Let’s take a look at AxiaFunder for those looking for alternative investments and other investment options.

If you have been proposed this option and want a second opinion, you can email me (advice@adamfayed.com) or contact me here.

We can sometimes offer discounts, and other benefits, if you want to invest in it, compared to many other providers, or introduce alternatives which might be better for your situation.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Who is AxiaFunder?

AxiaFunder is a UK-based crowdfunding platform that specializes in providing funding for litigation cases. The platform allows investors to invest in individual legal cases, with the potential to earn returns based on the outcome of the case.

As of the time of writing, the internal rate of return for the 7 resolved cases reached 45%.

AxiaFunder works with experienced litigation funders and lawyers to assess the merits of each case and determine the likelihood of success, with the aim of providing investors with access to high-quality investment opportunities in the litigation finance sector.

AxiaFunder aims to make litigation finance more accessible to a wider range of investors, including individual investors and institutional investors, by offering a simple and transparent investment process. The platform also provides investors with regular updates on the progress of the cases they have invested in, as well as detailed information about the potential returns and risks associated with each investment opportunity.

Who are eligible to invest?

Investors from nations outside the European Union (EU) and European Economic Area (EEA) may participate in AxiaFunder’s investment options. Subject to certain extra clearances, investors from outside the EEA, including the United States and Canada, are normally welcome to participate.

Sophisticated investors, high net worth individuals, and professional investors can partake in the investment options provided by AxiaFunder. The investment opportunities are not limited to individuals; companies can also invest.

Both individual and company investors are required to complete a profile on AxiaFunder’s platform, disclose personal information, and provide proof of identification and address. All investors must also take a “suitability test.”

Is there a minimum amount needed to invest?

Yes. Investors normally have to shell out a thousand pounds as minimum investment. Not only that, they should also infuse funds of at least 10,000 pounds per year into unlisted investments like bonds, equities, peer-to-peer (P2P) loans and property.

The maximum amount that may be invested varies from case to case.

What would your investment return look like?

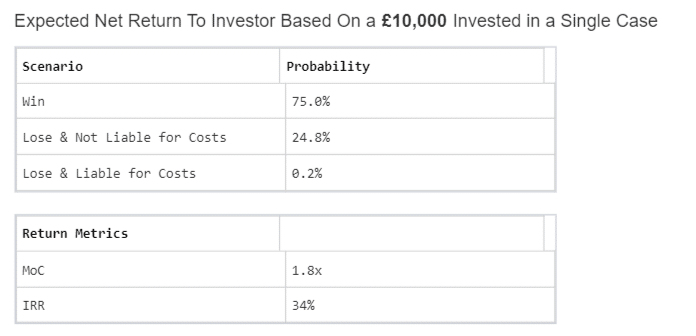

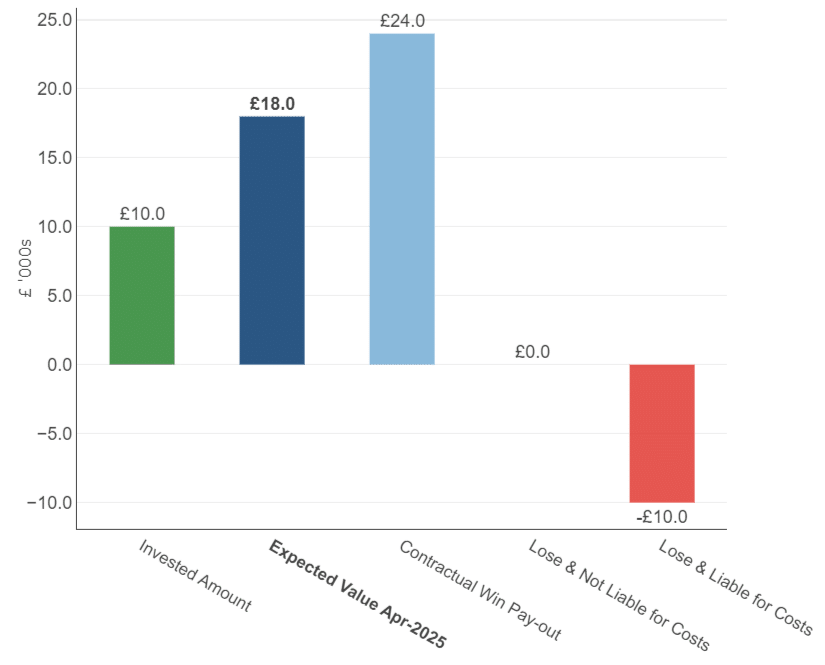

Investing in companies that are listed on the platform provided by AxiaFunder carries with it the opportunity of significant gains but also a high level of risk. You should carefully study the risk disclosures when making a decision to invest. The projected return using the company’s investment approach is between 20% and 30% percent each year.

