tastytrade Review

Analyze how Tastytrade can fit into your global trading strategies for diversified portfolio management.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Introduction

tastytrade, formerly known as tastyworks, is an ideal choice for advanced traders.

Especially those looking to enhance their stock, options, and futures expertise.

The platform offers various features tailored to meet the diverse needs of active traders, particularly those involved in derivatives trading.

Beginners may find tastytrade somewhat complex.

It compensates with its robust educational resources and research tools, facilitating learning.

However, its cost-effectiveness doesn’t entirely compensate for its limited account offerings and lack of specific investment options.

Consequently, tastytrade effectively caters to active traders, but it may not align well with the preferences of everyday investors.

Today, I will provide a detailed overview of tastytrade and all the necessary information.

Without any delay, let us start our topic for today, i.e., reviewing tastytrade and its features.

Disclaimer – Please note that tastytrade primarily operates in the U.S., yet it also offers accounts for international customers.

I will primarily cover the information related to international accounts in this article.

Table of Contents

Account Types

There are several account types offered by tastytrade, each with its trading capabilities.

Individual Accounts

Individual accounts at tastytrade come in two sub-account types: “Margin Account” and “Cash Account.”

— Margin Account

The individual margin account type at tastytrade offers the highest degree of flexibility.

Depending on your trading level, you can leverage all the trading strategies provided and even borrow funds for equity (share) transactions.

It’s worth noting that options are not eligible for margin trading.

While there is no initial minimum requirement, you must maintain a balance of $2,000 in the account to enjoy full margin privileges.

Keep in mind that increased flexibility also entails higher exposure to potential risks.

— Cash Account

Opting for a cash account means forgoing the advantages of margin.

In this account type, you cover the entire purchase cost of your trades with the available funds without the benefits of borrowing.

Notably, there is no minimum account balance required for a cash account.

Retirement Accounts

— Traditional IRA

In individual accounts, a Traditional IRA is designed for individuals with earned income or those filing a joint return with a working spouse.

Typically, earnings grow tax-deferred and are subject to taxation at the regular tax rate upon withdrawal.

— Roth IRA

A Roth IRA involves after-tax contributions for individuals with earned income.

The funds in a Roth IRA account can be withdrawn tax-free and penalty-free at any time.

Earnings may also be withdrawn tax-free and penalty-free if they meet the criteria for qualified distributions.

— SEP IRA

Another option is the SEP IRA, available to self-employed people and small business owners or employees.

The earnings in a SEP IRA usually grow tax-deferred and become subject to taxation at the ordinary tax rate upon withdrawal.

Entity Accounts

Corporate accounts cater to legally established U.S. entities in joint accounts, including C-Corp, S-Corp, LLC, and Partnership accounts.

On the other hand, trust accounts can be opened for revocable or irrevocable trusts, with the requirement of providing a Trust Certificate during the account’s opening.

Joint Accounts

Joint accounts encompass Tenants in Common accounts, where multiple owners control distinct portions of the account’s assets.

In this setup, upon the demise of one account owner, their share of assets passes to their estate.

Alternatively, With Rights of Survivorship (WROS), joint accounts grant equal asset ownership to two or more individuals.

In the event of one account owner’s passing, the surviving owner(s) assume full account rights.

International Customers

For international customers, various account types are available, including individual margin, individual cash, and joint accounts.

However, entity accounts are not currently supported for international customers.

As an international customer, you can open an account with tastytrade in several countries, yet many other countries are restricted.

Please click here to know whether you can open an account with tastytrade.

Funding (International Accounts)

International customers can choose between two funding methods.

It’s important to note that both funding methods require deposits in USD.

The funds for your account should originate from your country of residence, where your trading activities are taking place.

It’s essential to be aware that tastytrade does not offer currency conversion services.

The two primary funding options available are:

⁃ Bank Wire

⁃ CurrencyFair

Please be aware that ACH relationships cannot be established with international bank accounts, TransferWise accounts, or Revolut Accounts.

