This Swissquote review will tackle the features, services, and pros and cons of one of Switzerland’s top financial and trading services provider. And, how Swissquote can be part of your international trading platforms strategy.

As of May 29, 2000, Gland-based Swissquote Group shares could be purchased through the SIX Swiss Exchange. The group operates in other locations like Bucharest, Cyprus, Dubai, Hong Kong, London, Luxembourg, Malta, and Zurich. The Swiss banking group launched its namesake trading platform in 1996.

Unfortunately, the Swissquote trading platform does not accept traders from the United States.

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Table of Contents

Swissquote Features and Safety

Swissquote offers a variety of tools and resources to its customers, giving them peace of mind as they trade. Clients are protected from losses in excess of their account balance thanks to negative balance protection. Up to 8,500 GBP of client deposits are insured against loss. It’s worth noting that this safeguard is only available to ordinary investors with EU-based accounts; non-EU and professional customers are not covered.

Swissquote’s leverage feature lets investors increase their holdings with borrowed capital. The leverage offered varies across different asset classes. Traders should proceed with care and use smaller leverages initially until they have sufficient trust in their trading techniques.

Swissquote is dedicated to offering first-rate service to its clients, with support staff available from 8 to 8 UK time, Mondays through Fridays. They are quick to respond and provides high-quality help on a wide variety of issues, such as the platform’s APIs and password resets.

Customers can contact the service team by email, live chat, phone, or by physically visiting the Swissquote office in the UK. This comprehensive customer support ensures that clients receive effective solutions and guidance whenever they require assistance.

Is Swissquote safe?

Swissquote is subject to oversight from various agencies like the UK’s Financial Conduct Authority and Hong Kong’s Securities and Futures Commission. Because of the strict nature of the restrictions imposed by these organizations, Swissquote must work hard to ensure that it remains in compliance at all times.

Client monies are held in separate accounts at all times, and they are fully protected by comprehensive insurance and compensation plans. Their every transaction and action is being thoroughly audited, supervised, and reported. Swissquote bank faces crippling fines if it does not follow these rules.

Swissquote Trading and Minimums

Trading Accounts

A demo account is available on Swissquote so that new users can get a feel for the platform before committing any real money. Meanwhile, Standard, Premium, Prime, and Professional are the four active accounts for individual investors to choose from. The Swissquote premium account stands out among the rest as a customer favorite.

Swissquote makes it easy and straightforward to open an account. Clients register online by providing their personal data like name, birth date, occupation, and country of residence. In addition, customers need to respond to several simple questions designed to gauge their level of financial literacy. It is crucial to study the application thoroughly before submitting it for consideration.

The company requires account opening applicants to verify their identities by video identification or by emailing copies of supporting identification documents such as national IDs, bank statements, driver’s licenses, and utility bills. Video identification works for both UK and Swiss Bank branches. It’s crucial to keep in mind, though, that opening an account and getting started trading stocks, foreign exchange, and contract for differences might take a while.

Swissquote offers various services to help traders negotiate sophisticated trading tactics, especially in high-risk environments. Expert Advisors, helpful tutorial videos, and low leverage in conventional markets like stocks and currencies are all features that traders may utilize on the platform.

The Swissquote trading platform has several advantages, however the minimum deposit is very high in comparison to the rest of the industry. Even though Swissquote may be limited in terms of accessible instruments, markets, and payment methods, forex traders situated in the European Union nevertheless choose the platform due to its zero-commission trading accounts and cheaper spreads.

There are numerous financial services provided, including the Trading Central Plug-in, which stands out for the analyst perspectives, daily market reports, and adaptive convergence divergence indicators it provides. The Autochartist plugin can scan the market for volatility and provide trade alerts, automatic technical analysis, event effect analysis, and more. Additional trading and non-trading tools can be accessed with the MetaTrader Master Edition Plug-in.

Copy trades and Expert Advisors from prominent traders and investors are also available on Swissquote, giving customers a number of options to consider. In addition, traders can examine the efficacy of their trading techniques by back-testing.

Swissquote offers approximately 130 different markets for trading, including FX, indices, precious metals, bonds, and commodities, so it can meet the needs of traders with a wide range of preferences.

