In this WH Ireland review, we’ll inquire into the company’s background as well as the services it offers to clients. We’ll also look at WHIreland’s available financial data to determine its solidity.

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Who is WH Ireland?

WH Ireland is a financial services provider established in the United Kingdom that assists both public and private expanding enterprises with investment management, financial planning, and other related services. Corporate finance, brokerage, and capital formation are all part of their extensive menu of services. WH Ireland has a substantial regional presence in the UK, serving a wide range of clients from individuals to corporations to trustees to funds to institutions.

WHIreland is a trading brand used by WH Ireland Limited, a wholly owned arm of WH Ireland Group plc. WH Ireland Limited is authorized by and subject to the supervision of the Financial Conduct Authority as a regulated entity in the United Kingdom.

WHIreland Financials

After disappointing second-half trading results, which were mostly attributable to stock market volatility, WH Ireland reportedly issued a loss warning, according to This is Money. The London-based firm has noted that its capital markets segment has been hampered by the low levels of transactional activity seen across capital markets throughout 2022. Consequently, WH Ireland expects pre-tax losses of more than £2.2 million for the fiscal year ended March 2023 on revenues of roughly £26 million.

Despite this, WH Ireland is reportedly confident that its capital market division will be able to profit from an eventual market upturn because of recent cost-cutting efforts. Compared to 2022, the company’s customer base has remained steady as well.

Although WH Ireland’s wealth management division performed well, its overall assets under management by the end of March slipped to £1.5 billion from £1.6 billion in 2022, the report said. Total group assets under management for the firm also slid year over year to £2.2 billion from £2.4 billion.

The company hasn’t yet released its annual report for the financial year ended March 31, 2023.

WH Ireland Wealth Management

The company’s Wealth Management services focus on giving clients advice that is easy to understand and free of jargon, as well as providing them with individualized investment management strategies. The firm provides a variety of services, including discretionary management, model portfolios, charity investment management, and an Inheritance Tax (IHT) portfolio service.

The Inheritance Tax portfolio service is geared toward assisting customers in reducing their IHT liability through the purchase of shares that qualify for Business Relief. This relief is available to holders of qualifying shares in AIM-listed companies for at least two years.

The service is provided on a discretionary basis, so it’s up to seasoned investment managers to keep a close eye on the holdings and make sure the growth stocks they’ve chosen qualify for Business Relief.

The wealth management services are supplemented by a staff of highly trained financial advisors that help clients navigate the complexity of the modern financial system. Financial planners provide customers with impartial recommendations based on a thorough understanding of their objectives, risk tolerance, and concerns. Financial advisors develop unique plans for each client that can grow and change as their circumstances do.

Access to a financial planner who designs unique, tax-efficient strategies for retirement, inheritance, and lifestyle protection is just one of the many perks of the firm’s wealth management services. The company offers secure custody facilities for the safekeeping and administration of clients’ investments, and clients have secure, round-the-clock web access to monitor their holdings.

Customers can also opt to have their dividends deposited into their bank account of choice or reinvested in their portfolio at no extra cost within an ISA tax wrapper. An annual tax package is also supplied, which features a capital gains calculation and consolidated tax certificates.

Bespoke Discretionary Portfolio

Bespoke Discretionary Portfolio is WH Ireland’s premium solution for investments over £150,000. Each client who uses this service is paired with a qualified investing Manager who gets to know them and their unique needs in terms of investing goals, time horizon, and comfort level with risk.

The Investment Manager takes an active role in managing the client’s investments within the parameters of the mandate established between the two parties. With this service, investors may better manage their portfolios and react quickly to emerging threats and opportunities.

Navigator model portfolio

The minimum first investment for the Navigator model portfolio service is £50,000. The company’s own specialized research staff monitors this service, guaranteeing clients receive investment strategies that are both cost-effective and varied.

A variety of discretionary model portfolios suitable for different levels of risk tolerance are available through the Navigator model portfolio service. There is no need for a formal annual review if the client’s financial situation has not altered, which can save them time and effort.

What are the charges?

