Is Friends Provident International Premier Advance Savings Plan worth getting? The savings plan is typically offered to expats in the Middle East, Latin America, Africa and beyond.

However, it has became increasingly likely that locals who want to diversify their wealth have also entered into offshore schemes like this.

The question is whether this is a good route and therefore I will investigate further during this article.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is the Premier Advance Savings Plan from Friends Provident International?

FPI offers a popular savings plan called Premier Advance, which is intended to be held as an investment that targets a medium- to long-term time frame.

You must be 18 to 70 years old to be eligible to participate in the savings scheme. The lives that are guaranteed may be of any age, provided that at least one of them is younger than 76 when the original payment period comes to an end. The plan calls for a minimum regular payment, the amount of which might change depending on the frequency that is selected.

If you are between 18 and 70 years old at the start of the plan, you are eligible to join, and the lives assured can be of any age, as long as one of them is under 76 at the end of the initial payment term. The plan requires a minimum regular payment that may vary based on the chosen frequency.

The Premier Advance savings plan is designed to assist you in accumulating a quantity of money that you will be free to spend as you see fit after the conclusion of the payment period. You can choose from a range of funds to meet your investment needs and make your investment more valuable. You, as the owner of the policy, are agreeing to be responsible for making consistent payments for the duration of the payment term.

However, Friends Provident International announced that new investors in the UAE cannot anymore set up an account for this product.

FPI Premier Advance Payments and Other Terms

FPI Premier Advance is a unit-linked regular savings plan that also incorporates an element of life protection. After 10 years, if you have maintained your payments, you will be eligible for a continuing loyalty reward.

You or another person, or the two of you together, may develop a plan that covers up to four lifetimes, each of which can be different. You are also able to choose the length during which you will make payments; the periods may vary anywhere from 5 to 25 years.

You are able to pay into your policy every month, quarter, half-year, or yearly if you so want. You may change the frequency of your payments by using any payment due date that is in line with the new frequency of your payments. Payment increases and extra lump sum payments may be made on any payment due date, so long as at least five years remain on the payment term.

You have the option of initially structuring your plan as 10 policies that are quite similar to one another so that you may give yourself more leeway. For instance, you could choose to cash in certain policies while continuing to make payments on others. After the beginning of your plan, you will not be able to make any changes to the amount of policies.

You also have the ability to swap funds at any moment and may make withdrawals either one-time or on a recurrent basis. You are also always free to cash out your plan, notwithstanding the possibility that doing so could incur a cost.

What currencies are accepted?

You have the option of making contributions and having your plan denominated in any of the currencies below that are accepted under the Premier Advance Savings Plan:

- United States dollars (USD)

- British pounds sterling (GBP)

- Euros (EUR)

- Hong Kong dollars (HKD)

All payments, statements, and communications will be done in the currency chosen unless another currency is specified on the application. The currency is still changeable depending on necessity.

What’s the minimum I can contribute to Premier Advance?

The minimum monthly savings required vary depending on the selected premium payment frequency. However, the lowest possible monthly payment a saver can make is equivalent to 300 USD.

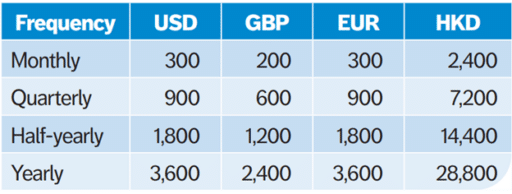

Refer to the table below from Friends Provident International for the minimum requirements based on the currency selected:

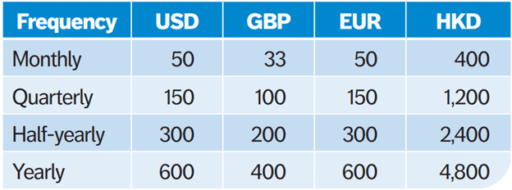

As mentioned earlier, you can grow your payments provided that a minimum of five years is still left on your policy term. The following table illustrates how payment increments will work depending on the currency used:

The plan enables for extra one-time payments to be made as long as those payments satisfy the specified minimum amount. This minimum varies depending on the currency that is selected; nevertheless, it is often at least 3,000 in USD or euros, 2,000 British pounds, or 24,000 Hong Kong dollars.

However, making changes to the premium payments or lump sum top-ups might call for at least five years of commitment on the part of the policyholder.

You may either pay the whole savings plan off in one lump sum after the first one and a half year, or you can momentarily pause contributions for up to 12 months. The fees will continue to be imposed though, plus the plan’s value will rise and fall with the ups and downs of the funds into which it is invested.

How are my funds allocated?

The in-house investment experts at Friends Provident International have selected a wide range of funds from which to choose. One hundred different funds, each with its own risk rating, span the whole spectrum of global markets and asset types. The money you provide will be allocated to the account or accounts you choose.

You can discover a wealth of information on the funds, including recent performance data, price, and risk ratings, as well as a variety of tools to help you narrow your focus on the firm’s website.

Investors may choose to hold their assets in US dollars, British pounds, or Euros, and can purchase up to 10 funds at once. Your payments to Friends Provident will be used to purchase units in the funds you opt for. The value of the fund’s assets determines the unit price.

Your money is divided into initial and accumulating units. The original units get payments for the first one and a half year.

Once the 18 months have passed, the funds will be transferred to the accumulation units. Extra lump sums are allocated to accumulating units as well. The unit cost is the same for both types. You can always switch your money around.

What costs should I know about?

