Read this article to find out the 6 different ways to send money from Bulgaria. We’ve taken into consideration transfer fees, exchange rates, processing time, and other important factors when choosing a service provider.

Whilst this article does not represent formal tax or any other sort of advice, the article is correct as far as we are aware, at the time of writing, but some of the details might become outdated.

One of the biggest motivations for expats to send money home is to invest in property or stocks and shares.

Yet most of the time it makes more sense to invest in a cross-border, expat-specialised solution, directly from your country of residence.

This means you can take your investment with you when you move from country to country.

If you are looking to invest in expat-specialised solutions or have any questions, don’t hesitate to contact me or use the WhatsApp function below.

Introduction

Bulgaria, officially called the Republic of Bulgaria, can be found in southeastern Europe. It is bordered by Greece, the Republic of Macedonia, Romania, Serbia, and Turkey. On January 1, 2007, the country joined the European Union. However, the Bulgarian lev (BGN) is its official currency. It has yet to adopt the Euro currency after certain conditions are complied with. Despite this, there are different options to send money from Bulgaria. Take a look at the list below.

Six Ways to Send Money from Bulgaria

1. Wise

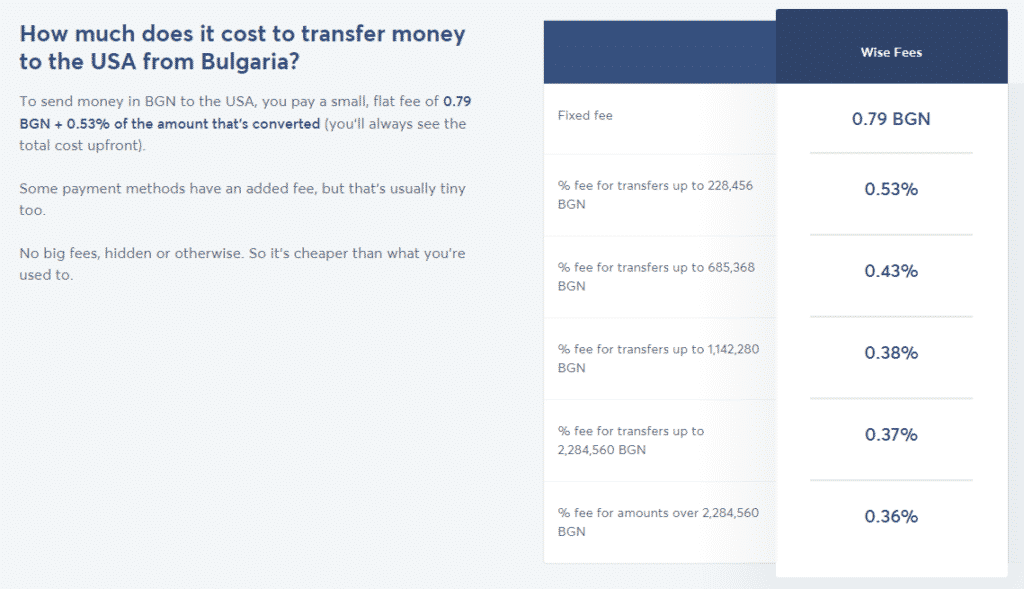

Wise offers a competitive money transfer service with the use of the mid-market exchange rate. An account must be created online to make use of their platform. They have three transfer types, specifically, fast transfer, easy transfer, and low cost transfer. Each has different payment methods, processing times, and transfer fees.

When sending 10,000 BGN from Bulgaria to the USA, a low cost transfer will be charged 53.51 BGN. This transaction can be paid for by bank transfer. With an exchange rate of 1 BGN = 0.545956 USD, the recipient will get 5,430.35 USD. On the other hand, a fast and easy transfer will be charged 113.82 BGN, and it can be paid by debit or credit card. The recipient will get 5,398 USD. In either case, the sender will need to pay 10,000 BGN to initiate the transfer. The maximum amount that can be sent is 2,000,000 BGN.

- Payment methods: debit card, credit card, bank transfer

- Receiving methods: bank account

- Processing time: instantly or up to 5 working days

- Transfer fee: fixed fee plus a percentage of the amount transferred

2. Revolut

Revolut is a fintech company that supports more than 200 countries and over 30 currencies. They offer four different plans, each with its own subscription fee and benefits. With a Revolut account, users can spend, save, and invest all on just one platform.

