This article is mainly about Investors Trust S&P 500 investing and MSCI products.

During this article, we will discuss:

- Who is the investors Trust company?

- Should l buy s&p500 investing?

Explore S&P 500 investing and whether you should invest in it according to Investors Trust SP 500 Review Should You Buy.

Advisors and introducers who want to distribute Investors Trust globally can also reach out to me.

Firstly, who is Investors Trust S&P 500 investing?

Investors Trust is a fast-growing investment provider based in Puerto Rico, Cayman Islands, Malaysia, and beyond. They also have administration offices in the UAE and Uruguay.

Investors trust with in $3.2billion in assets under management and clients in over a hundred countries, they are increasingly becoming a bigger player in the offshore investing landscape, having grown more than 45% per year during the pandemic.

Most of the Investors trust clients are expats or locals in Latin American, Africa and Asia.

The S&P500 investment product is more widely sold than the MSCI one, but the plans are very similar, as I will explain in this article.

If you want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

What are the basics associated with S&P500 investing?

The basic elements of the plans are below:

- The plans are available in USD only. With a minimum starting point of $200 a month, this option can be taken out over 10, 15, or 20 years.

- The 10-year option only has a 100% guarantee, meaning that you don’t have much downside protection.

- The 15 and 20-year accounts have 140% and 160% protection respectively, meaning that you can make some money, even if the market has fallen.

- There is a $10 a month fixed-charge alongside a 0.125% monthly fee applied on all terms. The admin fee is 2% for the 10-year account, 1.7% for the 15-year, and 1.1% for the 20-year.

