Este artículo analiza el bono emitido por Kaeva PLC, evaluando sus términos y particularidades. También actualiza sobre el programa de bonos, ya que no se pagaron intereses a tiempo y se iniciaron procedimientos de liquidación contra Kaeva Pty Ltd., deudor.

Este incumplimiento reciente hace clave revaluar todo tu portafolio, ya que podrías estar expuesto a riesgos ocultos.

Si deseas invertir como expatriado o persona con alto patrimonio neto, puedes escribirme al correo (hello@adamfayed.com) o por WhatsApp (+44‑7393‑450‑837).

También aplicable si buscas una revisión gratuita de cartera para expatriados y optimizar tus inversiones o identificar oportunidades.

Algunos hechos podrían haber cambiado desde la redacción. Nada aquí constituye asesoría financiera, legal, fiscal o personal, ni representa una invitación a invertir o recomendación de productos o servicios específicos.

Kaeva PLC ofrecía oportunidades a inversores institucionales. Antes operaba como BWIInternational Capital PLC e Index Ecogen PLC. Fue constituida el 17 de agosto de 2016 para emitir valores negociables como secured notes, y cambió oficialmente a Kaeva Ltd el 2 de octubre de 2023. En esta reseña, ambos nombres se consideran equivalentes.

Términos y Características del Bono Kaeva PLC

Kaeva emitió hasta 1.000 millones de GBP en senior secured notes con tasa fija del 9 % anual, pagaderos semestralmente. Los bonos estaban disponibles en GBP, EUR y USD.

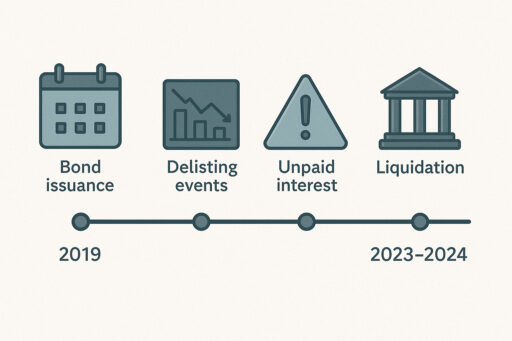

Emitidos el 8 de febrero de 2019, vencieron el 8 de febrero de 2024 como primera emisión de un programa mercantil por 5.000 millones de GBP. Los fondos netos se destinaron a préstamos anticipados o inversiones respaldadas por activos.

Las notas estaban garantizadas por los proyectos mismos, con prioridad de pago como senior, y cotizaban en Euronext Dublín y la Bolsa de Fráncfort, siendo fáciles de negociar. Pueden ser mantenidas en vehículos como UCITS, ISA, SIPP, SSAS, QROPS y Portfolio Bonds.

Pros y Contras de los Bonos Senior Secured a Tasa Fija

Ventajas

- Pagan intereses fijos de forma regular.

- En caso de problemas, los bonistas senior cobran antes que otros acreedores.

Riesgos

- Los cambios en las tasas de interés pueden reducir el valor de mercado del bono.

- Existe riesgo de impago por parte del emisor.

Actualizaciones sobre el Bono Kaeva PLC

- El 9 de abril de 2022, Kaeva retiró las notas 2024 de la Bolsa de Fráncfort; el 6 de febrero de 2023 hizo lo mismo en Euronext Dublín.

- En 2023 no se obtuvieron ingresos por la emisión, comparado con 1,9 millones GBP el año anterior.

- Para el ejercicio que cerró el 31 de agosto de 2023, no se pagaron cupones pues Kaeva Pty Ltd (deudor) no cumplió con los pagos.

- El 9 de julio de 2023 se inició el proceso de liquidación de Kaeva Pty Ltd; esto activó el vencimiento inmediato de las secured notes.

- Al no recuperarse activos suficientes, Kaeva Ltd informó a acreedores e inversores que no habrá pagos. Aun así, sigue operando como going concern.

- El 14 de marzo de 2024 se convocó una reunión informal de tenedores de notas para abordar el retraso en pagos y definir pasos futuros. Se requerirán nuevas votaciones sobre posibles modificaciones del acuerdo.

Reflexiones Finales

Las inversiones en bonos conllevan riesgos como el default y la pérdida de capital. Es esencial analizar la solvencia del emisor, diversificar y planificar cuidadosamente, preferiblemente con asesoría profesional.

El impago de intereses y el proceso de liquidación exponen a los bonistas a pérdidas significativas. Aunque los tenedores senior tienen prioridad, los activos podrían no cubrir todos los pasivos, y el capital invertido puede perderse o recuperarse parcialmente.

Podría ser necesario emprender acciones legales en el proceso de liquidación, lo cual implica esfuerzo, tiempo y costos.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.