WH Ireland has several pricing tiers for its services. The Financial Planning cost is 0.5 percent per year and includes all of the company’s financial planning services. WH Ireland does not impose any additional dealing commissions or transaction fees on top of the 0.3 percent Custody charge, which covers all custody services, safekeeping facilities, and dealing costs.

There are also other costs that may apply to your situation. Purchases of UK Equities and Investment Trusts are subject to a 0.5 percent stamp tax. This charge is necessary to meet the requirements of the laws that govern such dealings. In addition, there is a fee of £25 per transaction for payments made by CHAPS (Clearing House Automated Payment System) or by check.

Capital Markets

Whether a company is public or private, WH Ireland Capital Markets may help with financial advice and brokerage. Initial public offerings (IPOs), placements of private and public equities, mergers and acquisitions (M&As), and other specialized tasks are all within the scope of their extensive knowledge.

They have connected with an array of investors, from large institutions to wealthy individuals and family offices, through the WH Ireland Investor Forum. With the depth of its network, WH Ireland Capital Markets is able to match promising startups with dependable financiers.

After years of assisting various growth companies in realizing their dreams, the team is now actively engaged with over a hundred growth companies to aid in the attainment of their strategic goals.

Public Markets

Services provided by WH Ireland include Corporate Finance, Research, Sales, Corporate Broking, Market Making, Trading, Fundraising, and more for publicly traded corporations and other institutions. The majority of the firm’s corporate clients can take advantage of the firm’s full Nominated Adviser (Nomad) service, thanks to the firm’s competence in this area.

Corporate Advisory

WHIreland provides financial advice and services to both private and public companies. They are one of the top three Nominated Advisers for AIM companies, a position that gives them significant influence in compliance with the rules governing AIM-listed businesses.

Companies listed on the Main Market, Standard List, Aquis Exchange (former NEX), and the International Property Stock Exchange (IPSX) all rely on WH Ireland as their financial advisor and broker. To guarantee that their customers are meeting their ongoing duties under the AIM standards, they offer more than just financial counsel; they also provide strategic insights and regulatory guidance.

Among the many areas in which they excel are capital raising, mergers and acquisitions, market communication, share repurchase, debt vs. equity analysis, compliance with the UK Takeover Code, and the creation of dividend programs.

IPOs

Prior to an IPO, WH Ireland offers in-depth guidance and assistance in a number of crucial areas. Preparedness analysis, capital structure determination, corporate governance assurance, due diligence management, admission document or prospectus writing, equity story and positioning creation, investor marketing strategy development, and IPO project management oversight are all part of the IPO process.

Increases in free-float and liquidity, as well as the acquisition of working capital, growth capital, and the facilitation of shareholders’ sell-down, are just a few of the many reasons why corporations need additional funding during the IPO. Using its comprehensive knowledge of the client’s business, WHIreland develops strategic marketing plans and employs its broking and sales team’s vast distribution network in an effort to generate substantial demand for the IPO.

Beyond the first public offering, WH Ireland has remained a reliable partner. Supporting Nomads and Financial Advisors, holding investor relations events and roadshows, providing timely research updates, and easing the process of market making, trading, and broking are all examples of what this entails. Facilitating clients’ smooth entry into the public markets and continuing success as a publicly traded firm are also given priority.

Mergers & Acquisitions

WH Ireland’s strong advising capacity extends to many different types of strategic deals. This knowledge encompasses M&A, divestitures, and reorganizations. The company provides a full range of services for its clients, with an emphasis on merger and acquisition advising for publicly traded companies and other listed organizations.

In addition, WH Ireland can advise and act as a facilitator in private acquisitions for both the offeror and offeree. WH Ireland’s expertise and experience allow them to guide clients through even the most intricate transactions.

Institutional Sales & Broking

WH Ireland’s business development staff finds and cultivates investors willing to lend money to corporations. They can tap into a sizable investment pool comprised of institutions, private client brokers, Venture Capital Trusts (VCTs), Enterprise Investment Schemes(EIS), private equity firms, family offices, and high net worth individuals.

The WH Ireland Institutional Sales team works closely with corporate management and Investor Relations and Research to learn about investment opportunities. With this information in hand, investors are given recommendations on where to go for funding based on the specifics of their individual investment proposals.

