The Royal Bank of Canada, or RBC for short, was established in 1864. At that time, it was called the Merchants’ Bank of Halifax. During their first few years, they have already opened offices across eastern Canada, such as in the provinces of Nova Scotia, New Brunswick, and Prince Edward Island. Then, around 3 decades later, they made their way to Vancouver City in western Canada.

In 1901, the Merchants’ Bank of Halifax changed its name to what we now know as the Royal Bank of Canada. Throughout the years, they have been growing their portfolio of products and services to serve not just individuals in Canada, but also around the globe. Currently, they are the bank of choice for their 16 million clients.

In this RBC Savings Accounts review, we will focus on the products that they have for personal banking and their respective advantages and disadvantages.

RBC offers four savings accounts that are differentiated by the type of currency accepted, the allowable number of withdrawals per month, and the average monthly balance required.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

RBC High Interest eSavings

The RBC High Interest eSavings is an online savings account that offers an interest rate of 0.300% per annum. Interest is computed every day based on the closing credit balance.

Key Features of the RBC High Interest eSavings Account

- No minimum deposit is required

- No monthly fees are charged

- Electronic self-service transfers to your other RBC accounts are free of charge and completed in real time

- You can set up Save Matic, which allows for an automatic transfer of funds from your banking account to the savings account

- Free issuance of eStatements and eNotifications

- Free access to online, mobile, and telephone banking

- Free access to myFinance Tracker

The myFinanceTracker is a money management system freely offered by RBC to their customers. Through this product, users can do the following: track their expenses, set goals and budgets, and obtain a graphic picture of their financial activities.

Cons of the RBC High Interest eSavings Account

Many of the transactions performed with such an account are charged with a fee. Though it may seem like a small price for a one-time occurrence, such expenses can accumulate overtime. You can find a list of them below.

- Only 1 withdrawal from an RBC Royal Bank ATM is free. Succeeding debits are charged $5.00 each.

- Withdrawing at a non-RBC Royal Bank ATM that has the PLUS System symbol will be charged $3.00 per transaction if the machine is located in Canada or the U.S. The fee is higher at $5.00 if the ATM is located outside Canada or the U.S.

- Conducting transactions using Interac e-Transfer is charged $1.00 each. Similarly, you will be charged $2.00 per transaction if you use a non-RBC Royal Bank ATM in Canada that utilizes Interac.

- Cross-border debits cost $1.00 per transaction. This is only possible on operating accounts, not on U.S. personal accounts.

- International money transfers are not available.

- You cannot be issued a monthly paper statement.

RBC Enhanced Savings

Individuals who can spare at least $5,000 can earn a tiered interest rate by opening an RBC Enhanced Savings account. This means that interest, which is calculated every day on the closing credit balance, increases when your balance does.

The interest rate ranges between 0.001% and 0.010%. However, to earn these rates, you must have a balance of at least $5,000 or up to more than $250,000.00.

Key Features of the RBC Enhanced Savings Account

- You can perform electronic self-service transfers to your other RBC accounts at any time of the day or week at no cost.

- You can link your bank account to your savings account through Save Matic

- You can make RBC international money transfers with this account. A $6 fee will apply for transactions involving $1,000 or less. Any amount over $1,000 will be charged $10.

- Free access to online, mobile, and telephone banking

- Free access to myFinanceTracker

- Free issuance of eStatements and eNotifications, which also includes cheque images

- Free issuance of a monthly paper statement

- No monthly fees are charged

- Compared to the RBC High Interest eSavings Account, withdrawals beyond the monthly limit will only be charged $2.00 per transaction

- You can save more than $250,000 in this account

Cons of the RBC Enhanced Savings Account

- Only 1 withdrawal is free of charge

- Similar fees apply when using Interac e-Transfer, Interac non-RBC Royal Bank ATMs, PLUS System non-RBC Royal Bank ATMs, and cross-border debit

- There may be other savings accounts with higher interest rates but lower minimum amounts required

RBC Day to Day Savings

The RBC Day to Day Savings account similarly works with a tiered interest rate. However, it doesn’t have the same high minimum balance requirement as the RBC Enhanced Savings Account.

The interest rate ranges between 0.005% and 0.010%. Your balance can be as low as $0.00 to start earning interest. But you can also deposit amounts greater than $5,000 to enjoy higher interest rates.

