Nutmeg Review – should you buy in 2022? That will be the topic of today’s article.

More specifically, is Nutmeg a good investment vehicle for your money as a beginner investor in 2021?

If you want to invest or ask me some questions, you can contact me using this form, or use the chat function below.

For those that prefer visual content, the video below summaries the content:

Robo Advisory Growth in the UK

Recently the use of robo advisors is continually growing in the UK.

Various investing public segments have already adopted the robo advisors’ service for different logical reasons. They planned a perfect strategy to work with robo advisors, which helped rationalize the process and effectively decrease costs.

They are being preferred by many people as the fees are pretty cheaper compared to traditional financial human advisors.

Robo-option is also a good match for millennials, as it provides a feeling of comfort to hesitant investors.

Plus, let’s mention again that robo advisors are cheaper than human ones, and this factor is definitely a good one to attract people’s attention.

However, as this field became enough popular, it is expected that there are a lot of unverified and untrustworthy advisors, who are dangerous to deal with. And this kind of situation makes it harder to choose the right financial platform to use.

In this review, we will cover Nutmeg, take a closer look at the idea of robo-advisors, the terms of use, and all the details you should know.

We will also speak about some of the positives and negatives of robots advisory, and Nutmeg.

1.Nutmeg Overview

Let’s start with the explanation of robo advisors. It is a digital platform which suggests financial or investment management that is based on algorithms and market analysis.

Nutmeg is the UK’s widest robo advisor and the first online financial investment management service, which dominates the market with its almost £2 billion of assets under a strong management.

This company was founded by Nick Hungerford and William Todd in 2011 and the main reason that motivated them to develop a company like Nutmeg was a lack of transparency in the investment field. So they built a perfect and easy way for others to invest which is called Nutmeg.

Nutmeg is a large and multifunctional company, which offers completely different services to different segments of people.

It offers Individual Savings Account (an investment option cultivated by the government), and the advantage is free-tax allowances. Besides, Nutmeg’s robo advisors offer Pension, General, Lifetime ISA, Junior and Stocks & Shares ISA investments.

Nowadays, the company has about 60 K customers, moreover in the last year the amount of investments reached £45 million which is a real big result.

This kind of increase pushed the company to the international market.

Nutmeg’s strength is based on the algorithms and in-house investment team they have, due to what they are able to provide individual investment portfolios.

The portfolio diversification is a result of different measures of invested funds, each portfolio that is being chosen for an individual depends on their risk.

- How Nutmeg works?

If you sure you want to become a part of this big investment platform just enter https://nutmeg.com/ and start setting up your account.

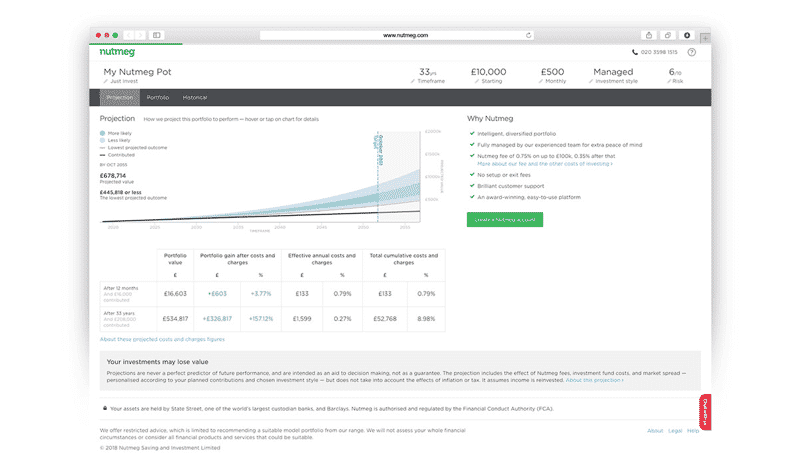

Once you have opened up an account, the interface looks like this:

To rapidly determine your type as an investor Nutmeg has prepared some questions for you, and the first is about your goals and an amount you are ready to invest.

Then the algorithm we were talking about will choose a portfolio for you which can help you reach your goals. Usually the funds you invest are being added in an enormous range of different funds, which gives you a chance to have higher profits.

