This article will review Sarwa Dubai to find out if it is a good investment option.

More specifically, this article will ask if Sarwa can reduce or eliminate the so-called behavior gap that has cost most do it yourself (DIY) investors dearly over the years.

The behavior gap and how firms are trying to prevent it

The father of low-cost investing, Vanguard’s Jack Bogle, mentioned in his book (below) the one big drawback of DIY investing: people behave irrationally.

Net inflows during 1999 were at their highest for so-called “buy and hold” Vanguard index funds, and outflows went through the roof during 2008 and March 2020.

In other words people “bought high and sold low” even though most people pledge they won’t be “that person” that panics during a market crash.

Even worse, as this book below states, people are very likely to:

- Buy Amazon stocks if they live closer to the warehouse (familiarity)

- Invest in firms from their home country (home country bias/familiarity bias)

- Overestimate their previous investment returns (hindsight bias)

All too often, people get seduced by stories like “this time is different” after every market crash.

We heard similar stories after this crash – “this is a pandemic so this time is different.”

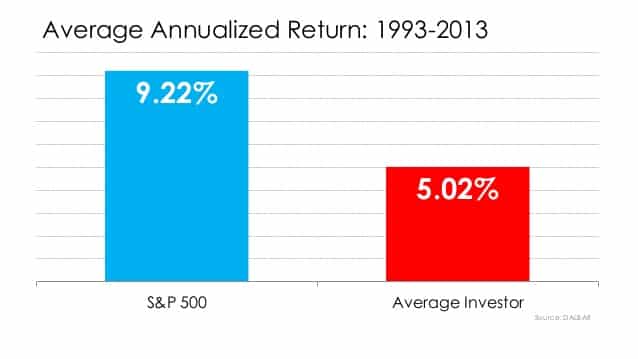

These kinds of emotional behaviors help explain the results below:

So robo-advisory firms are trying to fill this gap. They are trying to stop people from making stupid decisions with their money by automating the process.

This review will consider whether they do that effectively. Personally, I think they work great for some investors.

But the average investor is a human, of course, with known emotions such as fear. It during moments like the market downturns in 2020 and 2022, that we learn that the human nature can work better.

Or put in a more blunt way, it is harder to sell out if a human advisor is screaming at you, telling you not to do it, versus a screen.

The niche firms like Sarwa Dubai sit in

As a broad generalisation, these robot-advisory firms are more pitched towards the mass market and smaller investors.

Higher net worth individuals and those with specific tax needs like wealthier expats are less likely to use such solutions.

Sarwa, the Sheikh among robo-advisors, the Dubai algorithm

Sarwa, as Nutmeg, WealthSimple, Wealthify and many others, is a robo-adviser, meaning that it is an online investment service that uses algorithms to sort the ideal shares, bonds, ETFs that most suit to your risk preference, and therefore, also earning expectations, allowing you to enter the market for a reasonable price and to make some profit in preparation to your retirement.

Sarwa is a global provider regulated by the Dubai International Financial Centre and you can open your account from a vast number of countries. Its aim is to make investment simple to everyone, targeting low, medium and also medium-high income individuals, in fact, you can start investing with as little as $500 or over $500,000.

They work at competitive prices, their management fee is between 0.85% to 0.5% depending on your capital and 0% on your first $500.

And your portfolio is tailored to your financial goals in life and to the approach you want to take against risk, they say that they don’t pick stocks trying to time the market. They cut the noise and focus on building your long-term savings. And, if you want to withdraw your money, you can do it!

Sarwa’s interface and promises

Sarwa is designed to be extremely simple and understandable by the masses. Their website and app are some of the simplest you can find on the market and you can spot all the details you’re looking for within seconds.

Sarwa also features a detailed demo account you can study to have an idea of the yearly return projections you can expect with them. In this demo account, you can see the portfolio composition, projected gains, past performance, target allocation and activity status.