Key Features of the RBC Day to Day Savings Account

- No minimum balance is required

- Electronic self-service transfers to your other RBC accounts are free of charge. It can be done at any time of the day and the money will be deposited instantly.

- Free access to online, mobile, and telephone banking

- Free issuance of eStatements, eNotifications, and cheque images

- Free issuance of monthly paper statement

- Free access to myFinanceTracker

- No monthly fees are charged

- You can set up Save Matic to help you with your savings

- The fee for withdrawing money beyond the monthly limit is also lower at $2.00 per transaction

- You can make RBC international money transfers with fees similar to those charged with an RBC Enhanced Savings Account

Cons of the RBC Day to Day Savings Account

- Only 1 debit transaction is free per month

- Similar fees apply when accessing the Interac and PLUS System ATM networks, performing cross-border debits, and using Interac e-transfers

RBC U.S. High Interest eSavings Account

The U.S. Savings Account is for individuals who intend to save in the currency of U.S. dollars. It has an annual interest rate of 0.050%. Interest is similarly calculated daily from the closing credit balance.

Key Features of the RBC U.S. High Interest eSavings Account

- No minimum balance is required

- Free electronic self-service transfers to your other accounts at RBC throughout all the days of the week

- Free access to online, mobile, and telephone banking

- Free issuance of eStatements, eNotifications, and cheque images

- No monthly fees are charged

Cons of the RBC U.S. High Interest eSavings Account

- You are only entitled to 1 free debit transaction per month. Any transaction beyond that will be charged $3.00 each.

- Cheque debits are not accepted

- You cannot have access to the network of ATMs included in the Interac and PLUS Systems

- You cannot send money with Interac e-transfers and perform cross-border debit transactions

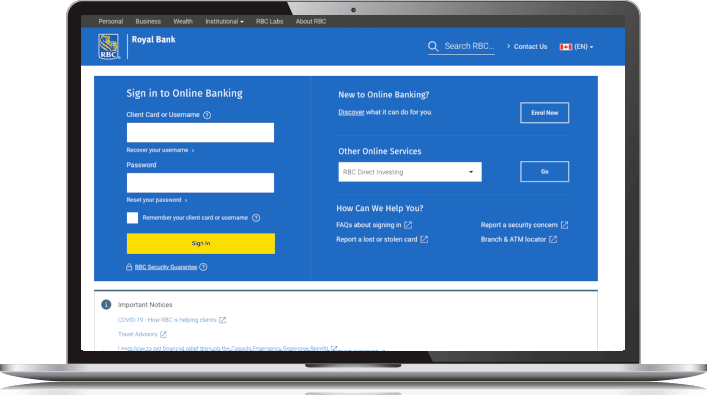

How do I open an RBC Savings Account?

For all the four RBC Savings Accounts listed above, the general eligibility criteria to open an account are as follows:

- Must be at least the age of majority in your respective province (18 or 19 years old)

- Must be opening an account for yourself

- Must be living in Canada at the time of application

As you proceed with the online application process, you will be required to input your Social Insurance Number (SIN). This piece of information is necessary because you will be opening a savings account that bears interest. Providing your SIN will enable RBC to issue the appropriate tax slips for the purposes of tax reporting. Apart from that, you will also be asked to provide your email address.

If you intend to open an RBC Savings Account for someone else, then you should head to a physical branch instead.

Lastly, you also have the option of calling them over the phone at 1-800-769-2561 to initiate the application process.

How do I deposit or withdraw money?

You can withdraw money from your RBC savings account by using an internal transfer to your other RBC personal deposit accounts. In addition to this, you can use the Interac e-Transfer, withdraw at an ATM, or visit an RBC branch.

To deposit money into your RBC savings account, you can similarly use an ATM, visit an RBC branch, or do it online.

Conclusion

With this, opening an RBC Savings Account is relatively easy. You can apply online, at a branch, or over the phone. Most of the accounts also do not require a minimum deposit for you to earn interest, and all of them do not have monthly fees.

However, be mindful of the costs applied to many of the transactions that you will make using your account. These fees do add up, making them unsuitable for everyday banking needs. Similarly, the interest rates of the RBC Savings Accounts are not that competitive against other Canadian digital banks. So, if this is a priority for you, then you can look into other options.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.