Nutmeg professionals choose the investments from about 2000ETFs, after they select the best matching ETF for every asset and other factors like type of ETS, costs or the trading volume.

Although your funds are being automatically invested, but the pools for them are selected by human investment managers, who are attentively looking for a suitable option to always meet the need of their customers.

As you have already understood Nutmeg users are investing funds and determine their risk level so another feature that is worth to be mentioned is the ability to change the risk level.

Now let’s talk about the Pros & Cons of the services that Nutmeg offers, and continue our journey to more detailed information.

Pros:

- First of all Nutmeg is a real strong competitor for any kind of financial business due to a lot of factors.

- Surprisingly very low fees, thanks to robo advisors.

- Quick and easy account set up.

- Transparency in the investment field.

- Perfect customer service and support.

- Nutmeg is the largest robo advisor in UK and a market leader.

Cons:

- The minimum investment is enough high especially when you choose Individual Savings Account. Minimum £500 is required for the first investment, and minimum £100 for each month until the balance will reach £5,000.

- No other researches are available, the material which is present on the official site is enough simple and basic.

- The minimum investment for a Pension Account is £5,000.

- Tradable assets options are limited, poor width.

- They are a good service for beginner investors that don’t have a lot of money. However, if you have any kind of niche areas of need, you are unlikely to be well serviced here. For example, let’s say you want high net wealth investments, expat investing advice or tax efficient investment advice, you are unlikely to find the answers here

- To follow up from the last point, it seems that this isn’t a portable option for UK expats – either non-British people living in the UK or British people planning to live overseas. So that means that in effect, you might need to close down your account if you move overseas, or at least start contributing.

- The biggest contribution towards investment returns are things like your own investment behaviour – how long you invest, for how long etc. So the fact that you can withdraw your money without penalty seems like a good thing, but might lead to people panic selling during market crashes.

- Investment Styles

After choosing your account, the next step you’ll take is to choose one of the three given investment styles – Fixed allocation, Fully managed, Socially responsible. Each of them has its advantages, differences and details you should know, also they are regularly being rebalanced and widen their ranges of risk levels.

- Fully managed – choosing this option Nutmeg’s investment team will manage your funds, regularly checking if you’ll have increased returns, and as a user you will have a wide range of available risk levels.

- Fixed allocations – when you select this investment style, you’ll get exceptionally robo services, this means no human advisors or managers. Your portfolio will be reviewed by human managers once a year to ensure your profits match your risk levels. Fixed allocation portfolios have the lowest fees, less than 40%, and this kind of style is recommended to experienced investors who will be not surprised of market’s ups and downs.

- Socially responsible – in this investment style your portfolios are being reviewed by Nutmeg’s in-house team, moreover they provide the profiles with strong stability and work with MSCI which allows a range of scores for every portfolio. The portfolio fee is the same as Fully Managed portfolios, 0.75%.

- Account Types at Nutmeg

Actually Nutmeg is cultivated for UK residents, but non-residents from some countries are also considered to use the robo advisor.

You can be a non-resident of UK, but if you have a British Passport you have all the opportunities to be a part of Nutmeg investment world.

When you want to set up your profile, you can study all the account types, features and other important points’ previews to figure out what you exactly need from the company.

To open account you will be asked to select your account type either a General Investment Account, a Stocks and Shares ISA, a Lifetime ISA or a Pension Account.

You know what’s coming after this, you have to figure out your risk level and answer some questions like what is your goal, why you invest your funds and what you’re expecting from this investment management, so the Nutmeg system could determine and recognize your type of investor. But for now let’s study the account types and its details.

- General Investment Account – you will be able to open this account after only you have already had all the tax-free accounts. It is a general account which gives you a great chance to be free from all the taxes and government incentives.

- Stocks and Shares ISA – this is a tax-free ISA that allows you to every year invest up to a fixed amount funds without paying any taxes. This account type will always keep its tax-free factor, even if it is time to sell.

