With 2021 almost over, what are some of the best banks for 2022 in the UK, Singapore, and beyond?

This article will review Revolut card and bank in 2022, and discuss some of the pros and cons associated with this option.

Assess the Revolut Card’s functionalities and alternatives, exploring insights from the Utmost Worldwide Choice Review.

If you are looking to invest, don’t hesitate to contact me or use the WhatsApp function below.

For expats in particular, it is a mistake to send money home to invest.

It is far more practical to set up portable, expat-specialized solutions.

This article will not focus on the investment side of Revolut’s offering, apart from saying it is very limited and better options exist.

Introduction:

Revolut – Revolut is a digital banking app that started in Europe in the year 2015. In the beginning, it started out as a travel card that provided cheap exchange rates and gradually became a digital banking service provider.

As for the services offered by Revolut, the major services comprise money transfers, global spending, and accessibility to cryptocurrency exchanges.

Among most other digital banking service providers, Revolut has been the fast-growing one providing a wide range of features to its customers.

Let us have a detailed look at the exquisite digital banking services offered by Revolut.

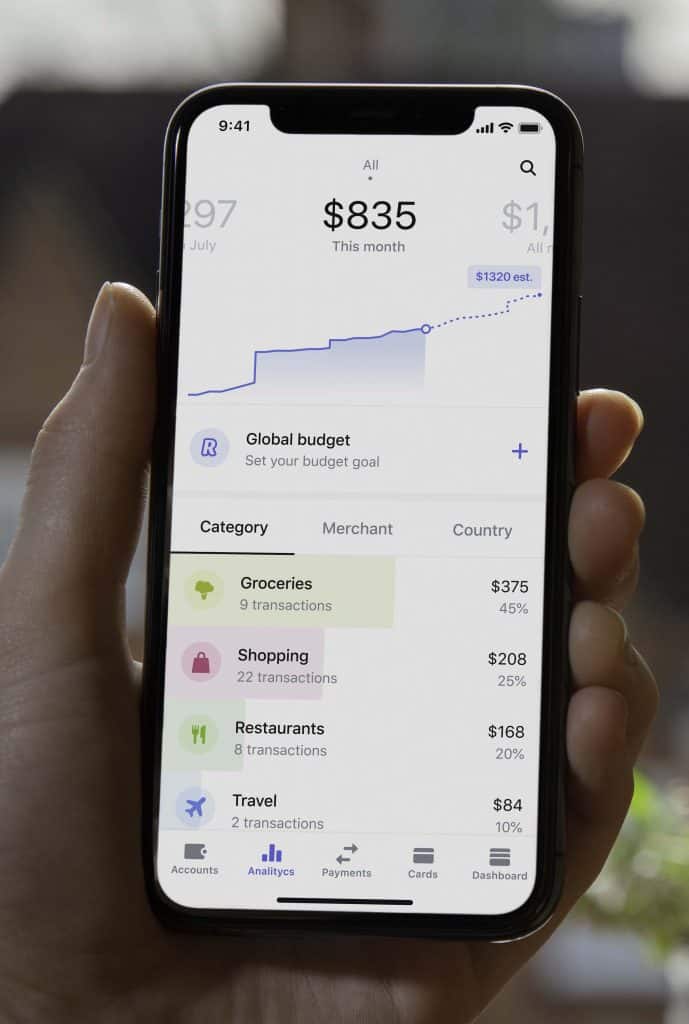

‘Spending Analytics’ – People are provided with weekly insights on their spending via Revolut’s categorization feature.

‘Monthly Spending Budgets’ – The spending of an individual can be monitored and managed by setting up monthly spending budgets.

‘Instant spending notifications’ – People get notifications when transactions (both inward and outward) have been made with the help of their Revolut account.

‘Managing Finances’ – People can connect all their bank accounts with Revolut using its open banking feature and manage all their money in one place.

‘Save Money’ – Cashbacks and rewards are offered to the people when they spend money using their card at exclusive outlets.

‘Split Bills’ – Bill amount can be split between family and friends with the help of Revolut.

‘Money Transfers’ – Money can be transferred overseas in more than 30 currencies making use of an Interbank Exchange Rate. Moreover, there is a 0.5% fee for the accounts having a balance exceeding an amount equivalent to £1,000.

‘Overseas spending’ – Individuals can spend money abroad without having to pay any sort of hidden fees.

‘Interests’ – Interest can be earned by individuals when they save money in their Revolut savings vault on their balance.

‘Round up spare change’ – If the account balance the exceeds round figure amount, the spare change would automatically be sent over to the savings.