Trading Platforms

ETrading

Swissquote provides multiple trading options to meet the demands of individual traders. ETrading is a good example of such a platform because of its straightforward functionality and well-organized tabs. While the platform’s user interface may look antiquated, some users have noted that it places a premium on Swiss markets relative to those of Europe and the US. Because of its adaptability, the eTrading platform may be personalized to meet the needs of individual traders.

Mobile

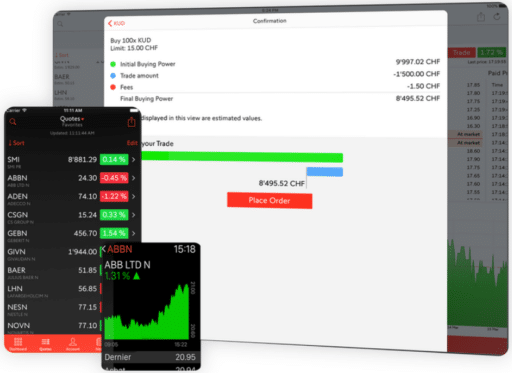

The Swissquote mobile apps, which feature the powerful Advance Trader platform, were designed with the trader in mind. Traders can get the app easily on their iOS or Android devices. Traders may switch between their mobile app and their desktop platform, which both support eight languages.

The trading capabilities available on the mobile app include sophisticated order types, real-time streaming quotes, and advanced chart patterns offered by Swissquote. The firm also works with MetaTrader 4 and MetaTrader 5, so traders may utilize the same automated trading techniques and analysis tools they do on their desktop PCs. Mobile push notifications, community chat features, and real-time financial reports are all features available to customers who are constantly on the go.

Advanced Trader

Advanced Trader, Swissquote’s in-house web platform, allows users to manage and rearrange layouts based on their preferences. There are robust in-app capabilities and tools for handling orders on this platform. Traders who use the Advanced Trader platform have access to exclusive market news and can easily transition between the web, mobile, and desktop versions of the platform.

Swissquote MT4

Swissquote also offers the popular trading platform MetaTrader 4 (MT4), which is highly regarded in the financial trading community. The Swissquote MT4 platform has a user interface made with newcomers in mind, making it ideal for ordinary investors and traders. It allows for quick trade execution, extensive liquidity, and the creation of automated trading strategies through the use of Expert Advisors.

The platform provides a first-rate interface by including live quotations and charts in real time and a mobile app for both iOS and Android.

Swissquote MT5

Swissquote’s MetaTrader 5 (MT5) platform provides advanced traders with all the functionality of MT4 as well as new trading choices and a different codebase. There is a Master Edition of MT5 as well as a netting mode and enhanced charting for mobile devices running on iOS and Android.

FX and CFDs traders can take advantage of one-click trading, real-time price quotations, social trading, copy trading, and extensive back-testing tools.

Financial Information eXchange API

Swissquote’s FIX API provides a solution for professional traders. Access to both previous and current price quotes is made possible by this API protocol’s seamless integration with an online trading platform. Swissquote allows traders to save time and money by connecting them directly to the platform’s liquidity providers. Direct communication via the FIX API gives traders an advantage when trading CFDs and forex in particular.

Account Minimums

Standard, premium, and prime accounts respectively demand $1,000, $10,000, and $50,000 deposits. Minimum deposits for professional accounts may vary depending on transaction volume.

Swissquote offers separate client accounts where traders can transfer money from their own bank accounts to finance their trading accounts. Alternatively, after setting up a real-money trading account, users can transfer the requisite minimum sum directly from their own profile.

To deposit funds into their account, traders should first log into their personal area. From there, they can select the deposit option and carefully follow the provided instructions to deposit funds into their trading account. Before making a deposit, it is vital for traders to select the appropriate deposit currency.

It’s crucial that the currency of the account to which money are being moved is identical to the currency of the funds being transferred. Trading accounts could be charged currency conversion costs if this requirement is not met.

Swissquote Investment Products and Services

Swiss DOTS

Swissquote also offers the Swiss DOTS trading platform, which features over 90,000 derivatives based on different underlying assets. These include indexes, ETFs, stocks, commodities, and exotic FX pairs. Swiss DOTS users can trade various stocks, options, warrants, and certificates.

Themes

Market makers can take advantage of themes trading. Online gaming, global recycling, the 5G revolution, and football mania are just some of the subjects that may be invested in and traded on this platform. Traders can gain useful insights and information from the Swissquote trading platform’s efficient documentation of the historical performance and underlying portfolio of structured products relating to these subjects.

