Vanilla Funds is an investment platform that offers a number of Exchange Traded Portfolios or ETPs.

But what are ETPs?

Like stocks, these financial products are traded on stock markets. They are created to mirror the outcomes of an underlying index, asset, or group of securities.

Products like commodity pools, exchange-traded notes, and exchange-traded funds are examples of ETPs.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for alternatives or a second opinion.

Some of the facts might change from the time of writing, and nothing written here is formal advice. So, potential investors shouldn’t invest or decide not to invest based on this review of Vanilla Funds Blue Chip Portfolio ETP alone.

For updated guidance, please contact me.

What is Vanilla Funds?

Similar to passively managed index funds, the platform’s main goal is to give investors simple and efficient investing opportunities.

Vanilla Funds aims to make the process of choosing funds for individual investors easier, given the growing complexity of the investment world.

Vanilla Funds ETPs

Vanilla Funds ETPs are available to investors throughout Europe via different brokers, as well as intermediary and self-directed platforms. These include:

- Ardan

- Capital International

- Capital Platforms

- FPI

- Hansard

- Hartley Pensions

- IFGL SIPP

- Interactive Brokers

- iPensions

- ITA

- Momentum

- Overseas Trust & Pension

- RL360

- Sovereign

- Utmost IOM

- Velocity Trade

The Vanilla Blue Chip Portfolio, the first ETP rolled out by Vanilla Funds, became live on the London Stock Exchange on March 26, 2024.

What are blue chips?

Blue-chip stocks are ownership stakes in reputable, financially secure businesses with a track record of dependability and excellence.

These organizations are well-known for producing steady profits and dividends and frequently top their respective sectors.

Vanilla Funds Blue Chip Portfolio ETP

The Vanilla Funds Blue Chip Portfolio is actively managed, which means that its holdings are frequently assessed and modified, with an emphasis on investing in leading US stocks.

The investor owns the actual equities in the portfolio since the ETP is supported by real assets.

Buying and selling is easy without the hassles of margin accounts or futures.

Blue Chip Portfolio USD

The top 10 holdings as of January 2025 include Berkshire Hathaway class B shares at 25.79%, Meta Platforms class A at 7.99%, and Amazon Inc. at 6.52%.

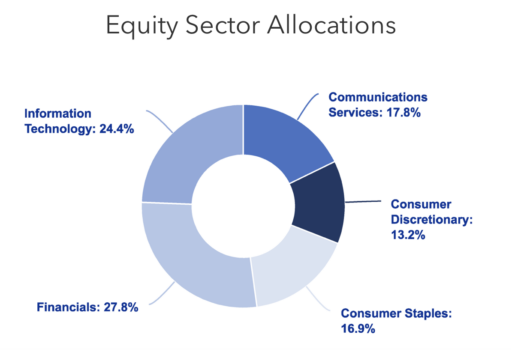

For sector allocations, Financials have the largest at 27.8%, closely trailed by IT with 24.4%. Meanwhile, Communications Services, Consumer Staples, and Consumer Discretionary respectively took 17.8%, 16.9%, and 13.2%.

In terms of performance, the USD-denominated Vanilla Funds Blue Chip Portfolio ETP showed returns of 0.25% at one month, 4.72% at three months, 13.11% at six months, and 28.55% at one year.

A 1.3% management fee applies.

Blue Chip Portfolio GBP

As per the latest available data (January 2025), the GBP-denominated investment fund’s top 10 holdings include Berkshire Hathaway at 22.92%, Broadcom Inc. at 7.99%, Alphabet Inc. at 6.57%, and Nvidia at a close 6.56%.

In terms of sector composition, IT grabbed the biggest portion at 28%, followed by Financials at 22.9%, Communications Services at 19.7%, Consumer Staples at 15.8%, and Consumer Discretionary at 13.6%.

The same 1.3% management fee is assessed.

The fund’s performance include:

- One-month return: 1.72%

- Three-month return: 11.62%

- Six-month return: 14.01%

- one-year return: 30.51%

Pros and cons of Vanilla Funds Blue Chip Portfolio ETPs

Benefits of investing in Vanilla Funds ETPs

- Vanilla Funds ETPs, such as the Vanilla Blue Chip Portfolio, concentrate on big, reputable businesses that have earned fame for their stability and buildout prospect. This gives investors access to superior assets that are generally less erratic.

- Investors can purchase and dispose ETP shares at market prices at any time during the trading day. Such liquidity gives more room for flexible asset management.

- ETPs are transparent about their holdings and outcomes. Investing in them can provide balance to make an investment basket more diversified.

- Vanilla Funds seeks to simplify investing by offering meticulously crafted portfolios that cater to the needs of individual clients.

Disadvantages of Blue Chip ETP

- Earnings cannot be guaranteed since this ETP provides no capital protection. So, return on investment may be far lower than what was initially shelled out.

- Every quarter, the portfolio is rebalanced using both technical and fundamental criteria. It’s possible that this technique won’t always produce the best results, especially if the markets suddenly shift during the investment term.

- Investors must go through advisors to access the investment. So, they must make sure that the advisor they pick is someone they [can] trust to craft their portfolio.

- The Vanilla Blue Chip Portfolio ETP does have growth potential through exposure to well-known stocks. However, investors should be aware of the risks too.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.