This article will review St James’s Place, an FTSE100 wealth and fund management company in the UK. It will also discuss the positives and negatives of investing with the firm.

For those that prefer visual content, this video summarizes the funds and company.

There are usually superior options available in the market.

Who is St James’s Place?

St James’s Place is originally a British company and still have their HQ in the country, but also now have offices in Singapore, Hong Kong and Shanghai, targeting expats.

There are two ways to gain access to their funds. Firstly, you can invest directly with them.

Second, their funds are available on countless DIY platforms, especially in the UK.

In addition to fund and investment management, St James’s Place offer additional services, such as mortgages and protection products like insurance.

They claim that their advice is guaranteed and that adds compliance benefits, and to have won many awards.

They have over 4,000 advisors in the partnership, with 730,000 clients and billions of assets under management.

A lot of these assets have come in recently from mergers and acquisitions, both in the UK and overseas.

If you want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

What are the typical costs?

The costs vary but typically are:

- Up to 5%-6% to get in – upfront cost.

- Ongoing charges of up to 2.5% per year. This includes fund fess.

- There are sometimes exit fees. This isn’t the case with their unit trust funds but is relevant for pension and bond products.

There has been some contradictory information online, with some people suggesting that the upfront fee is included within the ongoing fees, and others saying that isn’t the case.

Either way, the fees are above the industry average, and this lack of transparency has caused a far bigger issue, with negative public relations and media reports.

One of the most prominent examples is the consumer advocate group, Which, that has criticised how opaque some of the fees are, whilst others have critiqued some of the trips and incentives for advisors.

Some of these claims are unwarranted or exaggerated, but there is certainly a lot of room for improvement.

With that being said, St James’s Place have announced that they will review their fees and change them in the next few years.

Are the fees different within their funds?

Yes, but not radically different. None of the funds can compete with low-cost ETFs or index trackers.

St James’s Place International Corporate Bonds cost 1.45% per year, which is quite cheap compared to most of the other funds.

In comparison, the SJP Global Smaller Companies costs 2.15% per year.

St James’s Place Funds

How have their funds performed?

The performance of their funds have been mixed. Some have done OK.

One of their funds, SJP International Equity Fund, has performed very well in recent years, beating investment benchmarks. Other funds have performed much worse, with 80%-90% lagging their competitors and benchmarks.

So your mileage varies with these funds and as the saying goes, past performance is no indication of future returns. Their poorly performing funds might one day become their best “star performers”, and vice versa.

How are the funds likely to perform during a crisis?

One of the claims made for their funds is that they might underperform their benchmarks, but they won’t go down as far as the market, during periods of crisis like 2008 and 2020.

During 2008, many of SJPs funds did little better than the overall market.

The data below is for their UK Equity Fund:

We can also observe similar things during the 2022 stock market falls. St James’s Place funds haven’t done especially badly, but on many occasions they are trailing the market and other competitor firms.

With that being said, investors that use advisors do much better than those that do it yourself (DIY) invest.

That is true regardless of whether people use SJP or another advisory firm.

The main reason for that is most investors, left to their own devices, panic sell during a crash.

2020 offers a great example of that. Global stock markets did very well on average.

US Markets increased by 17% during 2020, with the Nasdaq rising over 43%, yet countless people panic sold during the worst of the stock market crash in February and March 2020.

How about the St James’s Place portfolios?

St James’s Place doesn’t recommend that clients go into one or even two of their funds.

They have a portfolio which combines many options into one, and this takes into account clients attitude to risk and volatility.

Examples of these portfolios include:

1.SJP Defensive portfolio – this fund is in conservative investments and has often given negative returns. One reason for this is due to the weak performance of government bonds in recent times.

2. SJP Strategic Growth – a more adventures fund than the defensive portfolio, this option has typically given 4% per year. It includes equities and bonds within the same portfolio.

3. SJP Adventurous Portfolio– this has been one of their better options in terms of performance, with growth of about 7.5% per year. This is mainly in global equity markets and less in bond funds.

4. SJP deferred income – typically, the fund has given investors 4%-5% per year, and is aiming to give investors access to dividend growth.

5. SJP Balanced Portfolio – the balanced portfolio is a mixture of the defensive and adventurous options. Average performance has been OK, at about 5% per year.

6. SJP immediate income portfolio – This option has also given investors about 4%-5% per year, and is aiming at income generating portfolios.

