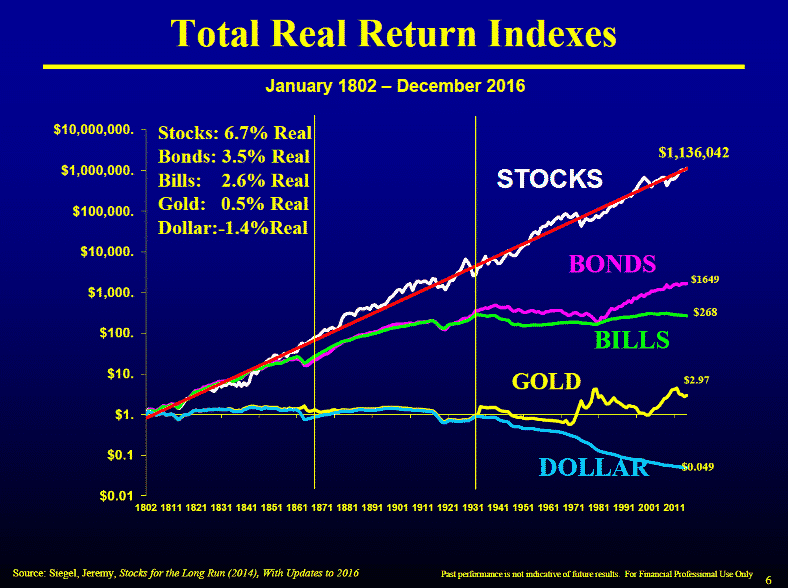

Terrible. Gold hasn’t even beaten cash in the bank if we look long-term.

It has merely held its value. Even cash has provided a small return after inflation until relatively recently.

Those small interest rates saved people from “currency debasement” as per the graph below showing the returns of T Bills:

Ultimately there is a simple reason why stocks have averaged 6.5% after inflation and gold has done 0%-0.5% after inflation.

Stocks are growth engines. Not all stocks, but the cream of the crop gets stronger.

This was innovation in 1900:

This is innovation in 2020:

The cream of the crop, listed on the S&P500, Dow Jones and Nasdaq gets stronger.

Netflix and Amazon are 1000x more profitable and efficient than firms 200 years ago due to technology.

Likewise, as we enter a digital world, the firms listed in 2035 or 2040 will be more efficient than Netflix and Amazon of 2020.

Technology doesn’t stand still. Whereas gold does. There is only so much gold in circulation.

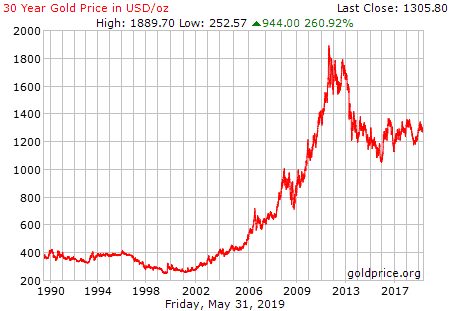

The supply is relatively stable but the demand goes up and down. So gold has its periods in the sun, like during 2000-2010, and its bad periods like the 1990s and 2011-present.

However, long-term, it stays stagnant. It is roughly where it was during the times of Christ and the price was much higher in the 1980s.