During the duration of your savings plan, an initial charge of 1.5% is taken out from the starting units every quarter to cover the fees. The initial units are cancelled on the quarterly anniversary of the plan’s start date. A monthly plan fee of USD 6 (GBP 4, EUR 6, HKD 48) is also charged, which is collected by cancelling accumulation units at regular monthly intervals based on the start date of the plan.

During periods where there are no accumulation units available, the plan payment will not earn any interest. Any accumulated fees will be deducted once accumulation units become available.

Additionally, an annual fee of 1.2% of the plan’s value is charged for administering the funds. The underlying fund manager’s annual management fees and other fund expenses vary depending on the fund you choose. These fees are deducted from the fund on each trade day and reflected in the unit price of the funds.

You could incur other fees depending on the payment method you use. For example, if you choose to pay using a credit card, Friends Provident International will deduct an extra 1% to 1.95% from each payment to compensate for the fees assessed by the credit card company. The exact cost will vary based on where you live.

All of these fees will commence upon the activation of your plan and will remain throughout the payment period. The monthly plan fee will also continue if you choose to keep your plan invested after your payment period has ended.

If you pay your savings plan in one lump sum, there will be a 7% fee. If you decide to make additional lump sum payments, there will be a bid-offer spread fee of 7% applied as well. This means that the deposited amount will be immediately trimmed by 7%.

You can also choose to have “enhanced initial units” applied to your plan, which are units above 100%. If you lower your original payment and continue with the scaled down payments for more than 12 months, you may recover a portion of the enhanced units, but there may be a charge involved. If you stop making payments for more than a year or cash in individual policies during the first five years, you may also be subject to charges for the recovery of enhanced units.

Switching between funds is currently free, but Friends Provident International has the right to charge up to 1% of the amount involved or 15 USD or euros, 10 pounds, or 120 HKD, whichever is greater, with one month’s written notice.

If you choose to cash in your savings plan before it matures, there will be a cash-in charge applied to the initial units. Note that your plan must have at least 12 months’ worth of payments to have a cash-in value. It is also important to be aware of other possible charges such as a monthly plan fee, an annual administration fee, and credit card fees if applicable.

How do withdrawals work?

Your savings plan offers the flexibility to withdraw funds as per your requirement, whether it’s a one-time withdrawal or regular withdrawals at periodic intervals such as monthly, quarterly, every term, half-yearly, or annually.

However, withdrawals can only be made from accumulation units, and they are free of cost. But if the proposed withdrawal causes the plan’s value to fall below the minimum plan value, or if there are insufficient accumulation units, the withdrawal will not be made.

You also have the option, once the first 18 months have passed, to pause the payments and table them for a period of up to a year. If you wish to stop payments altogether, you can pay off your plan in full. Nevertheless, your plan’s worth will continue to move up and down depending on how well the funds that you invest in perform, and costs will still be deducted, both of which can have an effect on the plan’s overall value.

If you decide to cash in your plan, the value will depend on several factors such as the investment duration, fund performance, fees, withdrawals made, and loyalty benefits earned. Due to volatility, the cash-in value is not guaranteed.

On the plan’s tenth anniversary, loyalty bonus units worth 0.5% annually will be added and paid in monthly installments as long as payments are made. The plan’s duration is intended to be the payment period, and if you cash in the policy before it ends, a cash-in fee will apply.

What happens to my Premier Advance Savings Plan if I die?

If you choose to base the plan on your life, it will terminate when you pass away. However, Friends Provident will provide an additional 1% on top of the plan’s cash-in value upon your death.

In case you wish to continue the plan after the first death, you can configure it to cover up to four lives. After the last survivor dies, the plan will pay 1% more than its cash-in value then terminate. Please note that the death benefit is based on the plan’s value, so no amount is guaranteed.

How about taxes?

In certain cases, you may be unable to realize the full benefit from the plan due to currency or tax limits or prohibitions.

Since Friends Provident International is a tax-exempt insurance provider in the Isle of Man and the UK, it is exempt from income, capital gains, and corporation taxes. So, their money can grow tax-free, apart from any withholding taxes on investment income that may be taken out in the country of origin.

In lieu of several deals with the Isle of Man government, Friends Provident is obligated to supply the Isle of Man Treasury Department with certain information on policyholders. This information may then be shared with other participating governments with whom Friends Provident has agreements.

Friends Provident must notify UK HM Revenue & Customs of certain circumstances if a UK resident person or trust receives benefits from the plan. Potential policyholders interested in relocating to the UK may find this data useful.

Your tax burden will vary according to your location and other circumstances, and tax regulations are always in flux. It would be better if you could discuss your specific situation with a lawyer, tax professional, or financial advisor.

Conclusion

Friends Provident cannot guarantee how much your plan will be worth in the future because it depends on many things, such as how well the investments perform, how much you withdraw, and changes to fees or tax laws. Thus, you may get less than you invested. Some investment options are riskier than others and may cause bigger fluctuations in value.

If you invest in funds denominated in a different currency than your plan, exchange rates may affect its value. Inflation can also decrease the purchasing power of any money you receive in the future.

Stopping payments early on may result in you getting back less money than you put in due to fees and changes in the market.

The FPI Premier Advance Savings Plan is more expensive than other options and its supposed tax benefits may not outweigh its fees and penalties. The penalties in the first 12 months are particularly unattractive and can cancel out any money saved during that time.

If you are eyeing this plan, make sure you understand the local tax laws and weigh the benefits against the lack of flexibility, limited investment options, and high charges.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Premier is shocking 14 years based on de veere advisors lost 33 per cent investment lots of hidden charges .Nobody should invest in this disgraceful sham

I am sorry that you had this experience with another company. I hope you haven’t been affected by their move to Puerto Rico.