CurrencyFair only accepts registration from a few countries, which can pose a problem with funding.

To find out whether CurrencyFair accepts applications from your country, click here.

The fund transfers usually take three to five business days to get deposited in your trading account after initiating.

The amount gets reversed if you deposit money using methods such as Revolut or XE.

There is also a reversal fee of $30 for such reversals; therefore, it is wise to deposit only using wire transfer or CurrencyFair.

Account Opening (International Accounts)

Applications are determined to be complete when accompanied by a copy of a passport or driver’s license and valid proof of address.

The proof of address document should not be older than one year.

A dedicated portal will allow you to upload these required documents throughout the application process conveniently.

Examples of acceptable proof of physical address documents include:

⁃ Government-issued photo I.D. (displaying the address)

⁃ Utility bill

⁃ Bank statement

⁃ Credit card bill

The approval process typically takes 1-3 business days, provided all required documentation is in proper order.

If any issues arise during the application process, our accounts team will contact you via email for resolution.

Withdrawals (International Accounts)

Similar to deposits, withdrawals are only available via bank wire transfer or CurrencyFair.

The fees for domestic wire withdrawals at tastytrade are $25 and $45 for foreign withdrawals using wire transfer.

International withdrawals at tastytrade usually take two to five business days upon request.

Withholding Tax

The tax treaty between the United States and your country governs the rate at which tax is withheld for international customers.

This withholding rate typically applies to various income sources, such as dividend or interest payments, rather than the profits generated from trades.

The deducted taxes are immediately subtracted upon payment to the account and can be viewed as a line item in the History tab.

Please click here to learn more about the withholding tax for international accounts at tastytrade.

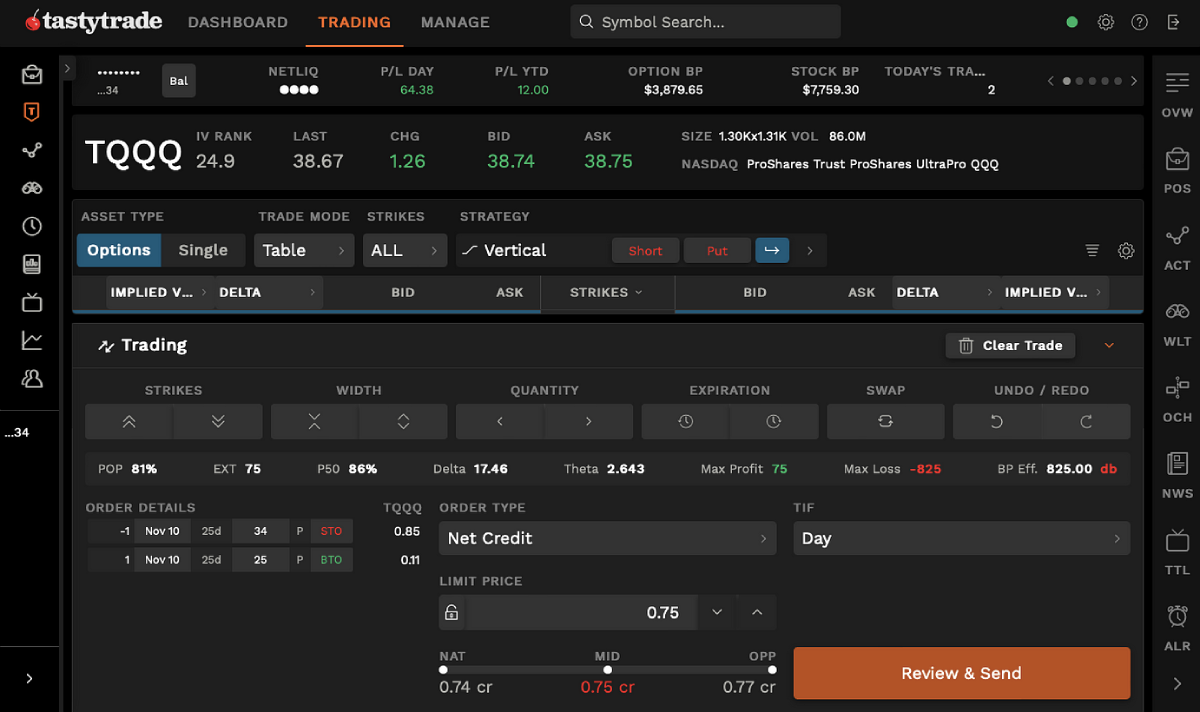

Platforms

There are three types of platforms offered by tastytrade, which are:

