Article last updated – May 17, 2020

Allianz expat insurance review – that will be the topic of today’s article.

It will answer some frequently asked questions (FAQs) and suggest how people can get cheaper coverage if so desired.

For people interested in international coverage, including discounts on the stated website quotes, please email me on advice@adamfayed.com or use the chat function below.

Who are Allianz?

They were founded in Germany over 100 years ago. Internationally, they partner with many insurers, including Orient Insurance company and NextCare.

They provide coverage to individuals, companies and families worldwide. They have different plans to suit different needs and budgets.

In general, they are on the more expensive side of the market.

Where is Allianz sold?

All around the world. However, countries with high densities of expats like UAE, Qatar, Thailand, Kuwait, Saudi Arabic, Switzerland, Germany, Mexico and Vietnam have many Alliance insurance-holders.

What are the different plans?

The corporate group coverage has four categories: premier, executive, classic and select.

The difference is the benefit level. For example, premier has a $10.5M yearly benefit level, whilst select is just over $1m. Maternity is fully covered on the top package, whilst the benefit is lower on the cheaper packages.

These main plans are then matched with three outpatient plans (gold, silver and pearl) which all have benefits such as health screening and infertility.

What are the positives about Allianz?

Allianz does offer compressive coverage and has great technology with the “My Health App”. They do also offer some specific benefits, like infertility treatment, which many other insurers do not.

You do also have the option to continue with the insurance, if you leave a group plan, due to getting a new job, and want to maintain individual coverage.

They do pay claims quickly, with 98%-99% of claims paid, although this does not make them unique in the health insurance industry.

What are the negatives about Allianz?

The main negative about Allianz is that it is expensive for the benefit levels. Ultimately, insurance is dead money if nothing happens. So it makes sense to get the most covered, for the least premium.

It is often cheaper to pay for procedures, such as medical check-ups, out of pocket.

Besides, there are other options available in the market which are cheaper, for the same benefit level.

On the individual health insurance side, the Classic Plan, isn’t as good as the corporate package, in many ways. The benefits are much more limited.

Another negative is that there are many restrictions in specific countries. So if you are an expat that is moving from country to country, you may have to communicate with Allianz before you leave.

Some other insurers are less restrictive in this way. Countless offer coverage if you move to any country in the world, with the exception of the US.

Frequently asked questions (FAQs)

This section will answer some FAQs:

What are some of the features of the insurance?

In addition to the previous points, the following features are worth mentioning

- There is 24 hours a day call support, offered in 5 languages. This includes 24/7 emergency assistance.

- Toll-free calls for 14 countries.

- Claims can be processed in numerous currencies.

- On some packages, laser eye surgery and war are covered, up to certain maximum benefit levels.

Which countries can you get treatment in?

This depends on your benefit coverage, but typically you can get treatment in any country which falls within your area of coverage – for example worldwide except USA.

This does mean that you can get covered in your home country, if it falls within your area of coverage.

What do the health and well being checks cover?

They cover screenings, blood testing, cardiovascular examinations and any needed tests, that are covered, based on your coverage level and package chosen.

How about the dental benefits?

Some of the plans include dental. In which case, you can usually pay upfront, and claim the money back.

The more expensive plans, do cover more extensive dental works, including :

- Dental surgery

- Dental drugs if needed

- Orthodontics

- Periodontics

All of these are stated in the benefits table

Can children be added to the policy?

Yes dependents can automatically be added to the policy. You can also purchase different benefits levels for family members.

In other words, you can pick an expensive option for yourself, and a cheaper one for your family, or vice versa.

What are the payment options?

Credit card, cheque and bank transfer can all be chosen. You can pick monthly or yearly payment options.

What does emergency care outside of chosen region mean?

It means that Allianz will cover you for emergencies, outside of your area of coverage, if you are travelling or on business.

Can pre-existing conditions be covered?

They can be, but they are subject to full medical underwriting. It also depends on which package you are on.

Which clinics and doctors can I see?

There is a full list on the Allianz website, of approved clinics. This is more restrictive than some other insurers, which allow you to pick your doctors and hospitals.

How long does it take to pay claims?

Assuming all of the paperwork is done correctly, it typically takes 2 days to refund your expenses.

You can also review your claims online and on the app.

How about travel insurance?

Allianz has a different benefit insurance category for travel insurance. With that being said, your insurance will cover you for emergencies, whilst you are travelling.

It isn’t “travel insurance” though, so you shouldn’t expect coverage for losses incurred which aren’t emergencies for your health.

Examples include lost bags, passports, wallets and other valuables.

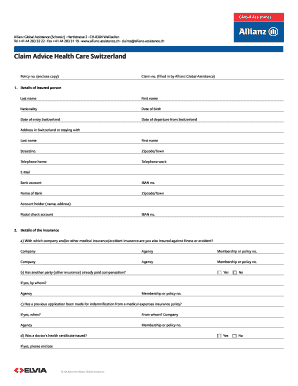

What do the claims forms look like?

It depends on where you live, and which insurance you have, but they are usually similar to this example:

What are the key mistakes people make with expat insurance?

One huge mistake is assuming that size and brand names matter. Bigger insurance firms are sometimes slower and more bureaucratic than smaller ones.

Beyond that, many people overspend on insurance, when a cheaper option is often just as good.

Conclusion

Allianz offers excellent coverage, but the price :premium ratio isn’t the best in the market.

There are some cheaper options, where the coverage is similar in terms of quality.

Most of the people I know that have taken out the insurance, have found the quality to be excellent, but feel they have overpaid with hindsight.

Further reading

1. RL360 PIMS Personal Investment Management Service Review could offer insights into expat-friendly insurance solutions.

2. The article below reviews Regency for Expats, which also covers individuals, families and groups for health and life insurance.