From the demo account they’re offering, you can notice that they invest your money majorly in the US stocks, developed market stocks, emerging markets, US real estate, US bonds and global bonds.

At the end of the page, there’s a calculator you can use to calculate how much you can expect after 5-10-15-20-25-30 years by inputting your starting amount, the risk level you’re wanting to take and the monthly amount you want to add.

Sarwa compares itself against the traditional investor and against savings accounts showing that they perform much better, promising a:

- 4.50% with the conservative risk level;

- 5.25% with the balanced risk level

- 6.00% with the growth risk level.

They say that traditional investors, based on a PCI index analysis, make only:

- 3.9% with the conservative risk level

- 4.3% with the balanced risk level

- 4.6% with the growth risk level

They say that savings accounts in 2018 worldwide offered generally:

- 0.5% with the conservative risk level

- 0.5% with the balanced risk level

- 0.5% with the growth risk level.

When you invest with Sarwa, your assets are actually held by the US-based interactive Brokers broker. In other words, Interactive Brokers executes trades and holds your cash and securities. Interactive Brokers is regulated by the SEC and is a member of the SIPC.

Therefore, all investment accounts at Sarwa are protected SIPC products. SIPC protects the securities of an account up to $500,000 against insolvency or bankruptcy.

Moreover, all your data is protected with 256-bit encryption. And as stated before, they are regulated by the Dubai Financial Services Authority (DFSA).

Sarwa compared with other robo-advisers

Surprisingly, even if Sarwa is still new to the market, it offers much better return rates than Wealthify, Nutmeg, Wealthsimple and so on, almost making as much as the market is making every year. At the same time, they add a characteristic feature, the human element.

In fact, Sarwa is not just a robo-advisor that dictates on your account what to buy and what to sell, but they also have real financial advisors that can get in touch with you for any need you may have.

Their advisors can talk to you about your time tested and proven investment strategy and can help you meet your financial goals whether it is saving for a house, planning for your family’s future, or going to holiday.

What investments does Sarwa offer?

For each of your financial objectives, Sarwa recommends a specific stock-to-bond allocation of their recommended portfolio strategy. This portfolio strategy is designed to reflect the total world market to help maximize expected returns while minimizing risk. Alternatively, you can also select from two other portfolio strategies that might match your investing views:

1. Sarwa halal, their BlackRock sharia-compliant portfolio strategy.

2. Sarwa SRI, their socially responsible portfolio strategy.

Sarwa offers you 7 types of risk levels, very conservative, conservative, moderate conservative, balanced, moderate growth, growth and aggressive.

At the same time, it proposes three different approaches. Wealthify allows you take a standard approach by buying any kind of share in your risk level and an ethical approach, meaning that your investments won’t go for institutions that are suspected of child labor or something similar.

Sarwa offers 3 approaches, also considering the Islamic tradition, the Conventional, Halal and Socially responsible.

Sarwa diversifies your investments mainly using Exchange Traded Funds (ETFs). They invest in:

- Large and medium-sized companies across major developed and emerging countries

- Fast-growing small companies in the US, Europe, Japan, and emerging markets

- Government and corporate bonds globally that provide steady income, low historical volatility and low correlation with stocks.

When they invest your money they try to:

- Invest in the stock markets of over 40 countries covering 90% of the world’s market

- Buy best class ETFs from top fund managers such as Vanguard and BlackRock

The intent of Sarwa is passive investing. For them, tracking the market over time using a diversified portfolio is the most reliable way to grow money long term.

They choose low-cost ETFs and only charge a small annual advisory fee on what you invest, and if you choose the ‘’very conservative’’ approach, it’s all bonds, US and global bonds.

How much does it cost to use Sarwa?

They say that other traditional financial manager accounts ask for a 2% and this is true, we have already written about Investec and how expensive is the service they are currently offering.