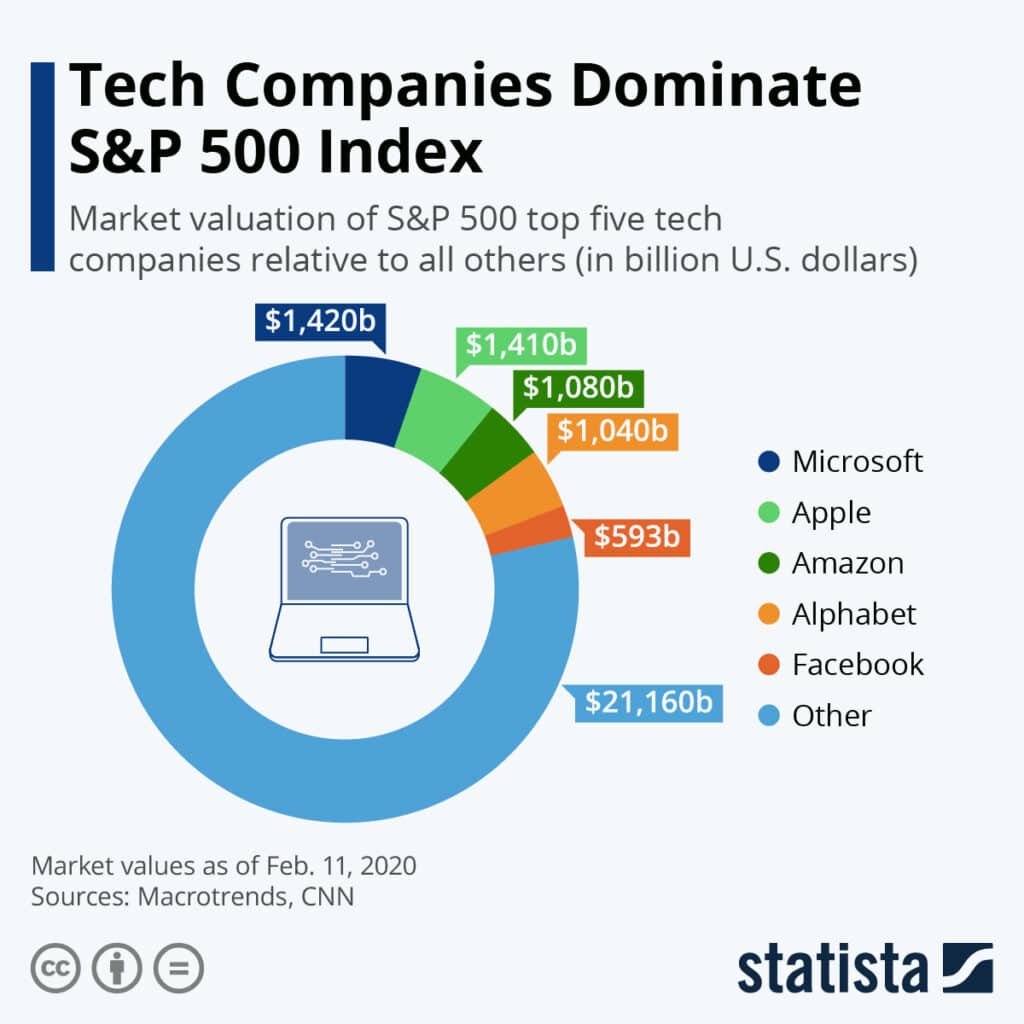

- There are two index series options. The S&P500 and MSCI EAFE. The S&P500 is one of the major indexes in the United States, focusing on 500 of the leading firms, including Apple, Microsoft, etc.

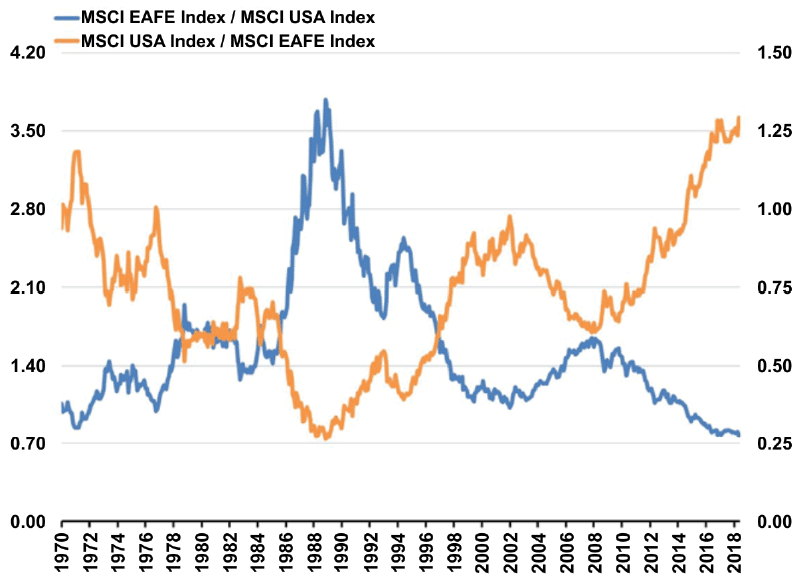

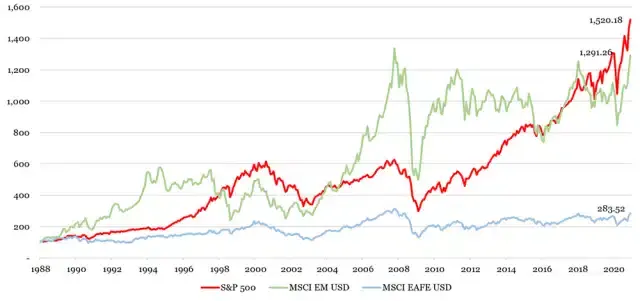

- Over most 30-year periods, the S&P500 index has averaged about 10% per year, even if some periods are better. In comparison, MSCI EAFE is an index focusing on 21 developed market indexes, excluding the United States and Canada. This includes stock markets in Japan, the UK, Germany, and France. In the last decade, the MSCI EAFE index has underperformed the S&P500, but this won’t last forever.

Below are the major firms in the S&P500 index:

This contrasts sharply with the regions found in the MSCI EAFE index, focusing on Europe, the Middle East and the Pacific.

Therefore, the fundamentals for the two investment accounts, including the fees and downside protection, are identical.

The only difference is which market, or index, they are focusing on, which will influence the long-term performance.

What are the positives and negatives associated with S&P 500 investing?

The main positives

- The accounts are unique in the space, in that they offer downside protection, which you usually can only get access to with a lump sum account.

- The evidence out there suggests that investors give up on markets when things become volatile. A Schwab study found that 35% of their do-it-yourself (DIY) clients panic sold during the 2020 Covid-related falls. The sample size was huge, given the size of the company.

- Furthermore, a Vanguard study showed that net inflows into the funds were highest during 1999-2000, after eighteen years of increases for the market, but net sales (outflows) were during the Global Financial Crisis of 2008-2009. Investors are emotional so are less likely to give up paying into an account with downside protection, when the markets are falling.

- There are no additional card fees, charged by Investors Trust, for Visa and MasterCards. Chinese-based investors, including expats living in China, can use UnionPay cards. The cost is only 1% because Investors Trust are absorbing some of the associated fees. This is currently unique in the international space.