ESG Investing

You can invest in firms with good ESG (Environmental, Social, and Governance) practices that have been evaluated by a trusted external supplier. Using a company’s ESG score, investors may quickly and easily see if their portfolios are in line with their personal principles.

The ESG score does the assessment work so that your money is invested in businesses that share your values. Having your financial house in order before a market crash can help you weather the storm. An investor can learn a company’s ESG score through basic research and utilize it in conjunction with other metrics to arrive at a well-informed investment choice. Swissquote also provides an ESG Screener to help you choose investments that fit your ethical and environmental standards.

Mobile Level 3

Two-factor authentication in the form of mobile Level 3 provides a trustworthy and hassle-free way to verify your identity when making critical purchases or signing legal documents. In comparison to more time-consuming and less secure methods of authentication, such as email or SMS verification, this function is effortlessly integrated into the Swissquote Trading app.

Your logins to your eBanking and eTrading platforms, use of the Swissquote Trading app, execution of trading operations, initiation of payments and transfers, and modification of profile and settings are all safe and secure with Mobile Level 3 authentication.

TWINT

Swissquote has released their very own TWINT app, which facilitates safe and simple mobile payments. The Swissquote TWINT app necessitates an eTrading account with Swissquote Bank and a smartphone with the following specifications: the most recent version of the Swissquote Trading app, iOS 13.0 or later, Android 7.0 or later, Bluetooth 4.0 or later, and a Swiss phone number.

In most cases, the Swissquote TWINT app won’t cost you a dime. The Swissquote TWINT app does not charge any fees for any of its features, including sending money to stores or other users. There may be infrequent costs levied by certain partners, such as those for cash withdrawals or valet parking.

Invest Easy

Invest Easy offers a convenient and straightforward solution for individuals who wish to dip their toes into the world of investment or explore their saving potential. Different users will appreciate the platform’s selection of risk levels. Attractive interest rates and investment options are provided, together with professionally established strategies that are adaptable to different investors’ risk tolerances and financial goals.

Invest Easy provides its clients with two alternative investment methods. The first is a method of saving money that avoids currency conversion fees while yet providing access to savings in many currencies. There is no minimum deposit required and interest rates of up to 2% are offered by this strategy. The second kind is investment methods, and they provide low minimum deposits, as low as 500 Swiss francs, and reasonable costs.

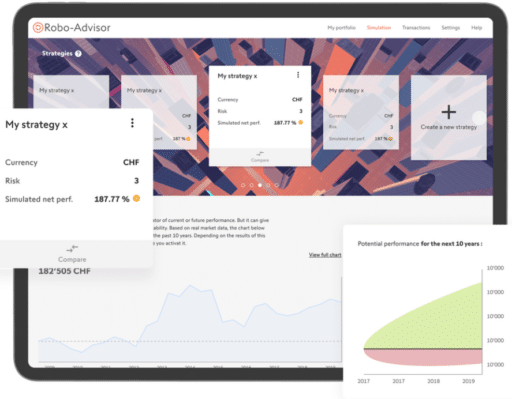

Robo-Advisory

For savvy investors looking for a one-stop shop that provides self-service automation, individualized guidance, and innovative features, the Robo-Advisory platform is the way to go. Users have access to a large and varied investment options with opportunities in shares, bonds, ETFs, and cryptocurrency.

In addition, the platform allows for extensive customization of strategies to meet the needs of each investor and their specific objectives. Automatic rebalancing helps preserve the target portfolio allocation over time, adding flexibility and ease to the investment process. Foreign exchange risk can also be hedged against through currency hedging.

You’ll need at least 50,000 francs to use the Swissquote robo advisor.

Invest 3A (coming soon)

Customers looking to put their 3A pillar to work will find this solution particularly useful. It provides a structured method of saving for the future while also offering tax benefits. The solution has an emphasis on usability, making it simple for customers to start saving right away. Investment gains can be amplified with the help of the government’s generous tax breaks.

By following these predetermined techniques, clients are better able to make educated decisions and successfully navigate the financial journey. Customers who want their savings to increase while still benefiting from tax breaks are the target audience for this service.

What are the fees?

