JH Balanced Class Fund Review – that will be the topic of today’s article.

Discover how to invest in the JH Balanced Class Fund, similar to the Hansard International Universal Personal Portfolio.

Nothing written here should be considered as financial advice, nor a solicitation to invest.

For any questions, or if you are looking to invest as an expat, you can contact me using this form, or via the WhatsApp function below.

Introduction

Nothing written here should be considered as financial advice, nor a solicitation to invest.

For any questions, or if you are looking to invest as an expat, you can contact me using this form, or via the WhatsApp function below.

John Hancock Life Insurance Company, USA is an insurance company headquartered in Boston. Founded on April 21, 1862, it was named after John Hancock, an eminent patriot.

In 2004, John Hancock was acquired by the Canadian life insurance company Manulife Financial. The company and most of Manulife’s US assets continue to operate under the John Hancock name.

On April 21, 1862, the charter of the John Hancock Mutual Life Insurance Company was approved by John A. Andrew, Governor of Massachusetts.

There was not always a standardization of how the name of the company was mentioned. For example, in a 1912 John Hancock advertisement, the company is referred to as the John Hancock Mutual Life Insurance Company, but in some John Hancock advertisements and newspaper articles from the 1930s, it is referred to as the John Hancock Life Insurance Company. However, 1940s sources again refer to the company as the John Hancock Mutual Life Insurance Company.

In 1972, Dr. Mary Ella Robertson was named the first black woman and the first woman to sit on the John Hancock Council.

In 2000, under the leadership of David F. D’Alessandro, the company was “demutualized,” which meant that the John Hancock Mutual Life Insurance Company formally ceased to exist and a new company was formed called John Hancock Financial Services, Inc. was born.

Policyholders received shares in the new company in exchange for giving up ownership of the old one. Life insurance continued to be marketed by an organization known as the John Hancock Variable Life Insurance Company, a subsidiary of John Hancock Financial Services Inc. On January 27, 2000, Hancock began trading on the New York Stock Exchange under the symbol JHF.

On September 29, 2003, Manulife Financial announced its intention to acquire John Hancock for $ 10.4 billion. The combined company will be headed by D’Alessandro, but he will step down in June 2004. The sale also included John Hancock’s Canadian subsidiary, Maritime Life; it was integrated into the Canadian operations of Manulife.

John Hancock Life Insurance Company (USA) provides insurance and financial services. The company offers life insurance, mutual funds, college savings, long-term care, retirement services, and institutional investment products. John Hancock Life Insurance serves clients in the United States.

For almost 160 years, people have trusted us because we are honest, reliable, and 100% loyal to their customers. And you can count on them to do the same, whether you are interested in investment, insurance, retirement, or financial advice.

For the finance professionals who help them deliver on that promise, their goal is to make your job as easy as possible by providing you with the tools and solutions to help you improve the lives of our clients. Because while their heritage is rich, they always strive to think forward.

For the company’s clients, this means an emphasis on listening and understanding each person’s unique situation so that they can truly meet you wherever you are. This means offering advice and solutions only after listening to all your wishes, needs and concerns.

What is a balanced mutual fund?

Before we get to an overview of the JH Balanced Class Fund, let’s first figure out what is a balanced mutual fund.