Browser Platform

Once you’ve logged in to the tastytrade website, you’ll gain access to the online browser platform.

However, you must log in again to access the actual trading platform interface to access advanced account management.

Their “follow tab” enables monitoring trades, providing you with added benefits through access to expert portfolios.

Moreover, you have the capability to replicate any trade posted on the platform, and you can include securities in a watchlist for monitoring.

One of the browser platform’s standout features is the live stream.

The livestream feature offers trading commentary and on-demand videos covering market topics, primarily focusing on derivatives.

The platform also includes a journal function for taking notes and tagging items within those notes for future reference.

For those ready to engage in trading, there are three modes available: stock, table, and curve.

These modes allow you to trade stocks without charts or graphs, with a graph, or by presenting the graph in a tabular format.

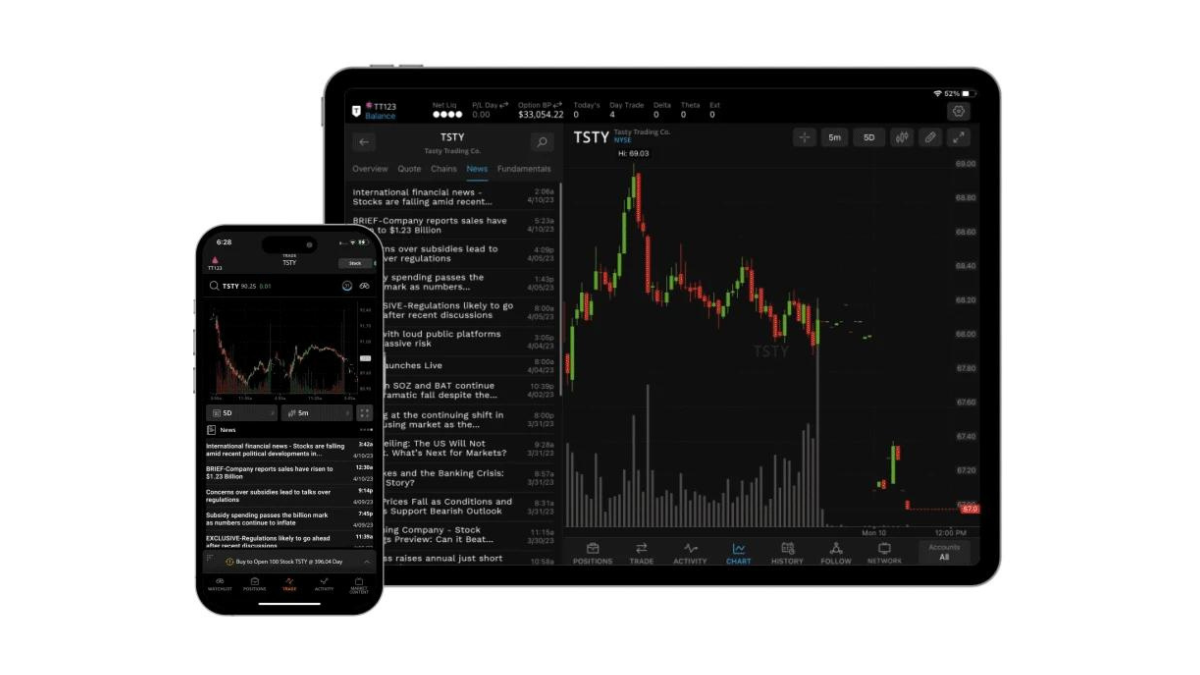

tastytrade Mobile App

If you’re away from your computer, Tastytrade provides a mobile application apt for both Apple and Android smartphones and tablets.