‘Get paid early’ – The salaries get paid into the Revolut account a day earlier than usual.

‘Pockets’ – Payments can be set automatically for the bills and subscriptions. In that way, all the bills and subscriptions will be paid automatically from the account and individuals won’t have to worry about missing a payment.

Currencies – There are 35 currencies that are available for the individuals within Revolut to exchange money. They are AED, AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HRK, HUF, RUB, SAR, SEK, SGD, THB, TRY, IDR, ILS, INR, ISK, JPY, MAD, MXN, MYR, NOK, NZD, PHP, PLN, QAR, RON, RSD, USD, ZAR.

Revolut Singapore:

Almost all the digital banking services that have been mentioned above are available in Revolut Singapore. Additionally, customers can pay their friends, control card & account with the app, and get access to 24/7 customer service.

There are three types of accounts offered by Revolut Singapore, which are Standard, Premium, and Metal. Let us know more about these types of accounts offered by Revolut in Singapore.

- Standard:

The monthly price for availing of the services of Standard account offered by Revolut Singapore is S$ 0.

This is considered a basic account and the features include domestic/international fund transfers, spend analytics, money management, and others.

People having this account are provided with a free Revolut card (Delivery Charges Apply), with which they can withdraw money at ATMs located abroad.

There is, however, a limit for the amount that can be withdrawn, which is $350 per month. After exceeding this limit, they are charged a fee of 2% for every withdrawal.

- Premium:

The monthly price for availing of the services of Premium account offered by Revolut Singapore is S$ 9.99.

This account offers all the services that are generally provided to the customers having a Standard account at Revolut Singapore.

With this account, people can exchange currency among 28 fiat currencies, and there is no monthly limit for that. Up to 3 cards can be linked to a Revolut Premium account.

A premium card is offered with an exclusive design and this card is eligible for free express delivery. There is, however, a limit for the amount that can be withdrawn, which is $700 per month.

Some other primary features include Priority Customer Support, Disposable Virtual Cards, Complimentary Travel Insurance, etc.

Free airport lounge passes are also offered to the customers having a Premium account if the flight gets delayed for more than 1 hour.

- Metal:

The monthly price for availing the services of Metal account offered by Revolut Singapore is S$ 19.99.

This account comes with all the services of standard and premium accounts. As the name suggests, a Metal contactless card is provided to the customers who opt for this account.

The card can be used for making overseas withdrawals, for an amount of up to $1,050 per each month.

24/7 concierge service as well as priority customer support is offered to the customers. Along with that, one free LoungeKey Pass is provided.

One of the exquisite features of this account is that 1% cashback can be vailed on domestic as well as international spending.

Safety – Revolut Singapore is regulated by the MAS (Monetary Authority of Singapore) as a remittance business.

In terms of smartphone security, the mobile app of Revolut is protected by a password along with a face ID/fingerprint. If the card is lost or misplaced, customers can freeze or unfreeze their card through their account.

Moreover, customers can control their accounts by turning on/off their online banking, ATM services, and contactless payments.

Drawbacks – Revolut imposes a markup of 0.5% on the major currencies and 1% on other currencies during weekends. Additionally, Thai Baht and Ukrainian Hryvnia have a markup of 1% during the normal days and 2% during weekends.

There is a monthly limit of $9,000 for making overseas fund transfers, and after exceeding this limit, a fee of 0.5% is applicable. Withdrawals made after exceeding the monthly withdrawal limit are charged with a 2% fee.

Customer service cannot be approached physically and there are no branches of Revolut. People who opt for the basic plan (Standard account) have to pay a delivery fee for obtaining the card.

Some features of Revolut are not made available in Singapore, which includes cryptocurrency exchanges, high-yield savings accounts, youth accounts, and others.

Account opening – People who are at least 18 years of age can sign up for a Revolut account by downloading and registering on the mobile application.

Usually, the information needed would be first name, last name, address, date of birth, photo of NRIC, and a selfie (for verification).

After successful verification, a person would be required to deposit an amount of at least $40 for requesting a card (either physical or virtual).

Deposits and Withdrawals – Funds can be deposited into an account using Mastercard and Visa cards having Singaporean currency. We said Singaporean currency as it is a better way to avoid the currency conversion fee.

Transferring money through a credit card will be recognized as a cash advance transaction at Revolut.

Transfers can be made to other Revolut account holders or by requesting an online payment form.

People can also withdraw the money into their bank account by following a specific set of instructions mentioned under the payments tab.

Revolut Australia:

Revolut has also been made available in Australia, which now allows the Australian people to download the app and create an account.

