Given that since I wrote this review Premier Trust Cayman are now bankrupt, it becomes especially important to review your situation.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Who are Premier Trust?

Premier Trust are a global life assurance product, offering unit-linked savings and investment plans.

The majority of the clients are in Africa, East Asia and Latin America, with a mix of locals and expats buying the plans.

If you already have this investment, or been proposed it, and are looking for better alternatives as an expat, you can contact me. My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837.

What are the main plan names and features?

Premier Trust have two solutions – principle protection and flexible.

The principle protection plans are downside-protected solutions, linked to markets such as the S&P500, MSCI World and Euro Markets. There are six market indexes to pick from overall.

The way this works in simple terms is that in the unlikely situation where some of these markets are down over the long-term, your accounts will still have a small “insured” guarantee.

There are different investment options within this family of products:

The Premier Principal Protection Series II is available in USD, Euros and Pounds and is 100% principle-protected, with a minimum $10,000 contribution. This is a lump sum product.

The Provest 10 Principal Protection Series III is a regular savings plan, which has a ten-=year term, and is 115% principle protection.

The Provest Principal Protection Series III, has the highest levels of protection, coming in at 140%, 160%, or 180% principle protection, depending on whether you pick the 15, 02 or 25 year option.

With these plans, your levels of protection are higher, the longer the term.

What are the fees like?

The fees do depend partly on the advisor, but the typical charges are around 2% per annum on the regular savings plans, reducing for the longer-term accounts.

The lump sum accounts have lower fees, with most being abolished after the initial period (usually 5-8 years) is over.

What are the positives associated with the plans?

The biggest positives about this plan are

- For conservative investors you get downside-protection. Whilst it is unlikely that you will need this protection, it gives emotional support in difficult market conditions

- The 180% principle protection is the highest in the industry. Again though, it is highly unlikely that you will need it.

- There is a segregation of clients assets, which means that your money should be secure if they go out of business. This is a standard for most firms in the offshore industry, and can be found elsewhere.

What are the negatives?

- The lump sum product doesn’t have any strong unique selling points. The protection is low, and assets available small.

- You can get the same protection elsewhere, with other benefits

- The plans are expensive compared to some of the alternatives on the market

- You do have to pay into this solution until the end to get the principle protection. If you stop paying in, this causes problems in the plan. So, although the plan might looks flexible on paper, with the ability to make withdrawals “free of charge”, that doesn’t mean that doing so is without consequences.

- Premier Trust had a regulatory issue in the Cayman Islands, which they have apparently worked their way through. This does show, however, that newer life companies can have issues which some of the more established players don’t have.

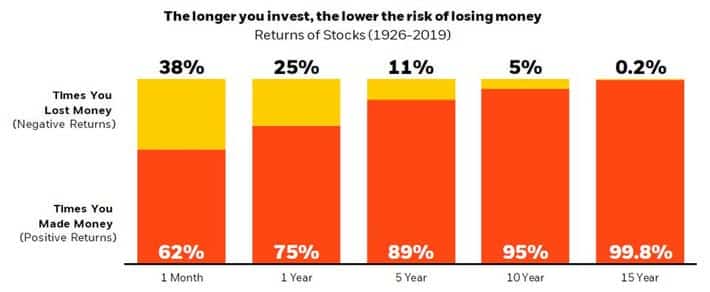

- Stock markets do tend to go up over time. As per the graph below, you probably don’t need the downside-protection on the S&P500:

Conclusion

This can be an excellent solution, for a small number of clients, in very limited situations.

For the majority of people, better solutions exist in the market.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.