Learn how Interactive Brokers can enhance your global brokerage accounts and diversify your investments.

Interactive Brokers LLC is a leading brokerage firm that stands out due to its low fees, wide selection of tradable assets, and sophisticated trading platforms. It is commonly regarded as a top forex broker, and its daily average revenue trade volume makes it the largest online brokerage company in the United States.

The corporation operates under the regulation of several authorities, including the Securities and Exchange Commission, the Financial Industry Regulatory Authority, and the New York Stock Exchange, among others.

In addition to its powerful charting tools, Interactive Brokers’ streamlined trading platforms (such as IBKR Mobile, the Client Portal, and Trader Workstation) make for a pleasant trading experience.

The online trade platform gives consumers access to a broad range of research providers and news services, both free and subscription based. In particular, Interactive Brokers allowed customers to trade cryptocurrencies including bitcoin, ethereum, litecoin, and bitcoin cash around the clock starting in 2021.

Financial stability, fiscal conservatism, and automated risk controls are deliberate organizational choices that shield Interactive Brokers and its customers against catastrophic losses in trading. Interactive Brokers, with its multiple award-winning platforms, welcomes traders of all skill levels. The company has numerous locations all around the world, including the US.

To further guide your research, we’ll delve into the products, services, accounts, eligibility, and positives and negatives of the US broker in this Interactive Brokers review.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

Interactive Brokers Products and Services

- Traders have access to a variety of trading platforms, including the Trader Workstation, Client Portal, and IBKR Mobile. With advanced charting capabilities, these platforms facilitate effortless trading.

- Comprehensive research tools are at your disposal via Interactive Brokers, with both free and paid subscription choices. Over 200 services from dozens of media and academic institutions are made available to users.

- Bitcoin, Ethereum, Litecoin, and Bitcoin Cash Trading

- Traders can use the IB application programming interfaces (APIs) to build their own automated trading systems on the broker platform.

- Individual accounts, joint and trust accounts, retirement accounts, advisor accounts, and institution accounts are only some of the investment vehicles supported by the platform.

Interactive Brokers Investments

Among the many investing options provided by Interactive Brokers, the following stand out:

- Stocks: Access stocks from over 135 marketplaces across 33 countries through Interactive Brokers.

- Options: Trade options on stocks, indices, and futures contracts on more than 60 exchanges worldwide.

- Futures: Learn about commodity, currency, and index futures trading on more than 45 global exchanges.

- Over 135 different currency pairings are available for trading in spot, forward, and option form.

- Bonds: Choose from more than 40,000 different bonds issued by 26 different countries. All types of bonds are included, from federal to corporate to local.

- Funds: Interactive Brokers provides access to a broad variety of investment funds, comprising over 19,000 no-transaction-fee mutual funds, as well as ETFs, closed-end funds, and hedge funds.

Interactive Brokers Account and Eligibility

Interactive Brokers Account Types

The trading platform provider offers Individual Accounts for traders and investors who would like to have more control over their money. Trust accounts are ideal for individuals who want to delegate investment management responsibilities to another party, whereas joint accounts are more suited to two people.

Traditional, Roth, SEP, and SIMPLE IRAs are just some of the retirement account options offered by Interactive Brokers. Different people have different retirement savings goals and tax situations, so these accounts are designed to meet those needs.

Interactive Brokers offers Advisor Accounts for individuals who are not trained financial advisors but nevertheless manage client funds. Financial advisors can take full control of their clients’ portfolios with the use of these accounts.

Interactive Brokers offers Institutional Accounts as a service to its institutional clientele. Hedge funds, registered investment advisors, proprietary trading groups, and introducing brokers are all part of this expansive category.

Interactive Brokers cash account options

In a cash account, you can trade options using Interactive Brokers; here are some important specifics about this feature:

US trading account options using a cash account does not require a minimum balance.

Options trading has limitations when working with a cash account. Notably, restrictions are placed on actions like shorting stock or futures, and the benefits of day trading are limited to half of the standard margin need during the trading day on certain exchanges.

Settlement of a stock, option, or futures trade is what actually releases the funds from the sale into your hands. You can withdraw money from the sale of US stocks three days after the trade closes, German stocks two days, and US options the same day.

To individuals who match the criteria, the Client Portal offers the option of switching from a cash account to a margin account.

Cash account vs margin account on Interactive Brokers

Differences between an Interactive Brokers cash account and a margin account primarily revolve around the availability of borrowed funds and the dangers that come with them.

There is no minimum balance necessary to make purchases or withdrawals from a Cash Account; instead, transactions are made directly from the account’s balance. Since borrowing money is forbidden, any attempts to “short” will fail.