As for the availability of the accounts, it also has the same three types of accounts namely, ‘Standard’, ‘Premium’, and ‘Metal’. However, the pricing of these accounts varies as they are $0, $10.99, and $29.99 respectively.

As for the features of these accounts, they are almost similar to the features that are offered by Revolut in other countries.

Revolut offers a Visa card to individuals, which can be used in stores and online websites in Australia without incurring any additional fees. The Metal card is a unique and exclusive card that happens to be the first of its kind in Australia.

One major thing that should be noticed over here is that Revolut does not have a banking license in Australia, and therefore it cannot provide a debit card to its customers.

Adding to that, Revolut does not have an ADI (Australian Deposit-Taking Institution) license in Australia. This means the money existing in a customer’s account is not backed by any sort of Government Guarantee Scheme.

Alternatively, some rivals in this field such as Up bank, 86 400, Xinja, and Volt were able to acquire an ADI license in Australia.

Revolut Japan:

After testing the service on 10,000 users, Revolut started its expansion in Japan as well. Now anybody living in Japan can be able to sign up with Revolut and open an account.

The authorization to operate from Japan’s Finance Service Agency was first acquired by Revolut in the year 2018.

When an individual signs up with Revolut in Japan, they are granted access to an e-wallet and a Visa debit card. Money can be deposited into the account and thereafter be used with the card, virtual card, and other means.

Notifications are provided for the transactions made and Revolut in Japan also allows to freeze or unfreeze the card with the help of their mobile application.

Money can be transferred to other Revolut account holders or directly to a bank account. Similar to Revolut in other countries, currency conversion can be done within the app.

Money can also be transferred to other users or a bank account in a currency that the customer wants to send (based on the availability of currencies in Revolut).

This is highly beneficial to the people when they want to travel more, as they won’t be required to pay a lot of money in the form of foreign exchange fees.

Vaults and rounding up options have also been made available. Although there are premium accounts of Revolut available for people in Japan, they don’t offer as exquisite features as Revolut does in other countries.

However, with premium plans, people get unique card designs, lower rates of foreign exchange, priority support, and the ability to buy access to airport lounges with the help of a LoungeKey Pass.

The major drawback of Revolut in Japan is that there won’t be the availability of buying cryptocurrencies, trading stocks, buying insurance products, or creating junior accounts for children.

Revolut USA:

Revolut has also been launched in the USA, which is completely based on its mobile application and absolutely no presence of brick-and-mortar locations.

Moreover, the individual accounts of Revolut in the US are insured by the FDIC for an amount of up to $250,000.

Revolut does not have a banking license in the US and for that, it offers technology that is integrated with the Metropolitan Commercial Bank (MCB) of New York.

Revolut offers services such as tracking accounts, spending, making payments, cards, etc. The currency conversion can be done within the app itself and Revolut does not charge any additional fees for this service.

For people who want to withdraw money from their Revolut account, there is an availability of 55,000+ ATMs in the Allpoint ATM network. The standard account allows only up to $300 per month (for free), after which a fee of 2% is charged.

The Premium account has a monthly fee of $9.99, which allows an individual to withdraw up to $600 per month without additional fees. It also offers a disposable virtual card, global travel insurance, and the ability to access airport lounges with the help of a LoungeKey Pass.

The Metal account, on the other hand, comes with a price of $14.99 per month and allows $900 per month (free withdrawals). Additionally, 1% of cashback can be availed on the transactions made with the Revolut card.

Revolut UK:

In the United Kingdom, Revolut has more than 8 million customers, and it has been reported by Revolut that these customers were successful in making more than 350 million transactions which were worth £40 billion.

Customers who open a standard account with Revolut in the UK are offered a UK current account, a Euro IBAN account, and a blue & pink bank card.

Some of the main banking services offered with a standard account at Revolut in the UK are as follows:

- Sending money to friends

- Withdrawing money from an ATM

- International Money Transfers

- Global Spending without any fees

- Accessibility of cryptocurrency exchange

Signing Up – In order to sign up with Revolut in the UK, the process has been given below:

- Download the Revolut application, which is available on Google Play Store as well as App Store.

- Submit and verify the mobile number.

- Submit general information such as full name, email address, residential address, date of birth, etc.

- Identity verification on the Revolut app with the help of a passport or a government-issued ID card.

- After your account has been approved successfully, you can receive your Revolut card within 3 to 5 business days.

- To avail of the services before obtaining a physical card, you can make use of Google Pay or Apple Pay.

- That’s all, you can now be able to start spending your money with the help of your Revolut account.

Features – Given below are major features offered to individuals with the help of a Revolut account in the UK.