You could also lose as much as double your initial investment if the case-insurer refuses to pay or goes bankrupt.

What are the services offered by AxiaFunder?

The company has several litigation funding services designed to help claimants with strong legal claims that may not have the financial resources to pursue their cases on their own. AxiaFunder provides funding for a range of legal claims, including commercial litigation, arbitration, and insurance claims.

Below are AxiaFunder’s services:

Investment Opportunities

AxiaFunder provides investment opportunities in legal claims, allowing individuals to invest in specific cases and potentially share in the rewards of successful outcomes. Investors can choose to invest in individual cases or build a diversified portfolio of legal claims.

Secondary Market

The secondary market allows investors to buy and sell their investments in legal claims with other investors on the AxiaFunder platform. This provides liquidity for investors who may wish to exit their investments before the cases are resolved.

Funding Claims

AxiaFunder also provides funding for legal claims, allowing claimants to access the resources they need to pursue their cases. In return, the company receives a share of the potential rewards of successful outcomes. This can be an attractive option for claimants who may not have the financial resources to pursue their claims on their own.

Portfolio Return Simulator

The portfolio return simulator is a tool that allows investors to simulate the potential returns and risks of building a diversified portfolio of legal claims. This tool takes into account various factors such as the distribution of investments across different cases, the expected timeline for resolution, and the potential damages awarded.

Single Case Simulator

The single case simulator is a tool that allows investors to simulate the potential returns and risks of investing in a specific legal claim. This tool takes into account various factors such as the strength of the case, the expected timeline for resolution, and the potential damages awarded.

What are the benefits and risks of AxiaFunder investments?

One of the primary advantages of investing with AxiaFunder is the potential for high returns. Legal claims can result in significant payouts, and the company aims to maximize these returns by investing in cases with strong legal merit and potential for success. Additionally, the platform offers a diversified portfolio of legal cases, which can help to mitigate the risk of any individual case not succeeding.

Another benefit of investing with AxiaFunder is the relatively low minimum investment requirement. While a minimum entry investment of 1,000 pounds plus an annual investment minimum of 10,000 pounds may not be considered a low minimum investment for all investors, AxiaFunder’s requirement may still be considered lesser compared to traditional legal funding opportunities.

The investment requirement also makes sense since the target investors of the company are individuals with high net worth.

Also, AxiaFunder has solid track record. To date, it has seven wins and no losses among the 17 commercial cases it chose to invest in. The remaining 10 cases are still ongoing.

However, there are also some potential drawbacks to investing with AxiaFunder. First and foremost, legal claims can be unpredictable and there is always a risk that a case may not be successful. If a case does not succeed, investors may not receive any return on their investment. Additionally, legal cases can be time-consuming, and it can take several years before a case is resolved and investors receive any potential payout.

Another potential disadvantage of investing with AxiaFunder is the lack of liquidity. As legal cases can take years to resolve, investors may not be able to access their funds until the case is settled. This means that investors may need to be prepared to hold their investment for a long period of time. This shouldn’t be a problem for long-term investors, though.

While AxiaFunder aims to provide as much information as possible about the legal cases it invests in, there may be limited information available about the cases. This lack of transparency can make it difficult for investors to fully assess the potential risks and rewards of an investment themselves.

Also bear in mind that past performance does not guarantee any future successes.

Overall, investing with AxiaFunder can offer the potential for high returns, but it is important to carefully consider the risks before making an investment. Investors should also thoroughly research any legal cases they are considering investing in to ensure they understand the potential rewards and dangers. Always keep investments diversified and consult with a professional financial advisor.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.