Most people assume the rich are getting richer, and that businesses are always the best investment. Why invest in the markets and get about 10%, moreover, when you can run your own business and grow 20%-30% per year?

So, how much richer have the rich gotten in recent years? 20% per year? 30% per year? The answer might surprise you; their wealth has risen slower than the US S&P, Dow Jones and Nasdaq.

In 2007, just before the financial crisis, the richest 12 people on the UK Sunday Times Rich List had a combined wealth of approximately 78.84 billion GBP. Today, the combined wealth of the top 12 is about 158.36billion GBP.

That represents a rise of about 101% in 12 years, or about 6% per year compounded growth.

The US S&P was trading at about 1,300-1,400 in 2007. It is at 2,900 now. It has risen about 119% in USD terms, despite the 2008-2009 collapse, and about 150% in GBP terms.

This means that to keep pace with the S&P, the 12 richest people in the UK, would need to have seen their wealth increase to close to 200billon GBP.

Or put in another way, most average buy and hold investors, have gotten better results than the wealthiest people in the country.

However, the last 12 years has been an extreme time, especially in the UK. So let’s look at a longer data set for the US.

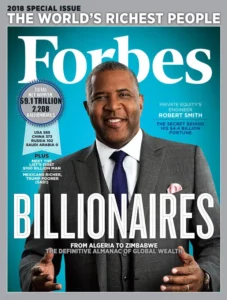

From the early 1980s until today, the original members of the US Forbes Rich List saw their wealth grow by 9% per year. The S&P, during the same period, has increased by an average of 11.20% per year.

Perhaps this shouldn’t surprise us after all. It is harder to compound larger sums of money than smaller sums of money.

Let’s take a simple example of an entrepreneur who uses Facebook ads to get sales. He or she spends $100 to get 10 leads. On average, 1 from 10 leads closes, and the average revenue is $10,000 from that 1 sale.

That entrepreneur could be making $9,700-$9,800 from a $100 investment, before tax, assuming they have no fixed costs due to being an online business. A huge return.

Now let’s say they increase the investment to $10,000 a month. They get 1,000 leads. They can’t handle all of these 1,000 leads themselves, so need to farm out some of these leads to a salesforce.

That means more costs, which in turn means fewer profits as a percentage of the original investment, even if total revenue increases.

For multi-billion dollar businesses, getting a good return on investment gets harder and harder. You need to get high sales even to maintain your position, let alone grow it.

Everybody is trying to learn from your success, and are copying your techniques. You only need one unexpected event, like a scandal or a top senior executive to leave, to see your business struggle to see any growth.

I personally saw many established business people in Thailand, with successful businesses that took 10-20 years to build up, get put out of business due to the 2014 political instability affecting their business.

It sure shows us why a business can’t be a pension.

Further reading

Nice article

Am an aspiring Investor and business owner based i East Africa

To your notice i did not know what S&P standards for.

.

thanks for the words thought respect

Standard and poor’s 500 companies.

S&P is a company that takes the 500 largest companies in the US and makes a fund out of them. That fund is regularly referred to as one of the indicators of economic growth. Also it’s easy to invest in. One can’t invest in the stock market. One has to have a fund or a stock to actually buy.