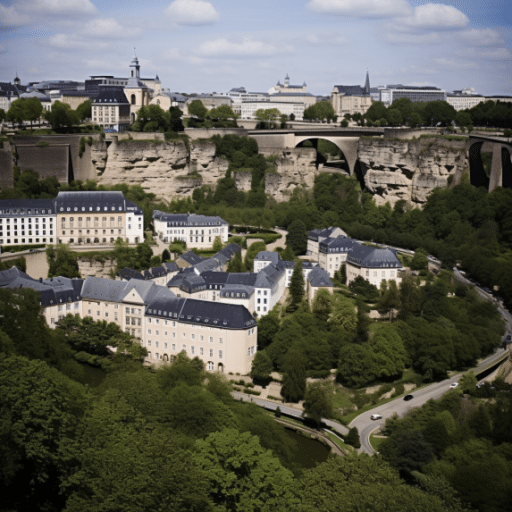

This article will review a platform in Luxembourg, Moventum platform.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Who are Moventum?

Moventum is a financial services company coming out of Luxembourg. They trace their origin back to 1986. They use the Banque de Luxembourg’s as the underlying trading system.

They have private clients who come to them directly, including high net wealth ones.

Many of their clients, however, are introduced from various independent financial offshore advisors, focusing on the expat market.

Where is Moventum sold?

They are sold worldwide in Qatar, Hong Kong, Singapore, Malaysia, China and other expat destinations.

They have been increasingly sold within the last decade or so, within the offshore financial advisory community.

What are the minimums?

Individual brokers have their own minimums, but there are no minimum’s on the Moventum Platform.

What currencies are accepted?

EUR, USD, GBP, CHF, AUD, NZD and JPY are all on the platform.

What are the fees?

Fees depend on what the advisor charges.

That is agreed with the client.

What are the positives about Moventum?

1. It is well-regulated in Luxembourg, although pretty much all offshore locations now have good investor protections these days.

2. It isn’t as high cost as some platforms if the right funding structure is put in on day one.

3. They use good technology and have extensive fund choices.

4. The platform itself is fine. It is how it is used that counts.

5. There is some limited government protections for the assets.

What are the negatives about the platform?

1.It is sometimes difficult to open accounts if you are based in some places

2.Your relationship with your advisor is key, as this is an advisor-led platform. If the portfolio construction makes sense for your individual situation, you might get a very different result compared to if you are in unsuitable investments.

Are there charges for getting out of this product?

Different structures can be put in place when it comes to withdrawals. It is possible to have a structure which is completely open, from a withdrawal perspective.

Other structures have withdrawal fees.

What have been some of the best performing funds on this platform?

It depends what time period you pick. In recent years, US Markets and funds have outperformed.

That hasn’t always been the case, and won’t always be the case going forward.

Conclusion

This can be an excellent platform if used well and correctly.

Further Reading

RL360 Quantum Savings Plan Review

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

i am very interested