7. SJP Balanced Income Portfolio – the performance for this option has been almost identical to the immediate income portfolio.

8. SJP managed funds portfolio – This has been the second best performing portfolio in the list, with returns of almost 7% in the last 5 years prior to the recent falls in the market related to corona virus.

9. SJP conservative portfolio – this option has performed similarly to most of the SJP funds in recent years, going up by 4%-5% per year.

Something to remember about these performances are that the global stock markets have had, on average, a good period in the last 10 years, with the exception of a few emerging markets and maybe the UK too.

So the average performance hasn’t been great with one or two exceptions, when you factor in this aspect into the equation.

What are the positives and negatives of investing with St James’s Place?

The main positives

As this is a well-regulated company, you are unlikely to face the worst case scenario. All advice is checked. Whilst this is the case with most companies these days, their compliance is relatively good

- Most of their funds don’t lose money, if you buy and hold them for years. Only the most conservative fund has done that in recent years. So whilst they might not be the best funds in the world (more on that later), they also aren’t the worst. This could be one of the reasons why they have a relatively good client retention rate in the UK and overseas. For the average conservative investor that isn’t overly happy with getting 4% per year when the market is doing 9%, for example, they might not want to leave the company and invest elsewhere.

- The few SJP staff members I have briefly met have seemed professional.

- Their wealth protection products are OK, even if not the cheapest in the market. The same can be said for the expat mortgages they offer, via Metro Bank.

- Some of the very poor online reviews are maybe a bit over the top. Even though they make good points, that doesn’t mean the criticism is 100% justified.

- They are better on average than a few of the traditional expat plans. I have reviewed those plans as well, as per the link at the bottom of this page.

The main negatives

- The funds are neither cheap nor do they perform well compared to the benchmarks in general.

- They are not truly independent. So this isn’t a million miles away from investing with a well-regulated bank, even though they can offer external fund managers. So it is highly likely that you will be suggested St James’s Place funds if you go with one of their advisors, especially in the expat market.

- In addition to point two, this point gets even more complicated. Their investment committee does look for excellent fund managers. So some fund managers are in-house and some are external. Regardless, even if their advisors believe that another provider has a better product (like Vanguard or somebody else) they can only use SJP products and services in most situations.

- They are quite UK-centric when it comes to expat advice and that isn’t ideal for non-British expats in Asia.

- The high net wealth solutions are quite basic, and again expensive, compared to some of the alternatives.

- The regulation is a double edged sword. Most clients, even if they want advice, also prefer to have some say about some of the investments that may be picked. With St James’s Place, you won’t be able to do 80% in “safe funds”, 10% in index funds and 10% in Bitcoin for example. So you have very little control.

- The approach is quite old fashioned. Two or three face-to-face meetings, face finds and a traditional approach to trying to beat markets, isn’t what most clients are looking for these days. We all want to use Uber rather than “normal taxis”, and likewise, with wealth management as well, most people want speed and online traceability. The ongoing corona virus is a great example of this. People didn’t want to meet in-person even before this pandemic. So they need to use technology more in the future.

- Linked to the last point, there has been some complaints online that the company stalls when it comes to moving money out to other providers or when a client wants to sell out. I highly suspect this is a bit harsh and linked to the last point. An old fashioned company, which is used to face-to-face and paper forms, isn’t going to be as quick as an investment app, when it comes to withdrawals and top ups.

- A big brand name isn’t always a good thing. It can mean you are client number 100,625 with less tailoring. In reality, you have different fund options with them, but you don’t have greater flexibility and choice compared to some providers.

- Beyond the actual fees, you have the opaque nature of the set up. Even one of their newest board members admitted their fees weren’t particularly transparent.

- As per the analysis above, your mileage might vary. Investor A, could be happy with Advisor B, in fund C. Investor B, in comparison, could be in one of their underperforming funds.

- In some offices, they have high advisor turnover, which significantly affects consistency of service.

- The way they have compensated and incentivised advisors has attracted a lot of negative publicity. Some of this publicity hasn’t been fair, but it does appear that incentives can sometimes cause conflicts of interests.

- The difference between the service in the UK and overseas is likely not the same, and even between different offices in the UK.

- The reliance on “star fund managers” as per the Neil Woodford affair.

What was the Neil Woodford issue?