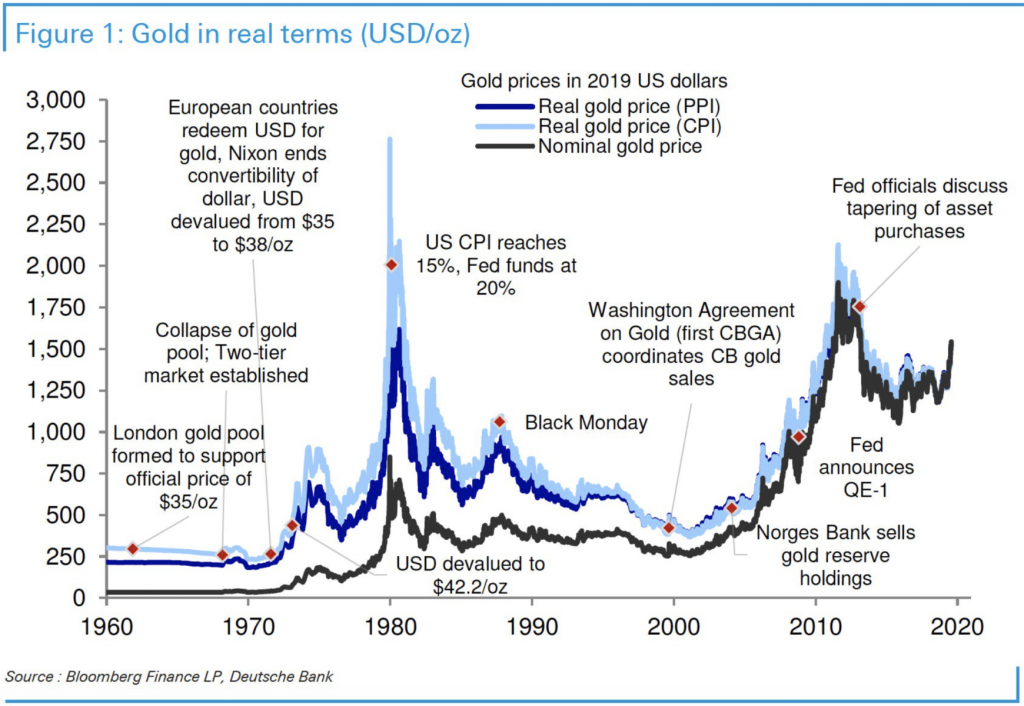

As per the graph below, gold hit about $3,000 adjusted to inflation in the 1980s:

And unlike stocks or bonds it doesn’t pay a dividend or coupon. So really it isn’t even an investment because you are hoping the person that comes after you, will pay more than you did, for the same asset which isn’t producing anything.

Even many gold bugs admit that gold merely holds its value long-term.

The hedge during a market crisis

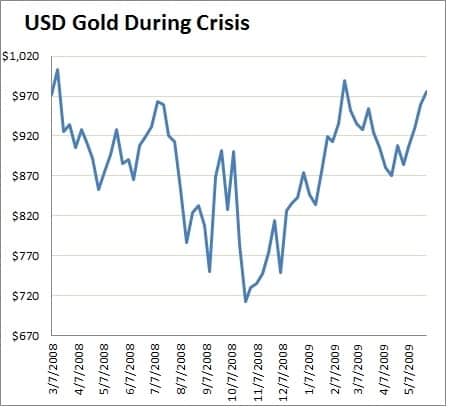

Gold might be a poor long-term bet, but how about during a crisis? Many people that know that gold is a poor long-term bet assume that it is a safe heaven during the bad times.

However, during very bad crisis like 2008-2009, gold haven’t performed well as the chart shows:

So it is a misconception that gold is always a safe heaven investment.

What is more interesting is that the 2008-2009 gold bear market came during a period of rising gold prices (2000-2011).

The only exception to that bull run was during the worst of the 2008 Financial Crisis.

Likewise, in March 2020, Gold’s bull run since 2018 was interrupted. It only increased again after things started to settle down a bit.

During periods of market turbulence, government bonds outperform.

Macro Fundamentals for Gold

Should people buy gold during the coronavirus situation? Firstly, we have to consider that the price of gold has been recovering since its 2011-2014 lows.

Some people cite the Federal Reserve’s QE program as a case for investing in gold.

They forget something obvious…….what has happened in the last 10 years!

Gold had a huge bull run from 2000 until 2011 but the best periods for gold were before 2008 and QE!

After QE, gold fell during the worst of the crisis and increased in 2010 and 2011.

After 2011, gold fell consistently until about 2015-2016:

Gold’s best run since its 2011 falls came in 2018 and 2019…..when QE was being decreased and the US Central Banks started to increase rates!

So for people to claim that QE and low interest rates is automatically good for gold, is to forget the lessons from the last 10 years.

Moreover, the USD got stronger compared to the Euro, Pound and yes gold during QE from 2008-present.

So the idea that QE is a form of currency debasement through debt and everybody will run to gold to avoid this, is to forget the lessons of the last 12 years.