Multi-currency trading and the purchase/sale of options are permitted via Forex conversions, although options trading is restricted. Settlement is the point at which a transaction is finalized; this can take anything from a few minutes to a few days depending on the asset sold.

In contrast, a Margin Account requires a minimum balance of $2,000 and permits the use of borrowed funds to leverage transactions. However, this raises leverage risks, including the potential for losses exceeding the initial investment.

Despite the additional risk, there is also the possibility for better profits compared to cash accounts. Borrowed funds incur interest, although shorting is allowed and day trading incentives are offered through this account.

Who can invest in Interactive Brokers?

By catering to traders, investors, and financial advisors, Interactive Brokers has become one of the go-to online trading platform US. Trading enthusiasts, industry pros, day traders, option and futures traders, and even overseas investors can all find a home on this flexible platform.

Interactive Brokers Eligibility and Requirements

To set up an account with Interactive Brokers, adherence to specific eligibility and requirements is imperative. Here are the key criteria for distinct account types:

- Individual Account: Opening an individual account necessitates furnishing personal details such as name, address, phone number, Social Security Number, or ID number for non-US citizens, along with proof of identification.

- Advisor Account: Information such as your name, address, phone number, and securities, commodities, and/or foreign exchange registration and license numbers are necessary to open a new adviser account. In the US, investment advisers must either be registered with the SEC or the state(s) of operation or qualify for an exemption from registration.

- Joint and Trust Account: Joint and trust accounts require the involvement of two individuals and a trustee. The trustee must submit relevant trust documentation.

- Institutional Account: Interactive Brokers extends institutional accounts tailored for registered investment advisors, hedge funds, proprietary trading groups, and introducing brokers. The specific requisites for these accounts may vary, necessitating direct contact with Interactive Brokers for comprehensive information on eligibility and requirements.

- Retirement Accounts: For Traditional IRA, Roth IRA, SEP IRA, or SIMPLE IRA accounts, meeting age and income prerequisites is vital. For instance, opening a Roth IRA mandates a minimum age of 50 years old, with income thresholds of less than $153,000 for single filers or $228,000 for married couples filing jointly in 2023.

Can non-US residents invest in Interactive Brokers?

Investors from outside the United States are warmly welcomed by Interactive Brokers, who now serve customers from virtually every country in the world. The usual rule is that citizens of nations with fragile economies or governments are exempt. Customers who are not US citizens may be asked to provide additional documentation as part of the account establishing procedure.

How to open an Interactive Brokers account

To get started with Interactive Brokers’ account opening process, please do the following:

You can open an account with Interactive Brokers as a person, a couple, a trust, a retiree, an advisor, or a business. Choose the account category that best fits your requirements.

Go to the New Account Signup Page: Visit [Interactive Brokers Account Opening Page] to create an account with them.

Complete the Registration procedure: All of the account opening procedure is done online, but it might be complicated because of the need to provide personal information and answers to many questions. Make sure you provide the bank everything they need to start an account and that everything is correct.

After your account has been approved, you can fund it through several channels such as bank wire transfers, ACH transfers, or credit/debit card deposits.

Get the Trading App: You can choose from the IBKR Mobile app, the Client Portal, or the Trader Workstation, depending on whichever trading platform best meets your needs. Download the chosen platform and acquaint yourself with its functionalities.

You can now begin trading with Interactive Brokers once your account has been funded and your preferred trading platform has been installed.

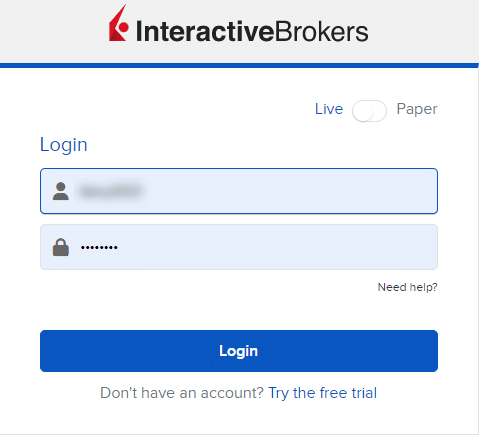

Interactive Brokers login

The Interactive Brokers Client Portal provides a single point of access for all aspects of managing and monitoring your Interactive Brokers account.

- Simply go to Interactive Brokers Client Portal to access the portal.

- Fill up the appropriate areas with your username and password.

- Make sure your browser supports JavaScript for optimal application functionality.

- After logging in, you’ll have quick access to a wealth of account management features, including the ability to place orders, manage open orders, evaluate recent trades, track performance, read the latest news, and more.