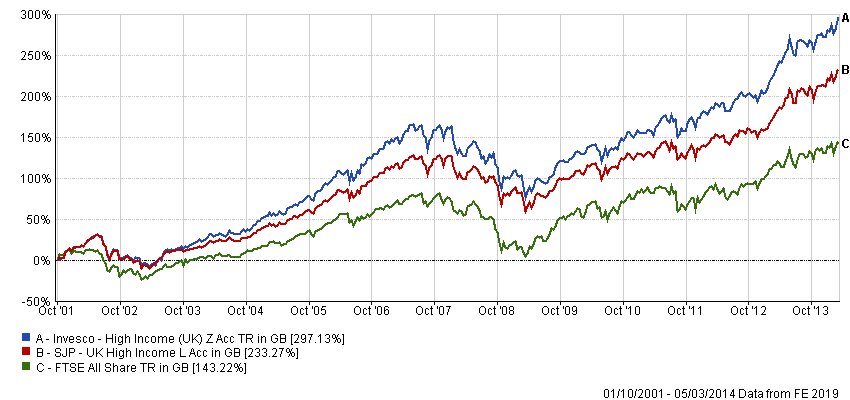

Neil Woodford was a “star fund manager” in the UK for years, beating the FTSE100 in the process:

He was seen as a safe manager to manage some of St James’s Place’s funds.

However, that came to an abrupt end, and St James’s Place dropped him from the funds he was managing, after Woodford’s funds were suspended.

That included the St James’s Place UK High Income and UK Equity Fund.

Whilst St James’ Place acted swiftly in this case, it does expose the ideas that they can do due diligence on “star fund managers” based on previous performance.

Past performance is seldom, if ever, a guide to future returns in the investment management business.

I am not implying that St James’ Place will have to make similar moves in the future with their current wealth managers, merely relying on previous star performers adds an extra layer of risk to the equation for investors.

What can you do if you have a St James’s Place fund and you aren’t happy?

This partly depends on whether you simply own their funds on an external platform, or are a direct investor.

If you own one of their funds on an external platform, selling out should be easy.

If you have a portfolio with them directly, you might be able to sell out without any penalties, or partially sell out, but that will depend on countless factors.

Sometimes you will need to wait a few years to have complete access to the money.

What are some of the biggest mistakes investors tend to make?

Many investors, the majority in fact, are more worried about losing something, than gaining.

This is called “loss aversion:

This is partly linked to sayings like “it is better the devil you know” and is one reason why “slightly disappointed” investors tend to stay long-term with numerous advisors firms.

This might seem rational, but ironically can lead to relative losses, compared to the alternative.

For example, if your account is worth 100,000 GBP and you are currently making 4% per year, you could lose up to two millions over a 30 year period, by missing out on 6% yearly returns.

Another misconception is that lower volatility, or standard deviation to use the fancy term, automatically means less risk. That is a key mistake.

Finally, many investors are too reassured by size. Whilst this has changed in recent years, with more people preferring boutique operators, some people still prefer big multinationals.

In reality, size usually implies a lack of specialisation and tailoring. The analogy I would make is, you are much more likely to get better service from a boutique legal recruitment company specialising in just one area, than a big recruitment agency.

The same thing applies to investing. Those within a niche are often better able to service your needs.

St James’s Place Review: Bottom Line

Whilst some of the worst reviews online aren’t fair or balanced, and St James’s Place isn’t a bad company, there are better funds and companies available for the majority of investors.

This applies to both the expats and UK market. In other words, lower cost, more transparent and tailored options exist.

For clients with existing St James’ Place assets, it therefore makes sense to review whether the money can be better deployed elsewhere.

If you have been proposed St James’s Place as an investment option, or are already in and aren’t happy, you can contact me.

Further Reading: Zurich International Vista Savings Plan Review

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Well, now I’m totally confused . I’m on the cost of opening a discretionary cash trust .ll I’ve opted for a medium risk with a monthly cheque to replace lost earnings . I’ve heard various reviews of the firm , and having worked hard for my money , I want to put it in the right place . But, not sure now if SJP is the best option ??

Just emailed you.

We were persuaded by our IFA to come with him to join SJP. It was the worst decision we ever made. All of the funds in our retirement accounts have performed badly and we continue to be stuck with 5% early exit penalty if we try to take our money and put it elsewhere for better returns and even if my 79 yr old husband takes an annuity we are still to pay the early exit fee. We have lost thousands from our original pension transfers. The negative reviews are all correct.

Thanks for sharing your perspective.