I often write answers on Quora, where I am the most viewed writer for investing, wealth and personal finance, with over 237.8 million views in the last few years.

On the answers below, taken from my online Quora answers, I focus on a range of topics including:

- Is it better to own gold or gold stocks? I explain why gold stocks is the worst of a bad bunch.

- Would Donald Trump now be wealthier if he had invested his inheritance in the stock market rather than become a businessman?

- Which stocks are likely to skyrocket after the end of the pandemic?

- How can you get wealthy at a young age?

If you want me to answer any questions on Quora or YouTube, or you are looking to invest, don’t hesitate to contact me, email (advice@adamfayed.com) or use the WhatsApp function below.

Is it better to own gold or gold stocks?

Source: Quora

If you put a gun to my head and forced me to buy one of the other, I would pick gold-related stocks like the gold mining companies.

The reason is obvious. Some pay a dividends. So, regardless of whether the price of the company is going up or down, you will make some money.

You will also make some money based on what the asset is actually producing.

Some of the companies-related to gold are also diversified into other areas as well.

Therefore, if you can buy a basket of companies-related to gold, you get a dividend and some diversification.

In comparison, if you buy physical gold or an ETF, you aren’t getting:

- A yield

- A dividend

- A coupon

- Business growth like in stocks

If you buy gold at 1,800 and it is still at 1,800 in ten years, you haven’t made any money.

In fact you have lost money – 0.1% per year if you have bought through an ETF and a fortune if you have insured physical gold!

With a gold stock, you would make money in that situation, due to the dividend.

2%-3% dividend yield per year will at least compound over time, even with a stock which is disappointing compared to the general stock market.

So, if you are buying the physical metal, the only hope is that the person coming after you will pay more for the asset than you paid.

That is a speculation and not an investment. That speculation may or may not pay off, but it is a speculation nevertheless.

I wouldn’t personally buy either. Gold, ultra long-term, just holds its value.

It has its great periods, like from 2000 until 2011, when it did 7x-8x.

It will have more good periods in the future as well, but the general trend is you make inflation buying gold as the chart below shows:

The supply is relatively stagnant but increasing slowly. The demand fluctuates.

Therefore, there are no huge growth drivers compared to stocks and some other areas.

Added to that, it hasn’t shown itself to be a safe heaven in recent times.

It fell in 2008–2009 despite having a great period from 2000–2008.

It also fell during the worst of the stock market route last year.

Look at the period where have been through recently . There has been loads of uncertainty between 2011–2021, yet gold is trading at 1,710 today.

That is about 20% below its 2011 price, and almost 45% adjusted for inflation.

The peak in real terms for gold happened in 1980.

So, it isn’t an asset which regularly hits new inflation-adjusted highs.

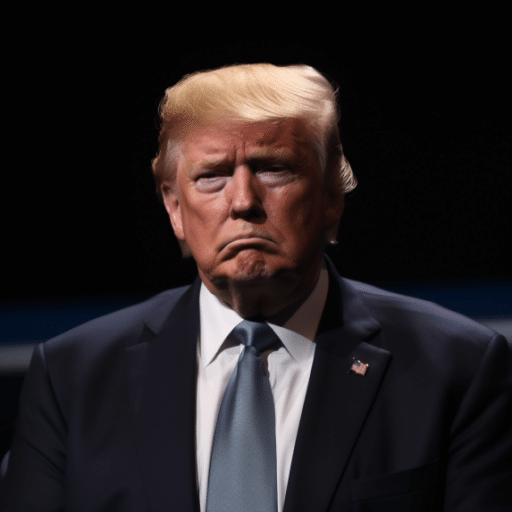

Is it true that if Donald Trump left all his inherited money (480M) at the bank instead of investing it, he would have had 10B now?

Source: Quora

I don’t think anybody has claimed he would have more if he had left his money in the bank.

There has been some debate about whether he would have made more investing it in the S&P500.

Some of these attacks are obviously political. His supporters don’t want to believe it and people who hate him definitely want to believe it.

It is hard to know the truth as there are countless variables here including taxes, his own spending habits, the exact period he invested for and many other things.

There is also the issue about the transparency of his wealth, as unlike somebody like Bezos, it is more difficult to estimate private wealth which is held in illiquid assets like real estate.

What I do know is

- If he would have invested his money passively the amount he would have now would be comparable to what he has

- This situation is pretty normal. Many very wealthy people go through two stages even if they are self-made. The first stage is the high-growth stage. In other words, they make many times what the stock market is making. Then, it eventually gets hard to make 10% per year, never mind 100%. There is a lot of debate about Buffett and why his firm had its best performance in the 1950s, 1960s and 1970s. One reason is that now Berhsire Hathaway is big, it is much more difficult to beat the market. This is probably one reason why the likes of Bill Gates now have most of their wealth in a diversified stock portfolio. It gets harder to beat the market the more you have. If you invest 20 billion in the S&P500 you will get the same percentage returns as if you invest $100, but the same isn’t true in business

- As per Piketty’s work, one of the biggest drivers of wealth inequality is that the general stock market outperforms wages and most assets.

- Since he came to office, his private wealth has fallen, whereas the stock market has soared. Therefore, since the original article was written in 2015, the figures now would be different.