On the other hand, Sarwa is relatively quite cheap and you can expect to pay a low advisory fee between:

- 0.00% up to $500 invested

- 0.85% up to $50,000 invested

- 0.70% up to $100,000 invested

- 0.50% over $100,000 invested

Their advisory fee is less than a quarter of the industry average in the region. Also, you have to add just 0.07 to 0.15% of fund fees, as they select low-cost investment funds when building your portfolio. In case your portfolio is worth less than $2,000, you will have to pay a bit less in ETF fees, like 0.10%.

Except for the fees presented above, you won’t pay anything for:

- Being inactive

- Initial setup charges

- Platform fees

- Auto dividend reinvestment

- Trading or broker charges such as commissions

- Account changes

- Rebalancing fees

- Exit fees

- And performance fees.

Comparison with traditional investments on regulated brokers

We do have to consider that Sarwa is designed for the newbies to the world of investments. It is easy to use and transparent.

Also, your aspirations have to be modest as your knowledge in finance is minimal, therefore your earning expectations act accordingly, in fact, these yields are not even close to what Warren Buffet is making, but it prevents you from losing money because of inflation and in exchange, it is better than keeping your money in the bank and not using them, as the PCI index suggested.

As we stated earlier the maximum expected yield return with the adventurous plan is 6%. The global economy grows on average by 7% annually so we are slighlty underperforming the market by choosing Sarwa, though, other robo-advisors offer much weaker results, such as 2-4%.

Generally, it takes just 1-2 hours of research to find better portfolios that best suit your age. Let’s dive into how they are chosen!

What do the real investors purchase?

Typically, the rule goes like this:

- Governmental bonds these days yield between 0.25% to 2% as the government always prints money in case they do not manage to repay their debt towards investors;

- ETFs are a set number of companies that belong to the same industry, like an ETF that contains 100 of the best performing airlines in the world, so if one fails, the overall trend is still up-trend and therefore less risky as it is diversified.

- Individual shares are riskier than most index funds, ETFs and bonds because they could perform both negatively or extremely good and generally you buy them individually so you must know what you are doing and do the research to be sure that the company will still exist in the future.

How is a portfolio determined from your starting age?

Generally, the younger you are the riskier investments you can take, therefore much more shares you can purchase; as you get old you want to preserve your investments or savings for your retirement so it is better to move your money towards ETFs and Governmental bond or just stick to 40% of shares, but less risky shares that pay dividends to add to your pension.

Vanguard ETFs

Vanguard ETFs have increasingly become more and more popular for their risk-reward ratio. As we stated before, the global growth ratio is currently around 7%, similarly to what Sarwa is offering but much more than the average other robo-advisors are offering.

There is a single Vanguard ETF that could be sufficient to single-handedly eliminate most of these robo-advisor competitors if the people made some research.

The Vanguard Total World Stock ETF is an extremely diversified ETF that makes us richer as our planet progresses, and our economy is always on an up-trend, never on a long term down-trend, or otherwise, we would reverse in time and technology towards the Stone age. This is what this Vanguard ETF offers:

- Invests in both foreign and U.S. stocks.

- Seeks to track the performance of the FTSE Global All Cap Index, which covers both well-established and still-developing markets.

- Has a high potential for growth, but also high risk; share value may swing up and down more than the U.S. or international stock funds.

- Only appropriate for long-term goals.

Sarwa’s customers and their opinions

What do the customers of Sarwa think of the performance of this robo-advisor? Here you can find their TrustPilot webpage https://www.trustpilot.com/review/sarwa.co, though, they are only 5 and could be bot-generated as they seem quite fake.

If you want to have more insights about how they are performing with their customers, it’s better to look at the review on Google Reviews. Here they score an outstanding 4.9 out of 5 with over 121 reviews. Therefore, we will be considering only 5 recent positive feedbacks and 1 negative for the sake of proportionality.

Here are the last 5-star reviews they received:

5-star review: Sarwa provides affordable and accessible investing to everyone whether you are new or an experienced inverter. The customer service and transparency are exceptional. The staff is always available to help clients and there is nothing hidden about your investment funds or costs.