Sending 10,000 BGN from Bulgaria to the USA will cost 50 BGN when transferred to a bank account or 40 BGN when transferred to another Revolut account. With an exchange rate of 1 BGN = 0.5455 USD, the recipient will get 5,454.86 USD by the next day or instantly, depending on the receiving method. The sender will need to pay the transfer fee in addition to the amount to be sent. Also, the maximum amount that can be transferred is 1 billion BGN.

- Payment methods: debit card, bank transfer, Apple Pay, Google Pay

- Receiving methods: bank account, Revolut account

- Processing time: within minutes or up to 5 working days

- Transfer fee: 0.3% – 0.5% of the transfer amount, but will depend on the Revolut membership, payment method, receiving country, and receiving method

3. WorldRemit

WorldRemit is a money transfer service provider that supports 130 countries and 70 currencies. Sending 1,000 BGN from Bulgaria to the USA will be charged 8.00 BGN. With an exchange rate of 1 BGN = 0.5389 USD, the recipient will get 538.90 USD in their bank account by the next working day. The sender will need to pay 1,008.00 BGN for the money transfer. The maximum amount that can be sent should be less than 2,000.00 BGN, which is inclusive of the fees as well. This means that only 1,991 BGN can be sent.

- Payment methods: debit card, credit card, ppre-paid card

- Receiving methods: bank account, mobile wallet, cash pickup, airtime top up

- Processing time: within minutes or up to 2 working days

- Transfer fee: depends on the payment method, receiving country, and receiving method

4. Skrill

Skrill is a virtual wallet that allows users to send, spend, and invest ever since it was launched in 2001. No transfer fees are charged when sending money to an international bank account. However, a maximum of 4.99% is charged per transaction when sending money internationally involving one send and receive currency. Similarly, a maximum of 4.99% per transaction is applied to the exchange rate as a mark-up fee when the send and receive currencies are different.

Sending 10,000 BGN from Bulgaria to the USA will not be charged a transfer fee when paying by debit card or cash. On the other hand, a 199.00 BGN transfer fee will be charged when paying by credit card. With an exchange rate of 1 BGN = 0.5308 USD, the recipient will get 5,307.90 USD in their bank account within a day or up to 3 days depending on the payment method. The sender has to pay either 10,000 BGN or 10,199 BGN for the money transfer.

- Payment methods: debit card, credit card, cash

- Receiving methods: bank account, mobile wallet

- Processing time: instantly or up to 5 working days

- Transfer fee: up to 4.99% of the amount to be sent

5. MoneyGram

MoneyGram is a money transfer company with a network of more than 200 countries and territories. Transfer fees are dependent on the amount to be sent, payment method, receiving country, and receiving method. At the same time, they also make money from foreign currency exchange.

For example, sending 1,000 BGN from Bulgaria to the USA will cost 8.00 BGN. With an exchange rate of 1 BGN = 0.5293 USD, the recipient will get 529.26 USD through cash pickup within the same day. The sender has to pay 1,008.00 BGN for the money transfer. The maximum amount that can be sent from Bulgaria is 9,999.00 BGN.

- Payment methods: debit card, credit card, bank transfer, in-store

- Receiving methods: bank account, Visa debit card, mobile wallet, cash pickup

- Processing time: within minutes or up to 5 days

- Transfer fee: fixed fee, depending on payment method, receiving method, and receiving country

6. Western Union

Western Union operates in more than 200 countries and territories worldwide. Apart from the transfer fees charged, the company also applies a mark-up fee to the foreign exchange rate. Sending 1,000 BGN from Bulgaria to the USA will cost 3.90 BGN. With an exchange rate of 1 BGN = 0.4869 USD, the recipient will get 486.88 USD by cash pickup within minutes. The maximum amount that can be transferred is 9,800 BGN. But when sending money to the mobile wallet of a recipient, the maximum amount is 2,200 BGN.

- Payment methods: debit card, credit card

- Receiving methods: cash pickup, mobile wallet

- Processing time: within minutes

- Transfer fee: fixed fee, depending on the payment method, receiving method, and receiving country

Conclusion

Given this, we’ve listed six different ways to send money from Bulgaria. For large money transfers, Revolut and Wise are suitable because of their high send limits. The service provider with the cheapest transfer fee is Western Union.

However, it also has the lowest exchange rate and limited options for payment and receipt of money. On the other hand, Wise offers the highest exchange rate. It would be best to choose the money service provider that has the lowest fees and the highest exchange rates in order to dampen losses due to such factors. But feasibility and convenience must be taken into account as well.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.