People can use the Revolut account in the UK as a current account. They get a UK account number as well as a sort code.

With this account, they can make withdrawals, set recurring payments, make contactless payments, and use other payment service provider apps such as Apple Pay and Google Pay.

Money can be transferred in 30 different currencies without incurring any additional fees. The transfers can be made as per the interbank exchange rates, which are the rates given by banks to each other.

Additionally, international spending is also charged as per the interbank rate, which is very beneficial for the people who travel a lot. Money could be stored and held in 30 different types of currencies via Revolut’s app.

Individuals can pay other people or split bills among friends and family. Spending analytics, limits for spending, and savings features are also offered.

People who have lost/misplaced their cards can freeze or unfreeze their cards through their mobile app. Cryptocurrency can also be purchased using Revolut in the UK.

Fees – The three account tiers offered by Revolut in the UK are as follows:

- Standard – £0

- Premium – £6.99

- Metal – £12.99

The markup, as usual, is 0.5% for 15 major currencies and is 1% for the remaining currencies.

There are no fees for the transfers in 30 fiat currencies (as per the interbank rate). However, for an amount exceeding £5,000 in a month, a bank transfer fee of 0.5% is applicable.

Withdrawals are allowed for an amount up to £200 per month and a 2% fee is charged after that limit. The withdrawal limits vary on the basis of the subscription chosen by the customer.

No overdraft facility and the transactions get declined if the amount of transaction exceeds the number of funds in the account. For delivery of the card (standard subscription), a delivery fee of £4.99 is collected.

How to top up – Linking the primary bank account with a Revolut card allows an individual to instantly top up their card and the process for doing this is provided below:

Open the Revolut app and then input the 16-digit card number, CVV, expiry date, along with the billing postcode.

It must be made sure that the address that has been provided is correct. If not correct, the payment is likely to fail.

After that, press on the ‘+’ symbol located in the top left corner of the accounts screen. From there, add the card from which you want to top up the money into the Revolut account.

Then tap on ‘Top Up’. That’s it, the money will successfully be added over to your Revolut account.

Is Revolut a real bank? – Revolut is not yet officially declared as a bank but is undergoing the process of becoming one. By the end of 2018, Revolut acquired a Europen banking license from the European Central Bank.

The license obtained is not yet fully functional though. It depends on a series of tests and enhancements on which Revolut is currently concentration upon.

UK’s top tier regulator FCA (Financial Conduct Authority) will lift off the restrictions on the license of Revolut after it is able to be fully operational.

Succeeding in the above-mentioned aspects will allow Revolut to call itself a functional bank. Revolut can offer upcoming services such as an overdraft.

After Brexit, it is anticipated that European banking licenses are distributed over in the UK. Simply put, the licenses will be equally valid in both regions. If things go south, Revolut stated that it would apply for a fully functional UK banking license.

Safety – Even though Revolut hasn’t become a bank yet, it is regulated by the FCA. The company is recognized as a financial institution involved in dealing with electronic money and is required to hold all the funds of their customers in a Segregated account.

To put it in simple terms, Revolut won’t be allowed to keep its finances and the customers’ money in the same place. Moreover, they cannot invest the customers’ money.

Once it officially becomes a bank, the funds held by Revolut will be protected by the Financial Services Compensation Scheme. The FSCS will then protect the deposits up to £85,000 in case anything goes wrong with the bank.

Customer Support – The customer support team of Revolut could be approached via Live chat (24/7), telephone support, and email support.

Revolut Cryptocurrency – Revolut performs exceedingly well when it comes to cryptocurrencies. Revolut performs exceedingly well in contrast to its competitors.

There is an availability of 5 different cryptocurrencies, which are Bitcoin, Litecoin, Ethereum, Bitcoin Cash, and XRP.

Revolut offers good exchange rates, low fees, etc., when it comes to cryptocurrencies.

Bottom Line:

Revolut is an excellent digital banking service provider for people who often travel a lot. The services offered are advantageous for people who want to transfer money to other countries.

Moreover, it also offers a wide range of features that no competitor in this field might be able to match.

If you are looking for a digital bank that has a full banking license in the UK, you can opt for Monzo or Starling. These also provide similar services along with having a full banking license as an additional feature.

If you are wishing to move to another country and need help with services related to a second passport, residency, etc., you can avail of the expert services offered by us in that particular field.

If you need an exquisite investment strategy or stock-related advice, or a professional wealth manager to take care of your financial assets, you are in the perfect place. We offer best-in-class services related to financial advice and wealth management.

That being said, we hope this article came in handy for finding the relevant information.