- The Forbes rich list, and Sunday Times one in the UK, has grown less quickly than the general stock market. This once again shows that it is the norm for wealthier people to grow their wealth at a more slow pace than the general market once they are already super rich.

- Most inherited wealthy people (especially the third generation) do eventually lose the money. There aren’t that many fourth and fifth generation rich. Some do exist but not many. So, Trump’s record isn’t particular worse than the average inherited wealthy person.

So, the answer to your question is probably, especially as the Dow Jones and S&P500 have been hitting regular highs in the last few months, but there are many variables at play.

Perhaps most importantly a President’s wealth, and the general stock market performance, shouldn’t be a political issue, yet it has increasingly become so.

Which stocks do you think will skyrocket when life completely returns to normal post-pandemic?

Source: Quora

Let’s look at the following facts and analysis

Let’s look at the following facts and analysis

- The general stock market tends to rise over time

- Yet the majority of stocks don’t beat the market. In other words, if the S&P500 averages 10% per year over a period of time, most of the stocks on the index won’t do 10% per year. A few well performing stocks will distort the average.

- In recent times it has been the FAANG and tech stocks that have beaten the market. We were moving into a technological future even before the pandemic.

- The pandemic forced the world to press the fast forward button on the digital process. Look at a firm like Zoom. It was already on the stock market and then skyrocketed after the pandemic:

- Just like after 9/11 when it took people a few years to feel comfortable flying again, it is likely that people will worry about crowded places for a while. Not everybody, but some people. I also think people will worry every time there is a small pandemic for a few years. Let’s imagine there is a small pandemic in 2023, the news media will make a bigger deal of it and ask “is this the next Covid?”.

- Against that, the world is trying to tax and regulate big tech.

- There might be a brief period where “pent up demand” ensures that oil, financial and other “old school” stocks skyrocket and tech falls. Yet long-term, the trends which have been going on for decades will continue. Look at our kids/grandkids/friend’s kids or whatever is appropriate for people reading this. I am pretty sure most of them spend most of there time on tech devices! There will come a time when close to 100% of some industries will do everything online.

- Other existing trends, such as healthy living including vegetarian and vegan lifestyles, have also only skyrocketed after the pandemic.

So, the bottom line is that nobody knows for sure. Long-term, tech isn’t going to get smaller.

It will only get bigger. We won’t return to a post-pandemic world because the world was already moving so fast in the 2010–2020 period.

The number of people doing things online was skyrocketing every single year.

I went partially remote in 2014 and fully in 2018 as I saw the trend before the pandemic. My major mistake was not doing it sooner.

The pandemic has merely forced more people to adapt to the new realities.

I do believe travel and tourism will recover though, as it is one of the few things which can’t be done well remotely.

Just stay well diversified and you will be fine.

How can I be wealthy at a young age?

Source: Quora

Wealth is something which compounds over time, as opposed to income, which tends to go up in a more linear way.

That means that becoming high-income at a young age is easier than becoming wealthy at a young age.

Even if you come out of university and get into one of the elite companies, advance and make hundreds of thousands by 27 like some people do in Silicon Valley and beyond, it isn’t easy to be a multi-millionaire by such ages.

Therefore, if you want to get wealthy, your only options are

- Take bigger risks. The get rich slow, tried and tested, approach will get you there by your mid 30s, 40s, 50s or 60s. If you want to get there in your 20s, you might need to start your own business or work on performance and not on salary . For example, take a job with a very low basic salary but huge bonuses if you succeed. You could put so many factors into this section including emigrating to get better opportunities and many other things. If you role the dice, you are more likely to end up with little to show for your efforts, but also more likely to make it big.

- Rely on luck. Marry into wealth. Win the lottery. Inherit money. This isn’t really a workable solution for most people of course.

Honestly, I would focus on the long-term, rather than the short-term.

Delaying gratification and playing the long game is one of the commonalities of wealthy people.

That doesn’t mean you should be “forever patience”, but be smart about setting yourself up for life, and not just looking to make as much as possible as soon as possible.

Some of the people I know who were doing extremely well at 25 peaked too early.

So, a balance is needed. Invest for compounded growth over decades and take calculated risks along the way.

If you don’t get lucky, you need to really role the dice to get very wealthy in your teens or 20s.

Simply becoming high-income is much easier. There are hundreds of thousands globally who have done that at quite a young age.

For that, you just need high skills and know how to interview well, and for that matter, where to look for the right opportunities.

The highest paid careers now are in Silicon Valley, management consulting and some parts of finance.

It is simply hard to get in to begin with.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 239 million answers views on Quora.com and a widely sold book on Amazon

Further Reading

In the answers below, taken from my online Quora answers, I speak about:

- Do successful stock investors pay attention to the stocks everyone online talks about, or do they take a different route?

- Is a buy and hold strategy the best one, or are there alternatives out there? I outline a “buy and hold plus” strategy.

- How long will $1million last in the US and globally, and which variables should be taken into account?

- Where can we find value in global real estate markets, and are REITS the best form of real estate investment?

- Why don’t kids get taught proper financial education, in a very fun, at a young age? I suggest this is one of the biggest drivers of wealth inequality that few speak about.

To read more click on the link below: