In this Commerzbank review, we’ll discuss what one of the largest banks in Germany can offer you as an expat or resident.

Assessing Commerzbank’s current accounts is beneficial to compare with Capital International Group.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

Commerzbank Aktiengesellschaft (AG) has been in the industry for more than a hundred years. It was established in 1870 and currently has its headquarters in Frankfurt am Main. In terms of total assets, Commerzbank was the fourth largest bank in Germany (507 billion) in 2020. This isn’t anything new because it consistently ranks high on the list every year. Other financial institutions that came before it were Deutsche Bank, DZ Bank AG, and KfW Group.

They offer products and services for private customers, small businesses, and corporate clients. Around 11 million private and small business customers choose Commerzbank for their banking needs. With this, let’s take a look at what the institution offers and see if they might just be what you’re looking for.

What Type of Account Can I Open at Commerzbank?

For everyday banking needs, you can choose from three checking accounts offered by Commerzbank.

1. Free Current Account “Basic” (Kostenloses Girokonto)

Just as the name suggests, opening a free current account “Basic” means that you will not pay any account management fees. However, this may seem too good to be true. And it somehow is, because it comes with certain conditions. Specifically, they are as follows:

- The account must be for private use.

- You must have a minimum deposit of €700 ($758.21 USD) per month.

- You will have to manage your current account digitally.

- If you do not want to be charged transaction fees, you can only deposit or withdraw cash at ATMs within the network of Commerzbank or the Cash Group.

- There should be no custody fee incurred.

You will have to pay an account management fee in the months that you are unable to meet the minimum monthly deposit. This will cost you €9.90 per month. Such fees will be charged starting the second full month from the date you opened a “Basic” current account.

Furthermore, for paper-based transactions, you will be charged €2.50 each time you do so. This includes the following: checks for paper-based domestic or SEPA transfers; collection of domestic checks; and cash withdrawal or deposit at a Commerzbank branch.

What can I get from a free current account?

Online and Mobile Banking

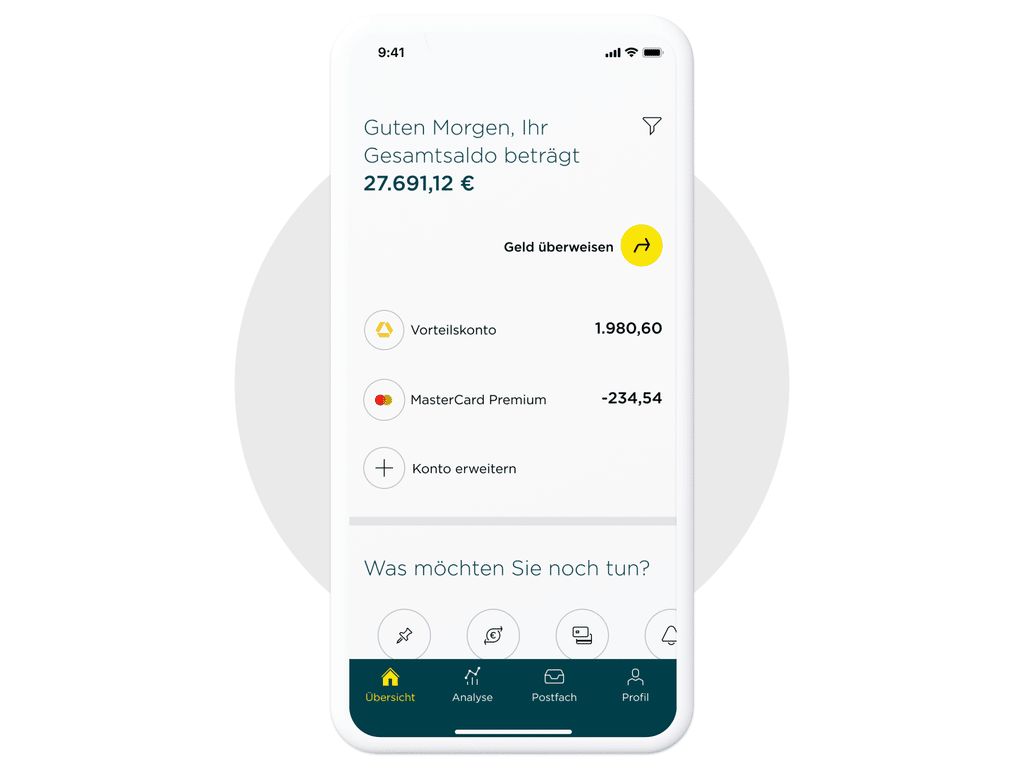

The Commerzbank banking app allows you to conduct all your banking transactions with just your phone at hand. Specifically, you can transfer money, make cashless payments, talk to customer service representatives, and many more. You can similarly perform such transactions through “My Online Banking” on the website.

Debit Cards

You will also be issued a virtual debit card. This allows you to make use of Apple Pay and Google Pay even without a traditional credit card. It can also be used in shops and ATMs wherever you are in the world.

Not only that, you will additionally receive a Girocard. This is a contactless debit card that you can use in establishments with contactless payment schemes. A Mastercard Debit can be issued only if your credit score meets their requirements. This costs €3.50 per month.

Cash Withdrawals and Deposits

Should the situation require it, you can withdraw cash using your Girocard at Commerzbank and Cash Group ATMs in Germany. You will not be charged any fees when doing so. But you can also make use of ATMs from other banks. The relevant institution will charge their own fees for such transactions.

Other than that, you can also withdraw cash without incurring fees at Shell petrol stations and branches of certain establishments. However, there is a minimum purchase value should you use their services. It often ranges between €5 and €20.

For deposits, you can make use of any Commerzbank cash deposit machine for free.

Starting Bonus

Apart from this, you can earn a €50 starting bonus if you’ve already surpassed the 3-month mark of actively using the account. This means that you have made a minimum of five monthly bookings that cost at least €25. Personal transfers are not considered part of a booking.

But that’s not the only condition. You must also comply with the following: open the checking account online; have not opened a current account at Commerzbank for the past 24 months; and agree to receive promotional emails and calls.

Referral Bonus

You can also earn a €100 referral bonus under the “customers refer customers program.” Just ask your friends to sign up for a free checking account (basic) using your promo code. Every quarter, you can earn up to €400 since four referrals are allowed. Other conditions apply.

2. Extra Classic Account (Extra Klassik)

If the free current account is not enough to meet your banking needs, then you can open an extra classic account instead. You will get additional benefits, but it also means that you need to pay a fee of €6,90 per month.

Apart from having access to what basic account holders have, you will also be entitled to the following:

- There is no requirement for a minimum monthly deposit.

- The ability to make cash deposits and withdrawals at Commerzbank branches for free.

- You can conduct paper-based payment orders, such as check cashing and bank transfers, for free.

- You will be issued paper account statements.

- You will be given two Girocards.

- You will be given one Commerzbank Mastercard Debit.

- You will be given priority when calling customer service.

The Commerzbank Mastercard Debit makes purchasing in-store or online much easier, whether you are in Germany or in a country elsewhere. It is recognized at more than 34 Mastercard acceptance points scattered across the globe. At the same time, you can also use it at ATMs.

3. Extra Premium Account

The Extra Premium Account entitles holders with even more benefits. But this comes with a concurrent increase in the monthly fees. Specifically, you will have to pay €12,90 per month.

This account is suitable for jetsetters who can’t seem to stay put in one place. With this account, you can enjoy the following benefits:

- There is no minimum monthly deposit required.

- You can deposit and withdraw cash at Commerzbank branches without paying fees.

- You can make paper-based payment orders, such as check cashing and bank transfers, at no cost.

- You will receive paper account statements.

- Your calls to the customer hotline will be prioritized.

- You will be issued two Girocards.

- You will be issued two premium credit cards.