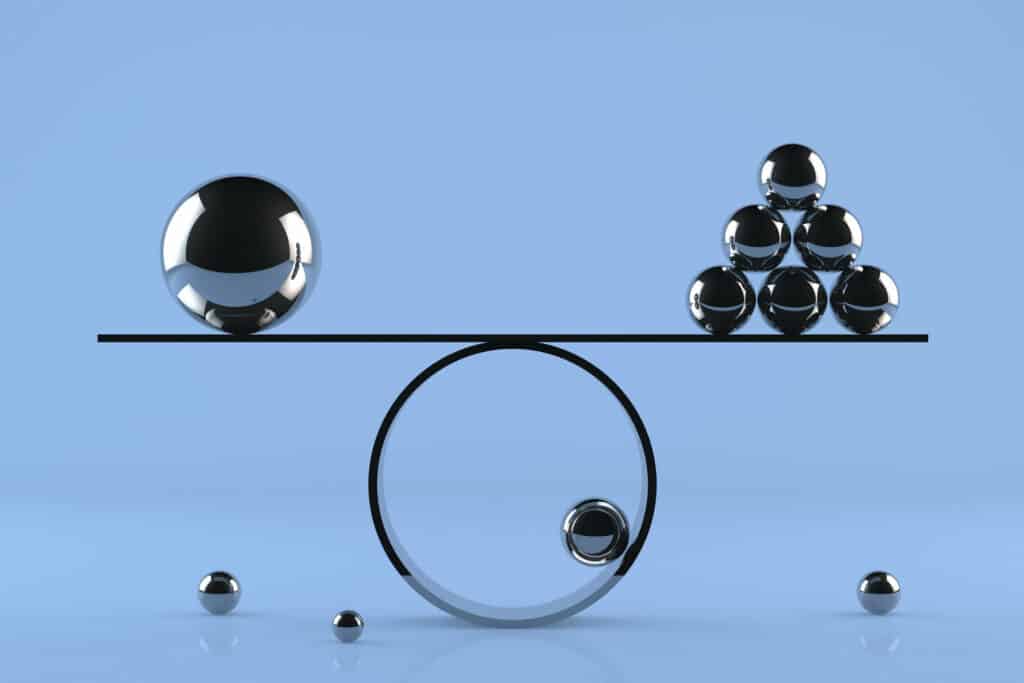

Financial experts have always advised investors to have a diversified portfolio that includes investments in various asset classes and securities. Diversification helps to reduce the risk associated with various investments; however, in their quest to diversify their portfolio, investors often end up making low-return or risky investments. Wouldn’t it be surprising if there was a method that allows investors to invest in equity and debt instruments both through a single fund? Well, there is, namely, balanced mutual funds.

Balanced funds, that are usually being called hybrid funds, are considered as a class of mutual funds that includes a bond component and an equity component at a specific ratio. These mutual funds help investors diversify their portfolios by investing in asset classes such as stocks and debt. Typically, hybrid mutual funds stick to a relatively fixed mix of bonds and stocks.

Balanced funds are a versatile investment option that offers access to both equity and debt securities. The main goal of these mutual funds is to balance the risk/reward ratio and optimize the return on investment in mutual funds. Thus, balanced or hybrid mutual funds are ideal for investors looking for capital gains with minimal risk.

Features of balanced funds

Below are some of the main features of Balanced Funds:

- Investing in balanced funds gives investors the opportunity to diversify their portfolio as these funds invest in a variety of instruments, including equity and debt assets.

- Balanced mutual funds invest in debt and equity instruments in a combined ratio, thereby minimizing the investor’s exposure to risk.

- Investing in hybrid funds allows the fund manager to adjust the fund’s portfolio in accordance with market conditions.

- Balanced mutual funds carry less risk than pure stock mutual funds.

- These mutual funds are designed to automatically rebalance an investor’s portfolio in the event of sharp market fluctuations. Rebalancing gives the fund managers the opportunity to sell stock mutual funds to keep the fund performance and vice versa.

JH Balanced Class Fund Overview

The fund is committed to recurring income, long-term capital and income growth, and capital preservation. The fund invests at least 25% of its assets in equity securities and at least 25% of its assets in senior debt securities. The fund allocates its investments among a diversified mix of debt and equity securities.

Strategy

Under normal market conditions, the fund invests at least 25% of its assets in equity securities and at least 25% of its assets in senior debt securities. The fund distributes its investments among a diversified mix of debt and equity securities, including securities of other investment companies that invest in debt and equity securities.

Risks

Stock markets are volatile and may decline significantly in response to adverse events related to issuers, political, regulatory, market, economic or other events. These risks can be increased in overseas markets. In general, the bond market is volatile and fixed income securities carry interest rate risk. (As interest rates rise, bond prices tend to fall, and vice versa. This effect is usually more pronounced for long-term securities.)

Fixed income securities also carry inflation, credit, and default risks for both issuers and counterparties. Further information on the risks of this product can be found in the brochure or other product materials, if available.

Who Should Invest in JH Balanced Class Fund?

This mutual fund is ideal for those investors looking for income and average capital gains from their mutual fund investments. People with a low-risk tolerance, such as retirees, can invest in this mutual funds to balance risk and return.

Typically, equity mutual funds follow a variable distribution of assets in accordance with market conditions. Hybrid funds have an advantage over equity funds because they strictly adhere to their asset allocation rules and never exceed established risk limits. This is the reason why hybrid funds generate higher returns on their equity component during bull markets.

How to Invest in JH Balanced Class Fund?

In case you are interested in investing your funds in JH Balanced Class fund, you can get a professional advisory from our team, just by clicking here and submitting the form.

If you are wondering how to buy balanced funds, today, you can easily buy balanced products from the comfort of your home. Just follow these steps to start your hybrid fund investment journey:

- Open an online account with AMC (Asset Management Company)

- Complete all KYC formalities

- Enter the required details as required

- Select a fund and transfer the amount

You can create a permanent instruction at your bank if you want to invest via SIP.

Balanced or hybrid funds have gained immense popularity among investors over the past few years as they provide the best of both worlds. If you are new to the world of investing, choosing balanced funds can be the starting point of your journey to investing in mutual funds.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 354.2 million answers views on Quora.com and a widely sold book on Amazon