- The MSCI EAFE index looks undervalued at this conjure, and the S&P500 has been one of the best performing indexes in the world. As the graph below shows, the MSCI USA Index (which is correlated to the S&P500) looks more overvalued on a price:earnings basis. Or to put it in simple terms, you are currently paying more for US stocks than international ones, for each USD, Pound or Euro in revenues. That doesn’t mean that you will make more money in the EAFE account compared to the S&P500, but it does increase the likelihood in the next decade.

One of the major reasons for these cheap valuations has been the recent under-performance of the MSCI EAFE index:

The main negatives

- Investors Trust’s sister product, the Evolution, is cheaper and has more fund choices. This includes funds, and ETFs, in commodities, mining, government and corporate bonds etc. It merely doesn’t have downside protection, which appeals to more conservative investors.

- You do need to pay in every time until the end to have the insurance of the downside-protection kick in. If you stop paying in for more than 90 days after the due date of the next payment, you lose that benefit.

- Unlike Evolution, these plans are only available in USD – not Euros or Pounds. This isn’t a big deal though, considering many people can use services such as Wise and Revolut, which are almost free for currency exchange.

- The 10-year option isn’t worth it, considering the protection is very small. The 15-year account is a good mid-point option for many investors, being shorter-term than 20-years but offering more protection than the 10-year

- If all investors behaved rationally during market falls, fewer people would need downside-protected solutions. One of the main benefits of the plan is it indirectly stops investors doing something silly. In other words, people keep paying in to avoid losing access to the downside protection.

- The downside-protection is linked to structured notes which might fail, but it is unlikely given the names backing up the plan, which are A-rated banks.

FAQs for S&P 500 investing

This section will answer some additional frequently asked questions people are asking at the moment.

Is now a good time to invest in the S&P500 investing and other stock markets?

This is a question which has been asked every year since stock markets were invented. The evidence suggests that nobody can find the right moment to put money in the markets – also known as market timing.

Markets tend to rise, and fall, during unexpected moments as well. Few expected the global stock markets to do so well after Brexit and Trump’s election in 2016, or after the disputed election in 2020.

Therefore, it is better to invest every month, or as a lump sum, as soon as you have the money.

Is S&P 500 investing in this structure safe?

Yes, Investors Trust have a segregated accounts system, which means that your money is not at risk if the company goes bust.

Considering how much AUM they have, in addition to the recent fast growth, it is exceptionally unlikely that such a system will be needed in the first place.

Is the Cayman Islands a good jurisdiction to hold offshore S&P 500 investing plans?

There is a lot of misleading things online about this issue.

Firstly, the plans are in Malaysia (Labuan), Puerto Rico and Cayman. The laws in Puerto Rico go all the way up to federal level.

So, you don’t need to buy a Cayman plan, and can elect for Labuan or Puerto Rico instead. However, Cayman is the fifth biggest global financial centre on some measures, so you shouldn’t be worried about it.

What is more, Investors Trust utilize onshore banking in the UK and US.

The bigger question is whether you need the downside-protection in the first place, rather than equivalent cheaper plans.

What happens if I lose contact with my S&P 500 investing advisor?

If you lose contact with your advisor, or aren’t happy with the service, you can approach countless other financial companies who can take over the running of the account.

We have helped numerous clients, who are using countless expat-focused providers, get better returns or service.

If you have had a bad experience with an advisory company, this isn’t the fault of the investment provider.

Are there tax benefits of S&P 500 investing in these kinds of policies?

Yes, but it depends on where you are from, and where you live.

In general, it does make sense for non-American expats to invest offshore, rather than in a home country or new country of residence.

Investing offshore tends to be more portable as well.

Have people tended to make good money in the S&P 500 investing plan?

Yes, assuming they have carried on investing on a regular basis, and haven’t stopped in the middle.

The MSCI plan has had average returns, at best, but that is because the index itself has done badly.

Investors Trust S&P 500 investing Review: Bottom Line

This can be an excellent solution for people in very specific situations – especially those investors who are overly worried about the volatility in the markets and are likely to panic sell.

It can also be good for diversification. In other words, some investors might want to put a percentage of their funds in such a solution.

For some other investors, however, alternative solutions offer better value, including other options on Investors Trust itself.

If you are looking to invest and want a second opinion, or already have the plan, you can email me – advice@adamfayed.com – or use the contact options here.

In some cases, I can offer the same plans at discounted prices. Also see another Investors Trust review here which discusses their Access Portfolio product.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.