I am not implying that the recent past is always a guide to the future.

Just because the USD got stronger and American markets hit record highs after 2008-2009 and gold once again fell during the worst of the March 2020, doesn’t automatically mean that gold will do badly relative to stock markets in the next 10 years.

I mean merely pointing out the obvious:

- Gold has lost to markets big time long-term.

- Gold doesn’t always gain in a crisis.

- Gold doesn’t always gain because of QE and 0% interest rates.

- The USD doesn’t automatically weaken under QE and 0% interest rates.

- Consumer price inflation has been weak for over 10 years. QE didn’t lead to consumer price inflation so won’t automatically again

- QE might have contributed towards asset price inflation in stocks and real estate from 2008-2020, but not all assets increase…….such as gold! So we can’t say all assets will rise because of QE.

Portfolios

What if you really can’t resist in investing in gold, in spite of the terrible long-term performance and questionable performance during times of crisis like 2008 and March 2020?

The best thing to do is keep your allocations low. Portfolios like these would make sense.

Age: 25-35-year-old portfolio

The lifestyle of these people is generally ‘’aggressive’’ because they are building a career but at the same time they do not have too many people that depend on them, like kids, and therefore they can accept a higher risk on both the short and long term.

People in this range of age are more flexible, it is rare to see 25-year-olds that buy a house or have a spouse and therefore they can learn from their mistakes quickly and fix them.

This portfolio is made up of: 15% in governmental bonds, 10% of REITs, 65% of shares, and 10% in gold.

Age: 35-45-year-old portfolio

In this range of age, you can risk less for numerous reasons. The time horizon for investments is shorter, you are starting to raise a family and therefore you could have some more expenses to take into consideration.

Does this family receive just one single salary? You cannot risk too much in this situation.

In this portfolio, we have 5% of cash, 20% of governmental bonds, 10% in REITs, 55% in shares and 10% in gold.

It is less risky than the previous but still highly risky. When you choose the shares, choose not only US shares but also European and shares coming from emerging countries.

When you choose shares in this portfolio, if you are in this range of age, you should opt for less risky shares in general.

Age: 45-65-year-old portfolio

In this range of age, you have to look towards the future. The income you were previously making through work now, as you retire, disappears and the investments you made in life should accompany this pension.

If you were to be good in the previous years choosing the good investments, we would already be having a good amount of capital.

Therefore we always have our 5% in cash, 27,5% in governmental bonds, 12.5% in REITs, 45% in shares and 10% in gold.

When choosing the shares for your portfolio, you should also consider some shares that give you dividends because we already have a huge capital to put to work.

Age: 55-65+-year-old portfolio

In this moment of our life, we are already close to our retirement or we are already benefiting from it. Our main goal is to protect our capital from market volatility and still make some money from it.

There’s no point to make it grow further, the only goal is to make an annual passive income. We cannot take any risk, imagine if the market crashed in your 85s and had to wait 10 years to recover, you can’t accept that. And all the shares you will pick have to give dividends.

In this case, our portfolio will contain 10% cash, 35% governmental bonds, 10% REITs, 30% shares and 10% in gold.

Conclusions

Gold is not a good long-term investment. Sure it has its good and bad times.

“Every dog has its day” and gold outperformed during 2000-2010, and not doubt will during some periods in the future.

That is hard to predict though. Timing the right time to buy gold isn’t much easier than timing the stock market.

That doesn’t make it a productive long-term investment though. If you really can’t resist investing in gold, keep it down to 5%-10% of your portfolio.

Especially be sceptical of anybody who claims that QE and 0% interest rates will debase the USD and lead to higher gold prices.

Those are the same people, in the main, that were predicting hyperinflation, $5,000 gold and a weaker dollar in 2008.

Instead, gold fell after 2011, the USD got stronger and the US Stock Stock markets once again beat gold.

So gold might underperform or outperform in 2020 or 2021. The point is, nobody knows in advance and it doesn’t perform well long-term in any case.

Further Reading

Are the rich really getting richer, at least over many decades? Or would have an average investor in the market beaten them?