- Lifetime ISA – you can approximately guess the idea of this account from its name, this is the UK’s initiative to foster and encourage people to start invest money for their future, for a house or something else. Choosing this account type you will be able to contribute up to £4000 every year until you become 50. For each investment the government is ready to give 25% government inducement. The only disadvantage of this account is that if you want to withdraw your funds before you become 60, you have to pay 25% government surcharge from the amount you withdraw.

- Pension Account – choosing this account type you get a great chance to lock all your investments until you become 55. The government continually supplements every investment you make, like about 25% in case you are a basic taxpayer. Certainly you have a possibility to withdraw your money, for the first 25% you withdraw no taxes will be paid, but for the next 75% you have to pay some income taxes. But the pension scheme allows you to withdraw your money without taxes at 55.

- Features

While setting up your account Nutmeg prepares for you some questions about your goals, expectations to determine your risk level, after that the robo advisor places your contributions into a selected portfolio via different assets and industries.

But let’s take a closer look at some features that are not being talked about so often but have a really big role in Nutmeg’s effective work.

- Two-step verification – this is one of the greatest features of these times, as nowadays there are a lot of frauds that are being committed by professional hackers. Although Nutmeg has the strongest security, the extra one will not interfere. The system allows you to install two-factor identification and it requires two form of verification before you can access to your account. Let’s agree this is a great feature for a company like Nutmeg.

- Socially Responsible Investing – Nutmeg provides this feature to cover the increasing investing access. Moreover, with this feature you will be provided with proactively managed portfolios that are based on three principles called ESG (environmental, social, general). The admissible contributions rule out companies that are dealing with some productions that are in the list of ESG issues like tobaccos, nuclear or weaponry products.

- Research tools – when you study the investment market you can see that Nutmeg online financial investment management service has plenty of research tools compared to others and this is because the company does not allow self-guided contributions and there is no any option to choose an individual investment style or account, everything is being completed by robo advisors. Anyways, you can see a page on their website called ‘Nutmegonomics’ where you’ll easily find information about markets.

- Proactively managed portfolios – this is an investment style by choosing which your contributions are being actively managed by Nutmeg’s human management team. As Nutmeg is a robo advisor and this feature is provided by human, it can cost more. This is for customers who want to work with human managers and will only feel comfortable in that way. The team follows the market trends every day and make sure your portfolio is rebalanced according your risk level.

- Financial advice – this feature represents itself a paid support from the team, you can reserve a call in advance and have a Q&A with a financial advisor about your problems and find a solution. If you take the advice this kind of support will cost you about £350.

- Customer care – another type of support for current and future customers is an online chat. It is available in working days where you can ask questions or complaint about something you don’t like.

- Nutmeg Pricing

The company’s pricing structure is pretty simple, the higher your investments, the lower your fees and vice versa.

The last reduces that Nutmeg has done were in 2017, in an attempt to increase competition in the investment market.

Furthermore, in the first year Nutmeg will run your money without any fees and this super exclusive offer makes many of the UK residents choose this platform to invest.

But now we’re about pricing and it depends on your investment style, let’s see how it works.

For example, imagine you have a fully managed portfolio and your first investment is up to £100,000, your first fee will be 0.75% on the amount and 0.35% on the portion beyond £100,000.

If your investment style is Fixed allocation, the first fee will be standard 0.45% on the amount and 0.25% beyond your funds. Socially responsible style has the same fee structure as Fully managed one.

But we are not finished with the fees, additional costs are coming.

There are Investment Fund Costs and Effect of Market Spread. You can find the latest updates on Nutmeg official website.

- More about Nutmeg investments

We’ve already mentioned that Nutmeg is literally the best and perfectly cultivated investment platform in UK and have talked about the main features and tools but let’s discuss some other points that we haven’t touched before in this review.

- Nutmeg is really a best option for beginning investors, who like passive investing system. Moreover passive investors may probably prefer a calm approach and will attentively look for a trustworthy platform for future investments, which comes with a strong support and advisory service. Often these kinds of investors prefer high returns and decreased risk levels.

- Nutmeg is easy to use, starting from setting up a portfolio which will take 10 minutes from you and finishing with other functions like checking your funds or changing your risk level. The website is pretty easy to manage, highlighting the features you want to use in the future. Support is in a high level, you can find hundreds of finance related articles and information on the site.