- The Interactive Brokers login page is available at Interactive Brokers Login if you prefer. Depending on your region and the type of account you have, the login procedure may be slightly different. Don’t be shy about contacting Interactive Brokers’ help team if you’re having trouble logging in.

What are the fees for trading on Interactive Brokers?

Interactive Brokers imposes various fees for trading, encompassing commissions, market data fees, and activity fees, with the specific charges contingent on factors such as the account type, trading platform, and the securities involved.

Trades conducted through Interactive Brokers incur commissions that fluctuate based on the type of security and the trading volume. For instance, the commission for US stocks stands at 0.005 USD per share, while for CAD stocks, it amounts to 0.01 CAD per share.

Monthly market data fees are applied by Interactive Brokers, with variations depending on the type of data and the exchange. As an illustration, the fee for the US Securities Snapshot and Futures Value Bundle is 10 USD per month.

A minimum activity fee of 10 USD per month is levied by Interactive Brokers, although this fee is exempted for accounts maintaining a balance of at least 100,000 USD or for accounts generating a minimum of 10 USD per month in commissions.

It is imperative to thoroughly examine the specific fees and charges associated with the relevant account type and trading platform, accessible on the website, or reach out to Interactive Brokers customer service for precise and current information on trading fees.

Interactive Brokers vs other online trading platforms

In contrast to other online trading platforms, Interactive Brokers stands out for its cost-effectiveness, broad selection of tradable securities, and robust research tools. Nonetheless, the platform’s information and navigation pose challenges, potentially creating difficulty for beginners or less experienced traders. Alternative online trading brokers may provide more user-friendly interfaces and additional guidance for new users.

Interactive Brokers Safety

How does Interactive Brokers ensure security for its clients?

The following are some of the many methods Interactive Brokers uses to keep its customers safe:

- By utilizing cutting-edge encryption technology, Interactive Brokers protects its clients’ data throughout transmission and storage.

- The US SEC and the UK Financial Conduct Authority are just two of the regulatory bodies over which Interactive Brokers must keep a close eye. The rules set very strict requirements for safety and conformity.

- Interactive Brokers offers a set of recommended cybersecurity procedures for clients to adopt. Implementing strong passwords, enabling multi-factor authentication, and performing routine software updates to patch previously discovered security holes are all recommended.

- Securities Investor Protection Corporation (SIPC) provides up to $500,000 in coverage (with a cash sublimit of $250,000) for clients’ securities accounts held at Interactive Brokers. In addition, the daily amount of cash and securities held for client benefit is calculated by the enhanced client protection program and then segregated.

- By being open and honest about its cybersecurity practices and its compliance with applicable regulations, Interactive Brokers demonstrates its dedication to openness. By being so open and honest, customers have a deeper appreciation for the safeguards in place to keep their money safe.

Pros and cons of Interactive Brokers

Interactive Brokers stands out as a highly acclaimed brokerage firm famous for its selection of tradable assets, cost-effective commissions, and top-notch trading systems. The company has received a lot of praise for its extensive range of securities, powerful set of research tools, and high standard of order execution.

The lack of specialized account kinds for Canadian investors and the complexity of the platform’s content and navigation are two potential negatives that customers may face despite these advantages. When weighing the benefits and drawbacks of the platform as a whole, traders will find numerous investment opportunities, including stocks, options, futures, ETFs, currencies, and more.

Its reputation for low fees and the availability of several tools for research as well as the debut of bitcoin trading only add to its allure. Users should examine these elements based on their unique tastes and requirements while considering Interactive Brokers for their financial operations.

Downsides of using Interactive Brokers encompass the intricate nature of information and navigation on the platform, potentially posing challenges for novice or less experienced traders. Additionally, Canadian investors using Interactive Brokers do not have access to certain account types, including Non-Registered Account, Tax-Free Savings Account (TFSA), and Registered Retirement Savings Plan (RRSPs).

Furthermore, users may find the platform’s navigation intricate, and its fee schedule might be perceived as complex. These factors should be considered by users when evaluating the platform for their specific needs and preferences.

Final Thoughts

Interactive Brokers is not the easiest platform to use, especially for newcomers, due to a lack of intuitive interfaces and thorough onboarding materials. Individuals with less experience in trading may struggle with the complex user interface and the relative dearth of handholding capabilities.

The low costs, wide assortment of tradable assets, and powerful research and online investing tools offered by Interactive Brokers make it stand out in the industry, notwithstanding the difficulties faced by novices.

Due to these features, the platform is best suited for skilled and active traders who are comfortable with navigating complex trading platforms and can make the most of the platform’s strengths in their trades. Prior to determining if the platform is suitable for their trading needs, prospective users must take into account their level of expertise and familiarity with complex interfaces.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.