Swissquote is no different from its competitors in that it uses spreads, or the difference between the purchasing and selling prices. Swissquote’s pricing structure and transaction costs are competitive. They have developed three tiers of minimum spreads based on the first deposit made by traders, which may be prohibitive for some traders and investors. The minimum deposit for a regular trading account up to $25,000 is $1,000.

There is no difference in the margin requirements for different types of trading accounts. The Elite account’s commission-based structure allows for individualized spreads with the exception of a lower margin call threshold stop-out.

Swissquote adds additional fees such as an overnight switch fee and an account maintenance fee, as well as inactivity penalties of 10 currency units per month after a period of inactivity lasting six months.

Both commissions and bid-ask spreads are included in Swissquote Brokers’ cryptocurrency trading fees. Robo-advisory services from Swissquote come with relatively high and variable fees.

When it comes to stock and ETF costs, Swissquote charges a lot, especially for stock-related transactions. Swissquote does charge a small fee for withdrawals and deposits, however this is still significantly lower than the costs charged by many of its rivals.

Options for making deposits are flexible at Swissquote Brokers. Clients can use prepaid, credit, or debit cards, as well as wire or bank transfers to fund their accounts in any one of nine available base currencies. Note that some banks may assess a minimum fee for certain payments. Clients must retain a minimum deposit of $1,000 (or the Swissquote-specified equivalent) in addition to paying any minimum fees that may apply.

In contrast, customers can start the withdrawal process through the online portal. Swissquote solely accepts bank transfers for withdrawals, as opposed to other payment options for funding. This may come at a little cost.

How long it takes for withdrawals to be processed varies. Credit card transactions can typically be processed instantly, while it takes one to three business days to finalize a wire or a bank transfer.

Swissquote Offshore Banking

The Swissquote Bank Expat Account is an offshore bank account tailored to the needs of international professionals with long-term postings abroad. It offers a full suite of online banking services, from simple payment processing to international trading across various asset classes.

The international professional can take advantage of Swissquote Bank’s set fee structure, competitive foreign exchange rates, and competitive savings rates. Swissquote offers advantageous exchange rates, different currency accounts for offshore saving, and no minimum balance requirements for offshore banking.

With a concentration on local and regional markets, the expat account provides access to numerous conventional and shariah-compliant investment solutions from reputable providers. Investors can choose from single shares, bonds, sukuks, mutual funds, and ETFs with a Middle East focus.

The key features of the expat account include the adaptability of a multicurrency Swiss bank account supporting USD, EUR, and GBP among other currencies, access to over 3 million instruments, no minimum balance requirement, attractive interest rates, no ongoing account maintenance fees, access to Mastercard multi-currency credit cards in gold and silver, and the opportunity to profit.

What are the pros and cons of Swissquote?

Swissquote allows users to explore multiple investing alternatives by offering access to several markets and products. It’s a good option for investors because there aren’t any hidden costs, like inactivity or maintenance fees.

The platform has a solid history and is built on top-notch technology, guaranteeing safe and effective trading at all times. Moreover, users can manage their investments in many currencies thanks to the platform’s support for Mastercard’s multi-currency capability. Safekeeping of deposits and valuables in Switzerland is an additional safeguard.

However, not all of the platform’s research tools are free to use, which may increase transaction fees. Some customers may also find it challenging to traverse the available trading platforms and select the best one for their needs due to the abundance of choices.

Swissquote trading does not come without its own set of risks, and that inexperienced investors may be particularly vulnerable.

Swissquote Review Final Thoughts

Swissquote is well-known for its superior website usability and several trading platforms and account options available to its customers. It gives customers a lot of leeway by offering both a proprietary trading platform (Advanced Trader) and the popular MetaTrader platforms. The in-house system is very adaptable, and it features a beautiful and straightforward interface. Synthetic CFDs and other financial instruments are also available for trade on Swissquote.

Swissquote platforms are known for their intelligent features, such as the automatic recognition of patterns. Because of this, Swissquote is great for novice traders who don’t know much about reading chart patterns. The broker also provides a Robo-advisory service, which has been well received by its clientele. Swissquote also offers a hedging function for those who may need it.

As a publicly traded Swiss broker with a banking heritage, Swissquote excels in terms of safety, inspiring confidence in investors. It’s worth noting, though, that Swissquote charges steep commissions. Certain consumers may feel overwhelmed by the variety of trading platforms available, and certain research tools are not free of charge.

Despite these concerns, Swissquote can still be an excellent choice for novice traders.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.