You can employ the same trading strategies as the other two platforms, and the live stream and Tastytrade team trades remain accessible.

Additionally, the mobile platform features a well-designed color scheme that enhances readability.

Desktop Platform

Most active traders likely prefer the desktop platform due to its superior charting capabilities.

To get started, simply download and install the software, then log in to begin your research, tracking, and trading activities.

The desktop platform’s graphing interface is more extensive, offering drawing tools, four distinct graph styles, and price history options.

It also permits you to expand to full-screen mode or arrange multiple charts within a single window for easy comparison.

While one-click trading is not supported, clicking on the price or bid above a graph will trigger an order ticket.

Although it provides extended duration options for trades, it shares the same advanced trade limitations as the browser platform.

Markets and Products

At tastytrade, you have the opportunity to engage in trading activities involving U.S. stocks, ETFs, options, and a limited selection of futures.

However, it’s important to note that certain popular asset classes, such as mutual funds and bonds, are notably absent.

Additionally, international assets are not available at tastytrade, which is a considerable drawback.

This array of choices is somewhat limited compared to rival brokerage firms.

Brokers like TradeStation and Interactive Brokers surpass tastytrade in terms of the variety of stock markets accessible for trading.

tastytrade provides access to a range of financial instruments, including stocks, options, ETFs, futures, and cryptocurrencies, all within the confines of U.S. markets.

However, specific details regarding the number of tradable products are somewhat elusive.

It’s worth mentioning that OTC (over-the-counter) and penny stock trading are not supported.

T-bills, bonds, and notes can be traded through tastytrade for those interested.

But you’ll need to reach out to the broker’s trade desk to facilitate these transactions.

In the grand scheme of things, when compared to its closest competitors, tastytrade’s market offerings and product range are more limited in scope.

Products Offered

⁃ Stocks

⁃ ETFs

⁃ Options

⁃ Futures

⁃ Cryptocurrencies

Stocks and ETFs

⁃ Number of stock markets: 4

⁃ Number of ETFs: 2,200

Options

⁃ Number of options markets: 8

Futures

⁃ Number of futures markets: 8

Fees

Opening a tastytrade account is a hassle-free process, and there’s no requirement for a minimum initial deposit.

Moreover, you won’t encounter any annual or monthly account fees, and there’s no charge for account inactivity.

Your funds can rest in your account free of charge.

— Non-Trading Fees

Monthly account fee: $0

Monthly Inactivity fee: $0

Minimum account deposit: $0

— Trading Costs & Commissions

tastytrade offers commission-free stock and ETF trades, regardless of the trading volume.

The trading fee structure is advantageous for those directly involved in stock trading.

However, where tastytrade truly excels is in its options trading commissions, as they are among the most competitive rates available.

Opening a position in options costs just $1 per contract, and there are no fees when you decide to close the position.

Additionally, there are no closing commissions for options on futures trades, although a minimal commission is applied to each contract for futures and micro futures.

It’s important to note that regulatory fees apply when you sell any equity independent of the commission structure.

— Fee Structure by Trade Type

Stocks: $0 to open, $0 to close

ETFs: $0 to open, $0 to close

Options Contracts: $1 per contract to open, $0 per contract to close

Futures Contracts: $1.25 per contract to open, $1.25 per contract to close

Options on Futures: USD 2.50 per contract to open, $0 per contract to close

Micro Futures: $0.85 per contract to open, $0.85 per contract to close

— Banking Fees

Tastytrade does not provide the option of using a debit or credit card for account withdrawals.

However, you can freely withdraw and deposit funds using ACH (automated clearing house).

Nevertheless, there is a fee associated with outgoing wire transfers: $25 for domestic transfers and $45 for international transfers.

If you opt for withdrawal checks, they are priced at $5 for domestic addresses and $10 for international addresses.