5-star review: I have been using Sarwa for almost one year now and it has been a rewarding experience in my financial history!

5-star review: If you do not have any financial knowledge, I recommend you Sarwa. They have absolutely the best customer service and a diverse range of products that will for sure make returns for you. I have made money just by sitting at home with Sarwa.

5-star review: Been with Sarwa for 2 months and already have been seeing a very impressive return on my portfolio. Not to mention the excellent customer service and a general sense that they truly care about their clients.

5-star review: As someone who is new to investing I definitely recommend Sarwa. A straightforward online platform, complete transparency, reasonable fees and great customer service.

And the last 1-star review they received:

1-star review: I have been with Sarwa for half a year now. I hate that the funds distribution are pre-determined while the allocations are automated based on the first initial survey. There’s no active market analysis while and no fundamental monitoring on the accounts against global trends. I don’t get where’s the diversification and the great human advice.

What are the advantages and disadvantages of Sarwa Dubai?

Advantages ++

- Sarwa is a Dubai-based company but it serves worldwide and it administers your money through Interactive Brokers, all investment accounts at Sarwa are protected SIPC products. SIPC protects the securities of an account up to $500,000 against insolvency or bankruptcy.

- Sarwa, compared to the robo-advisors you can find on the market, is much cheaper, transparent and easier to use. Moreover, the return you can expect with the Growth plan, is really close to what the stock market makes annually, meaning that Sarwa closely matches the movements that are happening and takes advantage of them.

- Sarwa relies mostly on ETFs and US and Global bonds which happen to be quite economic and deliver long term results outperforming the traditional investor and by far the typical savings account.

- Sarwa offer extremely competitive fees

- Customer support seems extremely friendly and professional.

Disadvantages —

- Sarwa is a robo-advisor, hence you completely rely on their algorithm and can’t choose your stocks, ETFs and bonds. Funds distribution is pre-determined while the allocations are automated based on the first initial survey.

- If you live in the USA or UK, there are no Roth IRA or ISA plans for you. For tax-efficient options, you should call the support team.

- They do not seem to offer anything to expats living abroad.

- Sarwa invests mainly in the US stocks and bonds.

- All their reviews have been extremely positive so far. Some of them, especially the negative ones, being people that are not educated in finance, seem happy with a 2 months increase or are unhappy with a 4 months decrease as they don’t understand the cyclicity of the market.

- They don’t service niche’s like high net wealth individuals well enough

- The whole point of a robot advice firm is to prevent people making stupid decisions like most DIY investors make. However, the fact that you can pull out all your money quickly and easily, can be a double edged sword. It is both a positive and negative. The early indictions are that many people panicked during the March 2020 crash

- They tend to use Interactive Brokers as the platform. This increases the risk of US estate and withholding taxes. For expats especially, it often makes sense to be in a 0% capital gains environment, outside the US.

Sarwa Dubai Review: What’s the bottom line?

Firms like this are good for beginning investors with relatively small amounts of capital.

The negative is that there is no indication that robo advisory firms can reduce the “behaviour gap” as well as traditional firms that can do things online.

The signs from the March 2020 crash is that investors in both DIY platforms and robo-advisory firms were more likely to panic than those with a human adviser.

The same is happening during the 2022 correction, after the interest rate hikes and war in Ukraine.

Or let’s put this another way. Regardless of how good the solution is, it is pointless if you will just pull out your money during market crashes and invest more during the good times.

Everybody says they won’t do it, but the statistics from March 2020, March 2008 and 1999, all indicate that people in reality do panic.

A human adviser can often close this behaviour gap more effectively.

In the market crash of 2008, the average human advisor lost less clients than robo advisory firms.

For this reason the lack of exit fees from these solutions are a double edged sword.

Further Reading: Dominion Capital Strategies Guernsey Review delves into tailored wealth management solutions, similar to insights considered in the Sarwa Dubai Review.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.