- Nutmeg’s first investment’s minimum amount is £500, and additional replenishment for every month is minimum £100. The first investment for Lifetime ISA and Junior ISA is £100.

- Nutmeg offers a fully designed and featured mobile app for iOS and Android systems with strong account functions. Nutmeg’s mobile app deliver is enough well-versed as it was originally founded in 2012 as a robo-based app.

- Nutmeg provides you with free educational content, blogs and recourses you’ll need to learn as an investor. The blog includes a big variety of educational articles and the blog is being regularly updated by the team, to provide people with the latest and fresh financial information.

- A lot of people definitely ask themselves; ‘Is Nutmeg worth to use?’ or ‘Is it a good feet for me?’. Okay let us help you, first of all if you are a UK resident who is looking for a platform to invest money for your future, like to buy a house, or gather money for future business investment, Nutmeg is definitely what you’re searching for. The company suggests you a solid way to invest and reasonable prices. Of course this is a robo-based system, but you have a possibility to ensure your investments to a human manager.

- Nutmeg is really a competitive company, and many of investing companies lack of the same level of Nutmeg’s offered service, that’s why the company does not face much pressure which may be noticed on the changing fees or extra services. So being a part of Nutmeg is a good advantage.

- Final Opinion of Nutmeg

As you can see Nutmeg provides a strong competitive service with many advantages which make the use easy and lovely.

Easy account set up, user-friendly tools and insights, forceful support and customer care, investments in decent hands – this is what you get from Nutmeg. Certainly this is not the first robo advisor in the market, and definitely it is expected that it could have its strong and weak angles, but the strengths lead.

Nutmeg is a perfect option for passive investors, who want to pay lower fees but get higher returns, the system offers you a perfect investment and settings options in spite of high fees and high minimum investment amount.

Besides, their business model becomes profitable day by day once they hit £1.5 billion assets under management and in 2020 it was announced that the assents amount reached £2 billion, which is a big result.

However, if you are looking for a low-fee stock investment platform than you’ve probably found it.

Nutmeg was and still is the cheapest investing online platform plus you get someone who is regularly checking the market trends and manages your portfolios.

The biggest negative about this option is that whilst it might be a great beginner option, it doesn’t service niche areas of need, like expat investing advice or high net wealth investing.

Moreover, there is some evidence that people panic sell in robo-advisory services.

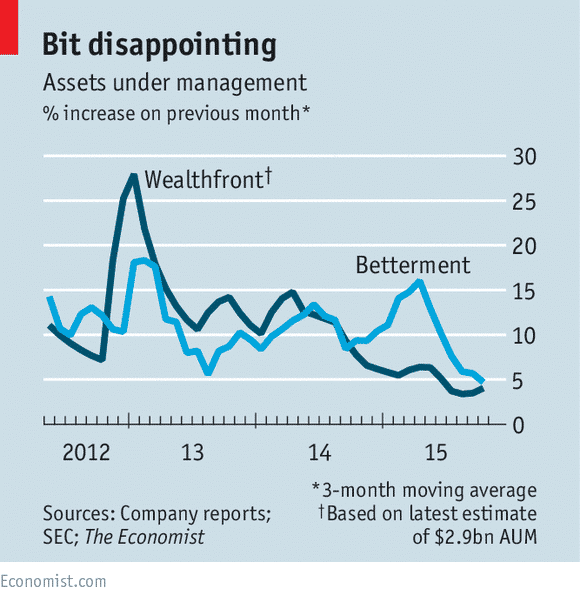

The figures below from the Economist shows that the growth of such firms has been slowing down recently – perhaps due to people being disappointed by the service or panic selling during market falls.

Whilst these stats are for US rob advisory firms such as Wealthfront, we could see similar trends in the UK with the likes of Nutmeg.

Conclusion

Does do it yourself (DIY) investing really work? That is the subject of the article below.

The evidence might shock you.

Further Reading: Premier Trust Review evaluates tailored investment solutions, aligning with discussions found in the Nutmeg Review.