Advantages of tastytrade

Tastytrade offers various convenient features and resources for traders.

You can easily customize your trading experience on their platform, and they provide a wide range of tradable assets.

Their options fee structure is competitive, and they offer valuable educational resources and live programming.

They also have an extensive library of educational content, with 10 hours of live programming on weekdays.

This content covers financial details, investment techniques, and fun activities related to options trading and the stock market.

They even post all the trades from their shows on the platform’s “follow page,” allowing you to filter and view trades for specific underlying stocks.

Tastytrade prioritizes options traders and provides advanced tools tailored to their needs.

You can analyze the risk profiles of multiple open positions, and the platform’s “Order Chains” tab helps you track a trade.

Tracking trades includes any rolls, closing legs, or adjustments.

This makes it a valuable resource for DIY investors looking to grow their portfolios.

Drawbacks of tastytrade

The tastytrade platform can be overwhelming for newer options traders because it’s primarily designed for experienced traders.

It has advanced features, which may make it more complicated for beginners compared to platforms with straightforward functionalities.

However, the company provides various resources and videos to assist beginners in getting started despite the platform’s learning curve.

Another drawback is the limited selection of fixed income options on tastytrade.

It mainly focuses on options trading and offers only U.S. treasury bonds, bills, and notes.

If you’re interested in other fixed income assets like corporate or municipal bonds, you won’t find them here.

tastytrade doesn’t support paper trading, which can be a valuable tool for learning and testing strategies, especially for beginners.

tastytrade has relatively high bank wire fees when it comes to withdrawing funds.

$25 for domestic and $45 for international transfers must be requested by 1 p.m. Central Standard Time.

There’s no option to use a credit or debit card for withdrawals, so you may need to pay a fee unless you opt for an ACH withdrawal.

Research

tastytrade’s research toolbox boasts several valuable components, including:

⁃ Trading ideas

⁃ Robust desktop charting tool

⁃ Top-notch news resources

However, it’s important to note that the research primarily revolves around options trading and offers limited fundamental data.

— Fundamental Data

tastytrade offers essential indicators for options trading, such as:

⁃ The Greeks

⁃ Implied volatility

⁃ IV rank

⁃ Correlation matrix

Its fundamental data for stocks is quite basic, featuring metrics like P/E ratios and dividend yields.

Additionally, consider exploring tastylive, a comprehensive resource hub for:

⁃ Investment knowledge

⁃ Live streaming

⁃ News

⁃ Insights

⁃ Trading concepts

⁃ Strategies

— Trading Ideas

tastytrade offers a social trading feature that allows users to explore trading ideas from its team members.

It’s important to note that these ideas do not constitute explicit investment advice but can benefit trading inspiration.

— Charting

tastytrade boasts a robust charting tool, especially suitable for options-focused traders.

Users can access up to 100 technical indicators, making it a comprehensive resource for technical analysis.

This tool is handy when assessing the probability of profit, especially for portfolios with multiple positions on a single stock.

Notably, tastytrade offers free real-time quotes, enhancing the charting experience.

News Feed

tastytrade delivers news content through its educational platform, tastylive.

This resource provides access to a vast amount of informative content related to options and futures trading.

Users can also enjoy live news coverage, including a live trading show hosted by the tastytrade team during weekday trading hours.

Education

tastytrade offers an excellent array of educational resources tailored explicitly to options trading on its platform.

Regrettably, there is no provision for a demo account, which could be a valuable tool for users to practice trading strategies.

At tastytrade, you can enhance your options trading knowledge through multiple avenues, including:

— Platform Tutorial Videos

These videos walk you through the trading platform’s intricacies, ensuring you can navigate it proficiently.

— General Educational Videos

A wide range of educational videos offers insights into different aspects of options trading.

The videos are well-produced and engaging, making learning a more enjoyable experience.

— Webinars

Users can participate in webinars that delve into the finer details of trading with tastytrade products, providing valuable insights.