- You will receive an insurance package for your family.

- You will get a free money market account.

Withdrawing cash from third-party ATMs can be done at no cost when you use your premium credit card. This is applicable not just within Germany, but even outside of the country. However, this is only applicable to a maximum of 12 cash withdrawals in the country and 25 cash withdrawals abroad.

As mentioned above, extra premium account holders and their family members will also be insured. The insurance package for the family includes the following: travel cancellation, trip cancellation, foreign travel accident, travel service and emergency call, foreign travel health, baggage, and flight delay.

The individual whose name appears on the premium credit card will additionally receive cell phone misuse protection and cash protection.

Can I open a checking account at Commerzbank?

The criteria for opening a checking account aren’t too stringent. You just have to be a private individual of legal age with an unlimited tax liability in Germany. This means that you must be a resident of the country.

As a freelancer or businessman, you are not allowed to open this type of account for your business activities. Instead, you must open a different account at Commerzbank intended for commercial use.

How can I open a checking account at Commerzbank?

First, you have to complete the online application. You will be asked for your personal data, such as reporting address, employment, and contact details. At the same time, you will have to decide on your user name and PIN. This will be used for your online banking transactions. Commerzbank will then issue you a new International Bank Account Number (IBAN) and order confirmation.

Second, you have to save your application. After this, you will be sent an email that includes all the relevant documents and cancellation policy.

Third, Commerzbank needs to verify your identity. This will be done through video chat, PostIdent, or at a branch of the bank.

Fourth, you will receive a letter that states how you can activate the photoTAN authorization procedure for your online bank account. Expect to receive it within 1-2 working days of a successful identity verification. When you have activated the photoTAN, you can now use your account.

Fifth, one day after activating the photoTAN procedure, you will receive your Girocard PIN.

Sixth, you will receive the physical Girocard four business days later. Withdrawals and payments using the card can often be done after a week of receipt.

I don’t have any money left in my account. Can I take on a loan?

Yes, Commerzbank has an overdraft facility. This means that the bank will lend you money if your account does not have sufficient funds to complete the transaction. You have to set this feature up if you want to make use of it. However, this will only be approved if you meet their creditworthiness criteria.

Your type of account will determine the yearly overdraft interest charged. They are as follows: free checking account – 9.75%; extra classic account – 8.75%; and extra premium account – 7.75%.

I need help with my Commerzbank current account. How can I contact them?

Commerzbank has customer service representatives ready to help you 24/7. Just call them over the phone at 069/580-8000 8000.

You can also get support through the mobile app, online site, or at the bank branches.

Don’t worry about language barriers. English-speaking representatives are available in any way you reach out to them.

Is my money safe in a Commerzbank current account?

The photoTAN and mobileTan processes protect your transactions with Commerzbank, whether they are done on the site or the mobile app. However, if you fall victim to phishing or malware, the institution will reimburse you for all the money that you have lost if you meet certain conditions.

Why Should I Open a Commerzbank Current Account?

- Talk to customer service representatives in German or English

- Have access to online and mobile banking

- You don’t have to pay for account management fees

- Receive free debit cards which can be used for deposits, withdrawals, and payments

- Use your card inside and outside of Germany for withdrawals and payments

- Receive an insurance package when you open an extra premium account

Why Should I Not Open a Commerzbank Current Account?

- The free current account has a €700 minimum monthly deposit

- You will have to pay €6,90 or €12,90 per month to have an account with no minimum monthly deposit

Conclusion

With this Commerzbank Review, we have seen what types of current accounts you can open and their features. It has the advantage of being able to use your cards almost anywhere, not just in Germany, but also abroad. At the same time, talking to English-speaking customer support makes the process less challenging. You will also have access to a mobile banking app that makes financial transactions very convenient for you.

However, this all comes with a cost, either as a minimum monthly deposit or a monthly fee. So, evaluate for yourself whether that will be worth the services that you can use with a Commerzbank current account.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.