Moreover, the group helps with the creation of presentations, the planning of road shows, and the acquisition of necessary money from an ever-growing pool of well-informed customers. They target to secure adequate cash for the investment possibilities they recommend.

Equity Research

The Equity Research team at WH Ireland focuses heavily on expanding businesses and distributes its findings to a diverse group of investors. The information is not just provided to institutional fund managers, but also to High Net Worth Individuals, Private Client Wealth Managers, and family offices.

Direct dissemination and WH Ireland’s Research Portal are just two of the ways that the findings from this study are made available to the public. Also, it is available through major data aggregators like Bloomberg, Refinitiv, Capital IQ, Factset, and ResearchTree.

This strategy guarantees that the Equity Research reaches its target audience, letting investors use the insights provided by WH Ireland’s research team to make educated investment decisions.

Investor Relations

When helping its corporate clients, WH Ireland works with them to create a cohesive image for their brands. Each customer receives individualized attention as they work with them to create an effective investor relations plan that complements the larger business objective.

Throughout the United Kingdom, WH Ireland provides institutional, private client broker, family office, and professional clients with extensive access to equity markets. They help companies all the way through the public markets, not only during the IPO process.

Consumer, financial, healthcare, industrial, mining, oil and gas, support services, as well as technology are just some of the many fields in which WH Ireland excels. With this depth of industry expertise, they can give clients advice that is uniquely suited to their business.

Market Making & Sales Trading

WH Ireland makes sure their clients’ shares, along with a wide variety of other shares traded on major exchanges, always have buyers and sellers. By taking part in their clients’ trades, WH Ireland learns more about stock behavior, market demands, and how to keep a large market share, all of which improves their grasp of market dynamics and guarantees high liquidity.

WH Ireland’s Retail Service Provider facility allows them to conduct trading activities with key platforms in the UK, expanding the trading opportunities available to their customers.

Moreover, the company has a Sales Trading department that focuses on serving the needs of institutions and people with substantial personal wealth. Their Sales Trading staff has extensive knowledge of both corporate and non-corporate securities, enabling them to give their exclusive clientele with invaluable market insights, information, and personalized execution services.

Investor Forum

High-Net-Worth Investors, Family Offices, Private Wealth Managers, and Fund Managers can interact with a private community at the Investor Forum that shares their interest in finding, researching, and investing in companies with strong growth potential. Publicly traded and privately held businesses alike will find a home on this flexible platform.

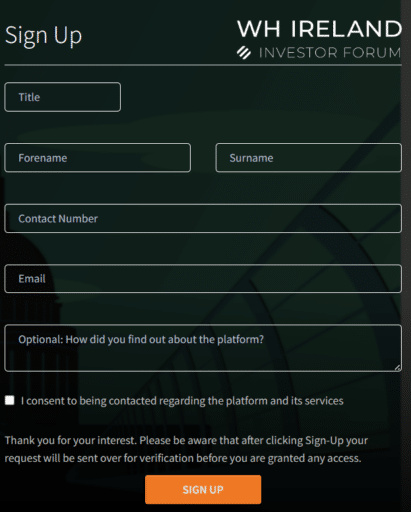

You’ll be asked to fill out a form to join the forum. A verification will be conducted before access to the forum is granted.

Private Companies

WH Ireland also specializes in raising capital for private companies by leveraging various funding sources. They have the resources and knowledge to help firms of all sizes and stages find the right investors through their Investor Forum, pre-IPO funding, EIS/VCT funds, and private equity opportunities.

By taking a holistic approach, WH Ireland is able to match businesses with the most suitable investors, who in turn are able to provide the necessary money for the companies’ further development and growth.

WHIreland offers M&A advice, IPO services, and the Investor Forum for private firms as well.

Final Thoughts

If you plan on investing, always remember that the principal amount invested and any income earned are both at risk of decline due to market fluctuations. In some cases, you could not even get back what you put in. This is true with any investments, not just with WHIreland.

Note that there’s not much information going around about WH Ireland when your surf the net, so it won’t hurt to exercise extra caution. Be sure to review all related documents from the company and be wary of hidden charges, if any. Talking to a trusted financial advisor should be very helpful.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.