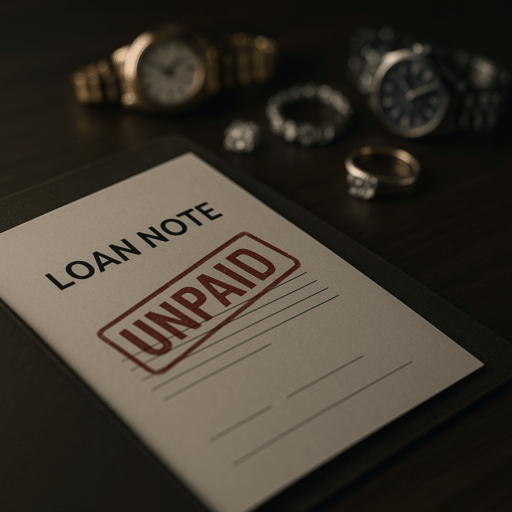

Hemos recibido información de que las notas de préstamo de London DE han incumplido pagos, lo cual demuestra que este tipo de inversión implica muchos riesgos.

En 2019, la empresa buscaba recaudar un millón de libras mediante notas de préstamo, además de otro millón por venta de acciones para financiar su crecimiento.

Esta reseña presenta información sobre London DE Limited y sus actividades. También compartimos consejos para invertir en joyas, junto con sus pros y contras, para determinar si vale la pena. London DE Limited, especializada en joyería y relojes, ofrece diamantes, esmeraldas, rubíes, zafiros y otras gemas certificadas y obtenidas de manera ética en el Reino Unido.

Si deseas invertir como expatriado o persona con alto patrimonio neto, puedes escribirme (hello@adamfayed.com) o por WhatsApp (+44‑7393‑450‑837).

Esto también aplica si buscas una revisión gratuita de tu cartera para optimizar tus inversiones e identificar nuevas oportunidades de crecimiento.

Algunos datos pueden haber cambiado desde la fecha de publicación. Nada de esto constituye asesoría financiera, legal o fiscal, ni es una recomendación o invitación a invertir.

Antes de invertir en esta clase de activos, evalúa cuidadosamente los riesgos y beneficios.

La joyería no sigue un precio estándar como las acciones o los bonos. Por eso, conviene invertir solo una pequeña parte del portafolio en joyería como la de London DE.

Si ya posees notas de préstamo con la empresa, es fundamental revisar todo tu portafolio, ya que podrían existir otros riesgos ocultos tras el incumplimiento. Aunque la empresa lo niega, hemos sido contactados por clientes que no han recibido pagos desde hace años (año 2025).

Invertir en notas de préstamo implica riesgos importantes, y puedes perder todo tu dinero. Este artículo es solo para no residentes en el Reino Unido y debes hacer tu propia investigación.

Actualizaciones sobre London DE Limited

Además de sus colecciones propias, London DE ofrece servicios personalizados para crear diseños únicos.

Los diamantes están certificados por instituciones como el Diamond High Council y el International Gemological Institute.

Inversión en Joyería

Consejos para invertir en joyas

- Aprende sobre metales, gemas y tendencias de mercado.

- Invierte en joyería fina y bien elaborada.

- Diversifica tu inversión entre distintos tipos de piezas.

- Elige artículos únicos, de edición limitada o con valor histórico.

- Obtén tasaciones profesionales para decisiones informadas.

- Asegura tus joyas contra robo, daño o pérdida.

- Considera cajas fuertes o bóvedas bancarias para almacenaje seguro.

Pros y Contras de Invertir en Joyería

✅ Ventajas

- La joyería fina suele mantener o aumentar su valor (especialmente gemas raras).

- Combina belleza estética y ganancia potencial.

- Es una inversión pasiva y fácil de conservar.

- Es un activo líquido: puede venderse rápido por su valor en materiales.

- Tamaño reducido y mantenimiento bajo.

- Piezas únicas o con valor sentimental pueden valer más.

‼️ Riesgos

- Costo inicial elevado.

- Gastos adicionales por seguro y almacenaje.

- Las piedras preciosas son menos volátiles, pero también menos predecibles.

- Dificultades para encontrar compradores o establecer valor justo.

- Comisiones por subastas, certificaciones o ventas pueden ser elevadas.

- La joyería personalizada puede depreciarse.

- La ganancia suele ser a largo plazo, no inmediata.

¿Vale la pena invertir en joyas?

Sí, puede ser rentable si se hace con conocimiento y análisis. La joyería puede diversificar el portafolio y ofrecer oportunidades atractivas.

Sin embargo, a largo plazo, puede no superar a otros activos, lo que podría limitar la rentabilidad de fondos de retiro.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.