— Quality Educational Articles

In addition to videos, users can access high-quality articles that offer in-depth knowledge about options trading.

tastytrade’s educational materials are accessible through its educational platform, known as tastytrade.

This platform is a comprehensive resource for individuals looking to build their options trading skills from the ground up.

It’s important to highlight that these educational resources are readily available without any cost.

Furthermore, if you choose to register, you can unlock additional market insights and research content.

Customer Support

You have several options to reach out to tastytrade’s customer support:

⁃ Live Chat

⁃ Phone

⁃ Email

If you have a general inquiry, you can also make use of the chatbot provided by tastytrade.

When contacting tastytrade’s phone support, customers are able to receive prompt and pertinent responses.

However, it’s important to note that their phone support is available exclusively on weekdays, from 7 a.m. to 5 p.m. (GMT-6).

tastytrade’s email support operates around the clock, five days a week.

Through the live chat feature, you can expect pertinent answers within minutes.

Please click here to contact tastytrade to know the details regarding this matter.

Safety

Yes, tastytrade is regulated by several authorities, including:

⁃ The Securities and Exchange Commission (SEC)

⁃ The Financial Industry Regulatory Authority (FINRA)

⁃ The National Futures Association

— tastytrade Investor Protection

For accounts held by Australian residents, regulation is overseen by the ASIC.

All other accounts fall under tasty’s U.S. entity and are subject to SEC and FINRA regulations.

This distinction is significant because it makes clients eligible for the U.S. investor protection provided by the Securities Investor Protection Corporation (SIPC).

This substantial protection covers cash or securities losses in case of the broker’s insolvency.

SIPC protection has a limit of $500,000, including a $250,000 cap for cash.

In addition to SIPC protection, the broker’s clearing firm has acquired extra insurance called “excess SIPC.”

This insurance comes into play if SIPC limits are reached and offers additional coverage for securities and cash, up to a combined total of $150 million.

Individual customer sub-limits are $37.5 million for securities and $900,000 for cash.

In the unfortunate event of an issue, non-US citizens with accounts at tastytrade are treated similarly to U.S. residents.

The $500,000/$250,000 protection level exceeds what most European investor protection schemes provide.

It’s essential to note that SIPC protection does not cover all types of investments.

Generally, SIPC safeguards notes, stocks, bonds, mutual fund shares, and other registered securities.

SIPC does not extend to instruments like:

⁃ Unregistered investment contracts

⁃ Unregistered limited partnerships

⁃ Fixed annuity contracts

⁃ Currency

⁃ Interests in gold, silver, commodity futures contracts, or commodity options

However, it’s worth highlighting that Australian clients do not benefit from any investor protection scheme.

Bottom Line

Listed below are the ratings provided to tastytrade by some of the significant review websites online.

Investopedia – 3.9 out of 5 stars

BrokerChooser – 4.1 out of 5 stars

Finder – 4.1 out of 5 stars

Bankrate – 3.5 out of 5 stars

The Motley Fool – 4 out of 5 stars

Trustpilot – 4.5 out of 5 stars (349 reviews)

Based on these ratings, we can safely assume tastytrade to be a reliable and good brokerage firm.

— tastytrade’s Strengths

tastytrade excels in options and futures trading and offers some of the best pricing in the industry for these contracts.

Regarding stock and ETF options, it charges only $1 to open and $0 to close, whereas most brokers charge $0.65 for both opening and closing, totaling $1.30.

— tastytrade’s Weaknesses

While you can buy stocks and ETFs on tastytrade, it primarily serves as a trading platform.

Everyday investors seeking a user-friendly platform with tools for fundamental analysis or stock-specific news may find better alternatives elsewhere.

However, options and futures traders might still find it suitable.

Disclaimer – I am neither affiliated with tastytrade nor endorse it. The primary objective of this article is to review the broker and provide all the necessary details in a single place.

That being said, I strongly hope the information presented in this article was helpful to you.

If you are an expat or a high-net-worth individual, you can contact me to find out whether you can benefit from my top-notch investment solutions.

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.