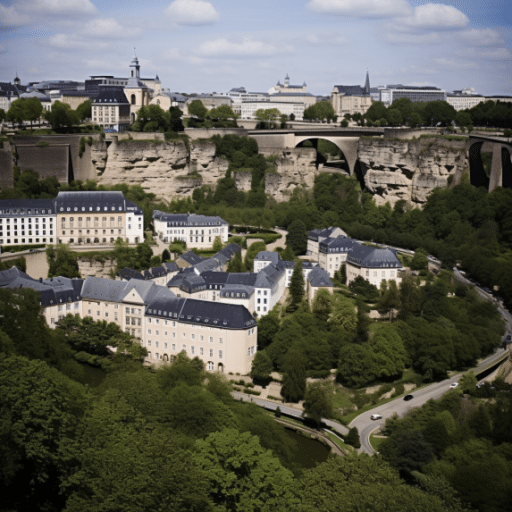

This article will review a platform in Luxembourg, Moventum platform.

If you have an investment here, or are thinking about buying, and would like a conversation please via email (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

Alternatively you can contact me in the chat function below.

Who are Moventum?

Moventum is a financial services company coming out of Luxembourg. They trace their origin back to 1986. They use the Banque de Luxembourg’s as the underlying trading system.

They have private clients who come to them directly, including high net wealth ones.

Many of their clients, however, are introduced from various independent financial offshore advisors, focusing on the expat market.

Where is Moventum sold?

They are sold worldwide in Dubai, Qatar, Hong Kong, Singapore, Malaysia, China and other expat destinations.

They have been increasingly sold within the last decade or so, within the offshore financial advisory community.

What are the minimums?

Individual brokers have their own minimums, but there are no minimum’s on the Moventum Platform.

What currencies are accepted?

EUR, USD, GBP, CHF, AUD, NZD and JPY are all on the platform.

What are the fees?

This is a key point. As most investors are with different brokers, investor A could be paying 4x more than investor B.

Sounds incredible, but let’s look at a simple example, to illustrate the point.

Greg pays a 0.75%-1% broker management fee + 0.1% for index funds + the Moventum platform fees.

David is paying 1%-1.5% management fee + 1.5%-2.5% for actively managed fees + the Moventum platform fees.

Greg is paying around 1%-1.5%, whilst David is paying up to 4.3% per year.

Over a period of 5–10 years, this could make a huge difference.

What’re the positives about the platform?

1. It is well-regulated in Luxembourg, although pretty much all offshore locations now have good investor protections these days.

2. It isn’t as high cost as some platforms if the right funding structure is put in on day one.

3. They use good technology and have extensive fund choices.

4. The platform itself is fine. It is how it is used that counts.

5. There is some limited government protections for the assets.

What are the negatives about the platform?

1. Some clients are paying high fees, due to the charging structure chosen by their broker on day 1, or indirectly due to the funds that have been picked.

2. Extensive fund choices sound great on paper, but this also means that many clients are put in the wrong investments. It is important to, therefore, pick the right advisor.

3. If you have been introduced by a financial advisory company, your mileage my vary. In practice this means you may have a great or bad experience, like in any other industry or service, depending on the firm you are with.

Are there charges for getting out of this product?

Different structures can be put in place when it comes to withdrawals. It is possible to have a structure which is completely open, from a withdrawal perspective.

Other structures have withdrawal fees.

What have been some of the best performing funds on this platform?

It depends what time period you pick. In recent years, US Markets and funds have outperformed.

That hasn’t always been the case, and won’t always be the case going forward.

Are most clients happy?

Some are happy. This tends to be the ones in sensible investments within the platform.

The unhappy ones have often been put in high-cost and opaque investments.

For unhappy clients, if there are charges for getting out of the product, what can I do?

It depends on each case. In some cases, reducing the management fee and fund charges can make a difference.

For instance, if somebody has already been invested in funds within the platform for 5 years+, the exit charges don’t apply any longer.

In such cases, simply reducing the fees within the platform, could increase performance.

For other clients, encashing the money could make sense, depending on many factors, such as comparing the charging structure with alternative platforms.

Conclusion

This can be an excellent platform if used well and correctly.

The negatives only tend to come if you have appointed the wrong advisor who has picked unsuitable investments.

Further Reading: RL360 Quantum Savings Plan Review assesses diversified investment strategies, aligning with considerations in the Moventum Platform Luxembourg Review.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.

Further reading

What are some of the investment options for UK expats? The article below discusses this issue in more detail.