Ascend is a regular premium unit-linked insurance plan offered by Hansard Worldwide Limited, a unit of financial services firm Hansard Global.

In this Hansard Ascend review, we’ll talk about the product’s main features, charges, as well as advantages and disadvantages, among other key points.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (hello@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some facts might change from the time of writing. Nothing written here is financial, legal, tax, or any kind of individual advice or a solicitation to invest.

So, potential investors shouldn’t base any investment decision on this Hansard product review alone.

What is Hansard Worldwide Ascend?

Ascend is a flexible investment plan with an insurance wrapper, built for individuals or businesses aiming to grow their wealth over a 5 to 25-year horizon.

Policy management is available around-the-clock via your Hansard online account, and withdrawals are free of penalties at any time.

Ascend offers a loyalty bonus of 0.6% per annum from day one. It jumps to 1% per annum after 10 years or once you’ve contributed for 10 years.

Who can invest in Hansard Ascend?

Eligible applicants include individuals (age ≤75 at the end of the term) and corporate entities.

For life assurance contracts, the owner and life assured must be under 65 at the contract start.

The investment product targets those who want a simple and flexible online investment solution, plan to invest regularly over the medium to long term, and are looking to diversify their portfolio with international options.

How to Invest

With Ascend, you can customize your plan to suit your financial strategy.

You can contribute monthly, quarterly, semi-annually, or annually. The minimum is 300 US dollars, euros, or British pounds per month.

Top-ups can be made at any time with the same 300 minimum.

You can keep your plan in one currency or spread investments across all three major currencies.

Ascend Investment Options

The investment options include a restricted fund list.

To help control risk during market swings, you can choose the Deposit Fund or customize your investment strategy with access to Hansard Unit-linked Funds.

You also get to choose how your plan is set up: life assurance or capital redemption, based on where you live.

The life assurance option has no fixed end date and will pay out 100.1% of the contract value to your beneficiary or estate upon death.

Meanwhile, the capital redemption contract has a fixed term of 99 years and do not include life cover. Upon the owner’s death, the policy continues under the beneficiary or estate until the term ends or it is surrendered.

Hansard Ascend Charges

The Ascend fees that apply include:

✔️Annual Management Charge

- Initial Units: 7% per year

- Accumulation and Loyalty Bonus Units: 1.2% per year

✔️Service Charge

- Active Contracts: 9.50 USD / 7 GBP / 9 EUR per month

- Paid-Up Contracts (when contributions stop during the commitment period):

28.50 USD / 21 GBP / 27 EUR per month

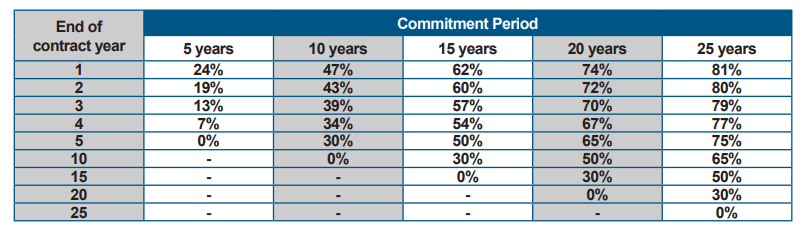

✔️Termination Charge

If you cancel early, you’ll be billed the annual fees that would’ve applied for the rest of the term.

✔️Other Potential Costs:

- Underlying fund charges

- Bank transfer fees

- Credit card fees

- Currency conversion costs

- Mandated agent/advisor fees

Pros and Cons of Hansard Worldwide Ascend

Ascend Hansard Investment Benefits

- Decide how frequently to contribute.

- Top-ups can be made any time.

- Various international funds are made available.

- The life assurance option includes a built-in death benefit.

- Provides a loyalty bonus

- No penalty costs for withdrawals

- Offers easy online account tracking

Ascend Investment Risks

- Initial units are subject to higher annual charges.

- Ending your contract early would result in exit charges (termination fees).

- Returns depend on market outcomes and are not guaranteed.

- Although flexible, the plan targets medium- to long-term commitment.

- Should the company become bankrupt, there is no fallback compensation.

- You could earn more with this Hansard plan, but it involves a higher level of risk which could result in capital loss.

Overall, it is a decent product, but better options exist.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.